How Much Tax Return Do You Get

How Much Tax Return Do You Get: Understanding Your Refund

That time of year rolls around, and one question dominates everyone's mind: How much tax return do you get? Whether you're dreaming of a substantial refund check or dreading an unexpected tax bill, understanding how the IRS calculates your money back is crucial. The simple truth is, there is no one-size-fits-all answer—it depends entirely on your specific financial situation from the past year.

This guide will break down the key factors influencing your tax outcome. We're going to look at everything from your withholding status to the credits and deductions you might be eligible for. Let's dive in and figure out how to estimate what the government owes you.

The Basics: Is a Tax Return the Same as a Tax Refund?

Before we can determine how much tax return you get, we need to clear up a common misunderstanding. When people ask this question, they are usually referring to the tax refund. A tax return is the paperwork—the Form 1040—you file with the IRS to report your income, deductions, and credits.

A tax refund, on the other hand, is the money you get back. You receive a refund when you have paid more taxes throughout the year (through paycheck withholdings and estimated payments) than your actual tax liability requires. Essentially, you gave the government an interest-free loan, and now they are paying you back.

If your withholdings were exactly right, your refund would be zero, and you would owe nothing. If you under-withheld, you would owe the IRS money instead of getting a refund.

Key Factors That Determine Your Tax Refund Amount

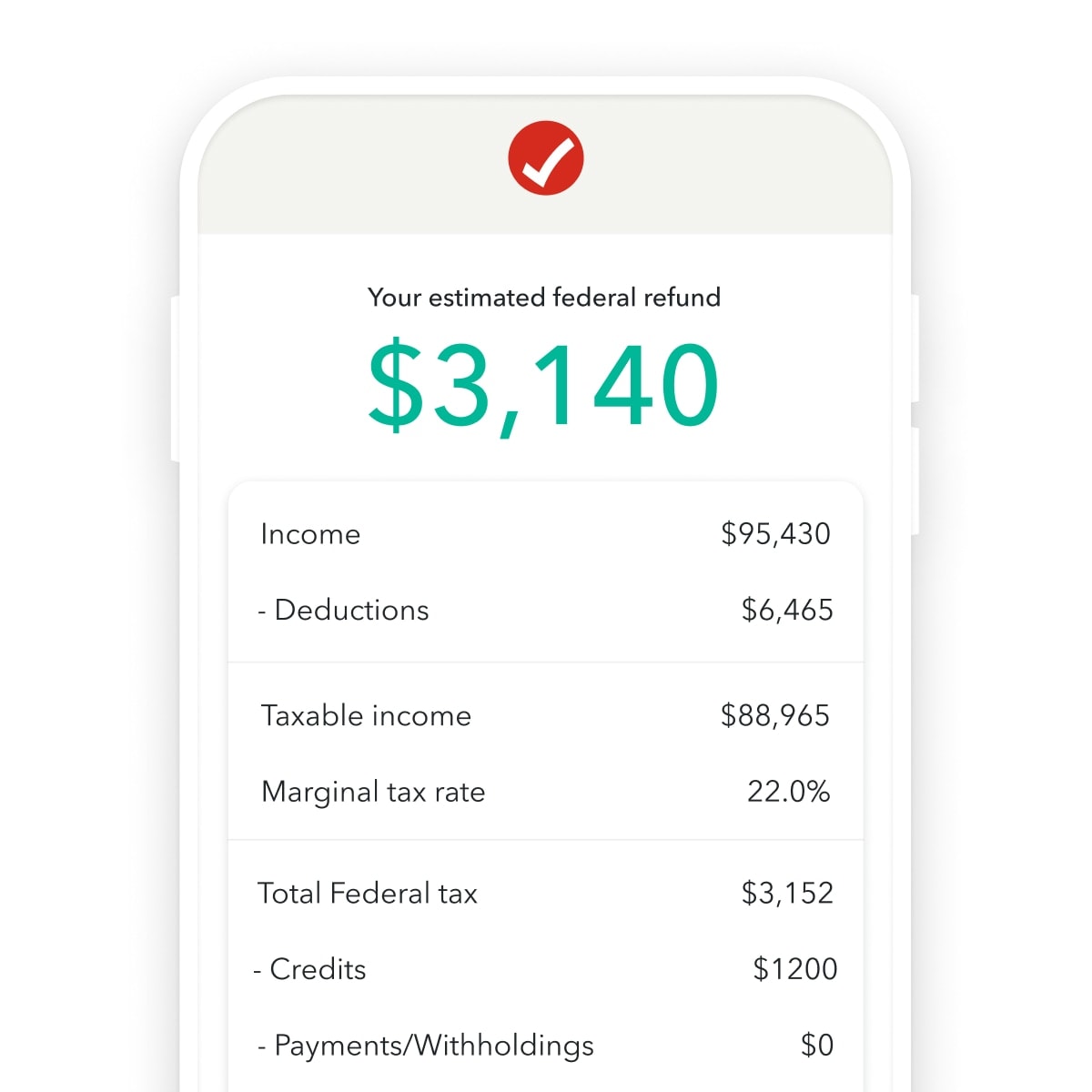

So, what variables truly control the size of your potential refund? It all boils down to two categories: how much tax you prepaid and how many benefits (deductions and credits) you qualify for.

