How Do I Get Started Buying Stocks

How Do I Get Started Buying Stocks: Your Ultimate Beginner's Guide

If you're reading this, you've probably realized that keeping all your savings in a basic bank account isn't helping you reach your long-term financial dreams. You're ready to make your money work harder, but the world of investing—especially the stock market—seems confusing and overwhelming. Don't worry, you are in the right place!

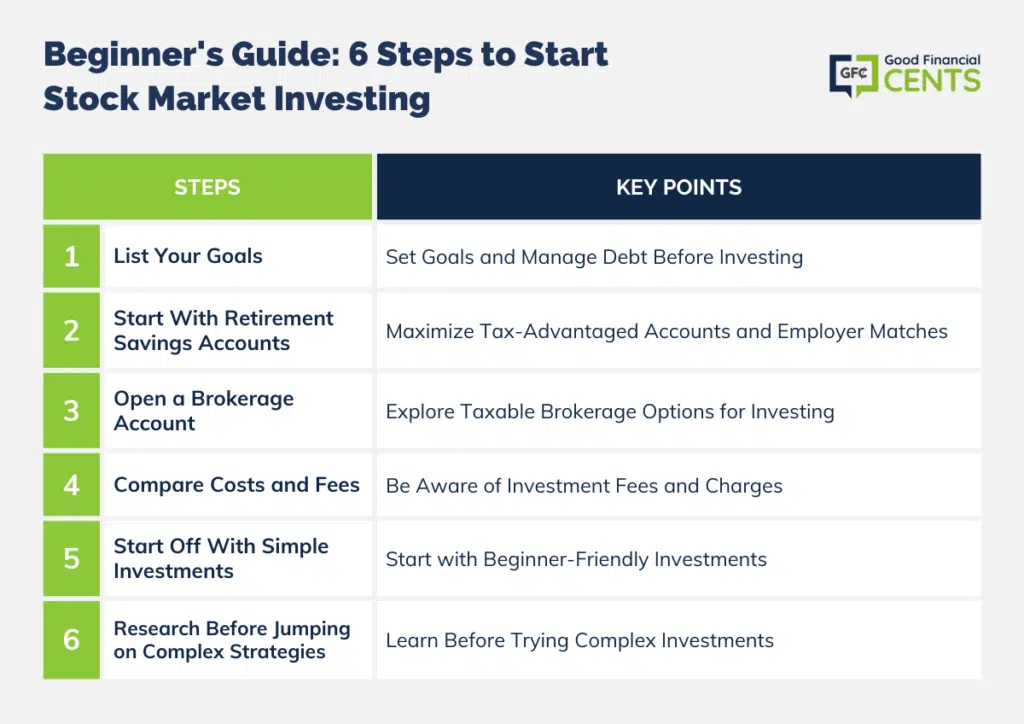

Learning How Do I Get Started Buying Stocks is a journey, not a sprint. This guide will break down the complex steps into simple, actionable advice so you can start investing with confidence and intelligence, even if you've never touched a trading platform before.

We'll cover everything from preparing your finances to executing your very first trade. Let's get started on building your wealth!

Before You Dive In: Setting the Stage

Before you commit a single dollar to the stock market, it's absolutely crucial to ensure your personal finances are ready for the inevitable ups and downs of investing. Think of this as building a solid foundation before you start constructing a skyscraper.

Investing money that you might need next month or that should be paying off high-interest debt is a common beginner mistake. We want to avoid that! You must have two key things in place: a solid emergency fund and a handle on high-interest debt.

Defining Your Financial Goals

What are you investing for? Having clear goals dictates your investment strategy, how much risk you take, and how long you plan to keep your money invested.

If your goal is saving for a house down payment in three years, you should choose lower-risk investments. However, if your goal is retirement 30 years from now, you can afford to take on more risk for potentially higher returns. Be specific about what you hope to achieve.

Here are typical goals for new investors:

- Building long-term wealth for retirement.

- Saving for a large purchase (like a car or home down payment).

- Earning passive income through dividends.

- Funding a child's college education.

Understanding Risk Tolerance

Risk tolerance is simply how much volatility (price change) you can handle without panicking and selling everything. The stock market will go down sometimes; that is guaranteed. Your reaction to these dips determines your long-term success.

A younger investor with decades until retirement usually has high risk tolerance because they have time to recover from downturns. An older investor nearing retirement typically has low risk tolerance and focuses on preservation.

Be honest with yourself about your risk tolerance. This will prevent emotional mistakes down the line when the market inevitably gets choppy.

