Get Out Of Credit Debt

Get Out Of Credit Debt: Your Friendly Guide to Financial Freedom

If you are reading this, chances are you are feeling the heavy burden of credit card debt. That overwhelming feeling, the high-interest rates, and the confusing statements can make it seem impossible to escape. But let us assure you: it is absolutely possible to Get Out Of Credit Debt, and you do not have to do it alone.

This guide is your roadmap. We will walk you through practical, step-by-step strategies designed not only to eliminate your current debt but also to build strong financial habits for a debt-free future. Ready to take back control? Let us dive in.

Acknowledging the Problem: Why Credit Debt Happens

Before you can fix the problem, you need to understand the root cause. Credit card debt rarely happens overnight. Often, it is a slow buildup resulting from poor habits, unexpected emergencies, or a lack of financial literacy. Understanding the 'why' helps prevent future relapse.

Common culprits include reliance on credit for daily needs, unexpected medical bills, job loss, or simply making minimum payments for too long, allowing interest to compound aggressively. No matter the reason, the key is forgiveness and forward momentum—focusing on the steps you can take right now.

Step 1: Taking Control – Budgeting and Inventory

The first rule of winning a financial war is accurate intelligence. You need to know exactly where your money is going and exactly how much you owe. This might feel scary, but this step is the most empowering part of the entire process.

Creating a Realistic Budget

A budget is not about restricting yourself forever; it is about allocating your money purposefully. The 50/30/20 rule is a great place to start: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Start by tracking every dollar you spend for one month. Use a spreadsheet or a budgeting app. Be honest about your income versus your expenditures. Look for areas where you can immediately cut back, such as unused subscriptions or eating out less frequently. Every dollar you free up can go directly toward paying down your credit card balances.

Knowing Your Enemy: Listing All Debts

To truly Get Out Of Credit Debt, you must quantify the total damage. Create a comprehensive debt inventory. This organized view will help you select the best repayment strategy.

Your list should include the following information for every debt:

- Name of the creditor (e.g., Visa, Mastercard).

- Total outstanding balance.

- The annual percentage rate (APR).

- The required minimum monthly payment.

Once this list is complete, you have a clear picture of the challenge ahead. Now we move on to the strategy phase.

