How Much Student Loans Can You Get

How Much Student Loans Can You Get: Your Ultimate Guide

If you're gearing up for college or grad school, you've probably spent hours trying to calculate tuition, housing, and textbook costs. It's a massive puzzle, and for many students, the solution involves borrowing. But this brings up the fundamental question: How Much Student Loans Can You Get?

The short answer is: it depends heavily on your student status, whether you choose federal or private loans, and the total cost of your education. Unlike credit cards or mortgages, student loans often have strict annual and lifetime limits set by the government or based on your school's official Cost of Attendance (COA).

We're here to break down these complexities so you can confidently plan your finances without relying on guesswork. Let's dive into the specifics of federal and private loan limits.

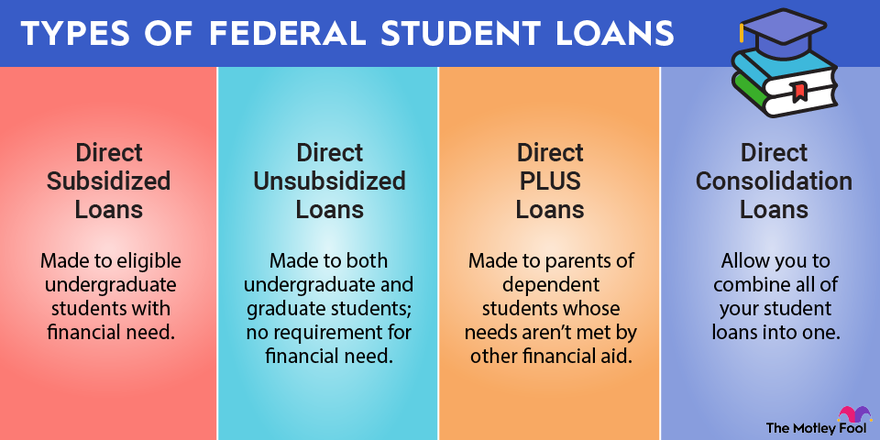

Understanding the Two Main Types of Student Loans

When asking How Much Student Loans Can You Get, you first need to identify the source of the funds. The rules and limits are dramatically different depending on whether you are working with the government or a private lender.