The Essential First Step: Opening a Brokerage Account

You can't just call up Microsoft and buy a share. You need a licensed middleman—that's where a brokerage account comes in. A brokerage account is a secure account that holds your cash and investments.

Choosing the right brokerage is fundamental to knowing How Do I Get Started Buying Stocks efficiently and affordably.

Choosing the Right Brokerage Platform

For beginners, online brokers are usually the best choice. Many major platforms now offer $0 commission fees for stock trading, which saves you money instantly. Look for a platform that is easy to navigate and offers educational resources.

Here are key factors to consider when making your selection:

- Fees and Commissions: Most major brokers offer zero-commission stock trades, but check for fees related to mutual funds or account maintenance.

- Investment Selection: Do they offer stocks, ETFs, and fractional shares? Fractional shares are essential for beginners with smaller budgets.

- Ease of Use: Is their website and mobile app user-friendly? This is especially important when you are learning the ropes.

- Customer Support: Are they available via chat or phone if you run into an issue?

Funding Your Account

Once your account is open, the next step is linking your bank account and transferring your starting capital. Start small! You do not need thousands of dollars to begin. A common practice is to start with a modest amount, like $100 or $500, and commit to adding funds regularly (e.g., monthly contributions).

This process of regular investing, known as dollar-cost averaging, helps smooth out the market fluctuations and is a great habit for new investors.

Learning the Ropes: What Should You Buy?

This is where many new investors get stuck. Should you buy the latest tech stock, or something more conservative? For the vast majority of beginners, diversification is key, and that often means starting with baskets of stocks rather than individual companies.

Stocks vs. ETFs/Mutual Funds

Understanding the difference between these assets will help you structure a safe and effective starting portfolio.

Individual Stocks

When you buy an individual stock, you are buying a tiny piece of ownership in one specific company, like Apple or Netflix. This carries higher risk because if that single company fails, you lose your investment. It requires more research and monitoring.

ETFs (Exchange-Traded Funds)

ETFs are baskets of many different stocks (sometimes hundreds) bundled together. Buying one share of an ETF instantly diversifies your investment across various companies or sectors. Index funds (which track the overall market like the S&P 500) are excellent starting points for hands-off investing.

Start Small with Fractional Shares

A few years ago, if a company's stock cost $2,000 per share, you needed $2,000 just to buy one share. Thanks to fractional shares, many brokers now allow you to invest based on a dollar amount (e.g., "I want to invest $50 in Amazon"), regardless of the share price. This buys you a fraction of a share.

Fractional shares are perfect for beginners. They eliminate the barrier of high stock prices and allow you to fully diversify your portfolio even if you only have $100 to invest.

Making Your First Purchase (The Execution)

It's time for the exciting part! Since you've already funded your account, making your first trade is straightforward. Remember, your first purchase should align with your long-term goals, so consider starting with a broad, low-cost ETF.

Here's a step-by-step guide to executing your first trade:

- Search for the Ticker Symbol: Every investment has a unique identifier (e.g., VOO for a popular S&P 500 ETF). Search for the ticker symbol on your broker's platform.

- Place a Trade Order: Click the "Trade" or "Buy" button associated with that asset.

- Determine Amount and Type: Since you are a beginner, you should almost always select a "Market Order" for simplicity, which executes your trade immediately at the best available price. If you are using fractional shares, input the dollar amount you wish to invest. If buying full shares, input the number of shares.

- Review and Execute: Double-check all details (ticker, price, amount) and submit the order.

- Confirmation: Congratulations! You are now an investor. Your broker will send you a confirmation email documenting the trade.

Long-Term Success: Maintaining Your Portfolio

Buying stocks is not a one-time event; it's an ongoing discipline. Successful long-term investing means resisting the urge to check prices daily and ignoring short-term market noise. The key is consistency and patience.

Continue making regular contributions to your brokerage account. This consistent behavior, often called "set it and forget it" investing, is the most powerful tool a beginner can employ to build substantial wealth over decades.

Focus on reviewing your portfolio only once or twice a year to ensure your investments still align with your goals and risk tolerance. That's all there is to it!

Conclusion

Figuring out How Do I Get Started Buying Stocks can feel intimidating, but by breaking it down into simple steps—getting your finances in order, opening a commission-free brokerage account, and starting with diversified, low-cost funds—you've cleared the biggest hurdles. Remember to start small, invest consistently, and focus on the long haul. The sooner you start, the better, so take that first step today!