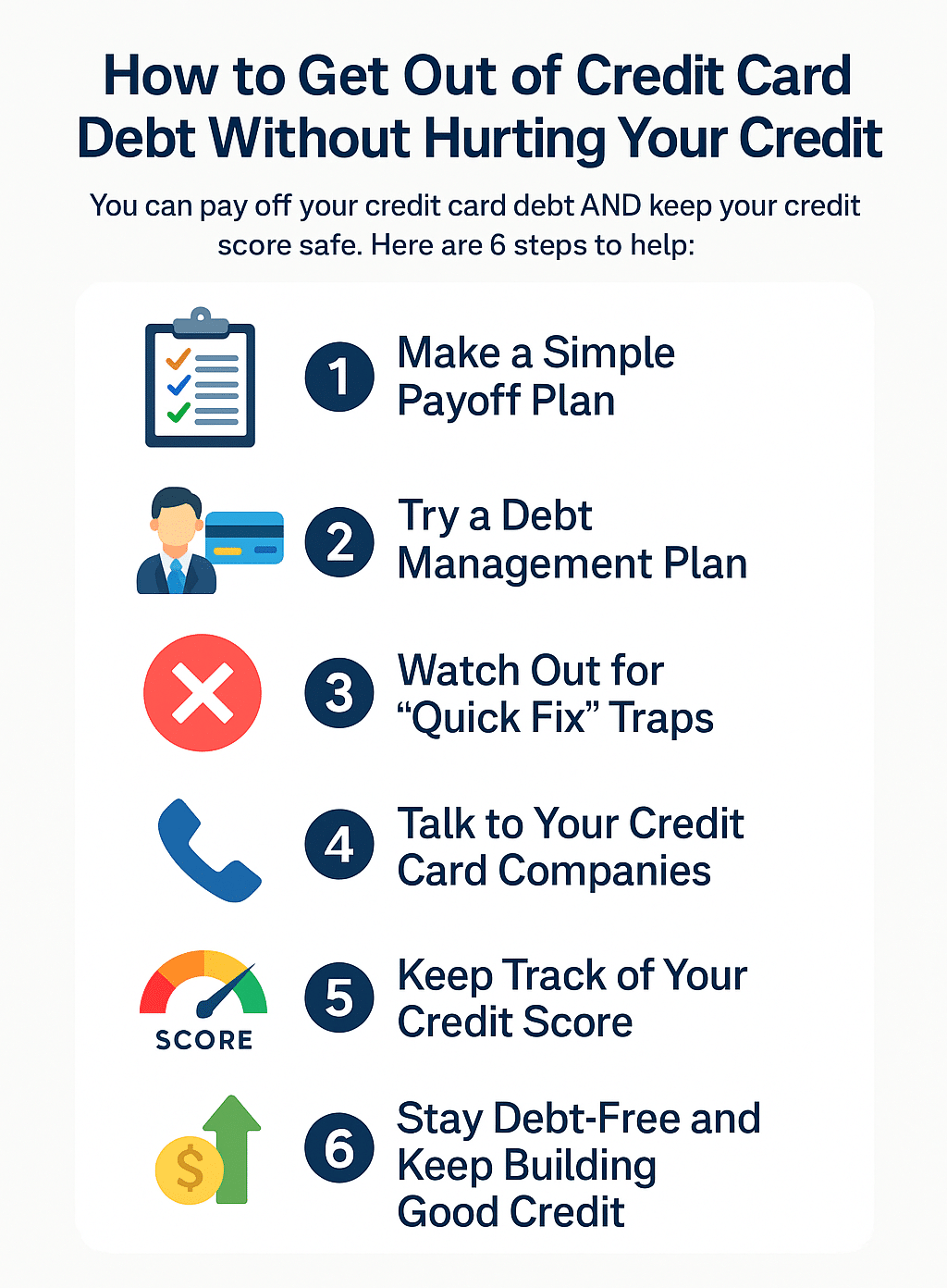

Step 2: Choosing Your Attack Plan (Debt Repayment Strategies)

There are two primary methods that financial experts recommend for aggressive debt repayment. Both work, but they appeal to different psychological drivers.

The Debt Snowball Method

Popularized by financial guru Dave Ramsey, the Snowball Method focuses on behavioral momentum. It is designed for people who need quick wins to stay motivated.

- List your debts from smallest balance to largest balance, regardless of the interest rate.

- Pay only the minimum payment on all debts except the smallest one.

- Throw every extra dollar you can find at the smallest debt until it is gone.

- Once the smallest debt is paid off, take the money you were paying on it (plus the minimum payment) and roll that total amount into the next smallest debt.

This creates a psychological "snowball" of cash flow that grows larger with each debt you eliminate. This method proves that small successes are vital to the long game of eliminating debt.

The Debt Avalanche Method

The Avalanche Method is mathematically the most efficient route. It saves you the most money in interest over time, making it ideal if you are disciplined and focused on maximizing savings.

- List your debts from the highest interest rate (APR) to the lowest interest rate.

- Pay only the minimum payment on all debts except the one with the highest APR.

- Attack the highest-interest debt with all your extra cash.

- Once the highest-interest debt is gone, move all those funds to the next highest-interest debt.

Although you might not see the initial debts disappear as quickly as with the Snowball, the Avalanche method ensures you spend less overall on interest, helping you Get Out Of Credit Debt faster in terms of time and cost.

Step 3: Boosting Your Income and Cutting Costs

While strict budgeting helps, sometimes the solution requires finding more money to fuel your repayment plan. This means either earning more or reducing the cost of the debt itself.

Negotiating Interest Rates

Many people do not realize that credit card interest rates are often negotiable. If you have been a good customer (paying on time, even if only the minimum), call your creditor and ask for a lower APR.

Be polite but firm. Explain that you are aggressively trying to repay your balance and that a lower rate would help you pay them back faster. The worst they can say is no, but a success here can save you hundreds, if not thousands, of dollars.

The Power of Balance Transfers

A balance transfer involves moving high-interest debt from one card to a new card offering a 0% introductory APR. These introductory periods usually last 12 to 21 months.

This is a powerful tool, provided you have a strict plan to pay off the balance entirely before the promotional period ends and the high standard rate kicks in. Remember that balance transfers usually come with a transfer fee, typically 3% to 5% of the transferred amount. Use this strategy only if you are committed to paying down the principal rapidly.

Long-Term Habits for Staying Debt-Free

Achieving zero balance is a monumental accomplishment, but the real victory is staying debt-free. Avoiding the credit debt trap requires adopting healthier, permanent financial habits.

Focus on these key areas once your cards are paid off:

- **Build an Emergency Fund:** Aim for three to six months of living expenses saved in a high-yield savings account. This fund prevents you from reaching for credit cards when life inevitably throws a curveball.

- **Use Credit Cards Responsibly (or Not at All):** If you continue to use credit, treat it like cash. Pay the statement balance in full every single month to avoid incurring any interest charges.

