Get Student Loans Forgiven

Get Student Loans Forgiven: Your Complete Guide to Debt Relief

Hey there! If you're struggling under the weight of student debt, you're not alone. The phrase "Get Student Loans Forgiven" often sounds like a mythical creature, but relief programs are real, and many people qualify. This guide will walk you through the primary pathways to getting your student loans canceled or forgiven.

It's important to understand that loan forgiveness usually requires commitment, specific employment, or consistent payments over a long period. We're here to break down the eligibility requirements, potential pitfalls, and the exact steps you need to take to finally shed that debt.

Understanding Loan Forgiveness: Is It Right for You?

Before diving into specific programs, let's clarify what loan forgiveness means. Forgiveness, cancellation, and discharge all mean you are no longer required to repay some or all of your federal student loan debt. This is different from deferment or forbearance, which only temporarily pause your payments.

The first step toward figuring out how to get student loans forgiven is identifying the type of loans you hold. The vast majority of forgiveness programs apply only to federal loans, not private ones. If you have private loans, your options for cancellation are extremely limited, typically only involving bankruptcy or death/disability.

Federal vs. Private Loans: Who Qualifies?

If your loans are federal (Direct Loans, FFEL, or Perkins), you have a much wider array of options. Many older loan types must often be consolidated into a Direct Consolidation Loan before they qualify for the best forgiveness programs, such as PSLF.

Private loans are issued by banks or private institutions. They rarely offer forgiveness, though they may offer refinancing options to lower interest rates. If you want to Get Student Loans Forgiven, make sure you know exactly who your loan servicer is and what kind of loans you have.

Here are the types of federal loans that are generally eligible for forgiveness programs:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Direct Consolidation Loans

Public Service Loan Forgiveness (PSLF): The Gold Standard

Public Service Loan Forgiveness (PSLF) is often the most discussed pathway to Get Student Loans Forgiven completely. This program is designed to encourage individuals to enter and continue to work full-time in public service jobs.

If you meet all the criteria, PSLF can wipe out 100% of your remaining federal student loan balance, tax-free, after 120 qualifying monthly payments.

Meeting the PSLF Requirements

PSLF has strict requirements that must all be met simultaneously. Missing even one requirement can delay or completely halt your path to forgiveness. Pay close attention to these rules!

You must satisfy three main conditions to qualify:

- You must be employed full-time by a qualifying employer.

- You must have Direct Loans (or consolidated non-Direct Loans).

- You must make 120 qualifying payments under an Income-Driven Repayment (IDR) plan.

Qualifying employers include government organizations at any level (federal, state, local, or tribal) and most non-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code.

The Importance of Eligible Payments

The payments must be made under a qualifying repayment plan. Generally, this means an Income-Driven Repayment (IDR) plan. Standard 10-year repayment plans also count, but since that plan pays off your loan in 10 years anyway, you wouldn't have anything left to forgive!

Also, payments must be on time (no later than 15 days after the due date) and for the full amount due. It is strongly recommended that PSLF applicants submit an Employment Certification Form (ECF) annually or whenever they change jobs. This ensures the Department of Education is tracking your progress accurately.

Income-Driven Repayment (IDR) Plans: Forgiveness Over Time

If you don't work in public service, you can still Get Student Loans Forgiven through Income-Driven Repayment (IDR) plans. These plans calculate your monthly payment based on your income and family size, making repayment more affordable. However, the path to forgiveness is longer.

Under an IDR plan, any remaining balance is forgiven after 20 or 25 years of qualifying payments, depending on the specific plan. While this relief is substantial, it often comes with a significant catch: the forgiven amount may be treated as taxable income by the IRS when the forgiveness occurs.

Comparing Different IDR Options

There are several types of IDR plans, each offering slightly different payment calculations and forgiveness timelines. Choosing the right one is crucial for minimizing your monthly payment and maximizing the amount eligible for eventual forgiveness.

The main IDR plans available are:

- SAVE Plan (or REPAYE): This plan often results in the lowest monthly payments, potentially 10% of discretionary income. Forgiveness occurs after 20 years for undergraduate loans and 25 years for graduate loans.

- PAYE Plan (Pay As You Earn): Payments are generally 10% of discretionary income, capped at the standard 10-year payment amount. Forgiveness after 20 years.

- IBR Plan (Income-Based Repayment): Payments are 10% or 15% of discretionary income, depending on when you took out the loans. Forgiveness after 20 or 25 years.

