How Do I Get A Ptin

How Do I Get A PTIN? Your Complete Guide to IRS Registration

If you're planning to prepare federal tax returns for compensation, whether you're a seasoned CPA or just starting out, there's one non-negotiable requirement: you need a PTIN. But maybe you're asking, "How do I get a PTIN?" Don't worry, you're in the right place. This guide will walk you through the entire process, making sure your journey from aspiring preparer to registered professional is smooth and headache-free.

The PTIN, or Preparer Tax Identification Number, is essential for every paid tax preparer in the United States. It's the IRS's way of keeping track of who is preparing returns, ensuring accountability and security in the tax system. Let's dive straight into the steps you need to take to secure yours today.

What Exactly Is a PTIN and Who Needs One?

The PTIN is a unique identification number assigned to tax professionals. If you prepare, or assist in preparing, federal tax returns or claims for refund, and you are compensated for that work, the IRS mandates that you must have a valid PTIN.

Think of the PTIN as your official license plate in the tax preparation world. Without it, you cannot legally sign returns as a paid preparer. It must be renewed annually to remain valid.

Who Must Obtain a PTIN?

The requirement covers a broad range of professionals. If you receive any form of payment for preparing a tax return, you fall under this mandate. This includes, but is not limited to, the following:

- Certified Public Accountants (CPAs)

- Enrolled Agents (EAs)

- Attorneys who prepare tax returns

- Non-credentialed tax preparers (unregulated preparers)

- Employees of a firm who prepare returns for clients

It is important to note that if you prepare returns solely for yourself or your immediate family without compensation, a PTIN is generally not required. However, for everyone else charging a fee, knowing how do I get a PTIN is your first step toward legitimate operation.

Preparing for the PTIN Application Process

Before you jump onto the IRS website, gather all the necessary information. Having these details ready ensures a smooth, uninterrupted application and prevents delays. The IRS requires specific personal and professional details to verify your identity and credentials.

Taking the time now to organize your documents will save you significant frustration later. You should allocate about 15-30 minutes for the actual online application process, provided you have everything ready.

Required Information Checklist

To register or renew your PTIN, you will need the following information at your fingertips:

- Your Social Security Number (SSN)

- Your name, mailing address, and email address

- Details about your most recent prior-year individual tax return (e.g., filing status, tax amount, or AGI)

- Professional credentials (if applicable), such as your CPA license number, Enrolled Agent status, or state bar number

- Documentation regarding any prior felony convictions or issues with your tax compliance (if applicable)

- The required application fee (payable by credit card, debit card, or electronic funds withdrawal)

Keep in mind that the application fee is subject to change each year, so check the official IRS website for the current amount before you begin the process. The fee is non-refundable, regardless of whether your application is approved.

