How To Get On Payment Plan With Irs

How To Get On Payment Plan With Irs: Your Stress-Free Guide

Dealing with the IRS can feel overwhelming, especially when you owe back taxes and simply can't afford to pay the lump sum right away. If you find yourself in this stressful situation, take a deep breath. You are not alone, and the good news is that the IRS actually offers several viable solutions to help you settle your tax debt without losing sleep.

The key solution we are focusing on today is the Installment Agreement—essentially, a payment plan. Learning how to get on payment plan with IRS is a critical step toward achieving financial peace of mind. This comprehensive guide will walk you through all the necessary steps, ensuring you understand your options and the application process.

Let's dive into the details so you can start tackling that tax bill the smart way.

Why You Need a Payment Plan (And Why Waiting Is a Bad Idea)

Ignoring a tax bill is the absolute worst strategy. When you owe the IRS money, penalties and interest start accruing immediately. These fees compound over time, meaning a small debt can quickly balloon into a much larger problem. By proactively establishing an IRS payment plan, you demonstrate good faith and minimize further financial damage.

Furthermore, setting up an agreement prevents the IRS from taking more aggressive collection actions, such as placing tax liens on your property or issuing levies on your bank accounts and wages. The sooner you act, the greater your control over the situation.

Understanding Your IRS Payment Options

The IRS offers different types of payment arrangements depending on the amount you owe and how quickly you can pay it back. It's crucial to choose the option that best fits your financial reality.

Short-Term Payment Plan (180 Days or Less)

If you can pay off your tax liability within 180 days, this is your simplest choice. There is no setup fee for this option, though interest and penalties still apply. However, the failure-to-pay penalty rate is often reduced once the arrangement is in place.

This plan is generally available to taxpayers who owe any combined amount of tax, penalties, and interest, as long as the total debt can be paid off in six months or less. This is ideal if you are waiting on a large bonus or a significant incoming payment.

Long-Term Installment Agreement (LTIA)

When you need more than 180 days to pay, you will request a formal Long-Term Installment Agreement. These plans allow you up to 72 months (six years) to pay off your balance. There is a setup fee for this type of agreement, but it can be significantly reduced or waived for low-income taxpayers.

The primary benefit of the LTIA is that once approved, the failure-to-pay penalty is often cut in half, making the overall cost of the debt significantly lower than if you simply ignored the bill.

Streamlined Installment Agreement (SIA)

The Streamlined Installment Agreement is the easiest way how to get on payment plan with IRS because it requires minimal financial disclosure. If you qualify, the IRS will typically accept your proposed payment amount, provided it settles the debt within 72 months.

You generally qualify for the SIA if:

- Your combined tax, penalties, and interest are $50,000 or less (for individuals, including sole proprietors and Schedule C filers).

- Your combined tax, penalties, and interest are $25,000 or less (for businesses).

- You have filed all required tax returns.

This is the preferred option for most taxpayers due to its speed and simplicity.

Non-Streamlined Agreements

If your tax debt exceeds the streamlined limits (i.e., over $50,000 for individuals), or if the IRS has already started aggressive collection action, you will need a Non-Streamlined Agreement. This requires completing a comprehensive financial statement (Form 433-F or 433-A) to prove your inability to pay the debt faster.

In this scenario, the IRS determines your ability to pay based on allowable living expenses and asset equity. This process is more detailed and often benefits from professional tax assistance.

Step-by-Step: How To Get On Payment Plan With Irs

Once you've determined which type of agreement suits your situation, the application process is quite straightforward. Follow these steps to secure your installment agreement.

Step 1: Get Compliant and Calculate Your Debt

Before the IRS will even consider your request for a payment plan, you must be current on all filing requirements. This means you must have filed all previous tax returns, even if you owe taxes on those years.

Next, accurately calculate the total balance due, including penalties and interest up to the current date. You need this precise figure to determine your eligibility for streamlined versus non-streamlined agreements.

