How To Get A Mortgage With Adverse Credit

How To Get A Mortgage With Adverse Credit: Your Step-by-Step Guide

If you've encountered financial difficulties in the past and are now wondering how to get a mortgage with adverse credit, rest assured—you are not alone. Many people face setbacks, but a challenging credit history doesn't automatically mean your dream of homeownership is over.

It can feel daunting when mainstream lenders seem to shut the door, but the good news is that specialist lenders and clever strategies can make securing a mortgage possible. This guide will walk you through exactly what you need to do, step by step, to turn your adverse credit history into a manageable hurdle.

We're going to cover everything from understanding what lenders look for to finding the right specialist broker who can make all the difference.

Understanding Adverse Credit and Mortgage Lenders

Before you jump into applications, you need a clear picture of your credit situation. Adverse credit is simply any marker on your credit file that indicates you haven't managed borrowing or repayments perfectly in the past. The severity of the adverse credit dictates how difficult the application process will be.

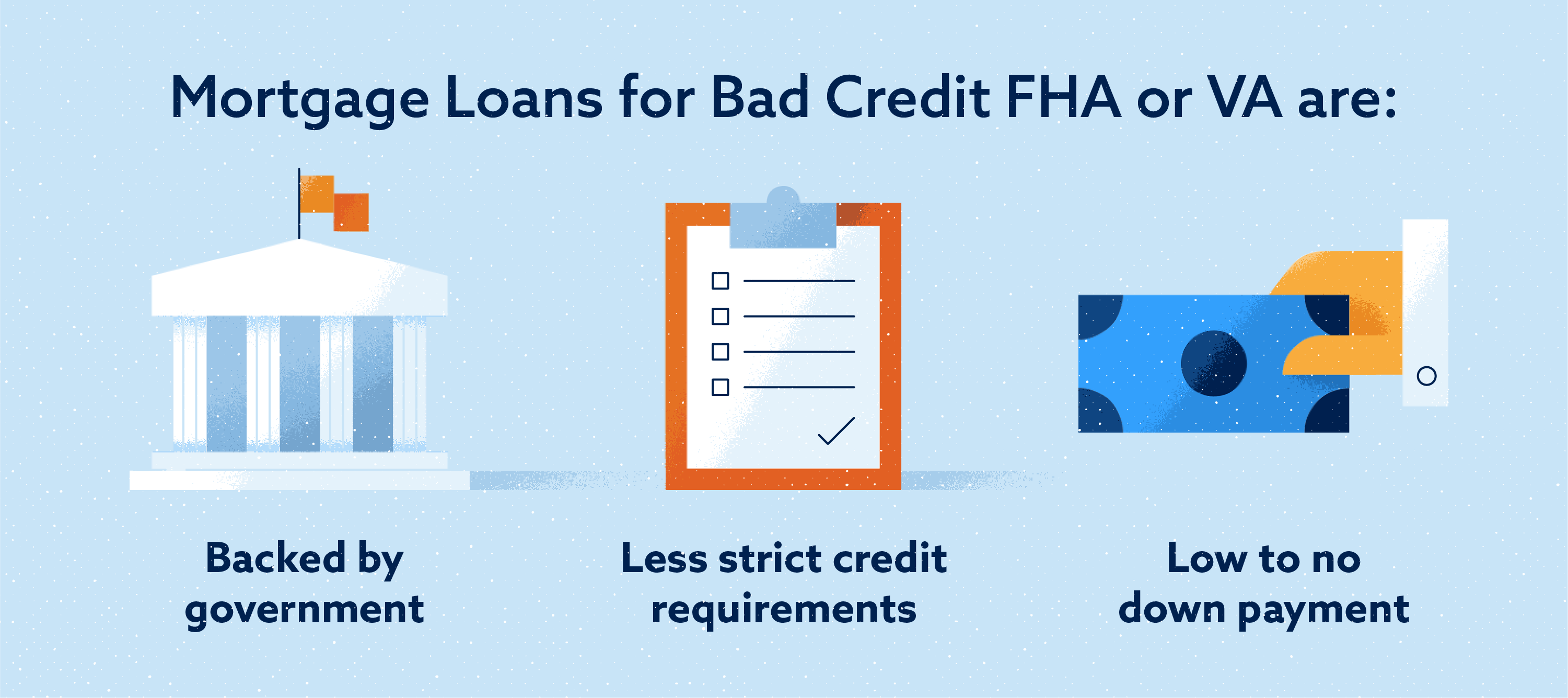

Standard high street banks often use automated systems that instantly reject applicants with any history of adverse credit. However, specialist lenders assess applications manually, looking at the "why" and "when" behind the credit issues, which is crucial for borrowers asking how to get a mortgage with adverse credit.

Identifying Different Types of Adverse Credit

Lenders categorize adverse credit into various types, some being much more serious than others. Knowing your exact issue helps a specialist broker match you with the correct lender.