If your income is low relative to your debt, an IDR plan is essential not only for affordable payments but also as a route to ultimately Get Student Loans Forgiven.

Specialized Forgiveness Programs

Beyond the major PSLF and IDR pathways, there are several programs targeting specific professions or circumstances. These often provide faster relief but only apply to a smaller subset of borrowers.

Teacher Loan Forgiveness (TLF)

If you teach full-time for five consecutive, complete academic years in a low-income school or educational service agency, you may qualify for TLF. This program can forgive up to $17,500 of your Direct Subsidized and Unsubsidized Loans.

The maximum amount ($17,500) is reserved for highly qualified math, science, or special education teachers. Other eligible teachers may receive up to $5,000 in forgiveness. Importantly, you cannot receive credit for the same period of service for both PSLF and TLF.

Perkins Loan Cancellation

Federal Perkins Loans, though no longer offered, have their own generous cancellation program. Borrowers working in certain public service jobs (like teaching, nursing, law enforcement, or firefighting) can have up to 100% of their Perkins Loans canceled over a five-year period.

The percentage of the loan canceled increases each year of qualifying service. If you have older Perkins Loans, check with your school or servicer immediately to see if you qualify.

Other Avenues to Get Student Loans Forgiven

While less common, some other situations lead to loan cancellation or discharge:

- Total and Permanent Disability (TPD) Discharge: If you become totally and permanently disabled, your federal loans can be discharged.

- Borrower Defense to Repayment: This applies if your school misled you or engaged in misconduct that violated certain state laws.

- Closed School Discharge: If your school closed while you were enrolled or shortly after you withdrew, you may qualify.

Conclusion: Taking the Necessary Steps to Find Relief

Finding a way to Get Student Loans Forgiven requires careful planning and persistence. Whether you are aiming for the tax-free benefits of PSLF or the long-term affordability of an IDR plan, the key is to ensure your loans are federal and you are enrolled in the correct repayment plan from day one.

Don't wait until you've made hundreds of payments to check your eligibility. Use the Department of Education's resources, submit your employment certifications promptly, and stay in close communication with your loan servicer. Taking these proactive steps will greatly increase your chances of achieving student loan forgiveness and finally reaching financial freedom.

Frequently Asked Questions (FAQ) About Loan Forgiveness

- Can I get private student loans forgiven?

- Generally, no. Private loans do not qualify for federal forgiveness programs like PSLF or IDR forgiveness. Private lenders might offer temporary relief (forbearance) but rarely cancel the debt, except in cases of death or total disability, and sometimes bankruptcy.

- Does forgiveness affect my credit score?

- When you Get Student Loans Forgiven legally through a federal program, the debt is resolved, which typically does not negatively impact your credit score. If the debt is discharged due to default, however, your credit score will already have suffered severe damage.

- Will I have to pay taxes on the forgiven amount?

- It depends. If your loans are forgiven through Public Service Loan Forgiveness (PSLF), the amount canceled is NOT considered taxable income by the IRS. However, if your loans are forgiven after 20 or 25 years under an Income-Driven Repayment (IDR) plan, the forgiven amount IS generally treated as taxable income (though temporary federal provisions sometimes suspend this rule).

- What is a "qualifying payment" for PSLF?

- A qualifying payment is a full, on-time monthly payment made after October 1, 2007, under a qualifying repayment plan (usually IDR plans), while you are employed full-time by a qualifying non-profit or government employer, and your loan must be a Direct Loan.

- How do I apply for PSLF?

- You must submit the PSLF Form (which serves as the Employment Certification Form and the final application) to the Department of Education or your loan servicer (currently MOHELA). It's best practice to submit this form annually to ensure your payments are being counted correctly.

Get Student Loans Forgiven

Get Student Loans Forgiven Wallpapers

Collection of get student loans forgiven wallpapers for your desktop and mobile devices.

Vivid Get Student Loans Forgiven Artwork Digital Art

Discover an amazing get student loans forgiven background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic Get Student Loans Forgiven Capture Collection

A captivating get student loans forgiven scene that brings tranquility and beauty to any device.