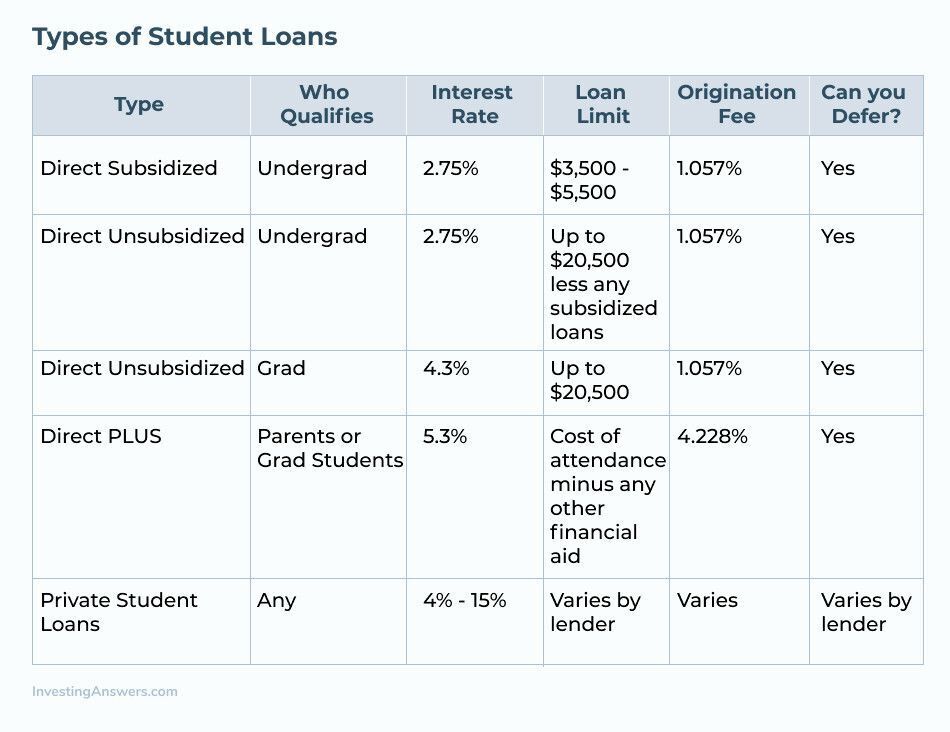

Generally, student loans fall into two major categories: Federal Loans and Private Loans. Federal loans are issued by the Department of Education, offering attractive benefits like fixed interest rates, income-driven repayment plans, and potential forgiveness programs. Private loans, on the other hand, come from banks, credit unions, or online lenders, and usually require a credit check and potentially a cosigner.

Because federal loans are typically the best deal, you should always maximize your eligibility there first before turning to private options. Their borrowing limits are strictly defined by law.

Federal Student Loan Limits: What to Expect

Federal student loans are primarily offered through the Direct Loan Program. The specific amount you can borrow each year—your annual limit—is determined by your grade level (freshman, sophomore, etc.) and your dependency status (dependent or independent student).

The annual limits apply to a combination of Direct Subsidized and Unsubsidized loans. Subsidized loans are reserved for students with demonstrated financial need, and the government pays the interest while you're in school. Unsubsidized loans are available to all students regardless of need, but interest accrues immediately.

Understanding these limits is the first crucial step in calculating How Much Student Loans Can You Get through the most reliable source.

