How To Get Mortgage License

How To Get Mortgage License: Your Complete Step-by-Step Guide

Thinking about diving into the world of mortgage lending? Becoming a licensed Mortgage Loan Originator (MLO) can be a fantastic career choice, offering flexibility and great earning potential. However, the path to licensure isn't always straightforward. It involves specific federal and state requirements that you must meet.

If you've been asking yourself, "How to get mortgage license?" you've come to the right place. We'll break down the entire process into manageable steps, ensuring you understand exactly what you need to do to get licensed and start helping clients achieve their homeownership dreams.

Understanding the Mortgage Loan Originator (MLO) Role

A Mortgage Loan Originator is essentially the liaison between the borrower and the lender. You are responsible for discussing loan terms, taking applications, and helping guide clients through the often complex process of securing a home loan.

The SAFE Act (Secure and Fair Enforcement for Mortgage Licensing Act) mandates that all MLOs must be registered and licensed through the Nationwide Multistate Licensing System & Registry (NMLS). This system ensures consistency, consumer protection, and transparency across the industry nationwide.

Federal vs. State Licensing

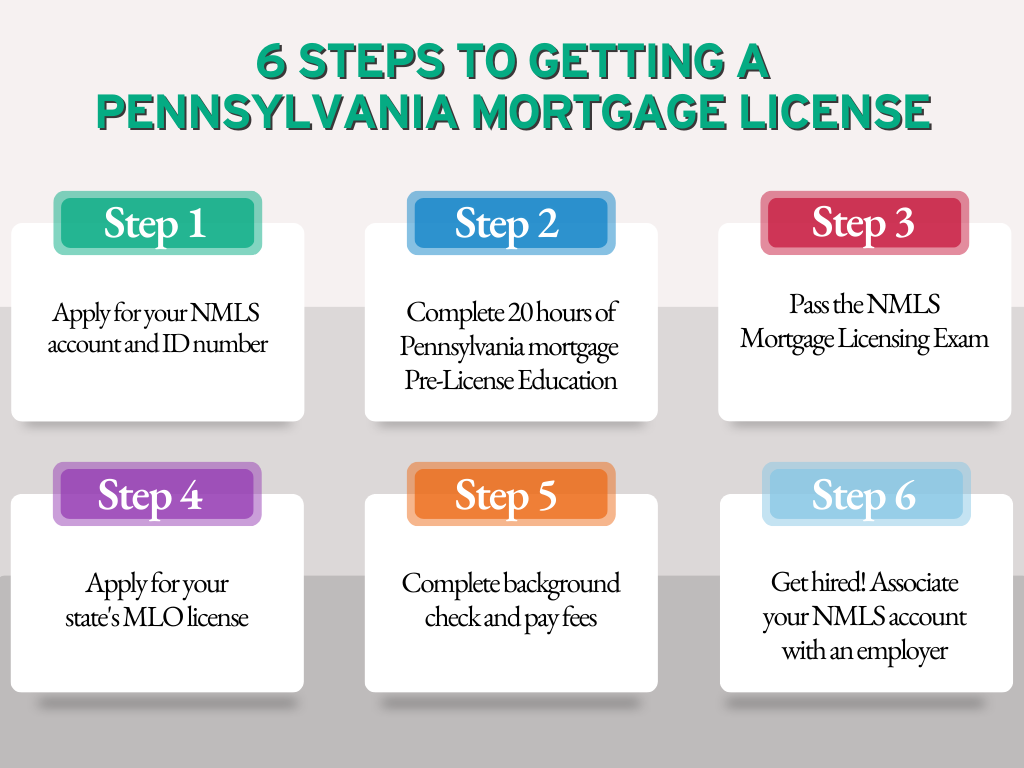

This is where things can get a little tricky. While the NMLS is the central hub, you must meet both federal and state requirements. The federal requirements, such as the initial 20 hours of education and the comprehensive exam, are standard across the board.

However, each state has its own specific prerequisites, including potential additional educational hours, specific testing requirements, or minimum net worth rules. You must obtain a license for every state in which you plan to originate loans.

Step 1: Meet the Prerequisites (The Foundation)

Before you spend time and money on classes, make sure you qualify for the license based on your history. The NMLS establishes baseline standards for eligibility. If you don't meet these foundational requirements, you won't be able to proceed.