Here are the crucial factors that dictate how much tax return you get:

- Gross Income: Your total earnings determine which tax bracket you fall into, impacting your total tax liability.

- Filing Status: Filing as Single, Married Filing Jointly, Head of Household, etc., affects your standard deduction amount and tax rate schedules.

- Prepaid Taxes (Withholdings): This is the total amount already taken out of your paychecks throughout the year (found on your W-2).

- Deductions: Whether you take the standard deduction or itemize your deductions, this reduces your taxable income.

- Tax Credits: These are the most powerful factors, as credits reduce your tax bill dollar-for-dollar.

A higher tax refund usually means that your withholdings were too high, or you qualified for significant refundable tax credits, like the Earned Income Tax Credit (EITC).

Decoding Your W-2 and Withholding Strategy

Your W-2 form is the cornerstone of your tax return calculation. Box 1 shows your taxable wages, and Box 2 shows the amount of federal income tax withheld. The amount in Box 2 is essentially your starting point for your potential refund.

If you set your Form W-4 (Employee's Withholding Certificate) to withhold very little, your Box 2 number will be small, increasing your chances of owing money. Conversely, if you asked your employer to withhold a lot (perhaps by claiming zero dependents or requesting extra withholding), your Box 2 number will be high, increasing your potential refund.

The goal of smart tax planning isn't necessarily getting a huge refund, but setting your withholding so you neither owe nor receive a substantial amount. A big refund just means the government held onto your money interest-free.

Why Your Withholding Strategy Matters (And How to Change It)

If you consistently wonder how much tax return do you get, it's time to revisit your W-4 form. This form dictates how much tax your employer pulls out of each paycheck. If you adjust your W-4 to claim fewer allowances (or increase the additional withholding amount), more money will be taken out, and your potential refund will increase.

The IRS recommends using their Tax Withholding Estimator tool. This tool considers your income, deductions, and credits to suggest exactly how you should fill out your W-4 to achieve a target refund amount (or zero balance). It's especially important to check this if you've had major life changes, such as getting married, having a child, or starting a side gig.

A tax refund is often viewed as a forced savings plan. However, that money could have been in your pocket every month, earning interest or helping you pay down debt. Optimizing your withholding ensures you have maximum cash flow throughout the year.

Claiming Credits and Deductions to Maximize Your Return

If you want to maximize the amount of money you get back—that is, increase your refund—you need to utilize every applicable tax break. Tax breaks fall into two main categories: deductions and credits. Both are essential in determining how much tax return you get.

Deductions reduce the amount of income that is taxed. For 2023 and 2024, most people take the Standard Deduction, but if you have high medical expenses, state and local taxes, or mortgage interest, itemizing might be better.

Credits are far more valuable because they are subtracted directly from the tax owed. Here are some of the most common and powerful tax credits:

- Child Tax Credit (CTC): Available for families with qualifying dependent children, offering up to $2,000 per child, with a portion often being refundable.

- Earned Income Tax Credit (EITC): Designed for low-to-moderate-income working individuals and couples, this is a significant and often refundable credit.

- American Opportunity Tax Credit (AOTC): For higher education expenses, this credit provides up to $2,500, with 40% of it being refundable.

- Child and Dependent Care Credit: Helps offset the costs of caring for dependents to allow you to work.

Make sure you save all receipts and documentation throughout the year, especially for educational, dependent care, and medical expenses. Missing out on a key credit could cost you hundreds, or even thousands, of dollars in your refund.

Common Scenarios That Lead to Big Refunds

While everyone's refund is unique, certain life events dramatically increase the likelihood of a large tax refund because they unlock significant tax credits:

- Welcoming a New Child: A new baby makes you eligible for the Child Tax Credit and potentially Head of Household filing status, often resulting in a major refund boost.

- First-Time Home Buyers: Although there is no longer a federal credit specifically for first-time buyers, mortgage interest and property taxes can significantly lower your taxable income if you choose to itemize.

- Attending College: Students or parents paying for college can claim valuable education credits, which can be partially refundable.

- Low Income with Dependents: Qualifying for the Earned Income Tax Credit (EITC) while having dependent children is perhaps the single biggest source of large tax refunds for many working families.

If any of these scenarios applied to you in the last tax year, be sure to highlight them when preparing your return to ensure you maximize how much tax return you get.

