Get Lendly

Get Lendly: Your Guide to Smarter Personal Loans and Salary-Based Financing

Are you looking for a financial solution that moves faster than traditional banks and recognizes the value of your regular income? If you've been searching for personal loans online, chances are you've come across the name Lendly. But what exactly is Get Lendly, and can it really help bridge those financial gaps?

In today's fast-paced world, needing quick access to funds is common. Whether it's an unexpected car repair or a sudden medical bill, having options outside of standard lending institutions can be a lifeline. This comprehensive guide will walk you through everything you need to know about Get Lendly, its process, and whether it's the right fit for your financial journey.

We'll break down their unique approach to lending, detail the eligibility criteria, and help you understand the commitment before you decide to apply. Let's dive in!

What Exactly is Get Lendly and How Does It Work?

Get Lendly (often referred to simply as Lendly) is a financial technology company that offers personal installment loans. Their unique selling proposition revolves around utilizing your employment income and direct deposit information as the primary factor for approval, rather than relying solely on traditional credit scores.

Unlike payday loans, which typically require repayment on your very next paycheck, Lendly structures its products as installment loans. This means you repay the loan over a fixed period with regular, manageable payments, often designed to align with your payroll schedule.

The core concept is simple: Lendly uses your steady income as collateral. By verifying your employment and direct deposit history, they can assess your ability to repay the loan reliably, often allowing them to serve customers who might be overlooked by conventional banks due to a less-than-perfect credit history.

Key Features That Make Get Lendly Stand Out

Lendly positions itself as an accessible alternative, emphasizing several features designed for the modern borrower:

- Credit Score Flexibility: While a soft credit pull may occur, approvals heavily weigh steady employment rather than high credit scores.

- Automated Repayments: Payments are often set up to automatically deduct from your paycheck or bank account, ensuring you don't miss a payment date.

- Quick Funding: If approved, funds can often be deposited into your account within one to three business days, making it ideal for urgent needs.

- Transparency: The loan terms, including the Annual Percentage Rate (APR) and repayment schedule, are clearly outlined before you commit.

Who Is Lendly Best For? (The Ideal Borrower)

Get Lendly isn't necessarily aimed at the borrower who qualifies for the lowest rates at a major bank. Instead, it serves a specific segment of the population that is often marginalized by traditional lending criteria.

They are an excellent option for individuals who have steady jobs and reliable income but may have thin credit files or past financial missteps that have damaged their scores. If you've found yourself rejected by mainstream lenders simply because of your credit history, but you know you can manage the payments, Lendly provides an alternative pathway.

However, it is crucial to remember that convenience often comes at a cost. Due to the inherent risk associated with credit flexibility, the interest rates charged by Lendly may be higher than those offered to individuals with prime credit scores.

Eligibility Requirements: Can I Get Lendly?

While the exact requirements can vary by state and loan product, there are a few core criteria that applicants generally need to meet to successfully Get Lendly financing. These are designed to prove stable income and residency.

You typically need to:

- Be at least 18 years of age (or 19 in Alabama and Nebraska).

- Have an active checking account set up for direct deposit.

- Demonstrate consistent, verifiable income from a current job (often requiring employment for a minimum period, such as 90 days).

- Provide proof of US citizenship or permanent residency.

The emphasis here is on the "verifiable income." Lendly needs assurance that your salary is reliably deposited into your account, which is why bank statements or pay stubs are often requested during the application review.

