How To Get Out Of Credit Card Debt Fast

How To Get Out Of Credit Card Debt Fast: Your Practical Guide to Financial Freedom

If you are reading this, chances are you are feeling the weight of credit card debt. That feeling of constantly juggling minimum payments while the interest keeps piling up can be overwhelming, making the goal of financial freedom seem impossibly far away. But here's the good news: escaping this cycle is absolutely possible, and maybe even faster than you think!

We are going to walk through a strategic, step-by-step plan focused on exactly How To Get Out Of Credit Card Debt Fast. This isn't about quick fixes; it's about implementing sustainable, aggressive strategies that cut down your balances quickly and permanently. Let's get started on paving your path to zero debt.

First Steps: Understanding Your Debt Landscape

Before you can attack your debt, you need to know exactly what you are fighting. Think of this as reconnaissance. You need a clear, non-judgmental view of every dollar you owe.

Gather all your credit card statements. You must list out every single debt, the current balance, and most crucially, the Annual Percentage Rate (APR), which is the interest rate. This data will determine which debt attack strategy works best for you.

Create a Brutally Honest Budget

The secret to paying off debt fast is freeing up cash flow. This means scrutinizing every expense. You need to find "extra" money that can be directed toward your highest-interest debts.

Start tracking where every dollar goes for 30 days. Don't just estimate; use bank statements or a tracking app. Once you have a clear picture, you can start making surgical cuts to your spending.

Here are key areas to focus on when cutting costs:

- Identify and cut subscriptions you barely use (gym memberships, streaming services).

- Reduce dining out drastically; switch to meal prepping at home.

- Negotiate recurring bills like internet and phone services.

- Implement a "no-spend" challenge for non-essential purchases for 30 days.

