How To Get Life Insurance On A Parent

How To Get Life Insurance On A Parent: A Comprehensive Guide

Thinking about your parent's future finances can be daunting, but it's also one of the most loving and responsible steps you can take. If you've found yourself asking, "How To Get Life Insurance On A Parent?" you're certainly not alone. Many adult children realize that while their parents provided for them, they might need a safety net now to cover final expenses, debts, or estate taxes.

This process can seem complex due to legal requirements and health considerations, but with the right information, it is entirely manageable. We'll walk you through the necessary steps, legal considerations, and practical tips to secure a policy that brings peace of mind to everyone involved.

The key takeaway right from the start is this: you absolutely can purchase life insurance for your parent, but their full cooperation and consent are mandatory.

Why Consider Life Insurance for Your Parents?

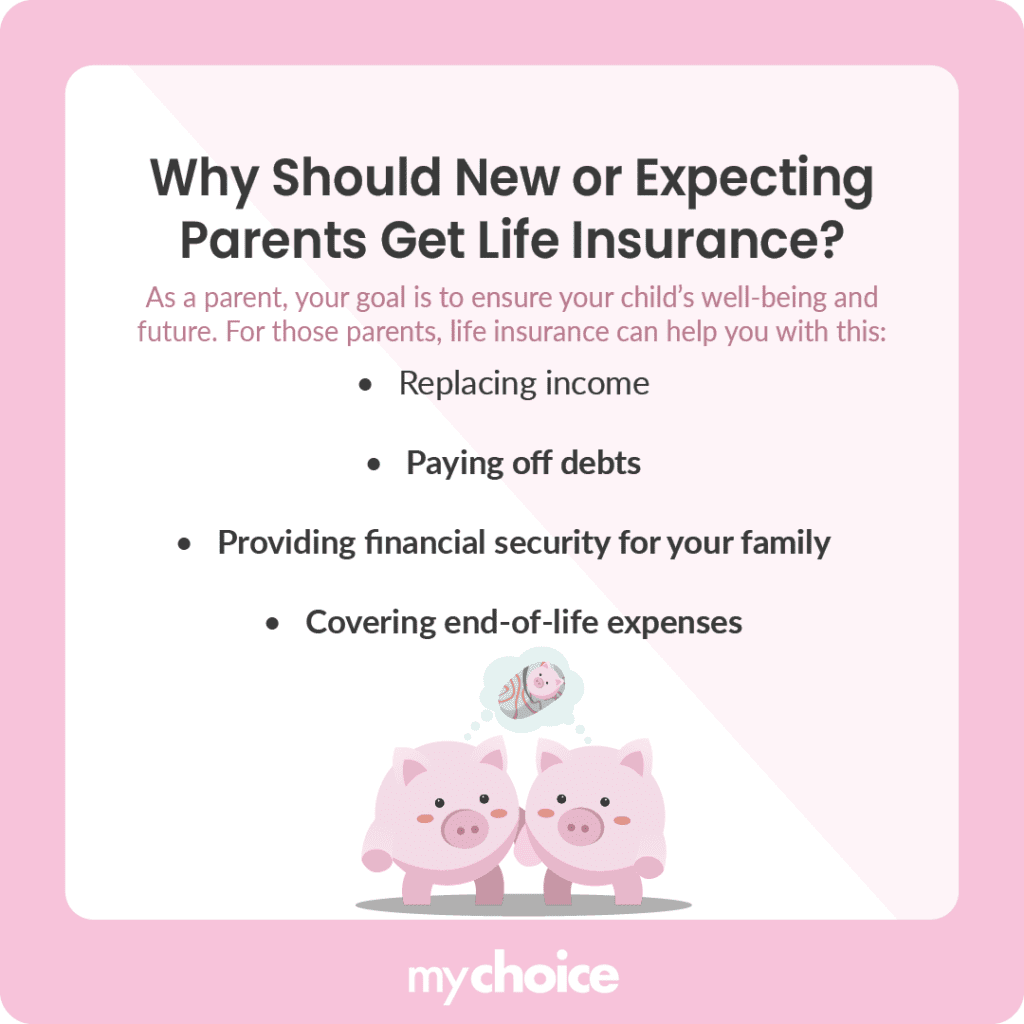

It's natural to want to protect your family from unforeseen financial burdens. While the conversation about life insurance might feel awkward, framing it in terms of financial responsibility can ease the tension. Life insurance serves several critical functions when applied to aging parents.