The Application Process: Getting Started with Get Lendly

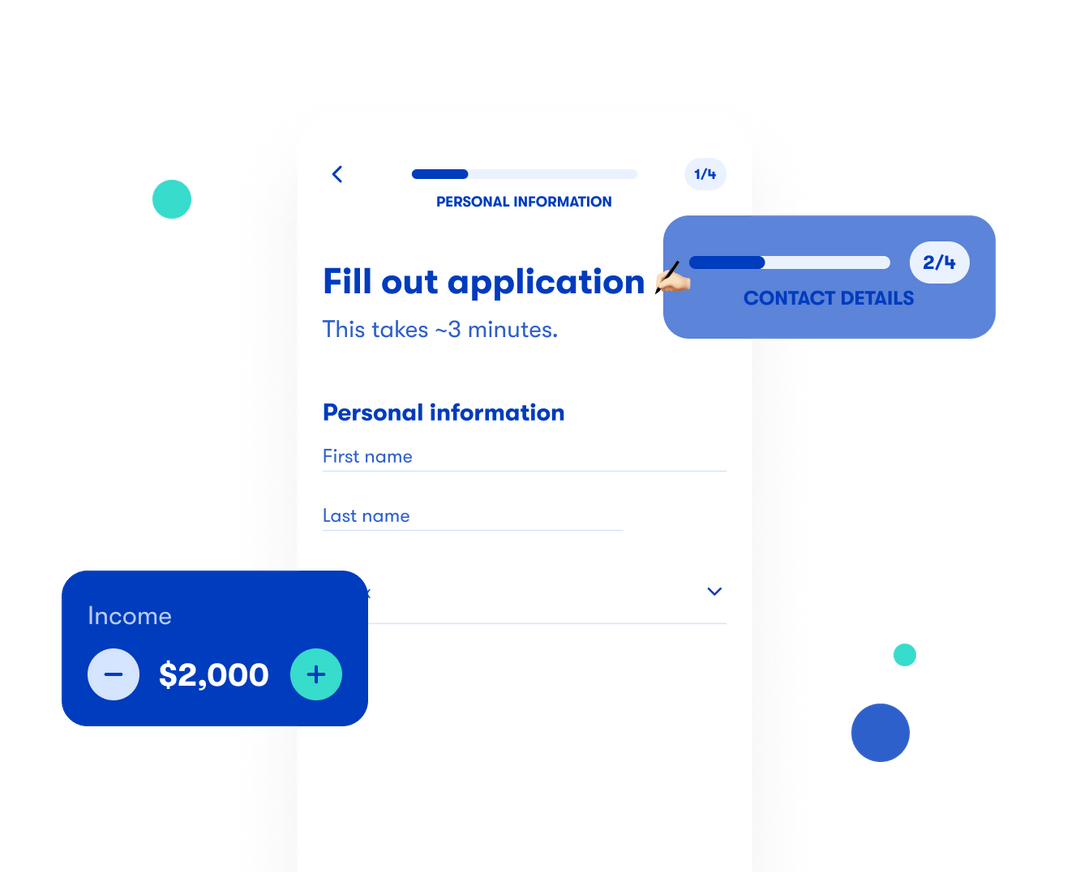

The entire application process for Lendly is conducted online and is generally designed to be streamlined and efficient. If you have all your necessary documents ready, you can often complete the submission within minutes.

Here are the steps involved in securing a loan:

- Complete the Online Form: You start by providing basic personal and employment details on the official Lendly website.

- Income Verification: You will be asked to link your bank account or upload documentation (like recent pay stubs) to verify your direct deposit history and income level.

- Review Loan Offer: If approved, Lendly will present you with the loan amount, the associated APR, and the full repayment schedule.

- Sign and Fund: If you accept the terms, you sign the agreement electronically. The funds are then processed and sent to your bank account via ACH transfer.

It's essential to review the loan agreement thoroughly before signing. Pay close attention to the interest rate and total repayment amount to ensure the loan is affordable for your budget.

The Pros and Cons of Choosing Get Lendly

As with any financial product, there are distinct advantages and disadvantages when you choose to Get Lendly financing. Weighing these factors is crucial for making a responsible borrowing decision.

The Advantages (Pros)

- Access for Lower Credit Scores: The employment-based model significantly increases access for those with poor or limited credit history.

- Speed and Convenience: The online application and fast funding make it a viable solution for immediate financial emergencies.

- Structured Repayments: Installment loans are generally safer and easier to manage than revolving lines of credit or single-payment payday loans.

The Disadvantages (Cons)

- High APRs: Interest rates are often significantly higher than traditional bank loans, reflecting the risk associated with subprime lending.

- Mandatory Direct Deposit: You must have a direct deposit setup, limiting options for those paid via paper check or cash.

- Debt Cycle Risk: Although structured, taking out loans at higher interest rates can still lead to a challenging debt cycle if not managed carefully.

Comparing Get Lendly to Traditional Lenders

When you compare Lendly to a major commercial bank or credit union, the fundamental difference lies in their underwriting philosophy. Traditional lenders prioritize high credit scores (e.g., FICO scores above 700) to ensure repayment and offer their lowest APRs to those borrowers.

Lendly, on the other hand, operates more like an emergency financial service. While their rates might be higher, they prioritize income stability over credit history. If you have been employed reliably for five years but have a 580 credit score, a bank might reject you instantly, whereas Lendly sees a reliable income stream.

