How To Get A Hard Loan

How To Get A Hard Loan: Your No-Nonsense Guide to Private Financing

Hey there! If you're reading this, you're probably in a situation where speed, flexibility, and unique criteria matter more than the rigid rules of traditional banks. Maybe you're an investor who spotted a fantastic property flip, but you need cash *yesterday*. That's where knowing How To Get A Hard Loan comes into play.

A hard money loan isn't your average mortgage. It's a specialized, short-term financing option designed for real estate transactions, particularly those involving investment properties or quick turnaround times. We're going to break down everything you need to know, from understanding the basics to walking away with the funds you need. Let's dive in!

What Exactly is a Hard Loan? (Setting the Foundation)

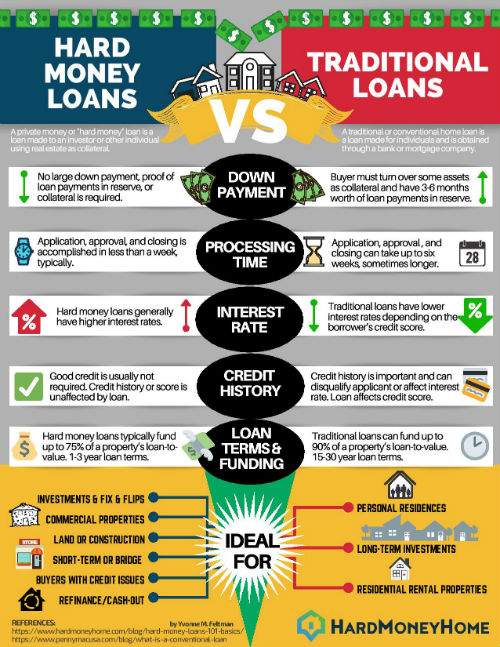

A hard money loan is a non-conforming loan funded by private investors or private lending companies, rather than traditional financial institutions like banks. The term "hard" refers to the fact that the loan is secured by a "hard" asset—typically real estate—rather than the borrower's creditworthiness or income history.

Think of it this way: traditional lenders look at your tax returns and credit score (your financial past). Hard money lenders primarily look at the value and profitability of the property being used as collateral (the investment's potential). This focus shift is crucial for understanding How To Get A Hard Loan successfully.

Because the risk is mitigated by the asset itself, these loans are often processed incredibly fast—sometimes in less than a week. However, they usually come with higher interest rates and fees compared to conventional loans, reflecting the speed and convenience they offer.

Why Choose a Hard Loan? (Pros and Cons)

Understanding why you might need one is the first step toward figuring out How To Get A Hard Loan that fits your needs. They are perfect for specific scenarios but are definitely not a one-size-fits-all solution.

Speed and Flexibility (The Main Benefits)

The biggest attraction of hard money is the turnaround time. If a deal requires immediate closing—perhaps the seller is highly motivated or the property is going to auction—banks simply can't move fast enough. Hard money lenders can.

They also offer greater flexibility in terms of borrower qualification. If your credit score took a hit recently, or if you are self-employed and struggle to show steady income documentation, a hard money lender will likely be more accommodating if the underlying asset is strong.

Key situations where hard loans shine:

- Flipping houses (fix-and-flip projects).

- Bridging finance between sales or refinances.

- Purchasing properties banks won't touch (e.g., highly dilapidated homes).

- When the borrower has a complex financial background.

The Drawbacks You Must Know

No free lunch, right? The speed and flexibility come at a cost. Hard money loans are significantly more expensive than conventional financing. Interest rates often range from 8% to 15%, and you'll usually pay 2 to 5 points (a point is 1% of the loan amount) in origination fees.

Furthermore, these loans are typically short-term, usually lasting 6 months to 3 years. This means you must have a solid exit strategy—whether that's selling the property or refinancing it through a traditional lender—before the loan matures.

Step-by-Step Guide on How To Get A Hard Loan

Ready to jump in? Securing a hard loan is generally faster than dealing with a bank, but it still requires preparation and due diligence. Follow these steps to maximize your chances of approval.

Step 1: Evaluate Your Collateral (The Crucial Asset)

Since the property secures the loan, lenders focus heavily on its value, particularly the After Repair Value (ARV). You need to demonstrate that the property, once renovated, will be worth substantially more than the loan amount.

Hard money lenders typically use the Loan-to-Value (LTV) ratio, often capped around 65% to 75% of the property's *current* value, or 70% of the ARV for fix-and-flip loans. Do your own calculations first so you know exactly how much equity you need to bring to the table.

Step 2: Find the Right Lender

Hard money lenders specialize, often focusing on certain geographical areas or property types (e.g., commercial vs. residential). You need a lender who is familiar with your specific market. Look for established private lenders through real estate networking events, online directories, or local brokers.

Don't just look for the lowest rate; look for reliability and transparent fee structures. A slight difference in interest rate might not matter if the lender delays the closing and you lose the deal.

Step 3: Prepare Your Documentation

While the focus is on the asset, lenders still require borrower documentation to ensure you have the experience and capital to execute the plan. Being organized here is key to understanding How To Get A Hard Loan quickly.

Key Documents Required

- Property Details: Purchase contract, appraisal reports, title insurance.

- Investment Plan: Detailed scope of work, budget for renovations, and projected timeline (the "exit strategy").

- Borrower Information: Entity documents (LLC/Corp), proof of liquid funds for the down payment and reserves, and sometimes, a credit report (though the requirement is usually lower than bank standards).

Ensure your renovation budget is realistic. Lenders need confidence that you haven't underestimated the cost of repairs, as this directly affects the property's ARV and their security.

Step 4: Underwriting and Closing

Once your documents are submitted, the lender will perform their due diligence. This includes reviewing your proposal, ordering an inspection or BPO (Broker Price Opinion) to verify the current and future value, and checking title history.