Here are the most common reasons adult children look into obtaining a policy for their mother or father:

- Covering Final Expenses: Funeral, burial, and related costs can easily exceed $10,000. A life insurance policy ensures that these costs do not fall onto the surviving children or strain existing savings.

- Paying Off Existing Debts: If your parent has outstanding mortgages, medical bills, or personal loans, the death benefit can cover these obligations, preventing creditors from pursuing the estate.

- Income Replacement: While less common for retired parents, if a parent is still working and contributing financially to the household (perhaps caring for a spouse or grandchild), the death benefit can replace that lost income.

- Estate Planning and Taxation: In larger estates, life insurance can provide liquidity to pay inheritance taxes without having to sell off other assets quickly.

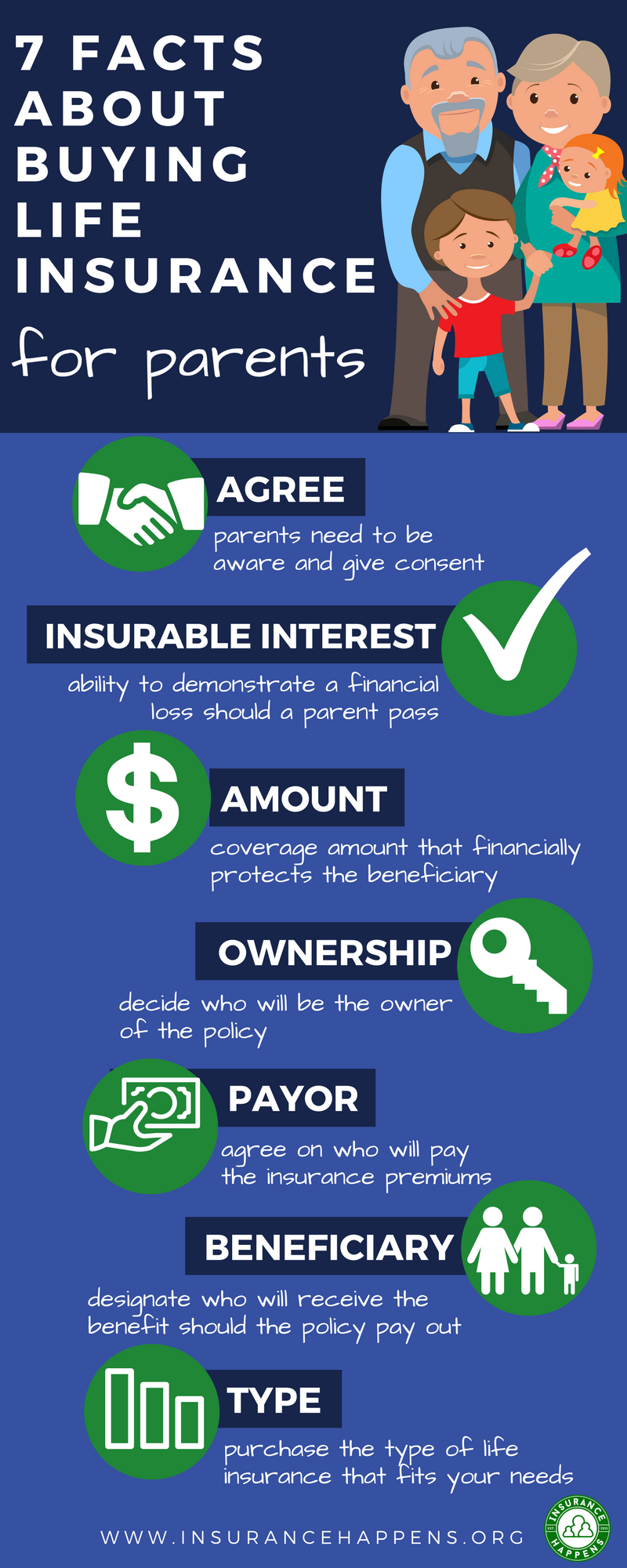

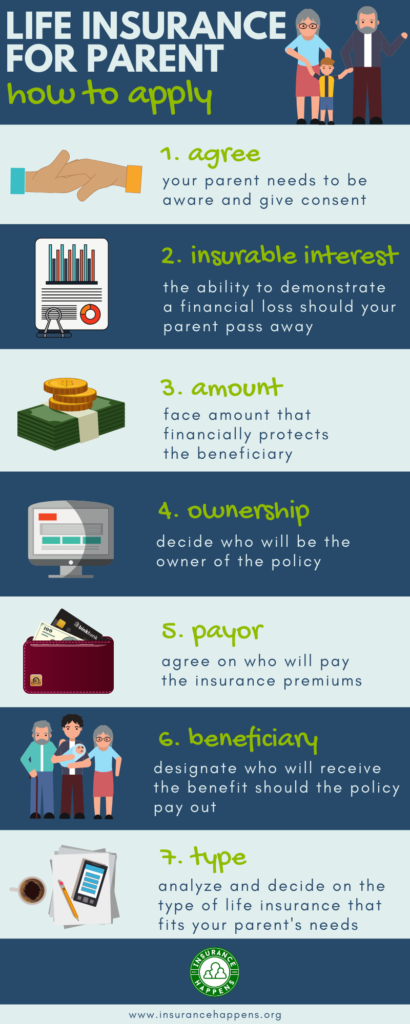

The Essential Requirement: Demonstrating Insurable Interest

Before you even look at quotes, you must understand the concept of "insurable interest." This legal requirement prevents people from taking out policies on strangers and is fundamental to the question of How To Get Life Insurance On A Parent.

Understanding Insurable Interest

Insurable interest means that if the insured person dies, the policy owner (you, in this case) would suffer a financial loss. Because children are legally responsible for their parents' final expenses or sometimes provide financial support, an insurable interest typically exists automatically between parents and adult children.

However, simply having an insurable interest isn't enough. Your parent must also be involved in the application process and provide written consent. The insurer will confirm that the relationship is legitimate and that the purpose of the policy is protection, not speculation.

Step-by-Step Guide: How To Get Life Insurance On A Parent

Once you've established the need and confirmed insurable interest, follow these steps to move the process forward.

Getting Their Buy-In and Consent

This is arguably the most crucial and potentially sensitive step. Your parent must be the one to sign the application form and may need to undergo a medical exam.

- Have an Open Conversation: Explain why you want the policy—focusing on relieving future financial stress on them and the family, rather than focusing solely on their eventual passing.

- Determine the Policy Roles: Typically, the parent will be the "Insured," the child will be the "Owner" (paying the premiums), and the child will be the "Beneficiary."

- Secure Cooperation: Ensure they agree to share their medical history, meet with an examiner (if required), and sign all necessary paperwork.

Choosing the Right Type of Policy