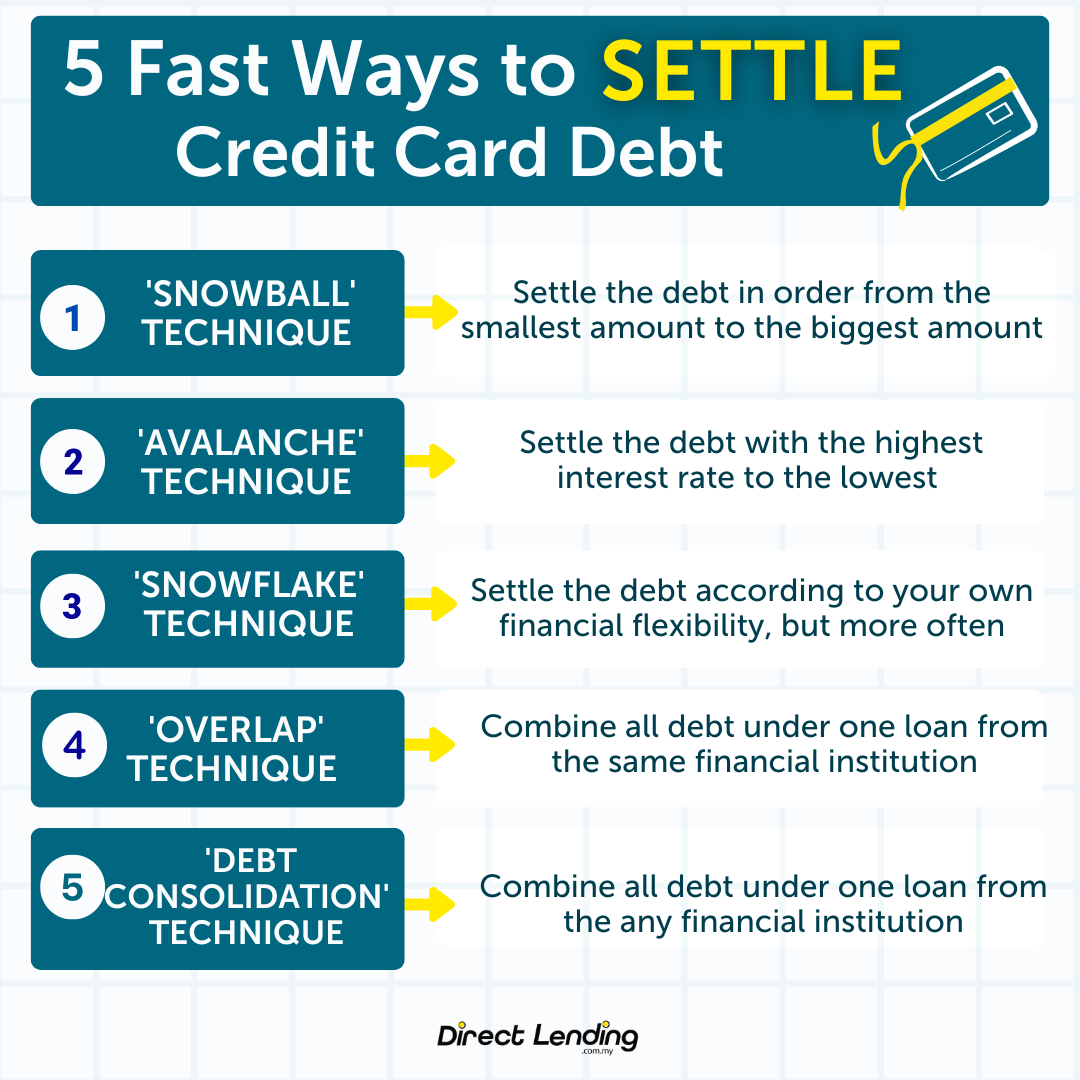

Choosing Your Debt Attack Strategy

Once you know how much money you can allocate towards debt repayment—the "debt snowball"—you need a strategy for applying that money. There are two primary, proven methods to help you figure out How To Get Out Of Credit Card Debt Fast: the Avalanche method and the Snowball method.

The Debt Avalanche Method: Targeting High Interest

The Avalanche method is mathematically the most efficient way to pay off debt. It saves you the most money and allows you to pay off the total debt in the shortest amount of time.

This strategy involves listing all your debts and ordering them by APR (interest rate), from highest to lowest. You pay the minimum on every account except the one with the highest APR. You throw every extra dollar you have at that top debt. Once that card is paid off, you take the money you were paying on it and apply it to the next highest-interest debt.

If your motivation is driven by saving money and maximizing efficiency, the Avalanche method is the clear winner.

The Debt Snowball Method: Building Momentum

While the Avalanche method saves the most money, the Snowball method is often more powerful psychologically. It focuses on quick wins to keep your motivation high.

In the Snowball method, you order your debts by balance size, from smallest to largest, regardless of the interest rate. You pay the minimum on all debts except the smallest one, attacking it aggressively. Once that smallest debt is gone, you roll that full payment amount onto the next smallest debt, like a snowball gaining size.

The quick satisfaction of eliminating an entire debt early often provides the motivational fuel needed to stick with the plan long enough to achieve total freedom.

Turbocharging Your Payments and Reducing Interest

To truly speed up the process of getting rid of credit card debt, you need to attack the problem from both sides: increasing payments and decreasing the cost of the debt itself (interest).

This is where getting creative with income and refinancing debt comes into play. Think about side hustles, selling unused items, or temporary gig work—all extra income goes straight to debt.

Negotiating Lower Interest Rates

Did you know you can often call your credit card company and ask for a lower interest rate? Many card issuers are willing to temporarily lower your APR if you have a good track record of on-time payments, especially if you mention you are considering closing the card or consolidating your debt elsewhere.

The worst they can say is no, so it is always worth the 15-minute phone call. Saving even a few percentage points on a high balance can shave months off your repayment plan and significantly reduce the total amount of interest paid.

Consider a Balance Transfer Card

A balance transfer card can be a game-changer when attempting to figure out How To Get Out Of Credit Card Debt Fast. These cards offer a 0% introductory APR period, often lasting 12 to 21 months.

If you can transfer high-interest balances onto one of these cards, every dollar you pay goes directly toward the principal, not the interest, during that introductory period. This can accelerate your progress tremendously.

However, be aware of balance transfer fees (usually 3% to 5% of the transferred amount) and commit fully to paying off the balance before the 0% period expires. If you fail to pay it off, the regular, often high, APR kicks in.

Long-Term Habits for Staying Debt-Free

Getting out of debt quickly is only half the battle; staying out is the victory. True financial freedom comes from changing the habits that led to the debt in the first place.

One of the most important steps is building an emergency fund. Experts recommend saving $1,000 initially. This buffer prevents you from relying on credit cards when unexpected life events—like a car repair or medical bill—pop up.

Once you are completely debt-free, take the exact amount you were paying toward credit card debt and redirect it immediately into your savings, retirement funds, or fully-funded emergency fund (3 to 6 months of expenses). This is called pay yourself first.

Finally, consider putting your credit cards away entirely, or only using one card sparingly and paying the statement balance in full every month. This ensures you never pay interest again.

Conclusion: Committing to Financial Freedom

The journey to financial freedom requires discipline and commitment, but the payoff—zero stress and full control over your money—is priceless. By aggressively budgeting, choosing a smart debt attack method (Avalanche or Snowball), and leveraging tools like balance transfers and negotiations, you have a solid strategy for How To Get Out Of Credit Card Debt Fast.

