Get Term Life Insurance Online

Get Term Life Insurance Online: Your Quick and Easy Guide

Life is full of unexpected twists and turns, right? If you have people who depend on you—a spouse, children, or even elderly parents—thinking about how they would manage financially if you were gone is essential. That's where term life insurance steps in, offering peace of mind without breaking the bank.

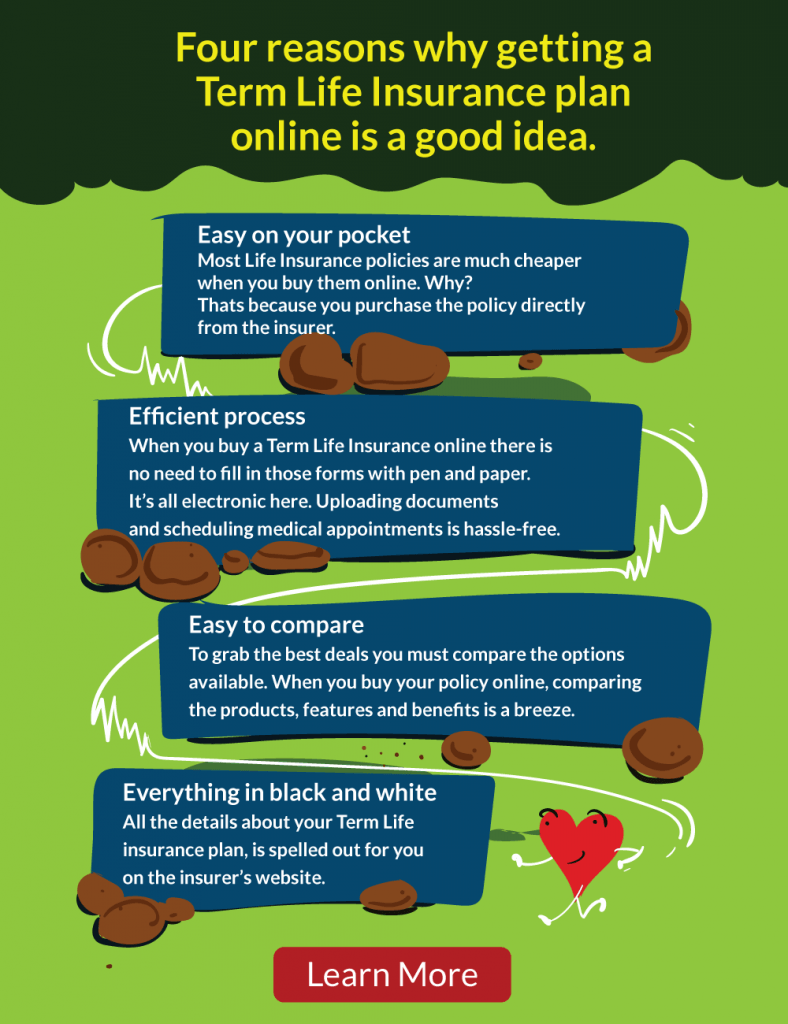

The good news? You no longer have to spend hours in an agent's office filling out endless paperwork. Today, you can easily Get Term Life Insurance Online, often faster than ordering takeout. This comprehensive guide will walk you through the process, helping you feel confident about securing your family's future right from your couch.

Why Term Life Insurance is a Smart Move

Term life insurance is the most straightforward and affordable type of coverage. It's designed to provide financial protection for a specific period of time—typically 10, 20, or 30 years—when your financial responsibilities are highest.

Unlike whole life insurance, which builds cash value and is generally more expensive, term life focuses purely on the death benefit. If you pass away during the policy term, your beneficiaries receive a tax-free lump sum payment. This money can be crucial for covering immediate costs and long-term security.

Key Benefits of Choosing Term Life

- Affordability: Premiums are generally much lower than permanent life insurance, especially when you are young and healthy.

- Simplicity: It's easy to understand. You choose a coverage amount and a term length, and the premium stays level for that period.

- Flexibility: You can select a term length that aligns perfectly with major financial milestones, such as paying off your mortgage or having your children graduate college.