Step 2: Choose Your Application Method

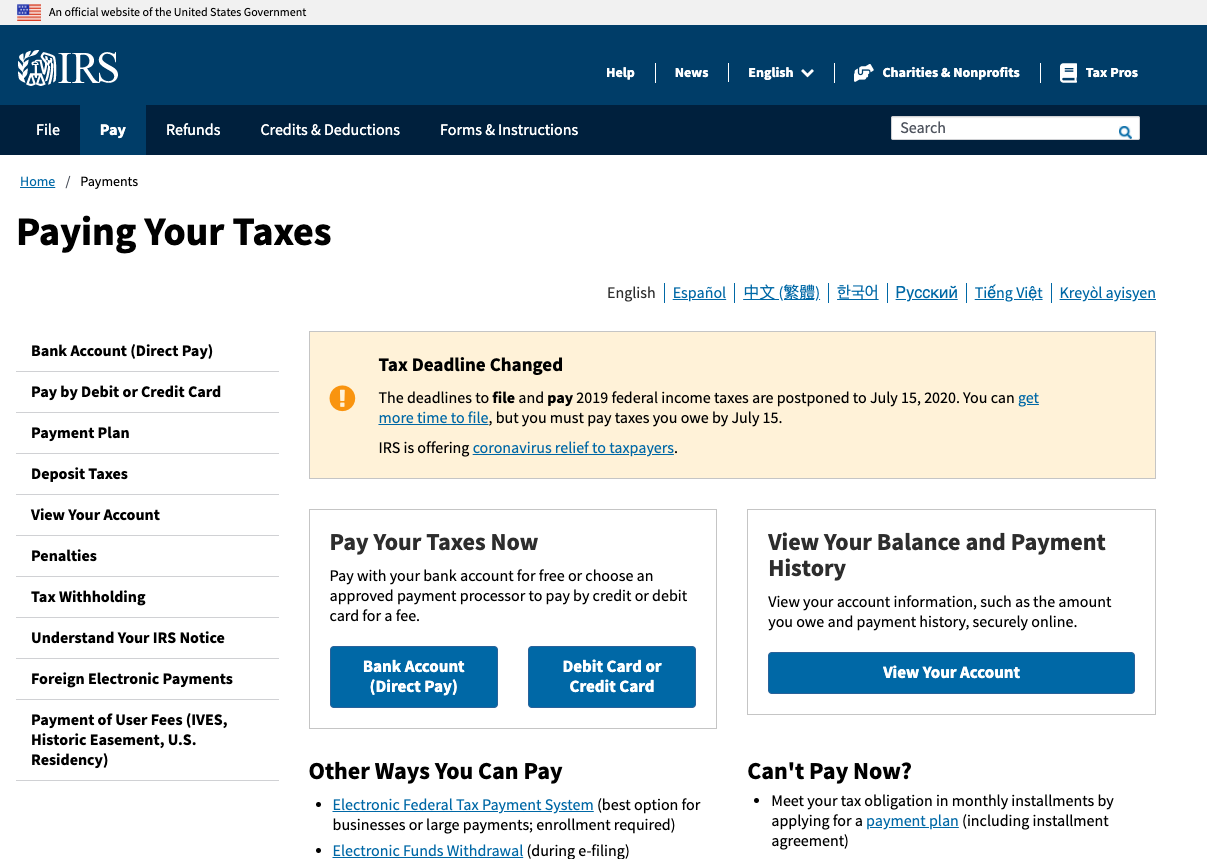

The IRS offers three main ways to apply for an installment agreement. We recommend the online method for speed and convenience if you qualify for the Streamlined or Short-Term plan.

- IRS Online Payment Agreement (OPA): This is the fastest way to establish a plan. It's available for individuals owing $50,000 or less, or businesses owing $25,000 or less. You receive instant confirmation.

- Filing Form 9465: You can file Form 9465, Installment Agreement Request, electronically with your tax return, or mail it separately to the IRS office that sent you the tax notice.

- Calling the IRS: If you receive a specific notice with a phone number, or if you require a complex or non-streamlined agreement, you may need to call the IRS directly or work with a tax professional.

Step 3: Determine Your Monthly Payment

When filling out the application (whether online or via Form 9465), you will propose a monthly payment amount and a payment date. If you qualify for the Streamlined plan, the IRS will typically accept your proposed payment as long as it pays off the debt within 72 months.

Pro Tip: Try to propose the highest payment you can comfortably afford. This will reduce the total amount of interest and penalties you pay over the life of the agreement.

Step 4: Maintain the Agreement

Getting approved is only half the battle. To keep the agreement active and avoid default, you must:

- Make all required monthly payments on time.

- File all future tax returns accurately and on time.

- Pay all future tax liabilities on time (e.g., pay the taxes you owe next year).

If you miss a payment or fail to file a future return, the IRS can terminate the installment agreement, and they will usually restart aggressive collection actions immediately.

What If I Can't Pay the Minimum Monthly Amount?

If your financial situation prevents you from paying the amount required to satisfy the debt in 72 months, the IRS offers other relief options. You might look into:

Offer in Compromise (OIC): This allows certain taxpayers to resolve their tax liability with the IRS for a smaller agreed-upon amount. This is generally accepted only when the taxpayer cannot pay the full amount due, and the lower offer represents the maximum the IRS can reasonably expect to collect.

Currently Not Collectible (CNC) Status: If you are experiencing genuine financial hardship (e.g., you can't pay your basic living expenses), the IRS may temporarily place your account in CNC status. Collections stop, but interest and penalties continue to accrue, and the status must be reviewed annually.

If you are exploring these options, seeking help from a Certified Public Accountant (CPA) or Enrolled Agent (EA) is highly recommended, as the OIC process is complex and requires extensive documentation.

