How To Get First Time Car Insurance

How To Get First Time Car Insurance: Your Ultimate Starter Guide

Getting behind the wheel for the first time is thrilling, but the paperwork that follows—especially insurance—can feel overwhelming. If you're wondering how to get first time car insurance, you've come to the right place. It might seem like a complex maze, but we're going to break down the process into simple, easy-to-follow steps.

As a new driver, insurance companies see you as a higher risk, which often means higher premiums. However, knowing the secrets to getting the best coverage without breaking the bank is essential. By the end of this guide, you'll be confident in finding the right policy and getting on the road legally and safely.

Why First-Time Car Insurance Feels Complicated (and How to Fix It)

Insurance terminology can feel like a foreign language. Deductibles, liability, comprehensive, collision—it's a lot to take in when you are just learning the rules of the road. Insurers primarily calculate risk based on experience, and since first-time drivers lack a driving history, they are grouped into a higher-risk category.

Don't worry; this complexity is manageable. The key is arming yourself with knowledge. Understanding the necessary documents and the basic types of coverage will demystify the process entirely. Once you know what you need, securing a first-time car insurance policy becomes straightforward.

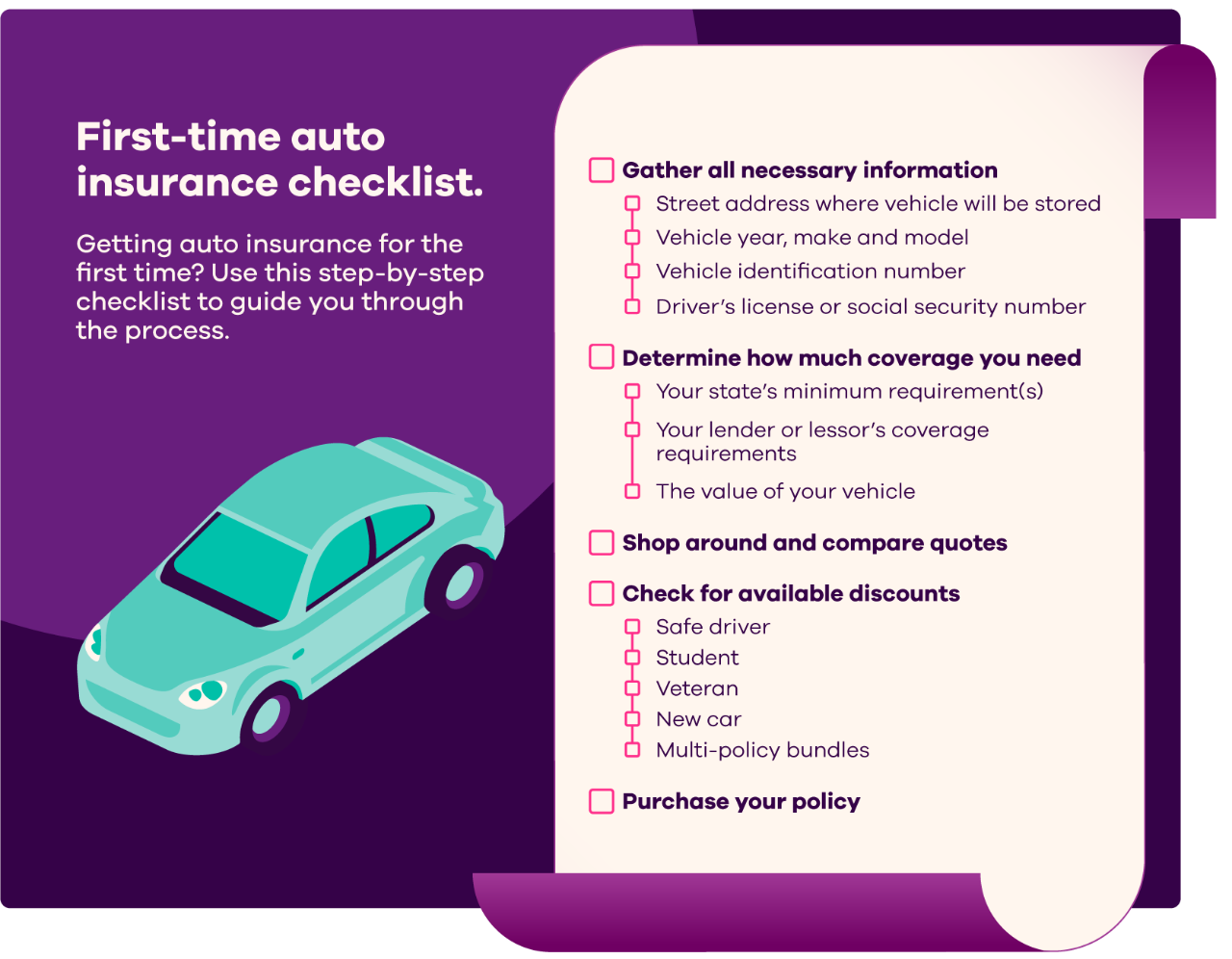

Step 1: Gathering Your Essential Documents

Before you even begin calling for quotes, organization is your best friend. Having all your information handy will streamline the process and ensure you get accurate estimates the first time around. Missing information can delay your coverage.