You generally must:

- Be at least 18 years old.

- Be a legal resident of the United States.

- Have never had an MLO license revoked in any state.

- Not have been convicted of a felony involving fraud, dishonesty, breach of trust, or money laundering in the last seven years. Note that if the felony was ever mortgage-related, you are permanently disqualified.

It is crucial to be fully transparent about your criminal and financial history right from the start. Misrepresentation will certainly lead to disqualification.

Step 2: Complete the NMLS Education Requirement

Education is key to ensuring you are prepared and knowledgeable about the industry's complex regulations. The SAFE Act requires a minimum amount of pre-licensure education (PE). You must complete these hours before you can schedule your licensing exam.

You need to register on the NMLS website first to get an NMLS ID number. This ID is essential for tracking your education, testing, and ultimately, your licensing application.

The 20 Hours of Pre-Licensure Education

The standard federal requirement is 20 hours of NMLS-approved education. These hours are generally broken down into specific topics to cover the breadth of federal laws and ethical practices. The coursework typically includes:

- 3 hours of Federal law and regulations.

- 3 hours of Ethics, including fraud, consumer protection, and fair lending issues.

- 2 hours of Training related to lending standards for non-traditional mortgage products.

- 12 hours of electives on mortgage origination activities (which may include state-specific content).

Remember that some states require additional hours on top of this minimum 20. Make sure you check your specific state's requirements on the NMLS website before enrolling in a course.

Step 3: Passing the NMLS Mortgage License Exam

Once your education is complete and reported to the NMLS, the next major hurdle is passing the SAFE MLO Test. This test assesses your knowledge of federal laws, ethics, and mortgage industry practices.

The test consists of 125 multiple-choice questions, and you need a score of 75% or higher to pass. It's a challenging exam, so dedicated study time is essential. You must schedule the exam through the NMLS test scheduling system.

Tips for Acing the Exam

Many successful MLOs recommend focusing heavily on practice tests and specific federal regulations like TILA (Truth in Lending Act) and RESPA (Real Estate Settlement Procedures Act). Study groups and dedicated review courses can significantly increase your chances of success. If you fail, you must wait 30 days before retaking the test. After three consecutive failures, you must wait six months before trying again.

Step 4: Background Checks and Credit Report

To ensure consumer trust and industry integrity, the SAFE Act requires all applicants to submit to a criminal background check and a credit check.

The background check requires you to schedule an appointment for fingerprinting. The NMLS system guides you to approved fingerprint vendors who will submit your prints directly to the FBI. This process verifies that you meet the ethical and criminal standards required to hold a license.

The credit report review is equally important. Regulators want to ensure that MLOs demonstrate financial responsibility. Issues like recent bankruptcies, tax liens, or severe delinquencies can raise red flags and potentially prevent you from getting licensed. Financial stability is considered a key factor in determining character and fitness.

Step 5: Applying Through the NMLS System

Once you have passed the exam and the background checks are in process, you are ready to submit your formal application through the NMLS. This application is often submitted in conjunction with your sponsoring employer, which is usually a state-licensed mortgage brokerage or lender.

Your sponsor will help ensure that all state-specific requirements, such as bonding or net worth documentation, are included in the application package. Remember, you cannot legally originate loans until your license status shows as 'Approved' in the NMLS system.

Step 6: Maintaining Your License: Continuing Education

Getting the license is the first major milestone, but keeping it requires continuous effort. Every MLO must complete Continuing Education (CE) annually to renew their license.

The federal requirement is typically 8 hours of NMLS-approved CE, covering federal law, ethics, and non-traditional mortgage lending. Just like the initial education, states may require additional CE hours specific to their local regulations.

It's important to complete your CE before the renewal deadline, which is usually December 31st each year. If you miss the deadline, you will face penalties or be required to complete "Late CE" to reactivate your license.

Conclusion: Success in Answering How To Get Mortgage License

Successfully navigating the path to becoming a licensed MLO requires diligence, study, and attention to detail. From securing your NMLS ID and completing the 20 hours of pre-licensure education, to passing the challenging SAFE MLO Test and submitting to thorough background checks, each step is critical.

