How Can Get Out Of Debt

How Can Get Out Of Debt: Your Ultimate Guide to Financial Freedom

If you are reading this, chances are you are feeling the heavy weight of debt pressing down on your shoulders. It's a stressful, often isolating experience, but let me assure you: you are not alone, and getting out of debt is completely achievable. This isn't just about cutting expenses; it's about building a sustainable plan and changing your relationship with money.

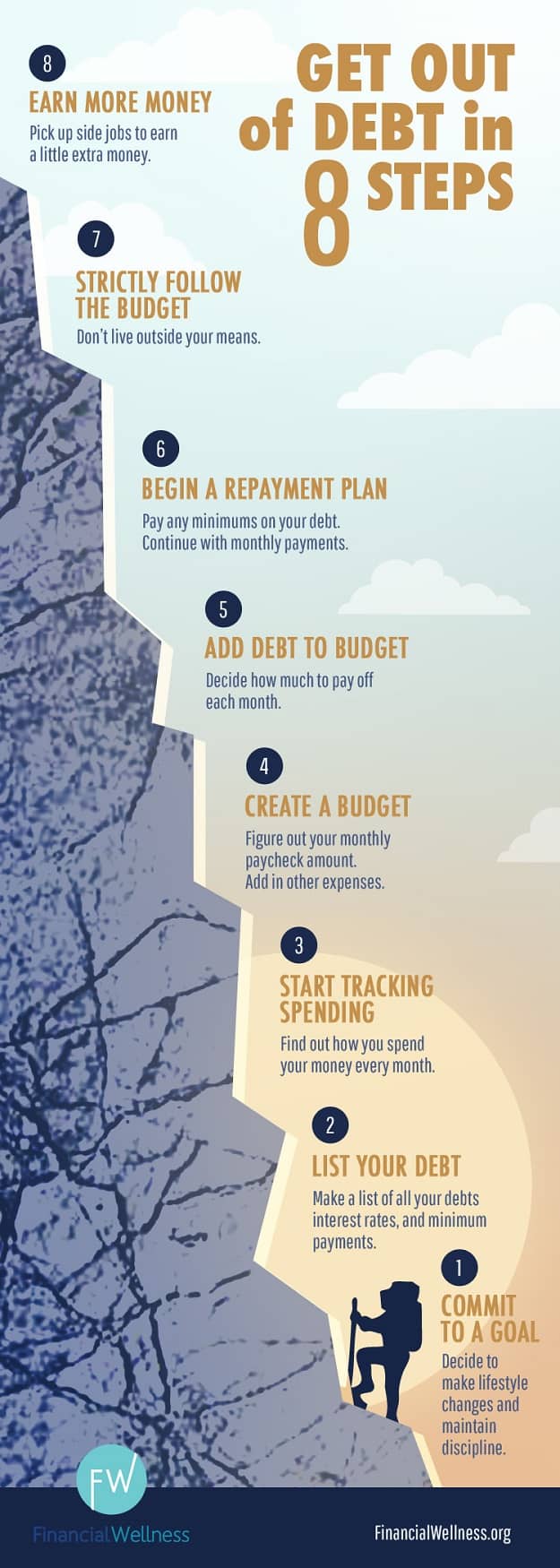

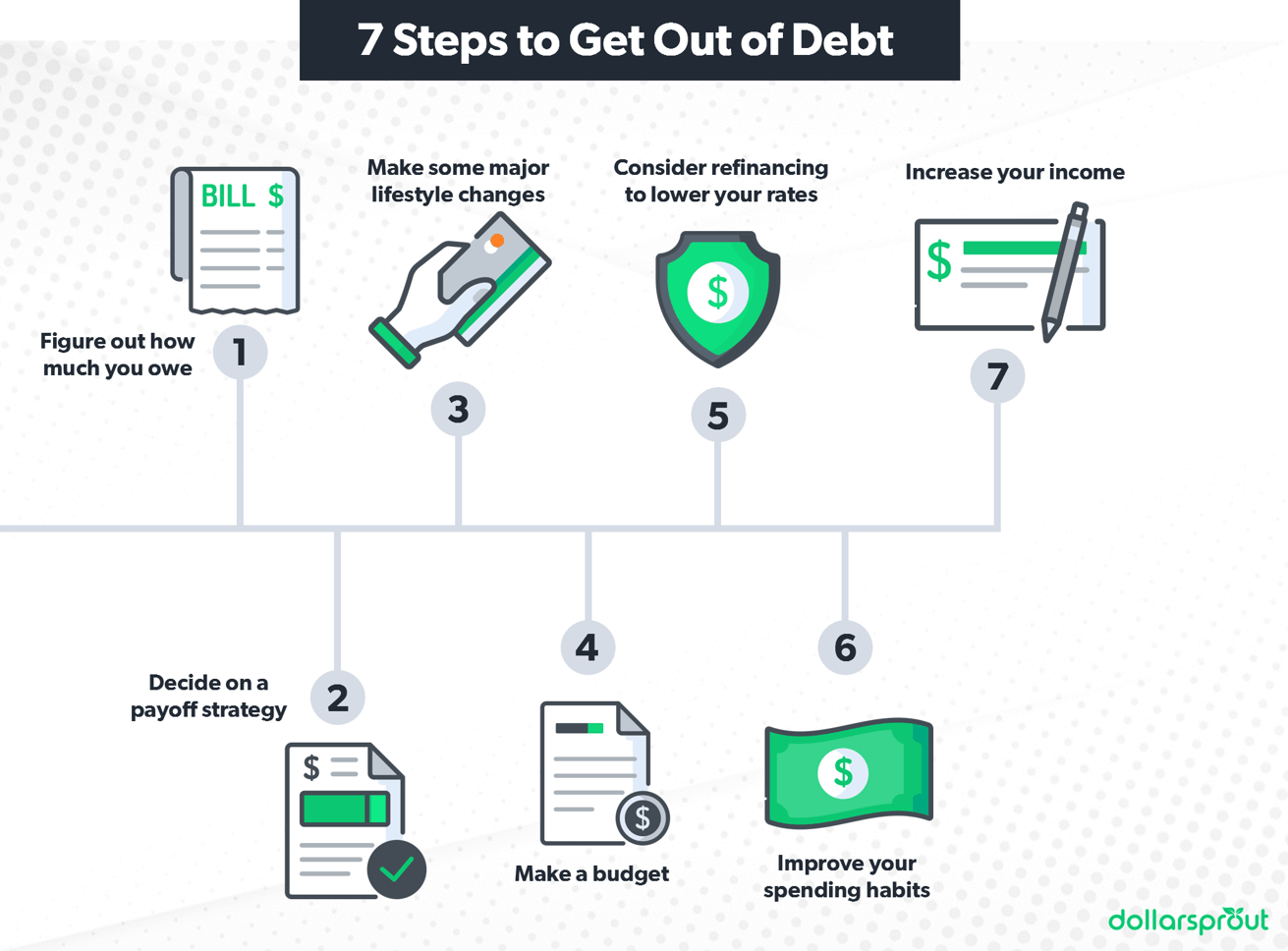

Many people ask, "How Can Get Out Of Debt quickly and effectively?" The answer isn't a single magic trick, but rather a structured approach broken down into manageable phases. We're going to walk through the diagnosis, the attack, and the long-term defense strategies together.

Phase 1: Understanding Your Debt Landscape

Before you can fight the enemy, you need to know exactly what you are up against. This first phase is crucial for laying the groundwork. It requires honesty, a little organization, and a commitment to face the numbers.

The Brutal Truth: Listing Every Penny Owed

Grab a spreadsheet or a piece of paper and list every single debt you have. This includes credit cards, student loans, car loans, medical bills, and even money borrowed from family. Don't worry about being judged; this document is just for you.

For maximum effectiveness, you need to track several key pieces of information for each debt:

- The creditor name (e.g., Chase, Sallie Mae, Hospital X).

- The total balance currently owed.

- The minimum monthly payment required.

- The interest rate (APR). This is arguably the most important number!

Once this list is complete, sort it by the highest interest rate first. This visualization is essential for determining the most mathematically sound attack plan later on.