Here is what you will need ready:

- Driver's License Information: Your full name, date of birth, license number, and the date you received your license.

- Vehicle Identification Number (VIN): This 17-digit code identifies the car you plan to insure.

- Vehicle Details: Make, model, year, current mileage, and primary parking location (garage, street, driveway).

- Financial and Educational Background: Some insurers ask about your schooling (especially if you are under 25) and may require your current address and payment method details.

- Driving School Certificates: Any proof of successful completion of driver education or defensive driving courses.

Having this information centralized helps the insurance agent quickly calculate your profile and provide a realistic quote on how to get first time car insurance effectively.

Step 2: Understanding Basic Car Insurance Coverage Types

When you start receiving quotes, you will hear a lot of confusing terms. Fundamentally, car insurance is broken down into mandatory coverage (required by your state) and optional coverage (smart to have, but not legally required).

The type of coverage you select will significantly impact your monthly premium. Make sure you understand exactly what you are paying for before signing on the dotted line.

Minimum Liability Coverage

Liability insurance is the minimum coverage required in almost every state. This coverage protects other people and their property if you are at fault in an accident. It does not cover your own vehicle or medical bills.

Liability is split into two parts: Bodily Injury Liability (BI) and Property Damage Liability (PD). BI covers medical expenses for others, and PD covers damage to someone else's car or property, like a fence or building. While minimum coverage is cheap, many experts recommend increasing your liability limits beyond the state minimum for true financial protection.

Collision and Comprehensive Coverage

These two are often purchased together, especially if you have a newer vehicle or a car loan, as lenders usually require them. They are essential components of what is often called "full coverage."

Collision coverage pays for damage to your own car resulting from an accident with another vehicle or object (like hitting a lamppost). Comprehensive coverage pays for damage to your car that isn't related to a crash, such as theft, vandalism, fire, or damage from natural disasters. Including these coverages significantly helps a new driver protect their investment.

Smart Strategies for Affordable First-Time Insurance Rates

Being a new driver doesn't mean you have to accept outrageously high premiums forever. Insurance companies offer numerous ways to reduce your rates. Implementing these strategies early on can make a significant difference when learning how to get first time car insurance affordably.

A few proactive steps now can save you hundreds of dollars annually. Remember, insurance companies love responsible drivers, and they reward behaviors that minimize risk.

Taking Defensive Driving Courses

This is perhaps the easiest way for a new driver to immediately qualify for a discount. Many insurance carriers offer a substantial discount (often 5% to 15%) if you complete an accredited driver safety or defensive driving course.

These courses not only improve your driving skills but also show the insurer that you are serious about safety. Make sure the course you choose is approved by your state's DMV and recognized by your insurance provider to ensure you qualify for the rate reduction.

Choosing the Right Vehicle

The type of car you drive is a huge factor in premium calculation. Sports cars, high-performance vehicles, and luxury cars are significantly more expensive to insure due to higher repair costs and a higher risk profile for aggressive driving.

Instead, opt for vehicles with high safety ratings, lower horsepower, and widely available parts. Mid-sized sedans or compact SUVs are typically the cheapest to insure. Always get a few insurance quotes on a potential car purchase before finalizing the deal.

The Quote Process: Getting the Best Deals

The biggest mistake new drivers make is accepting the first quote they receive. Shopping around is crucial to finding affordable first time car insurance. Rates can vary by hundreds of dollars between different companies, even for the exact same coverage.

Use comparison tools and contact several types of providers—large national companies, regional insurers, and local agents—to ensure you are getting a comprehensive view of the market.

When getting quotes, remember these tips:

- Compare at least five different insurance companies.

- Ask about all available discounts (good student, multi-car, safe driver monitoring apps, etc.).

- Inquire about increasing your deductible. A higher deductible means lower monthly premiums, but be sure you can afford the deductible amount if you need to file a claim.

- Don't be afraid to ask for explanations of jargon you don't understand.

If you are a young driver still living at home, see if you can be added to a parent's policy initially. While this might increase their premium slightly, it will almost always be cheaper than buying a separate policy as a first-time driver.

What If I Have a Clean Driving Record?

While a first-time driver doesn't have a *long* history, having a clean record since obtaining your license is still valuable. Insurance companies will look for any violations, even minor traffic citations, that occurred while you held a learner's permit or during your first few months as a licensed driver.