- Ease of Application: Modern technology makes it incredibly simple to Get Term Life Insurance Online quickly.

Choosing term life means you are investing in crucial financial stability for those you love most, ensuring they aren't left with debt or financial hardship during an already difficult time.

The Process to Get Term Life Insurance Online

The days of in-person appointments and stacks of paper are fading away. The process to Get Term Life Insurance Online has been streamlined and digitized, making it accessible 24/7. Here's how the modern application journey typically unfolds.

Step 1: Determine Your Coverage Needs

Before you start applying, you need to figure out the "how much" and "how long." A common rule of thumb is to calculate your total outstanding debts, plus future income replacement needs. Consider using the D.I.M.E. method:

- Debt: Mortgage, credit cards, loans, etc.

- Income: How many years of your salary do your dependents need replaced (e.g., 5-10 years)?

- Mortgage: The full payoff amount for your home.

- Education: Future college costs for your children.

Most online platforms offer quick calculators to help you estimate these figures, ensuring you don't over-insure or under-insure yourself.

Step 2: Compare Quotes and Carriers

This is where the power of online shopping truly shines. Aggregator websites and broker portals allow you to input your age, health class (estimated), and desired coverage amount just once.

In seconds, you will receive dozens of quotes from various highly-rated insurance carriers. Always look beyond the price; check the company's financial stability ratings (A.M. Best or Moody's) to ensure they can pay the claim when the time comes.

Step 3: The Online Application Process

Once you select a quote, you will be directed to the carrier's online application. This form typically asks for detailed information about your medical history, current medications, driving record, and lifestyle habits (like smoking or dangerous hobbies).

Be honest! Being upfront about your health ensures that your policy is issued correctly and that future claims won't be denied due to misrepresentation. The application is usually submitted digitally, minimizing environmental waste and speeding up the underwriting timeline.

Navigating the Medical Exam (or Avoiding It)

One of the biggest concerns people have when they decide to Get Term Life Insurance Online is the medical exam. While many traditional policies require one, the industry is quickly moving towards accelerated underwriting for healthier applicants.

Accelerated Underwriting: Going No-Exam

For younger, very healthy applicants seeking lower to moderate coverage amounts (often up to $1 million), many carriers now offer no-exam policies through accelerated underwriting. This process relies heavily on data.

Instead of a physical check-up, the insurance company uses proprietary algorithms to instantly review your medical records, prescription history, MIB (Medical Information Bureau) records, and public data. If all the data points align perfectly, you can be approved immediately—sometimes in minutes!

What Happens During a Standard Medical Exam

If your requested coverage is very high or your medical history is complex, a traditional exam will likely be required. This is not scary; it's free and convenient. A paramedical professional comes to your home or office.

The Exam typically involves:

- Recording your height, weight, and blood pressure.

- Collecting blood and urine samples.

- Asking a few basic medical questions.

The results are used by the underwriter to confirm the health class you were initially quoted. Planning ahead means you can prepare; avoid coffee, heavy meals, and vigorous exercise the morning before the appointment to ensure accurate readings.

Common Questions Before You Buy

We know that even when the process is easy, committing to life insurance can feel like a big decision. Here are answers to some frequently pondered questions when you Get Term Life Insurance Online.

H4: Can I Change My Coverage After I Buy It?

While your policy's premium is typically locked in for the term, some term policies offer convertibility. This means you have the option to convert the term policy into a permanent whole life policy later without having to undergo a new medical exam. This is a great feature if your financial needs or long-term estate planning goals change.

H4: What if I Move to a Different State?

Life insurance policies are generally portable and remain active regardless of which state you move to within the United States. However, it's always wise to inform your insurance carrier of your new address to ensure all communications and billing statements are accurate. The terms and conditions of your contract will remain the same.

H4: How Long Does the Approval Process Really Take?

If you qualify for accelerated underwriting (no-exam), approval can be nearly instantaneous, or within 48 hours. For policies requiring a medical exam, the process generally takes four to six weeks. This timeline includes scheduling the exam, laboratory analysis, and the final underwriting review.