- **Track Your Net Worth:** Shift your focus from monthly payments to growing your overall wealth. Knowing your net worth (assets minus liabilities) provides a motivational snapshot of your progress.

- **Automate Payments:** Set up automated transfers for savings and bill payments to eliminate the risk of late fees, which can quickly spiral into unnecessary debt.

Conclusion

The journey to Get Out Of Credit Debt is challenging, but every step you take brings you closer to genuine financial peace. Start with the honest assessment of your current situation, commit to a repayment plan like the Snowball or Avalanche, and actively seek ways to reduce your interest burden.

Remember, financial freedom is a marathon, not a sprint. Be patient with yourself, celebrate the small victories, and maintain those long-term habits. You have the power to change your financial future today.

Frequently Asked Questions (FAQ)

- Can I use my credit cards while I am paying off debt?

- It is strongly recommended that you stop using credit cards while implementing a repayment plan. If you must use one for essential, planned purchases, commit to paying the full balance immediately so you do not add new debt to the existing burden.

- Should I consolidate my debt into a personal loan?

- Debt consolidation loans can be helpful if they offer a significantly lower interest rate than your current cards and allow you to streamline payments. However, ensure the loan term is manageable and that you do not immediately rack up new debt on the now-empty credit cards.

- How long does it take to get out of credit debt?

- The time frame depends entirely on the total amount of debt, your interest rates, and the amount of money you dedicate monthly toward repayment above the minimum. Using the strategies above and aggressively attacking the principal can significantly cut your repayment time from years to months.

- Will my credit score drop if I start paying off large amounts of debt?

- No, paying off debt is generally excellent for your credit score. As your balances decrease, your "credit utilization ratio" (the amount of credit used versus the amount available) improves, which is a major positive factor in scoring models.

Get Out Of Credit Debt

Get Out Of Credit Debt Wallpapers

Collection of get out of credit debt wallpapers for your desktop and mobile devices.

Crisp Get Out Of Credit Debt Landscape for Your Screen

Immerse yourself in the stunning details of this beautiful get out of credit debt wallpaper, designed for a captivating visual experience.

Crisp Get Out Of Credit Debt Artwork for Mobile

Immerse yourself in the stunning details of this beautiful get out of credit debt wallpaper, designed for a captivating visual experience.

Stunning Get Out Of Credit Debt Wallpaper Digital Art

This gorgeous get out of credit debt photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Get Out Of Credit Debt Scene for Mobile

Find inspiration with this unique get out of credit debt illustration, crafted to provide a fresh look for your background.

Dynamic Get Out Of Credit Debt Abstract for Desktop

A captivating get out of credit debt scene that brings tranquility and beauty to any device.

Gorgeous Get Out Of Credit Debt Design Art

Find inspiration with this unique get out of credit debt illustration, crafted to provide a fresh look for your background.

Breathtaking Get Out Of Credit Debt View Collection

Explore this high-quality get out of credit debt image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Get Out Of Credit Debt View Art

Explore this high-quality get out of credit debt image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Get Out Of Credit Debt Design Concept

Discover an amazing get out of credit debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Get Out Of Credit Debt Landscape for Desktop

Discover an amazing get out of credit debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Get Out Of Credit Debt Photo Art

A captivating get out of credit debt scene that brings tranquility and beauty to any device.

Vivid Get Out Of Credit Debt Picture for Mobile

Experience the crisp clarity of this stunning get out of credit debt image, available in high resolution for all your screens.

Exquisite Get Out Of Credit Debt View Illustration

Immerse yourself in the stunning details of this beautiful get out of credit debt wallpaper, designed for a captivating visual experience.

Artistic Get Out Of Credit Debt Landscape Collection

This gorgeous get out of credit debt photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Get Out Of Credit Debt Photo Digital Art

A captivating get out of credit debt scene that brings tranquility and beauty to any device.

Beautiful Get Out Of Credit Debt Image Collection

Discover an amazing get out of credit debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Get Out Of Credit Debt Background Concept

Discover an amazing get out of credit debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Get Out Of Credit Debt View Illustration

Experience the crisp clarity of this stunning get out of credit debt image, available in high resolution for all your screens.

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)

Dynamic Get Out Of Credit Debt Image Photography

This gorgeous get out of credit debt photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Get Out Of Credit Debt Background Collection

Experience the crisp clarity of this stunning get out of credit debt image, available in high resolution for all your screens.

Download these get out of credit debt wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Get Out Of Credit Debt"

Post a Comment