If your record is spotless, make sure to emphasize this when talking to agents. Maintaining this clean record will be your ticket to dramatically lower rates once you hit the 3-year mark of continuous driving experience.

Conclusion

Learning how to get first time car insurance is a rite of passage for new drivers. While the initial quotes might seem steep, remember that insurance is highly personalized. By gathering your documents, understanding the core coverage types (liability, collision, comprehensive), and aggressively seeking out discounts, you can secure reliable and affordable coverage.

Don't settle for the first offer. Shop around, be smart about your vehicle choice, and prioritize safe driving. Every year you drive claim-free, your rates will continue to drop, making that first policy the most expensive one you'll ever buy. Get insured, drive safely, and enjoy the open road!

Frequently Asked Questions (FAQ) About First Time Car Insurance

- What is the average cost of first-time car insurance?

- The cost varies widely based on age, location, and vehicle type. However, first-time drivers, especially teenagers, can expect to pay significantly more than experienced drivers—often $2,000 to $4,000 annually for a full coverage policy.

- Is it cheaper to be added to a parent's policy or get my own?

- In almost all cases, it is much cheaper for a first-time driver to be added as an occasional driver on a parent's established policy than to purchase their own separate policy. This is known as bundling and significantly reduces the perceived risk.

- How long until my insurance rates go down?

- Rates typically begin to decrease noticeably after a driver hits two major milestones: turning 25, and accumulating 3-5 years of continuous, claim-free driving history. Maintaining a spotless record is the single biggest factor in long-term savings.

- What happens if I don't buy the minimum required liability insurance?

- Driving without minimum liability insurance is illegal in almost every U.S. state. Penalties can include fines, suspension of your license and registration, impoundment of your vehicle, and potentially jail time if involved in an accident.

How To Get First Time Car Insurance

How To Get First Time Car Insurance Wallpapers

Collection of how to get first time car insurance wallpapers for your desktop and mobile devices.

Amazing How To Get First Time Car Insurance Image for Mobile

Experience the crisp clarity of this stunning how to get first time car insurance image, available in high resolution for all your screens.

Vibrant How To Get First Time Car Insurance Moment Nature

Experience the crisp clarity of this stunning how to get first time car insurance image, available in high resolution for all your screens.

Vivid How To Get First Time Car Insurance View Collection

Transform your screen with this vivid how to get first time car insurance artwork, a true masterpiece of digital design.

Captivating How To Get First Time Car Insurance Scene Concept

This gorgeous how to get first time car insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic How To Get First Time Car Insurance Moment for Desktop

A captivating how to get first time car insurance scene that brings tranquility and beauty to any device.

Spectacular How To Get First Time Car Insurance View for Your Screen

A captivating how to get first time car insurance scene that brings tranquility and beauty to any device.

Vivid How To Get First Time Car Insurance View for Your Screen

Transform your screen with this vivid how to get first time car insurance artwork, a true masterpiece of digital design.

Exquisite How To Get First Time Car Insurance Image for Your Screen

Find inspiration with this unique how to get first time car insurance illustration, crafted to provide a fresh look for your background.

Beautiful How To Get First Time Car Insurance View Collection

Discover an amazing how to get first time car insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing How To Get First Time Car Insurance Moment in 4K

Transform your screen with this vivid how to get first time car insurance artwork, a true masterpiece of digital design.

Dynamic How To Get First Time Car Insurance View Illustration

This gorgeous how to get first time car insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic How To Get First Time Car Insurance Landscape Digital Art

Find inspiration with this unique how to get first time car insurance illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get First Time Car Insurance Image Illustration

Experience the crisp clarity of this stunning how to get first time car insurance image, available in high resolution for all your screens.

Gorgeous How To Get First Time Car Insurance Wallpaper for Desktop

Immerse yourself in the stunning details of this beautiful how to get first time car insurance wallpaper, designed for a captivating visual experience.

High-Quality How To Get First Time Car Insurance Moment Concept

Experience the crisp clarity of this stunning how to get first time car insurance image, available in high resolution for all your screens.

Amazing How To Get First Time Car Insurance Abstract Digital Art

Transform your screen with this vivid how to get first time car insurance artwork, a true masterpiece of digital design.

Breathtaking How To Get First Time Car Insurance Photo Illustration

Explore this high-quality how to get first time car insurance image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality How To Get First Time Car Insurance Moment Nature

Discover an amazing how to get first time car insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How To Get First Time Car Insurance View for Desktop

Immerse yourself in the stunning details of this beautiful how to get first time car insurance wallpaper, designed for a captivating visual experience.

Vivid How To Get First Time Car Insurance Artwork in 4K

Explore this high-quality how to get first time car insurance image, perfect for enhancing your desktop or mobile wallpaper.

Download these how to get first time car insurance wallpapers for free and use them on your desktop or mobile devices.