Frequently Asked Questions (FAQ)

- What is the minimum amount of money I need to start buying stocks?

- Thanks to fractional shares and zero-commission trading, you can generally start investing with as little as $5 or $10. However, most beginners aim to start with at least $100 to get a good base for diversification.

- Is it better to buy individual stocks or ETFs when I first start?

- For true beginners, ETFs (Exchange-Traded Funds) are highly recommended. They offer instant diversification across many companies, significantly reducing the risk compared to relying on the performance of a single stock.

- How often should I check my investments?

- For long-term investors, checking your investments daily is counterproductive and often leads to emotional decisions. It is best to check your portfolio quarterly or biannually. Consistency in investing is far more important than daily monitoring.

- Are there tax implications for buying stocks?

- Yes, there are. If you sell an investment for a profit (a capital gain) or receive dividends, you may owe taxes. Many brokerage firms provide tax forms (like the 1099 form) at the end of the year to help you report this income. It is always wise to consult a tax professional.

- What is a "ticker symbol"?

- A ticker symbol is a short, unique abbreviation used to identify publicly traded stocks or exchange-traded funds (ETFs). For example, Apple is AAPL, and Tesla is TSLA. You must use the ticker symbol when placing an order on your brokerage platform.

How Do I Get Started Buying Stocks

How Do I Get Started Buying Stocks Wallpapers

Collection of how do i get started buying stocks wallpapers for your desktop and mobile devices.

Dynamic How Do I Get Started Buying Stocks Moment Concept

Find inspiration with this unique how do i get started buying stocks illustration, crafted to provide a fresh look for your background.

Amazing How Do I Get Started Buying Stocks View Collection

Explore this high-quality how do i get started buying stocks image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous How Do I Get Started Buying Stocks Landscape Collection

Find inspiration with this unique how do i get started buying stocks illustration, crafted to provide a fresh look for your background.

High-Quality How Do I Get Started Buying Stocks Picture Digital Art

Discover an amazing how do i get started buying stocks background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed How Do I Get Started Buying Stocks Capture Digital Art

Explore this high-quality how do i get started buying stocks image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing How Do I Get Started Buying Stocks Abstract Illustration

Transform your screen with this vivid how do i get started buying stocks artwork, a true masterpiece of digital design.

Vivid How Do I Get Started Buying Stocks Background for Your Screen

Explore this high-quality how do i get started buying stocks image, perfect for enhancing your desktop or mobile wallpaper.

Lush How Do I Get Started Buying Stocks Image Collection

Immerse yourself in the stunning details of this beautiful how do i get started buying stocks wallpaper, designed for a captivating visual experience.

Artistic How Do I Get Started Buying Stocks Scene Nature

This gorgeous how do i get started buying stocks photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic How Do I Get Started Buying Stocks Capture in 4K

This gorgeous how do i get started buying stocks photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous How Do I Get Started Buying Stocks Moment Photography

A captivating how do i get started buying stocks scene that brings tranquility and beauty to any device.

Stunning How Do I Get Started Buying Stocks Picture for Your Screen

Find inspiration with this unique how do i get started buying stocks illustration, crafted to provide a fresh look for your background.

Lush How Do I Get Started Buying Stocks Moment Nature

Find inspiration with this unique how do i get started buying stocks illustration, crafted to provide a fresh look for your background.

Dynamic How Do I Get Started Buying Stocks Wallpaper Concept

Find inspiration with this unique how do i get started buying stocks illustration, crafted to provide a fresh look for your background.

Vivid How Do I Get Started Buying Stocks Picture Collection

Explore this high-quality how do i get started buying stocks image, perfect for enhancing your desktop or mobile wallpaper.

:max_bytes(150000):strip_icc()/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif)

Artistic How Do I Get Started Buying Stocks Wallpaper for Desktop

This gorgeous how do i get started buying stocks photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful How Do I Get Started Buying Stocks Design for Mobile

Discover an amazing how do i get started buying stocks background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid How Do I Get Started Buying Stocks Wallpaper Nature

Discover an amazing how do i get started buying stocks background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How Do I Get Started Buying Stocks Landscape for Mobile

This gorgeous how do i get started buying stocks photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How Do I Get Started Buying Stocks Artwork for Your Screen

Experience the crisp clarity of this stunning how do i get started buying stocks image, available in high resolution for all your screens.

Download these how do i get started buying stocks wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How Do I Get Started Buying Stocks"

Post a Comment