- Defaults: Missing payments on credit agreements, leading to the entire balance becoming due.

- County Court Judgements (CCJs): Formal court orders for unpaid debts. Lenders look closely at the value and the date the CCJ was settled.

- Late Payments/Arrears: Missed or late payments on credit cards, loans, or mortgages. Minor arrears (e.g., 1 or 2 missed payments) are usually easier to overcome.

- Individual Voluntary Arrangements (IVAs) or Bankruptcy: These are the most serious forms of adverse credit and require significantly more time and larger deposits.

- Debt Management Plans (DMPs): While not strictly adverse credit, being on a DMP shows reliance on managed repayment plans.

Generally, the older and smaller the debt, the less impact it will have on your mortgage application. Lenders prefer to see issues that occurred three to five years ago rather than last month.

How Lenders View Your Credit History

Lenders don't just see a black mark; they look at the context. They focus on three main factors when assessing risk:

Firstly, they consider the *severity* of the credit issue. A small defaulted phone bill is viewed differently than a repossession or a significant bankruptcy.

Secondly, the *time scale* is crucial. If the issue was registered over six years ago, it will often disappear from your record. If it was more recent, you must demonstrate a perfect repayment history since the event.

Thirdly, the *cause* matters. Did you experience an unavoidable life event (like redundancy or serious illness) or was the adverse credit due to poor financial management? Being able to explain the circumstances helps your case significantly.

Preparing Yourself for an Adverse Credit Mortgage Application

Preparation is key to successfully obtaining a mortgage, especially when dealing with adverse credit. You need to present yourself as the lowest possible risk to a lender.

The first step is always obtaining copies of your credit reports from all three major reference agencies (Experian, Equifax, and TransUnion). Check them meticulously for errors. If you find any mistakes, dispute them immediately—it could significantly boost your score.

Essential Steps to Improve Your Credit Profile Now

While fixing serious adverse credit takes time, you can implement strategies right now to strengthen your overall financial position and improve your chances of success.

Focus on reducing your current debt burden. Lenders calculate your Debt-to-Income (DTI) ratio, and a lower DTI indicates better financial health. Also, make sure you are registered on the electoral roll, as this provides crucial proof of address.

Furthermore, avoid making any new credit applications (such as credit cards or loans) in the months leading up to your mortgage application, as these will leave 'hard searches' on your file, making you look riskier.

Gathering the Necessary Documentation

Specialist adverse credit lenders usually require more comprehensive documentation than standard banks. Having everything ready upfront proves you are serious and organized.

- Explain Adverse Credit: Prepare a clear, concise written explanation detailing the reasons behind your credit issues and what steps you've taken to manage or resolve them.

- Proof of Income: Recent payslips (typically 3-6 months) or audited accounts if you are self-employed.

- Bank Statements: Statements (usually 3-6 months) showing income deposits and responsible management of your finances.

- Proof of Deposit: Documentation showing the source of your deposit funds. Remember, adverse credit mortgages usually require a larger deposit, often 15% to 25%.

A larger deposit acts as a buffer for the lender, significantly reducing their risk exposure and making them much more likely to approve your application.

Finding the Right Lender: Specialist Brokers Are Key

This is arguably the most crucial step when figuring out how to get a mortgage with adverse credit. Trying to approach specialist lenders directly can be tricky, as many only work through brokers. Furthermore, applying randomly risks further damage to your credit file through multiple searches.

An experienced mortgage broker specializing in adverse credit will have established relationships with lenders who manually underwrite cases. They know exactly which lender is most likely to approve your specific set of credit circumstances (e.g., Lender A accepts settled CCJs after 1 year, while Lender B only accepts defaults over 3 years old).

What to Expect During the Application Process

The process for adverse credit mortgages is often more rigorous and detailed than a standard application. You should prepare for longer processing times, as manual underwriting takes more effort.

Your broker will submit a Decision in Principle (DIP) or Agreement in Principle (AIP) to gauge initial interest. Once a specific lender is chosen, they will scrutinize all your submitted documents, including the mandatory written explanation for your credit issues. They might ask detailed follow-up questions about your income, spending habits, and the adverse events themselves.

Be honest, transparent, and responsive throughout this stage. Misleading information will result in an immediate rejection and could jeopardize future applications.

Finally, expect higher interest rates than those advertised on the high street. Lenders need to mitigate the perceived risk associated with adverse credit, and they do this by charging a premium. However, once you have maintained perfect payments for a few years, you can often remortgage onto a cheaper standard rate.

Conclusion: Achieving Homeownership Despite Adverse Credit

Securing a mortgage when you have adverse credit is certainly achievable, but it requires strategy, patience, and professional help. If you follow the necessary steps—understanding your credit issues, proactively improving your financial profile, and utilizing a specialist broker—you significantly boost your chances.