Breaking Down Federal Undergraduate Loan Limits

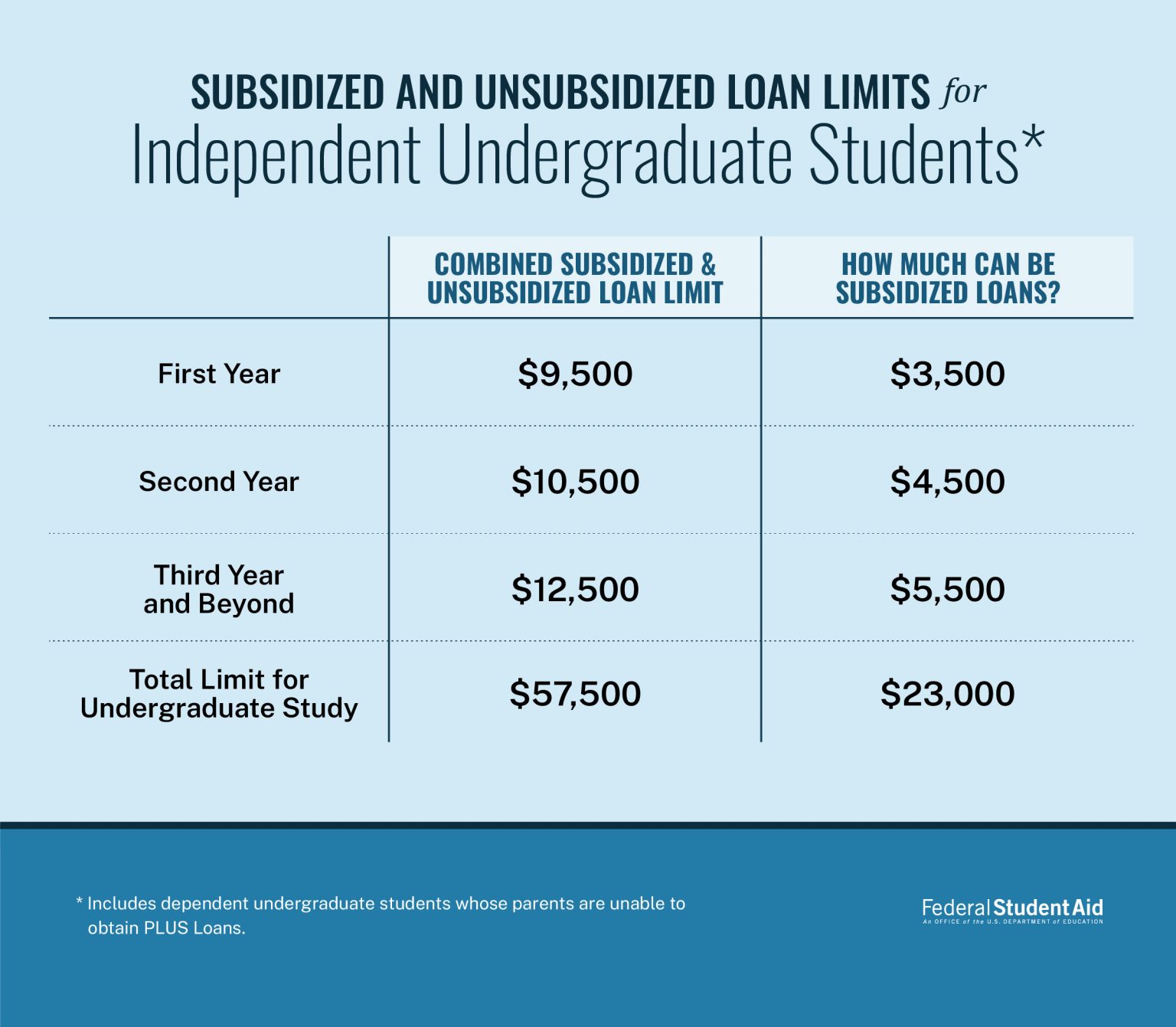

For undergraduates, the limits are highly dependent on whether you are claimed as a dependent on your parents' tax returns or if you qualify as an independent student.

Here is a general snapshot of the annual maximums for undergraduate Direct Loans:

- First Year (Dependent Student): Up to $5,500 ($3,500 of which can be subsidized).

- First Year (Independent Student): Up to $9,500 ($3,500 of which can be subsidized).

- Second Year (Dependent Student): Up to $6,500 ($4,500 of which can be subsidized).

- Second Year (Independent Student): Up to $10,500 ($4,500 of which can be subsidized).

- Third Year and Beyond (Dependent Student): Up to $7,500 ($5,500 of which can be subsidized).

- Third Year and Beyond (Independent Student): Up to $12,500 ($5,500 of which can be subsidized).

Remember, if your parents are denied a Direct PLUS Loan, you may qualify for the higher independent student limits, which significantly increases How Much Student Loans Can You Get annually.

Limits for Graduate and Professional Students

Once you enter graduate or professional school, your federal borrowing capacity increases dramatically, though access to subsidized loans disappears. Graduate students primarily utilize Direct Unsubsidized Loans and Graduate PLUS Loans.

The annual limit for Direct Unsubsidized Loans for graduate students is generally $20,500.

If that isn't enough to cover your costs, the Graduate PLUS Loan comes into play. These loans can be taken up to the school's full Cost of Attendance (COA), minus any other financial aid received. While this is technically a large amount, you must have reasonably good credit to qualify, and these loans have higher origination fees and interest rates than the standard Direct Unsubsidized Loans.

How Private Lenders Determine Loan Amounts

When federal limits are exhausted, private student loans are the next option. Private lenders don't have government-mandated caps on annual borrowing in the same way federal loans do. Instead, they base their limits on two main criteria.

First, they look at your financial standing, or that of your cosigner. A high credit score and steady income will make you eligible for larger sums and better interest rates. Second, and most importantly, they will never lend you more than the certified Cost of Attendance (COA) for your specific school, as determined by the financial aid office, minus any other aid you have already received.