Step-by-Step: The Online PTIN Application Process

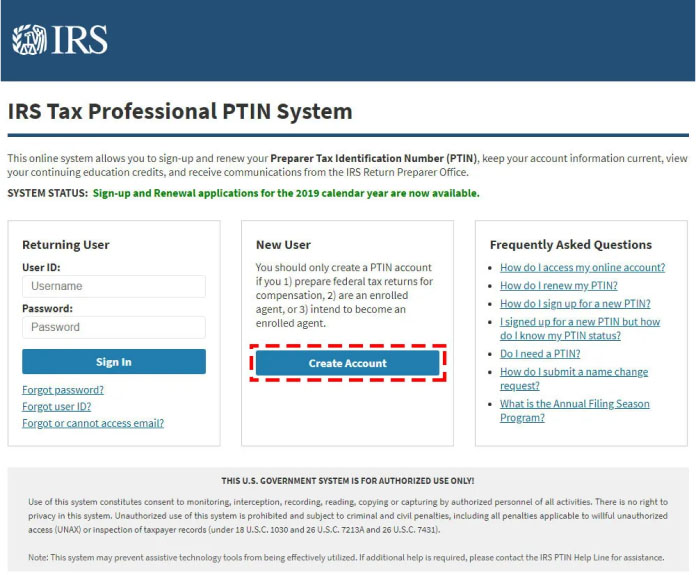

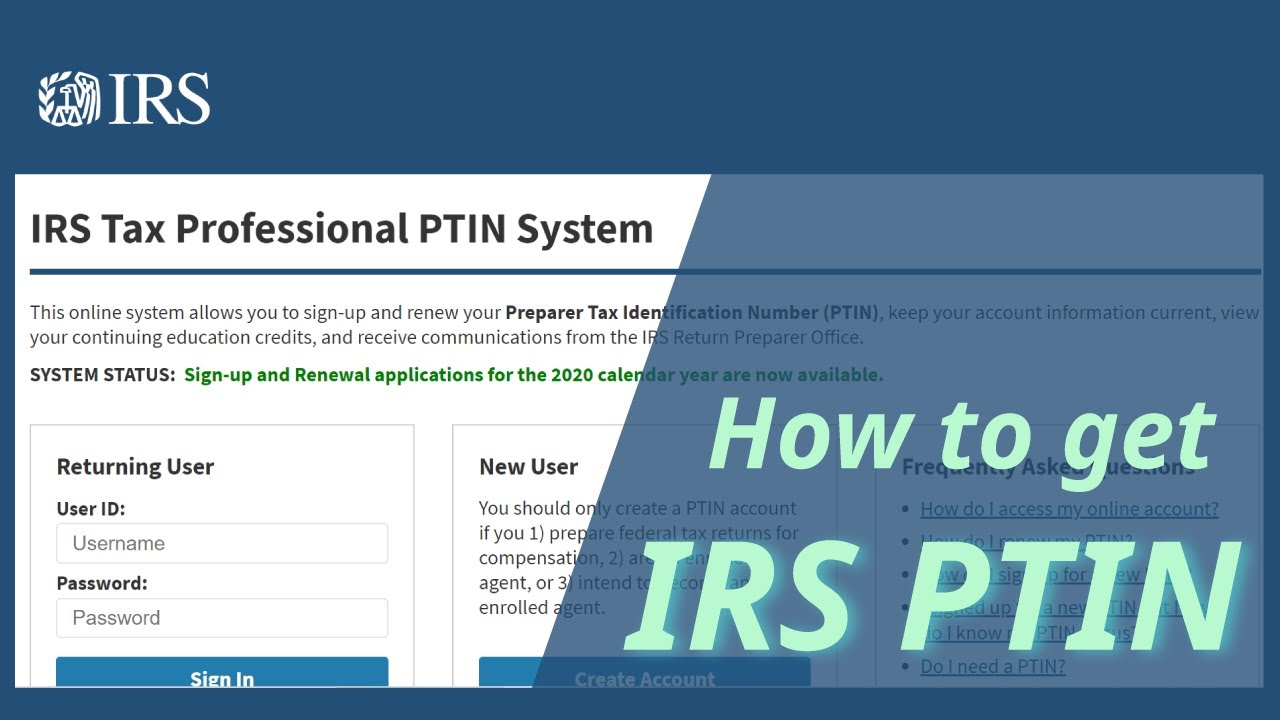

The primary and easiest way to obtain your PTIN is through the IRS online portal, officially called the IRS Tax Professional PTIN System. Here is the detailed roadmap for how do I get a PTIN online:

First, navigate to the official IRS website and locate the registration system. You will need to create a secure online account, which involves setting up a username and password.

Next, you will follow the prompts to complete the application sections. Be thorough and accurate when entering all personal, professional, and tax compliance details. The system will guide you through verification steps.

After inputting all required data, you must pay the application fee. Once payment is confirmed, the system processes your application. If successful, you will receive your PTIN immediately on the screen. It is crucial to print or save this confirmation page.

What if I Previously Had a PTIN?

If you had a PTIN in a previous year, you should not apply for a new one. Instead, you need to log back into your existing account and complete the annual renewal process. Using the same credentials ensures continuity in your preparer history with the IRS.

If you have forgotten your credentials, the system has recovery options available, often requiring verification through email and specific knowledge-based questions related to your tax history.