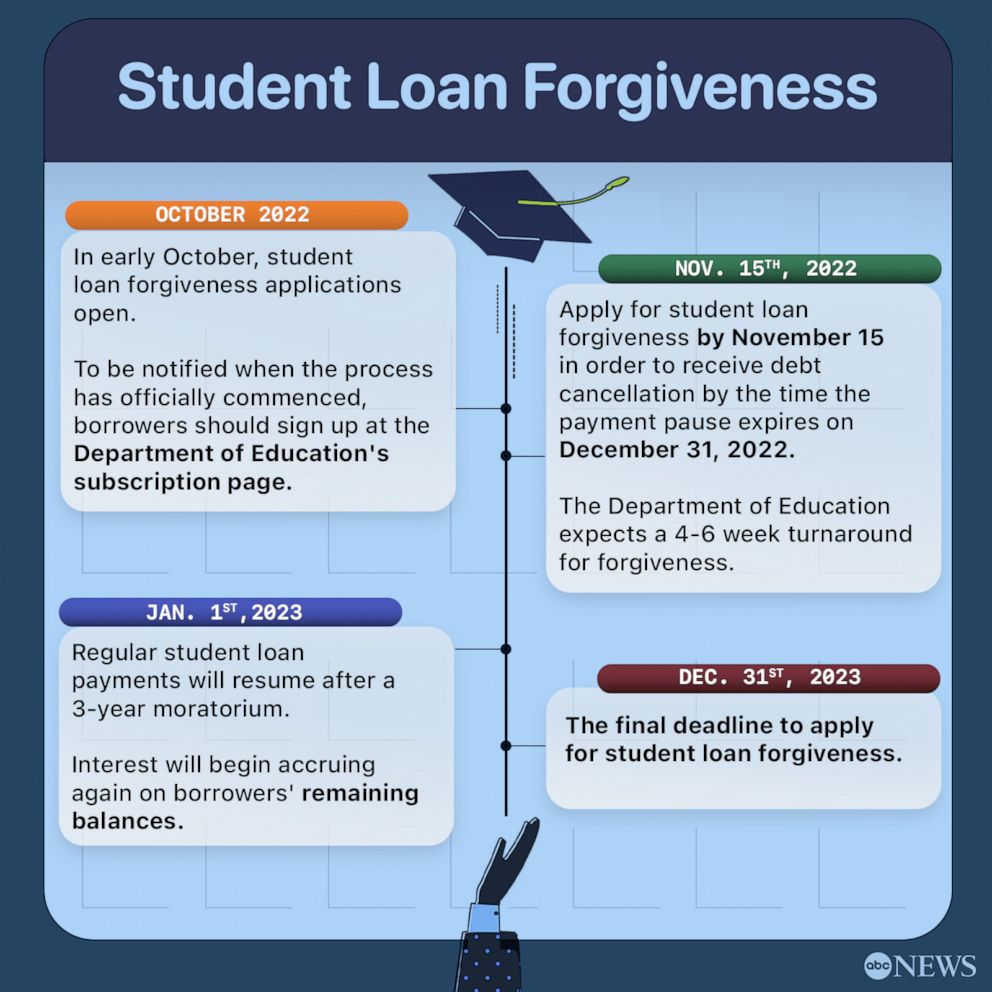

Stunning Get Student Loans Forgiven Picture in HD

A captivating get student loans forgiven scene that brings tranquility and beauty to any device.