The best policy depends heavily on your parent's age, health, and what the policy is intended to cover. For older parents seeking coverage just for burial costs, the options narrow down quickly.

- Term Life Insurance: Provides coverage for a specific time period (e.g., 10, 15, or 20 years). This is generally cheaper but may not be available for parents over 75 or 80.

- Whole Life/Permanent Insurance: Provides lifelong coverage and usually builds cash value. This is significantly more expensive but guarantees a payout regardless of how long the parent lives.

- Final Expense Insurance (Burial Insurance): A smaller whole life policy designed specifically to cover funeral costs. Premiums are generally affordable, and the underwriting process is simplified.

Navigating Health and Age Challenges

Age and pre-existing conditions are the biggest factors influencing eligibility and premium costs. It is important to be realistic about what coverage your parent can qualify for. If your parent is relatively healthy, standard Term or Whole Life policies are viable options.

Simplified Issue and Guaranteed Issue Options

If your parent has significant health issues or is over 75, you may need to look at policies that require less stringent underwriting.

Simplified Issue policies skip the medical exam but require applicants to answer a few health questions. Approval is quick, but coverage amounts are usually lower (often under $50,000).

Guaranteed Issue policies accept anyone regardless of health history, but they come with very high premiums, low coverage amounts, and often a two-year "waiting period" (meaning if the insured dies during the first two years from natural causes, only premiums paid are returned, not the full death benefit).

What If They Are Already Elderly or Ill?

While standard Term policies are likely out of reach for someone over 80 or who has severe health conditions, Guaranteed Issue Whole Life remains a possibility. This is usually the last resort when seeking life insurance for a parent.

Consider the total cost of premiums versus the death benefit. If the premiums over the expected lifespan nearly equal the payout, the policy may not be worthwhile. Instead, setting up a dedicated savings account for final expenses might be a more practical alternative.

Conclusion: Taking the Next Steps

The journey of learning How To Get Life Insurance On A Parent requires patience, sensitivity, and good research. The most important components are securing your parent's consent, demonstrating an insurable interest, and accurately assessing their health to find the right policy type.

Whether you opt for a high-value whole life plan or a simple final expense policy, taking this step ensures that when the time comes, your family is protected from financial stress, allowing you to focus on grieving and remembrance. Start by consulting with a licensed independent insurance agent who can compare rates across multiple carriers based on your parent's unique profile.