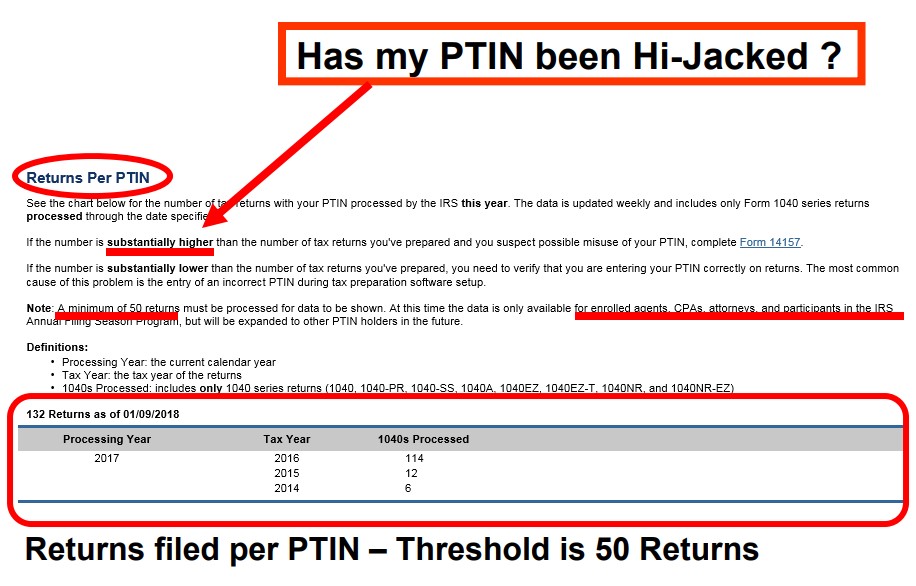

Renewing Your PTIN: Don't Let It Expire!

PTINs expire annually on December 31st, regardless of when they were initially issued. You must renew your PTIN for the upcoming filing season, typically starting in mid-October of the preceding year.

The renewal process is generally quicker than the initial application. You simply log in, verify your personal and professional information, confirm any Continuing Education (CE) requirements (if you are an EA or registered tax preparer), and pay the renewal fee. Missing the renewal deadline can prevent you from preparing returns for compensation at the start of the next tax season, so mark your calendar!

Troubleshooting Common PTIN Application Issues

While the online system is generally efficient, applicants sometimes encounter technical hurdles or compliance questions that halt the process. Understanding these common pitfalls can help you navigate them quickly.

One frequent issue is identity verification. If the IRS system cannot match the personal information you provided (especially your name and address) with their records, you may need to call the IRS PTIN help desk for manual verification. This often happens if you recently moved or changed your legal name.

Another challenge relates to credentialed preparers. Ensure that your professional license number (CPA, EA, etc.) is active and correctly entered. The IRS verifies these credentials with the respective licensing boards.

Finally, payment issues can occur. Double-check that your credit card information is current and that your bank is not blocking the transaction. If the payment fails, the PTIN will not be issued, even if all other information is complete.

What If I Can't Complete the Application Online?

Although the IRS highly prefers and encourages the online method, you can apply for a PTIN using a paper form, Form W-12, IRS Paid Preparer Tax Identification Number Application and Renewal. However, the paper application takes significantly longer to process (typically 4–6 weeks) and the fee may be slightly higher due to processing costs.

If you choose the paper route, make sure to fill out the form completely and mail it to the designated IRS address. This is usually only recommended if you have extenuating circumstances preventing online access.

Conclusion

So, how do I get a PTIN? The answer is clear: the process is straightforward, primarily handled through the IRS online portal, provided you are organized and prepared. Obtaining your PTIN is not just a regulatory hurdle; it's an affirmation of your commitment to professionalism in the tax industry.

Remember to gather your personal identification and professional details, complete the online form accurately, and pay the required fee. Once you receive your PTIN, you are authorized to begin preparing returns for compensation, just be sure to renew it annually before the December 31st deadline to maintain your standing.