Analyzing Your Cash Flow

A budget isn't a restriction; it's a map that shows you exactly where your money is going. You need to know how much money you have coming in versus how much is going out. If you don't already track your spending, use an app or bank statements to analyze the last 30 days of transactions.

Identify fixed expenses (rent, insurance) and variable expenses (groceries, entertainment). The goal here is to find the "debt difference"—the amount of money you can realistically free up each month to aggressively pay down debt beyond the minimum payments.

Be tough but realistic. Cutting cable might save you $100, which can go straight toward eliminating your debt faster. Every dollar counts when you are figuring out How Can Get Out Of Debt successfully.

Phase 2: Strategizing Your Debt Attack

With your debt list and budget in hand, it's time to move from defense to offense. You need a targeted strategy that keeps you motivated while maximizing your financial impact.

Choosing Your Debt Repayment Strategy

There are two primary methods for attacking your debt, often referred to as the Snowball and the Avalanche method. Both require you to make minimum payments on all debts while directing extra funds toward one specific debt.

The Debt Avalanche Method (Mathematically Superior)

In this method, you pay off the debt with the highest interest rate first, regardless of the balance size. This saves you the most money in the long run because you minimize interest accumulation. If your primary motivation is saving money, this is the way to go.

The Debt Snowball Method (Psychologically Satisfying)

Here, you pay off the smallest debt balance first. Once that debt is gone, you roll the money you were paying on it into the payment for the next smallest debt. While you might pay slightly more interest overall, the quick wins provide immense motivation to keep going.

Choose the method that best aligns with your personality. Consistency is more important than optimization when you are learning How Can Get Out Of Debt for good.

The Art of Negotiation and Consolidation

Sometimes, simply budgeting isn't enough; you need to reduce the rate at which your debt grows. High-interest credit card debt can feel impossible to escape, which is where negotiation comes in.

- Call Your Creditors: Believe it or not, your credit card companies would rather get some money than none. Call them and ask if they can temporarily lower your interest rate (APR) or waive a late fee.

- Debt Consolidation Loans: If you have multiple high-interest debts, consolidating them into one personal loan with a much lower fixed interest rate can dramatically reduce your monthly burden and simplify payments.

- Balance Transfers: Look for 0% APR balance transfer credit cards. Be warned: these offers are usually for a limited time (12-18 months) and often come with a 3-5% transfer fee. Only use this if you are confident you can pay off the debt entirely before the promotional rate expires.

Phase 3: Long-Term Habits for Staying Debt-Free

Paying off debt is a huge accomplishment, but the real victory is staying debt-free. This requires fundamental lifestyle shifts and planning for the unexpected.

Building a Robust Emergency Fund

The single biggest reason people fall back into debt is an unexpected expense—a car repair, a job loss, or a medical bill. Without savings, the credit card becomes the emergency fund, and the cycle starts all over again.

While you are aggressively paying off high-interest debt, try to maintain a small "starter" emergency fund of $1,000. Once the debt is gone, pivot your focus entirely to building a fully funded emergency fund, ideally covering 3 to 6 months of living expenses.

Avoiding the Debt Trap: Lifestyle Changes

Financial freedom is rarely achieved without changing the behaviors that caused the debt in the first place. This doesn't mean deprivation, but rather intentional spending.

Consider implementing the following habits to secure your future financial health:

- Use Cash for Variable Spending: The "cash envelope system" makes spending tangible and prevents overspending in categories like groceries and entertainment.

- Delay Gratification: Adopt a 30-day waiting rule for any non-essential purchase over a certain amount (e.g., $100). Often, the urge to buy disappears after a month.

- Automate Savings: Treat your savings contributions like a non-negotiable bill. Move money into savings the moment you get paid.

Conclusion

The journey of tackling debt is challenging, but it is one of the most rewarding steps you will ever take toward securing your future. We've covered everything from diagnosing the problem to implementing strategies like the Debt Snowball and making crucial lifestyle changes.

Remember, financial success is built through small, consistent steps, not giant leaps. If you diligently follow the phases outlined in this guide—understanding your debt, strategizing the attack, and building lasting habits—you will find the answer to the question "How Can Get Out Of Debt." Start today, stay focused, and celebrate every single win along the way.