Conclusion

Finding how to get on payment plan with IRS is one of the most proactive steps you can take to manage tax debt and avoid harsh IRS collections. By utilizing the Short-Term Payment Plan or the Long-Term Installment Agreement—especially the streamlined option—you can spread out your payments over several years while minimizing penalties.

Remember, prompt action is key. Do not let fear or procrastination lead to greater debt and stress. File any outstanding returns, choose the best payment option for your finances, and take control of your financial future today.

Frequently Asked Questions (FAQ) About IRS Payment Plans

- Can I set up an IRS payment plan if I haven't filed all my tax returns?

- No. The IRS requires you to be fully compliant, meaning all legally required tax returns must be filed before they will approve any payment arrangement, including an installment agreement.

- How much does it cost to set up an installment agreement?

- The fee varies. Setting up an agreement online using direct debit is the cheapest option (currently $31). Setting it up by phone or mail is more expensive (currently $149), but this fee is often reduced or waived for low-income taxpayers.

- Do I still have to pay interest and penalties on a payment plan?

- Yes, you do. Interest continues to accrue until the balance is paid in full. However, setting up a formal installment agreement significantly reduces the failure-to-pay penalty rate (usually from 0.5% to 0.25% per month).

- What happens if I default on my IRS payment plan?

- If you miss a payment or fail to meet a future tax obligation (like filing or paying next year's taxes), the IRS may terminate your agreement. If terminated, the full balance becomes due immediately, and the IRS can restart collection activities, including levies and liens.

How To Get On Payment Plan With Irs

How To Get On Payment Plan With Irs Wallpapers

Collection of how to get on payment plan with irs wallpapers for your desktop and mobile devices.

Beautiful How To Get On Payment Plan With Irs Design Nature

Experience the crisp clarity of this stunning how to get on payment plan with irs image, available in high resolution for all your screens.

Beautiful How To Get On Payment Plan With Irs Abstract for Mobile

Discover an amazing how to get on payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful How To Get On Payment Plan With Irs Moment Digital Art

Discover an amazing how to get on payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic How To Get On Payment Plan With Irs Photo Nature

This gorgeous how to get on payment plan with irs photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing How To Get On Payment Plan With Irs Artwork Collection

Discover an amazing how to get on payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic How To Get On Payment Plan With Irs Scene Illustration

Find inspiration with this unique how to get on payment plan with irs illustration, crafted to provide a fresh look for your background.

Lush How To Get On Payment Plan With Irs Landscape Nature

Find inspiration with this unique how to get on payment plan with irs illustration, crafted to provide a fresh look for your background.

Amazing How To Get On Payment Plan With Irs Wallpaper in 4K

Experience the crisp clarity of this stunning how to get on payment plan with irs image, available in high resolution for all your screens.

Crisp How To Get On Payment Plan With Irs Capture Nature

A captivating how to get on payment plan with irs scene that brings tranquility and beauty to any device.

Stunning How To Get On Payment Plan With Irs Background for Your Screen

Immerse yourself in the stunning details of this beautiful how to get on payment plan with irs wallpaper, designed for a captivating visual experience.

Stunning How To Get On Payment Plan With Irs Picture for Mobile

Immerse yourself in the stunning details of this beautiful how to get on payment plan with irs wallpaper, designed for a captivating visual experience.

Serene How To Get On Payment Plan With Irs Picture in 4K

Transform your screen with this vivid how to get on payment plan with irs artwork, a true masterpiece of digital design.

Stunning How To Get On Payment Plan With Irs Landscape for Your Screen

Find inspiration with this unique how to get on payment plan with irs illustration, crafted to provide a fresh look for your background.

Artistic How To Get On Payment Plan With Irs Scene Collection

Find inspiration with this unique how to get on payment plan with irs illustration, crafted to provide a fresh look for your background.

Mesmerizing How To Get On Payment Plan With Irs Scene in 4K

Explore this high-quality how to get on payment plan with irs image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get On Payment Plan With Irs Wallpaper for Your Screen

Find inspiration with this unique how to get on payment plan with irs illustration, crafted to provide a fresh look for your background.

Serene How To Get On Payment Plan With Irs Capture Concept

Explore this high-quality how to get on payment plan with irs image, perfect for enhancing your desktop or mobile wallpaper.

Vivid How To Get On Payment Plan With Irs Image Collection

Explore this high-quality how to get on payment plan with irs image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get On Payment Plan With Irs Image for Mobile

Find inspiration with this unique how to get on payment plan with irs illustration, crafted to provide a fresh look for your background.

Vibrant How To Get On Payment Plan With Irs View Collection

Discover an amazing how to get on payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these how to get on payment plan with irs wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get On Payment Plan With Irs"

Post a Comment