Frequently Asked Questions (FAQ)

- Can I use my Social Security Number instead of a PTIN?

- No. As of 2011, the IRS mandates that all paid preparers use a valid PTIN on any tax return they prepare. Using your SSN is prohibited for privacy and security reasons.

- Is there a cost associated with obtaining a PTIN?

- Yes, the IRS charges an application/renewal fee annually. This fee covers the cost of processing and administration of the PTIN system. Always verify the current fee on the official IRS website before applying.

- How long does it take to get a PTIN?

- If you apply online and all your information is verified successfully, you will receive your PTIN immediately upon successful submission and payment. Paper applications, however, can take 4 to 6 weeks.

- Do I need to take a test to get a PTIN?

- No, there is no proficiency exam required just to receive a PTIN. However, certain preparers (like Enrolled Agents or certain non-credentialed preparers) must complete specific Continuing Education (CE) requirements to maintain their status and renew their PTIN annually.

How Do I Get A Ptin

How Do I Get A Ptin Wallpapers

Collection of how do i get a ptin wallpapers for your desktop and mobile devices.

High-Quality How Do I Get A Ptin Moment Concept

Experience the crisp clarity of this stunning how do i get a ptin image, available in high resolution for all your screens.

Vibrant How Do I Get A Ptin View for Desktop

Experience the crisp clarity of this stunning how do i get a ptin image, available in high resolution for all your screens.

Gorgeous How Do I Get A Ptin Scene for Mobile

A captivating how do i get a ptin scene that brings tranquility and beauty to any device.

Crisp How Do I Get A Ptin Abstract in 4K

This gorgeous how do i get a ptin photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How Do I Get A Ptin View Illustration

Transform your screen with this vivid how do i get a ptin artwork, a true masterpiece of digital design.

Crisp How Do I Get A Ptin Background Concept

Immerse yourself in the stunning details of this beautiful how do i get a ptin wallpaper, designed for a captivating visual experience.

Beautiful How Do I Get A Ptin Photo Illustration

Transform your screen with this vivid how do i get a ptin artwork, a true masterpiece of digital design.

Beautiful How Do I Get A Ptin Artwork Concept

Experience the crisp clarity of this stunning how do i get a ptin image, available in high resolution for all your screens.

Lush How Do I Get A Ptin Landscape Nature

Find inspiration with this unique how do i get a ptin illustration, crafted to provide a fresh look for your background.

High-Quality How Do I Get A Ptin Abstract for Mobile

Explore this high-quality how do i get a ptin image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing How Do I Get A Ptin Image in 4K

Explore this high-quality how do i get a ptin image, perfect for enhancing your desktop or mobile wallpaper.

Serene How Do I Get A Ptin Landscape Collection

Transform your screen with this vivid how do i get a ptin artwork, a true masterpiece of digital design.

Vivid How Do I Get A Ptin Capture Nature

Explore this high-quality how do i get a ptin image, perfect for enhancing your desktop or mobile wallpaper.

Lush How Do I Get A Ptin Scene in HD

Find inspiration with this unique how do i get a ptin illustration, crafted to provide a fresh look for your background.

Spectacular How Do I Get A Ptin Photo Illustration

A captivating how do i get a ptin scene that brings tranquility and beauty to any device.

Gorgeous How Do I Get A Ptin Design Nature

Find inspiration with this unique how do i get a ptin illustration, crafted to provide a fresh look for your background.

High-Quality How Do I Get A Ptin Artwork in HD

Explore this high-quality how do i get a ptin image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality How Do I Get A Ptin Background Photography

Transform your screen with this vivid how do i get a ptin artwork, a true masterpiece of digital design.

Crisp How Do I Get A Ptin Design in HD

Find inspiration with this unique how do i get a ptin illustration, crafted to provide a fresh look for your background.

Vivid How Do I Get A Ptin Design Digital Art

Explore this high-quality how do i get a ptin image, perfect for enhancing your desktop or mobile wallpaper.

Download these how do i get a ptin wallpapers for free and use them on your desktop or mobile devices.