Remember, the core question of how to get a mortgage with adverse credit is answered by proving stability and mitigating risk. A larger deposit, solid documentation, and a compelling explanation of past issues are your strongest tools. Don't let past financial struggles define your future homeownership dreams; start preparing today.

Frequently Asked Questions (FAQ)

- Can I get a mortgage immediately after a bankruptcy or IVA?

- While technically possible with certain niche lenders, it is highly difficult. Most adverse credit lenders require at least 1 to 3 years post-discharge, with 3+ years being preferable. You will also need a very substantial deposit (often 30-40%).

- How much deposit do I need for an adverse credit mortgage?

- The typical minimum deposit is 15%, but for more severe issues like recent CCJs, IVAs, or bankruptcies, lenders often demand 20% to 25%. The larger your deposit, the lower the interest rate you are likely to be offered.

- Will high street banks lend to me if my adverse credit is minor?

- It depends entirely on their specific criteria. Some high street lenders may accept applicants with minor, old adverse credit (e.g., a single small default settled over five years ago), especially if you have a large deposit. However, a specialist broker can usually find you a better deal faster.

- How long does adverse credit stay on my credit file?

- Most adverse credit markers, including CCJs, defaults, IVAs, and bankruptcy, typically remain on your credit file for six years from the date they were registered or filed.

- Should I pay off my old defaulted debts before applying?

- Yes, absolutely. Lenders view settled or satisfied debts much more favorably than outstanding ones. While paying them off won't remove them from your file, it shows responsibility and commitment to resolving past issues.

How To Get A Mortgage With Adverse Credit

How To Get A Mortgage With Adverse Credit Wallpapers

Collection of how to get a mortgage with adverse credit wallpapers for your desktop and mobile devices.

Detailed How To Get A Mortgage With Adverse Credit Artwork Collection

Experience the crisp clarity of this stunning how to get a mortgage with adverse credit image, available in high resolution for all your screens.

Stunning How To Get A Mortgage With Adverse Credit Picture Collection

A captivating how to get a mortgage with adverse credit scene that brings tranquility and beauty to any device.

Exquisite How To Get A Mortgage With Adverse Credit Design Photography

Find inspiration with this unique how to get a mortgage with adverse credit illustration, crafted to provide a fresh look for your background.

Serene How To Get A Mortgage With Adverse Credit Moment Photography

Discover an amazing how to get a mortgage with adverse credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush How To Get A Mortgage With Adverse Credit Photo in HD

This gorgeous how to get a mortgage with adverse credit photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating How To Get A Mortgage With Adverse Credit Wallpaper Photography

A captivating how to get a mortgage with adverse credit scene that brings tranquility and beauty to any device.

Vivid How To Get A Mortgage With Adverse Credit Capture Collection

Discover an amazing how to get a mortgage with adverse credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How To Get A Mortgage With Adverse Credit Abstract Art

Immerse yourself in the stunning details of this beautiful how to get a mortgage with adverse credit wallpaper, designed for a captivating visual experience.

Exquisite How To Get A Mortgage With Adverse Credit Moment Illustration

Immerse yourself in the stunning details of this beautiful how to get a mortgage with adverse credit wallpaper, designed for a captivating visual experience.

Breathtaking How To Get A Mortgage With Adverse Credit View in HD

Discover an amazing how to get a mortgage with adverse credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How To Get A Mortgage With Adverse Credit View Art

A captivating how to get a mortgage with adverse credit scene that brings tranquility and beauty to any device.

Dynamic How To Get A Mortgage With Adverse Credit View Photography

Immerse yourself in the stunning details of this beautiful how to get a mortgage with adverse credit wallpaper, designed for a captivating visual experience.

Artistic How To Get A Mortgage With Adverse Credit Landscape Concept

This gorgeous how to get a mortgage with adverse credit photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene How To Get A Mortgage With Adverse Credit Wallpaper for Desktop

Explore this high-quality how to get a mortgage with adverse credit image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get A Mortgage With Adverse Credit Wallpaper Collection

Immerse yourself in the stunning details of this beautiful how to get a mortgage with adverse credit wallpaper, designed for a captivating visual experience.

Gorgeous How To Get A Mortgage With Adverse Credit Capture in 4K

Find inspiration with this unique how to get a mortgage with adverse credit illustration, crafted to provide a fresh look for your background.

Vivid How To Get A Mortgage With Adverse Credit Wallpaper in 4K

Transform your screen with this vivid how to get a mortgage with adverse credit artwork, a true masterpiece of digital design.

Stunning How To Get A Mortgage With Adverse Credit Design for Mobile

Immerse yourself in the stunning details of this beautiful how to get a mortgage with adverse credit wallpaper, designed for a captivating visual experience.

Vivid How To Get A Mortgage With Adverse Credit View Photography

Explore this high-quality how to get a mortgage with adverse credit image, perfect for enhancing your desktop or mobile wallpaper.

0 Response to "How To Get A Mortgage With Adverse Credit"

Post a Comment