Frequently Asked Questions (FAQ) About Insuring a Parent

- Can I buy life insurance for my parent without them knowing?

- No. Life insurance requires the legal signature and full consent of the insured person (your parent). They must participate in the application process and, potentially, the medical examination.

- Is it more expensive to buy life insurance for an older parent?

- Yes, significantly so. Premiums are directly tied to the risk the insurer takes, and risk increases with age. A parent in their 70s will pay much higher premiums than a parent in their 50s for the same amount of coverage. However, Final Expense policies are designed to be more affordable for seniors.

- What if my parent has Medicare? Does that cover burial?

- No. Medicare covers medical expenses, hospital stays, and prescription drugs, but it absolutely does not cover funeral, burial, or cremation costs. That is why considering How To Get Life Insurance On A Parent for final expenses is crucial.

- Do I have to be the beneficiary if I pay the premiums?

- You must be the policy owner (the one paying the premiums) to ensure you maintain control of the policy. As the owner, you will typically name yourself as the beneficiary to receive the payout upon their death. However, your parent (the insured) must consent to you being the policy owner and the beneficiary.

How To Get Life Insurance On A Parent

How To Get Life Insurance On A Parent Wallpapers

Collection of how to get life insurance on a parent wallpapers for your desktop and mobile devices.

Mesmerizing How To Get Life Insurance On A Parent Capture for Your Screen

Explore this high-quality how to get life insurance on a parent image, perfect for enhancing your desktop or mobile wallpaper.

Amazing How To Get Life Insurance On A Parent Capture Collection

Explore this high-quality how to get life insurance on a parent image, perfect for enhancing your desktop or mobile wallpaper.

Serene How To Get Life Insurance On A Parent Moment Nature

Experience the crisp clarity of this stunning how to get life insurance on a parent image, available in high resolution for all your screens.

Exquisite How To Get Life Insurance On A Parent Wallpaper Art

A captivating how to get life insurance on a parent scene that brings tranquility and beauty to any device.

Crisp How To Get Life Insurance On A Parent View Illustration

Find inspiration with this unique how to get life insurance on a parent illustration, crafted to provide a fresh look for your background.

Exquisite How To Get Life Insurance On A Parent Capture in HD

This gorgeous how to get life insurance on a parent photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking How To Get Life Insurance On A Parent Photo Collection

Discover an amazing how to get life insurance on a parent background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene How To Get Life Insurance On A Parent Moment Digital Art

Experience the crisp clarity of this stunning how to get life insurance on a parent image, available in high resolution for all your screens.

High-Quality How To Get Life Insurance On A Parent Landscape in HD

Experience the crisp clarity of this stunning how to get life insurance on a parent image, available in high resolution for all your screens.

Breathtaking How To Get Life Insurance On A Parent Capture Collection

Explore this high-quality how to get life insurance on a parent image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How To Get Life Insurance On A Parent Artwork Collection

Discover an amazing how to get life insurance on a parent background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How To Get Life Insurance On A Parent Photo in 4K

This gorgeous how to get life insurance on a parent photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality How To Get Life Insurance On A Parent Abstract Photography

Transform your screen with this vivid how to get life insurance on a parent artwork, a true masterpiece of digital design.

Captivating How To Get Life Insurance On A Parent Design for Your Screen

A captivating how to get life insurance on a parent scene that brings tranquility and beauty to any device.

Exquisite How To Get Life Insurance On A Parent Abstract Photography

Find inspiration with this unique how to get life insurance on a parent illustration, crafted to provide a fresh look for your background.

Serene How To Get Life Insurance On A Parent Landscape Art

Discover an amazing how to get life insurance on a parent background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful How To Get Life Insurance On A Parent Picture Collection

Experience the crisp clarity of this stunning how to get life insurance on a parent image, available in high resolution for all your screens.

Amazing How To Get Life Insurance On A Parent View Photography

Experience the crisp clarity of this stunning how to get life insurance on a parent image, available in high resolution for all your screens.

Vibrant How To Get Life Insurance On A Parent Picture for Desktop

Experience the crisp clarity of this stunning how to get life insurance on a parent image, available in high resolution for all your screens.

Detailed How To Get Life Insurance On A Parent Photo Photography

Experience the crisp clarity of this stunning how to get life insurance on a parent image, available in high resolution for all your screens.

Download these how to get life insurance on a parent wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Life Insurance On A Parent"

Post a Comment