While the process of figuring out "How To Get Mortgage License" might seem daunting at first, by following these structured steps and utilizing the resources provided by the NMLS and your chosen education provider, you will be well on your way to a rewarding career in the mortgage industry. Remember that staying compliant and completing your Continuing Education ensures your license remains active for years to come!

Frequently Asked Questions (FAQ)

- What is the difference between an MLO and a Loan Officer?

- The terms are often used interchangeably, but legally, an MLO (Mortgage Loan Originator) is the specific term used by the SAFE Act for any individual who takes a residential mortgage loan application or offers/negotiates terms for compensation. All licensed loan officers are MLOs.

- How long does the entire licensing process take?

- Typically, the process takes anywhere from 6 to 12 weeks. This timeframe accounts for the 20 hours of education, study time for the exam, scheduling the exam, waiting for background and credit checks to clear, and final state processing time.

- Can I work as an MLO in multiple states?

- Yes, absolutely. However, you must apply for and maintain a separate license in every state where you intend to originate loans. While the federal exam is only taken once, you must complete any required state-specific education and pay the associated state fees for each jurisdiction.

- What happens if I fail the NMLS exam?

- You are allowed to retake the exam after a waiting period of 30 days. You have three attempts before a mandatory six-month waiting period begins. It's recommended to invest in intensive study materials immediately after a failed attempt.

- Do I need to be sponsored by a company to get my mortgage license?

- In most states, yes. Your license application generally must be submitted through a sponsoring entity (such as a mortgage brokerage or bank) that is also licensed in that state. This entity ensures that you are covered by the necessary bond and handles certain administrative requirements.

How To Get Mortgage License

How To Get Mortgage License Wallpapers

Collection of how to get mortgage license wallpapers for your desktop and mobile devices.

Serene How To Get Mortgage License Landscape Concept

Explore this high-quality how to get mortgage license image, perfect for enhancing your desktop or mobile wallpaper.

Amazing How To Get Mortgage License Image Nature

Experience the crisp clarity of this stunning how to get mortgage license image, available in high resolution for all your screens.

Captivating How To Get Mortgage License Photo Photography

This gorgeous how to get mortgage license photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get Mortgage License Wallpaper for Desktop

Immerse yourself in the stunning details of this beautiful how to get mortgage license wallpaper, designed for a captivating visual experience.

Dynamic How To Get Mortgage License Artwork Concept

Find inspiration with this unique how to get mortgage license illustration, crafted to provide a fresh look for your background.

Stunning How To Get Mortgage License Design for Mobile

Immerse yourself in the stunning details of this beautiful how to get mortgage license wallpaper, designed for a captivating visual experience.

Amazing How To Get Mortgage License Moment for Desktop

Explore this high-quality how to get mortgage license image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get Mortgage License Abstract Concept

Experience the crisp clarity of this stunning how to get mortgage license image, available in high resolution for all your screens.

Lush How To Get Mortgage License Moment in HD

This gorgeous how to get mortgage license photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid How To Get Mortgage License Background for Mobile

Explore this high-quality how to get mortgage license image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How To Get Mortgage License Wallpaper Illustration

Explore this high-quality how to get mortgage license image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get Mortgage License Wallpaper in HD

This gorgeous how to get mortgage license photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful How To Get Mortgage License View Nature

Discover an amazing how to get mortgage license background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic How To Get Mortgage License Scene for Your Screen

Find inspiration with this unique how to get mortgage license illustration, crafted to provide a fresh look for your background.

Lush How To Get Mortgage License Wallpaper Illustration

A captivating how to get mortgage license scene that brings tranquility and beauty to any device.

Crisp How To Get Mortgage License Design Illustration

This gorgeous how to get mortgage license photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality How To Get Mortgage License Design Collection

Discover an amazing how to get mortgage license background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality How To Get Mortgage License Picture Photography

Discover an amazing how to get mortgage license background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning How To Get Mortgage License Abstract Concept

A captivating how to get mortgage license scene that brings tranquility and beauty to any device.

Serene How To Get Mortgage License Moment Art

Discover an amazing how to get mortgage license background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these how to get mortgage license wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Mortgage License"

Post a Comment