Furthermore, the speed of application is a major differentiator. While a bank might take days or even weeks for approval and funding, Lendly's automated system aims to provide an offer almost instantly, provided all employment verification checks are successful. For urgent needs, this speed is invaluable.

Ultimately, if you qualify for a low-interest loan at a credit union, that should always be your first choice. However, if those doors are closed, Get Lendly offers a clear, structured second option that avoids the notorious pitfalls of high-fee payday lenders.

Conclusion: Is Get Lendly the Right Choice for You?

Deciding whether to pursue financing through Lendly requires careful assessment of your needs versus the cost of the loan. Lendly provides a vital service by offering installment loans based primarily on employment stability, opening doors for borrowers with less-than-perfect credit.

The speed, convenience, and focus on steady income are definite benefits, particularly during financial emergencies. However, the higher interest rates mean you should treat a loan from Get Lendly as a short-term solution, not a long-term budgeting tool.

Before you commit, always ensure that the monthly repayment fits comfortably within your budget and that you have explored all other lower-interest alternatives. If you have stable employment and need funds quickly without a pristine credit score, then Lendly can certainly be an effective resource to help you regain financial footing.

Frequently Asked Questions (FAQ) About Get Lendly

- Can Get Lendly check my credit score?

- Yes, Lendly may perform a soft credit check as part of the underwriting process. However, unlike traditional lenders, the decision relies heavily on your verifiable income and employment history rather than just your credit score.

- How quickly can I receive funds after approval?

- Once approved and the loan agreement is signed, funds are typically transferred via ACH within one to three business days. For urgent needs, this rapid turnaround is one of the main appeals of Get Lendly.

- Does Lendly report payments to credit bureaus?

- Yes, Lendly generally reports payment activity to the major credit bureaus. This is a significant benefit for borrowers, as consistent, on-time repayment can help improve or rebuild your credit score over time. Conversely, missed payments can negatively affect your score.

- What happens if I change jobs while I have a loan?

- Since the loan is secured largely by your income, changing jobs can complicate the repayment process. You must notify Lendly immediately. Maintaining consistent income, even if from a new employer, is necessary to uphold the terms of your loan agreement.

Get Lendly

Get Lendly Wallpapers

Collection of get lendly wallpapers for your desktop and mobile devices.

Vibrant Get Lendly Artwork in HD

Transform your screen with this vivid get lendly artwork, a true masterpiece of digital design.

Amazing Get Lendly View in HD

Discover an amazing get lendly background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Get Lendly Picture for Mobile

Discover an amazing get lendly background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Get Lendly Design for Your Screen

This gorgeous get lendly photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Get Lendly Artwork for Your Screen

Immerse yourself in the stunning details of this beautiful get lendly wallpaper, designed for a captivating visual experience.

Serene Get Lendly Background Nature

Transform your screen with this vivid get lendly artwork, a true masterpiece of digital design.

Mesmerizing Get Lendly Scene Digital Art

Explore this high-quality get lendly image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Get Lendly Abstract Concept

Discover an amazing get lendly background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Get Lendly View in 4K

Find inspiration with this unique get lendly illustration, crafted to provide a fresh look for your background.

Vivid Get Lendly View in 4K

Explore this high-quality get lendly image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Get Lendly Design Collection

Experience the crisp clarity of this stunning get lendly image, available in high resolution for all your screens.

Exquisite Get Lendly Design in 4K

Find inspiration with this unique get lendly illustration, crafted to provide a fresh look for your background.

Lush Get Lendly Capture Concept

This gorgeous get lendly photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking Get Lendly Background Illustration

Explore this high-quality get lendly image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Get Lendly Artwork Photography

Transform your screen with this vivid get lendly artwork, a true masterpiece of digital design.

Detailed Get Lendly Artwork Collection

Experience the crisp clarity of this stunning get lendly image, available in high resolution for all your screens.

Lush Get Lendly Wallpaper for Your Screen

A captivating get lendly scene that brings tranquility and beauty to any device.

Spectacular Get Lendly Capture Collection

Immerse yourself in the stunning details of this beautiful get lendly wallpaper, designed for a captivating visual experience.

Stunning Get Lendly Landscape Collection

This gorgeous get lendly photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Get Lendly Capture Nature

This gorgeous get lendly photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these get lendly wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Get Lendly"

Post a Comment