Conclusion

Securing your family's financial future doesn't have to be a complicated task reserved only for financial experts. Thanks to digital innovation, the ability to Get Term Life Insurance Online is now faster, more transparent, and more user-friendly than ever before. You can research, compare, apply, and often get approved without ever needing to leave your home.

Don't put off this vital protection any longer. Take the first step today to evaluate your needs, compare quotes, and gain the peace of mind that comes with knowing your loved ones are covered.

Frequently Asked Questions (FAQ)

- What happens at the end of the term?

- When the term (e.g., 20 years) ends, you typically have three options: 1) Let the coverage lapse, 2) Renew the policy (though premiums will be significantly higher as you are older), or 3) Convert it into a permanent policy (if conversion is an option).

- Is term life insurance tax-deductible?

- No, the premiums paid for personal term life insurance are generally not tax-deductible. However, the death benefit paid out to your beneficiaries is typically received tax-free.

- Can I get term life insurance if I have a pre-existing medical condition?

- Yes, absolutely. Having a pre-existing condition doesn't prevent you from obtaining coverage, though it might impact your rate. Carriers look at the severity of the condition, how well it is managed, and the time elapsed since treatment. It is still highly recommended to Get Term Life Insurance Online and apply, as rates vary widely between companies.

- What factors affect my premium rate?

- Your premium is primarily determined by age, gender, overall health and lifestyle (e.g., smoking status, dangerous hobbies), coverage amount, and the length of the term.

Get Term Life Insurance Online

Get Term Life Insurance Online Wallpapers

Collection of get term life insurance online wallpapers for your desktop and mobile devices.

Detailed Get Term Life Insurance Online Wallpaper Nature

Transform your screen with this vivid get term life insurance online artwork, a true masterpiece of digital design.

Stunning Get Term Life Insurance Online Background Illustration

This gorgeous get term life insurance online photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Get Term Life Insurance Online Wallpaper Concept

This gorgeous get term life insurance online photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Get Term Life Insurance Online Abstract Photography

Transform your screen with this vivid get term life insurance online artwork, a true masterpiece of digital design.

Exquisite Get Term Life Insurance Online Wallpaper Collection

This gorgeous get term life insurance online photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Get Term Life Insurance Online Image in HD

Discover an amazing get term life insurance online background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality Get Term Life Insurance Online Capture in HD

Experience the crisp clarity of this stunning get term life insurance online image, available in high resolution for all your screens.

Crisp Get Term Life Insurance Online Landscape Illustration

Find inspiration with this unique get term life insurance online illustration, crafted to provide a fresh look for your background.

Breathtaking Get Term Life Insurance Online Picture Digital Art

Explore this high-quality get term life insurance online image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Get Term Life Insurance Online Landscape in HD

Discover an amazing get term life insurance online background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Get Term Life Insurance Online Wallpaper Art

Immerse yourself in the stunning details of this beautiful get term life insurance online wallpaper, designed for a captivating visual experience.

Breathtaking Get Term Life Insurance Online Picture Illustration

Explore this high-quality get term life insurance online image, perfect for enhancing your desktop or mobile wallpaper.

Lush Get Term Life Insurance Online Wallpaper Art

This gorgeous get term life insurance online photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Get Term Life Insurance Online Image for Desktop

This gorgeous get term life insurance online photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Get Term Life Insurance Online Background for Your Screen

Discover an amazing get term life insurance online background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Get Term Life Insurance Online Landscape Concept

This gorgeous get term life insurance online photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Get Term Life Insurance Online Background Collection

Transform your screen with this vivid get term life insurance online artwork, a true masterpiece of digital design.

Dynamic Get Term Life Insurance Online Scene Nature

This gorgeous get term life insurance online photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Get Term Life Insurance Online Photo Digital Art

Immerse yourself in the stunning details of this beautiful get term life insurance online wallpaper, designed for a captivating visual experience.

Crisp Get Term Life Insurance Online Abstract Art

A captivating get term life insurance online scene that brings tranquility and beauty to any device.

Download these get term life insurance online wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Get Term Life Insurance Online"

Post a Comment