The Bottom Line on Tax Returns

Ultimately, determining how much tax return do you get is a personalized equation. It is the result of calculating your total tax liability (based on income and deductions) and subtracting the total amount you already paid the IRS (through withholdings and estimated payments). A positive number means a refund; a negative number means you owe.

The goal shouldn't be a massive refund, but rather a strategic balance. Use tax software or a trusted preparer to ensure you claim every credit and deduction you deserve. By optimizing your W-4 and staying organized, you can take control of your finances and ensure you keep more of the money you earn.

- How long does it take to get my tax refund?

- The IRS states that most taxpayers who file electronically and choose direct deposit receive their refund in less than 21 calendar days. Paper returns can take six to eight weeks.

- What if my refund is smaller than last year?

- A smaller refund usually indicates one of two things: your employer withheld less money from your paychecks this year, or you qualified for fewer tax credits or deductions compared to the previous year. Always check your W-4 status if you notice a big change.

- Is it better to get a large tax refund or a small one?

- Financially speaking, it is generally better to have a smaller refund (ideally close to zero). A large refund means you gave the government an interest-free loan throughout the year, money you could have been using or investing instead.

- What is a refundable vs. non-refundable credit?

- A non-refundable credit can only reduce your tax liability to zero. A refundable credit, like the EITC or a portion of the Child Tax Credit, can reduce your tax liability below zero, meaning the IRS will send you the difference as a refund, even if you paid no tax.

- If I use the Standard Deduction, can I still claim credits?

- Yes! The Standard Deduction affects your taxable income, but you can still claim most tax credits (like the CTC or EITC) regardless of whether you itemize or take the standard deduction.

How Much Tax Return Do You Get

How Much Tax Return Do You Get Wallpapers

Collection of how much tax return do you get wallpapers for your desktop and mobile devices.

Stunning How Much Tax Return Do You Get Background Photography

Find inspiration with this unique how much tax return do you get illustration, crafted to provide a fresh look for your background.

Detailed How Much Tax Return Do You Get View Photography

Experience the crisp clarity of this stunning how much tax return do you get image, available in high resolution for all your screens.

Gorgeous How Much Tax Return Do You Get Capture in HD

Find inspiration with this unique how much tax return do you get illustration, crafted to provide a fresh look for your background.

Exquisite How Much Tax Return Do You Get View Illustration

Find inspiration with this unique how much tax return do you get illustration, crafted to provide a fresh look for your background.

Stunning How Much Tax Return Do You Get Moment in HD

Find inspiration with this unique how much tax return do you get illustration, crafted to provide a fresh look for your background.

Exquisite How Much Tax Return Do You Get Landscape Digital Art

Find inspiration with this unique how much tax return do you get illustration, crafted to provide a fresh look for your background.

Crisp How Much Tax Return Do You Get Moment in HD

Immerse yourself in the stunning details of this beautiful how much tax return do you get wallpaper, designed for a captivating visual experience.

Lush How Much Tax Return Do You Get Photo Art

Find inspiration with this unique how much tax return do you get illustration, crafted to provide a fresh look for your background.

Detailed How Much Tax Return Do You Get Capture Collection

Experience the crisp clarity of this stunning how much tax return do you get image, available in high resolution for all your screens.

Crisp How Much Tax Return Do You Get Design for Mobile

Immerse yourself in the stunning details of this beautiful how much tax return do you get wallpaper, designed for a captivating visual experience.

Captivating How Much Tax Return Do You Get Design in 4K

A captivating how much tax return do you get scene that brings tranquility and beauty to any device.

Artistic How Much Tax Return Do You Get Picture Digital Art

This gorgeous how much tax return do you get photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful How Much Tax Return Do You Get Abstract for Your Screen

Transform your screen with this vivid how much tax return do you get artwork, a true masterpiece of digital design.

Breathtaking How Much Tax Return Do You Get Background in 4K

Transform your screen with this vivid how much tax return do you get artwork, a true masterpiece of digital design.

Dynamic How Much Tax Return Do You Get View for Mobile

Immerse yourself in the stunning details of this beautiful how much tax return do you get wallpaper, designed for a captivating visual experience.

Detailed How Much Tax Return Do You Get Design Digital Art

Experience the crisp clarity of this stunning how much tax return do you get image, available in high resolution for all your screens.

Serene How Much Tax Return Do You Get Moment for Desktop

Discover an amazing how much tax return do you get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing How Much Tax Return Do You Get Artwork Concept

Discover an amazing how much tax return do you get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning How Much Tax Return Do You Get Background for Mobile

Find inspiration with this unique how much tax return do you get illustration, crafted to provide a fresh look for your background.

Serene How Much Tax Return Do You Get Scene for Desktop

Transform your screen with this vivid how much tax return do you get artwork, a true masterpiece of digital design.

Download these how much tax return do you get wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How Much Tax Return Do You Get"

Post a Comment