Frequently Asked Questions (FAQ)

- What is the absolute fastest way to get out of high-interest credit card debt?

- The fastest way is typically the Debt Avalanche method coupled with increasing your income and aggressively cutting expenses to maximize the extra payment amount. Focus all additional funds on the debt with the highest APR.

- Should I stop contributing to retirement while paying off debt?

- This is highly debated. Most financial experts agree that you should at least contribute enough to receive your employer's 401(k) match, as that is immediate 100% return on investment. Once the match is secured, divert all remaining funds to high-interest debt (over 8-10% APR).

- Will debt consolidation hurt my credit score?

- When done properly, debt consolidation may initially cause a slight dip (due to opening a new loan), but it generally helps your score in the long run. By paying off high-balance credit cards, you drastically improve your credit utilization ratio, which is a major factor in your score.

- How long does it realistically take to pay off significant debt?

- This depends entirely on the size of the debt and your income/expense ratio. If you can dedicate 10-15% of your income purely toward extra debt payments, you can often eliminate consumer debt (non-mortgage) within 2 to 5 years. It requires intense commitment and budgeting.

How Can Get Out Of Debt

How Can Get Out Of Debt Wallpapers

Collection of how can get out of debt wallpapers for your desktop and mobile devices.

Detailed How Can Get Out Of Debt View Art

Discover an amazing how can get out of debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)

Dynamic How Can Get Out Of Debt Image Photography

This gorgeous how can get out of debt photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite How Can Get Out Of Debt Wallpaper for Mobile

A captivating how can get out of debt scene that brings tranquility and beauty to any device.

Captivating How Can Get Out Of Debt Capture in HD

Find inspiration with this unique how can get out of debt illustration, crafted to provide a fresh look for your background.

Spectacular How Can Get Out Of Debt View Art

This gorgeous how can get out of debt photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular How Can Get Out Of Debt Picture Digital Art

Find inspiration with this unique how can get out of debt illustration, crafted to provide a fresh look for your background.

Gorgeous How Can Get Out Of Debt Design Art

Find inspiration with this unique how can get out of debt illustration, crafted to provide a fresh look for your background.

Breathtaking How Can Get Out Of Debt Image Art

Discover an amazing how can get out of debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing How Can Get Out Of Debt Scene Art

Transform your screen with this vivid how can get out of debt artwork, a true masterpiece of digital design.

Vivid How Can Get Out Of Debt View in HD

Experience the crisp clarity of this stunning how can get out of debt image, available in high resolution for all your screens.

Lush How Can Get Out Of Debt Artwork Concept

This gorgeous how can get out of debt photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene How Can Get Out Of Debt Picture Collection

Explore this high-quality how can get out of debt image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality How Can Get Out Of Debt View Digital Art

Experience the crisp clarity of this stunning how can get out of debt image, available in high resolution for all your screens.

Vibrant How Can Get Out Of Debt Artwork Nature

Experience the crisp clarity of this stunning how can get out of debt image, available in high resolution for all your screens.

Mesmerizing How Can Get Out Of Debt Landscape for Desktop

Experience the crisp clarity of this stunning how can get out of debt image, available in high resolution for all your screens.

High-Quality How Can Get Out Of Debt Moment Collection

Discover an amazing how can get out of debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene How Can Get Out Of Debt View Illustration

Experience the crisp clarity of this stunning how can get out of debt image, available in high resolution for all your screens.

Crisp How Can Get Out Of Debt Photo for Desktop

A captivating how can get out of debt scene that brings tranquility and beauty to any device.

Vibrant How Can Get Out Of Debt Photo in 4K

Experience the crisp clarity of this stunning how can get out of debt image, available in high resolution for all your screens.

Exquisite How Can Get Out Of Debt Background Photography

Immerse yourself in the stunning details of this beautiful how can get out of debt wallpaper, designed for a captivating visual experience.

Download these how can get out of debt wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How Can Get Out Of Debt"

Post a Comment