If all looks good, the lender issues the term sheet (Loan Commitment). Review this carefully! It outlines the interest rate, points, payment schedule, and any penalty clauses. Once signed, you move to the closing table, which can often happen within 7 to 14 days of initial contact.

Navigating Hard Loan Terms (Rates, LTV, and Period)

To successfully secure a hard loan, you need to speak the language. Here are three major terms you'll encounter when discussing How To Get A Hard Loan.

- Interest Rate (The Cost): Expect 8% to 15%. This is often interest-only payments, meaning you only pay the interest each month, and the full principal is due at maturity (a balloon payment).

- LTV (Loan-to-Value): This determines how much the lender will finance. If a property is valued at $100,000 and the lender offers 70% LTV, the loan maximum is $70,000. You must fund the remaining $30,000.

- Loan Term (The Clock): Typically short, 6 to 24 months. If you need longer, you must negotiate this upfront. Missing the maturity date can lead to default interest rates, which are significantly higher.

Always negotiate these terms, especially if you are a repeat borrower or if your collateral is exceptionally strong. Don't be afraid to ask for clarity on prepayment penalties—some lenders charge fees if you pay off the loan too early.

Conclusion: Securing Your Hard Loan

Learning How To Get A Hard Loan is all about shifting your focus from personal credit to asset value and a tight, realistic exit strategy. Hard money is not cheap, but it is undeniably fast and flexible, making it an invaluable tool for real estate investors who operate on tight deadlines.

If you approach the process prepared, with strong collateral and a detailed plan, you can secure the necessary financing quickly and successfully execute your investment goals. Good luck closing that deal!

Frequently Asked Questions (FAQ) About Hard Loans

- What is the minimum credit score required to get a hard loan?

- Unlike banks, most hard money lenders do not have strict minimum credit scores. While a better score helps secure better terms, many lenders focus more heavily on the equity in the collateral. Scores down to the low 600s or even upper 500s are often acceptable, provided the deal is strong.

- Can hard money loans be used for primary residences?

- Generally, no. Hard money loans are almost exclusively used for investment properties, commercial real estate, or fix-and-flip projects. Strict federal regulations (like the Dodd-Frank Act) make it difficult for private lenders to finance owner-occupied homes.

- How fast can I get funds after applying for a hard loan?

- The speed is the key benefit. If all your documentation (collateral valuation, title report, and exit strategy) is in order, funding can often occur within 7 to 14 business days, significantly faster than the typical 30 to 60 days required by banks.

- What happens if I can't pay off the hard loan by the maturity date?

- If you cannot pay off the principal by the maturity date, you are technically in default. You may be subject to a much higher default interest rate. Your best course of action is to communicate with the lender well in advance to negotiate an extension (often for a fee) or initiate a refinance plan immediately.

How To Get A Hard Loan

How To Get A Hard Loan Wallpapers

Collection of how to get a hard loan wallpapers for your desktop and mobile devices.

High-Quality How To Get A Hard Loan Photo Photography

Transform your screen with this vivid how to get a hard loan artwork, a true masterpiece of digital design.

Breathtaking How To Get A Hard Loan Picture Nature

Explore this high-quality how to get a hard loan image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing How To Get A Hard Loan Image Nature

Transform your screen with this vivid how to get a hard loan artwork, a true masterpiece of digital design.

Amazing How To Get A Hard Loan Moment Digital Art

Experience the crisp clarity of this stunning how to get a hard loan image, available in high resolution for all your screens.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

Mesmerizing How To Get A Hard Loan Artwork Nature

Transform your screen with this vivid how to get a hard loan artwork, a true masterpiece of digital design.

Captivating How To Get A Hard Loan Background Illustration

A captivating how to get a hard loan scene that brings tranquility and beauty to any device.

Artistic How To Get A Hard Loan Picture in 4K

This gorgeous how to get a hard loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful How To Get A Hard Loan Photo Collection

Discover an amazing how to get a hard loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous How To Get A Hard Loan Abstract Art

Find inspiration with this unique how to get a hard loan illustration, crafted to provide a fresh look for your background.

Artistic How To Get A Hard Loan Photo in HD

This gorgeous how to get a hard loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp How To Get A Hard Loan Design Concept

Find inspiration with this unique how to get a hard loan illustration, crafted to provide a fresh look for your background.

Amazing How To Get A Hard Loan Scene Nature

Explore this high-quality how to get a hard loan image, perfect for enhancing your desktop or mobile wallpaper.

Serene How To Get A Hard Loan Picture Digital Art

Experience the crisp clarity of this stunning how to get a hard loan image, available in high resolution for all your screens.

Dynamic How To Get A Hard Loan Picture for Desktop

A captivating how to get a hard loan scene that brings tranquility and beauty to any device.

Breathtaking How To Get A Hard Loan View Illustration

Experience the crisp clarity of this stunning how to get a hard loan image, available in high resolution for all your screens.

Captivating How To Get A Hard Loan Design Digital Art

Find inspiration with this unique how to get a hard loan illustration, crafted to provide a fresh look for your background.

Lush How To Get A Hard Loan Artwork in 4K

A captivating how to get a hard loan scene that brings tranquility and beauty to any device.

Vibrant How To Get A Hard Loan Wallpaper in 4K

Discover an amazing how to get a hard loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing How To Get A Hard Loan Picture Nature

Transform your screen with this vivid how to get a hard loan artwork, a true masterpiece of digital design.

Gorgeous How To Get A Hard Loan Image in HD

Find inspiration with this unique how to get a hard loan illustration, crafted to provide a fresh look for your background.

Download these how to get a hard loan wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get A Hard Loan"

Post a Comment