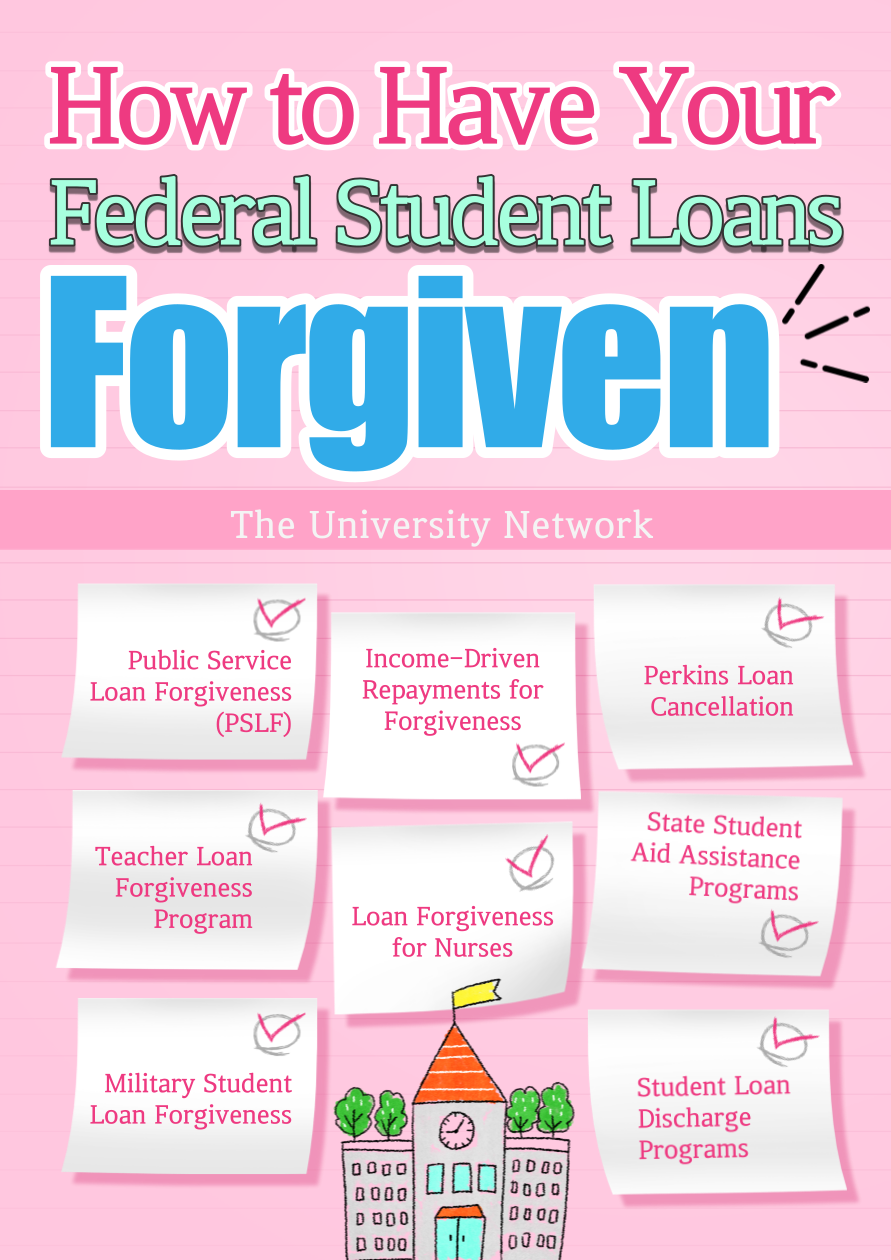

Serene Get Student Loans Forgiven Abstract Collection

Experience the crisp clarity of this stunning get student loans forgiven image, available in high resolution for all your screens.

Captivating Get Student Loans Forgiven View Nature

Immerse yourself in the stunning details of this beautiful get student loans forgiven wallpaper, designed for a captivating visual experience.

Breathtaking Get Student Loans Forgiven Picture Photography

Transform your screen with this vivid get student loans forgiven artwork, a true masterpiece of digital design.

Mesmerizing Get Student Loans Forgiven Design Nature

Discover an amazing get student loans forgiven background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Get Student Loans Forgiven Capture for Desktop

Transform your screen with this vivid get student loans forgiven artwork, a true masterpiece of digital design.

Mesmerizing Get Student Loans Forgiven View Illustration

Experience the crisp clarity of this stunning get student loans forgiven image, available in high resolution for all your screens.

Amazing Get Student Loans Forgiven Photo for Your Screen

Experience the crisp clarity of this stunning get student loans forgiven image, available in high resolution for all your screens.

Mesmerizing Get Student Loans Forgiven Scene for Mobile

Experience the crisp clarity of this stunning get student loans forgiven image, available in high resolution for all your screens.

:max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg)

Spectacular Get Student Loans Forgiven Landscape in HD

This gorgeous get student loans forgiven photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Get Student Loans Forgiven Moment in 4K

Discover an amazing get student loans forgiven background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Get Student Loans Forgiven Capture for Mobile

A captivating get student loans forgiven scene that brings tranquility and beauty to any device.

Amazing Get Student Loans Forgiven Artwork Nature

Explore this high-quality get student loans forgiven image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant Get Student Loans Forgiven Background Photography

Discover an amazing get student loans forgiven background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Get Student Loans Forgiven Moment for Mobile

This gorgeous get student loans forgiven photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Get Student Loans Forgiven Picture Photography

Discover an amazing get student loans forgiven background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking Get Student Loans Forgiven Abstract in 4K

Explore this high-quality get student loans forgiven image, perfect for enhancing your desktop or mobile wallpaper.

Amazing Get Student Loans Forgiven Moment Digital Art

Experience the crisp clarity of this stunning get student loans forgiven image, available in high resolution for all your screens.

Download these get student loans forgiven wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Get Student Loans Forgiven"

Post a Comment