This means that while the specific number for How Much Student Loans Can You Get privately might vary by lender, it will always be capped by the school's COA.

The All-Important Aggregate Limit

Beyond the annual limits, the government also sets a ceiling on the total amount of federal loans you can borrow throughout your entire academic career—the aggregate loan limit.

Once you hit this maximum, you cannot receive any more federal aid until you pay down some of your existing debt.

These aggregate limits are critical to remember, especially if you plan on pursuing multiple degrees or professional certifications:

- Dependent Undergraduates: The aggregate limit is $31,000 (no more than $23,000 of which can be subsidized).

- Independent Undergraduates (or dependents whose parents are denied PLUS Loans): The aggregate limit is $57,500 (no more than $23,000 of which can be subsidized).

- Graduate and Professional Students: The aggregate limit is $138,500 (this total includes any undergraduate federal loans).

Exceeding these federal totals means you must rely exclusively on private loans or other forms of funding, making the private loan process relevant to the question of How Much Student Loans Can You Get overall.

Factors Influencing Your Maximum Loan Amount

While federal limits are non-negotiable, several other elements can influence the precise amount you are offered by your school or a private lender. These factors help lenders manage risk and ensure you don't borrow substantially more than you truly need.

Key factors that adjust your borrowing power include:

- Cost of Attendance (COA): This is the official budget set by your school, including tuition, fees, books, supplies, room, board, and transportation. No lender, federal or private, will lend you more than your COA minus other aid.

- Other Financial Aid Received: Scholarships, grants, and stipends are subtracted from your COA before loan eligibility is calculated.

- Degree Program: Graduate and professional programs often have much higher COAs and therefore higher potential borrowing limits than undergraduate programs.

- Credit History (for Private and PLUS Loans): Your credit score, or that of your co-signer, directly impacts the approval and the interest rate you receive for non-Direct Subsidized or Unsubsidized federal loans.

Always review your financial aid award letter carefully. This letter details exactly how much loan money you are eligible to accept for the upcoming year.

Conclusion: Determining Your Borrowing Potential

So, How Much Student Loans Can You Get? The maximum amount you can borrow is a blend of rigid federal caps and flexible private loan availability, always tethered to your school's Cost of Attendance.

For most students, the strategy should be to secure the maximum allowed federal Direct Loans first (which are capped annually and aggregated), as these offer the most generous repayment terms. If a funding gap remains, you can then turn to Graduate or Parent PLUS loans (which cover the COA), or private student loans.

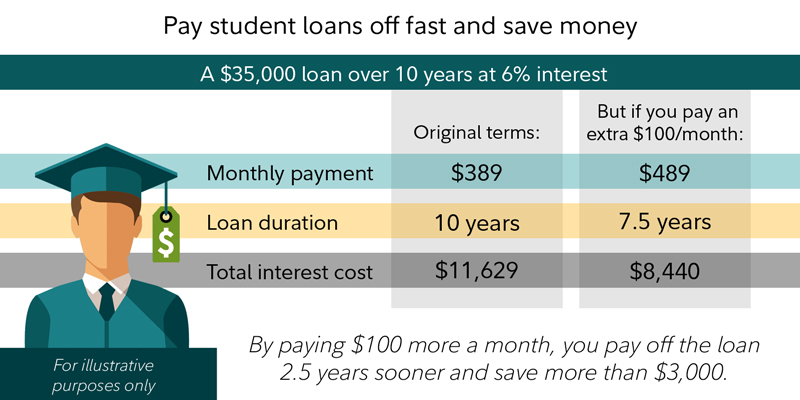

Always borrow only what you need. While high limits might be tempting, remember that every dollar borrowed must eventually be repaid, often with interest.

Frequently Asked Questions (FAQ)

- What is the absolute maximum federal aggregate loan limit?

- The highest aggregate limit applies to graduate and professional students, capped at $138,500 total (including all previous undergraduate federal borrowing).

- Can I borrow more than the cost of tuition?

- Yes, your maximum loan eligibility is based on the Cost of Attendance (COA), which includes tuition, fees, housing, books, and living expenses. However, the loan money you receive is typically disbursed to the school first to cover tuition and fees, and any remainder is given to you for living expenses.

- Do private lenders have an aggregate loan limit?

- Unlike federal loans, private lenders usually do not have a strict, universal aggregate limit. Instead, they cap your total borrowing at the certified Cost of Attendance (COA) for your program, year after year. As long as you maintain good credit and your school certifies the need, you can continue borrowing up to that annual cap.

- If I am a part-time student, does the limit change?

- Yes. Federal loan eligibility usually requires enrollment at least half-time. If you are enrolled less than half-time, your annual federal loan maximums may be reduced, especially for subsidized loans, as eligibility is tied to your enrollment intensity.

How Much Student Loans Can You Get

How Much Student Loans Can You Get Wallpapers

Collection of how much student loans can you get wallpapers for your desktop and mobile devices.

Crisp How Much Student Loans Can You Get Picture Digital Art

A captivating how much student loans can you get scene that brings tranquility and beauty to any device.

Detailed How Much Student Loans Can You Get Capture Collection

Experience the crisp clarity of this stunning how much student loans can you get image, available in high resolution for all your screens.

Serene How Much Student Loans Can You Get Artwork Concept

Discover an amazing how much student loans can you get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How Much Student Loans Can You Get View for Your Screen

Immerse yourself in the stunning details of this beautiful how much student loans can you get wallpaper, designed for a captivating visual experience.

Gorgeous How Much Student Loans Can You Get Background in 4K

Immerse yourself in the stunning details of this beautiful how much student loans can you get wallpaper, designed for a captivating visual experience.

Breathtaking How Much Student Loans Can You Get Landscape Collection

Discover an amazing how much student loans can you get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous How Much Student Loans Can You Get Artwork Art

Find inspiration with this unique how much student loans can you get illustration, crafted to provide a fresh look for your background.

Beautiful How Much Student Loans Can You Get Abstract Photography

Discover an amazing how much student loans can you get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing How Much Student Loans Can You Get Landscape Photography

Experience the crisp clarity of this stunning how much student loans can you get image, available in high resolution for all your screens.

Stunning How Much Student Loans Can You Get Photo Digital Art

This gorgeous how much student loans can you get photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How Much Student Loans Can You Get Scene Nature

Transform your screen with this vivid how much student loans can you get artwork, a true masterpiece of digital design.

Spectacular How Much Student Loans Can You Get Photo for Mobile

Find inspiration with this unique how much student loans can you get illustration, crafted to provide a fresh look for your background.

High-Quality How Much Student Loans Can You Get Abstract for Your Screen

Transform your screen with this vivid how much student loans can you get artwork, a true masterpiece of digital design.

High-Quality How Much Student Loans Can You Get Design in HD

Explore this high-quality how much student loans can you get image, perfect for enhancing your desktop or mobile wallpaper.

Stunning How Much Student Loans Can You Get Landscape Digital Art

This gorgeous how much student loans can you get photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene How Much Student Loans Can You Get Artwork for Mobile

Experience the crisp clarity of this stunning how much student loans can you get image, available in high resolution for all your screens.

High-Quality How Much Student Loans Can You Get View for Desktop

Experience the crisp clarity of this stunning how much student loans can you get image, available in high resolution for all your screens.

Lush How Much Student Loans Can You Get Abstract Art

This gorgeous how much student loans can you get photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite How Much Student Loans Can You Get View Photography

A captivating how much student loans can you get scene that brings tranquility and beauty to any device.

Exquisite How Much Student Loans Can You Get Abstract Nature

This gorgeous how much student loans can you get photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these how much student loans can you get wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How Much Student Loans Can You Get"

Post a Comment