Remember, every extra payment you make today accelerates your timeline. Stick to your plan, celebrate the small victories as you eliminate cards, and look forward to the day you make your final credit card payment. You've got this!

Frequently Asked Questions (FAQ)

- What is the absolute fastest way to pay off credit card debt?

- The fastest way is typically a combination of two things: applying the Debt Avalanche method (targeting highest interest first) and drastically increasing your monthly payment amount through budget cuts or earning extra income.

- Should I stop using my credit cards entirely while paying off debt?

- For most people, yes. Cutting up or securely locking away the cards removes the temptation to incur new debt. If you must use them for recurring bills, ensure you are paying the full balance every single month to avoid compounding interest.

- Does consolidating my debt hurt my credit score?

- Debt consolidation itself doesn't inherently hurt your score. However, if you take out a new personal loan, your credit report might take a temporary small hit due to the credit inquiry. Long term, successfully paying off high-interest revolving credit cards and maintaining low utilization will improve your score significantly.

- Is it better to pay off my smallest debt or the debt with the highest interest?

- It depends on your personality. Mathematically, paying off the highest interest (Avalanche) saves the most money. Psychologically, paying off the smallest balance (Snowball) provides early wins that boost motivation and adherence to the plan.

How To Get Out Of Credit Card Debt Fast

How To Get Out Of Credit Card Debt Fast Wallpapers

Collection of how to get out of credit card debt fast wallpapers for your desktop and mobile devices.

Crisp How To Get Out Of Credit Card Debt Fast View in HD

Immerse yourself in the stunning details of this beautiful how to get out of credit card debt fast wallpaper, designed for a captivating visual experience.

Gorgeous How To Get Out Of Credit Card Debt Fast Capture Nature

A captivating how to get out of credit card debt fast scene that brings tranquility and beauty to any device.

Exquisite How To Get Out Of Credit Card Debt Fast Wallpaper for Desktop

A captivating how to get out of credit card debt fast scene that brings tranquility and beauty to any device.

Exquisite How To Get Out Of Credit Card Debt Fast Moment for Your Screen

Find inspiration with this unique how to get out of credit card debt fast illustration, crafted to provide a fresh look for your background.

Serene How To Get Out Of Credit Card Debt Fast View Photography

Discover an amazing how to get out of credit card debt fast background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene How To Get Out Of Credit Card Debt Fast Capture Nature

Experience the crisp clarity of this stunning how to get out of credit card debt fast image, available in high resolution for all your screens.

Vibrant How To Get Out Of Credit Card Debt Fast Scene Art

Experience the crisp clarity of this stunning how to get out of credit card debt fast image, available in high resolution for all your screens.

Breathtaking How To Get Out Of Credit Card Debt Fast Image for Mobile

Experience the crisp clarity of this stunning how to get out of credit card debt fast image, available in high resolution for all your screens.

Amazing How To Get Out Of Credit Card Debt Fast View in 4K

Explore this high-quality how to get out of credit card debt fast image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing How To Get Out Of Credit Card Debt Fast Picture in HD

Experience the crisp clarity of this stunning how to get out of credit card debt fast image, available in high resolution for all your screens.

Artistic How To Get Out Of Credit Card Debt Fast Moment in 4K

Find inspiration with this unique how to get out of credit card debt fast illustration, crafted to provide a fresh look for your background.

Vivid How To Get Out Of Credit Card Debt Fast Design Nature

Transform your screen with this vivid how to get out of credit card debt fast artwork, a true masterpiece of digital design.

Beautiful How To Get Out Of Credit Card Debt Fast Capture Collection

Experience the crisp clarity of this stunning how to get out of credit card debt fast image, available in high resolution for all your screens.

Beautiful How To Get Out Of Credit Card Debt Fast Design for Desktop

Transform your screen with this vivid how to get out of credit card debt fast artwork, a true masterpiece of digital design.

Crisp How To Get Out Of Credit Card Debt Fast Scene for Your Screen

Find inspiration with this unique how to get out of credit card debt fast illustration, crafted to provide a fresh look for your background.

Stunning How To Get Out Of Credit Card Debt Fast Moment Collection

This gorgeous how to get out of credit card debt fast photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed How To Get Out Of Credit Card Debt Fast Moment Collection

Explore this high-quality how to get out of credit card debt fast image, perfect for enhancing your desktop or mobile wallpaper.

Amazing How To Get Out Of Credit Card Debt Fast Background in HD

Transform your screen with this vivid how to get out of credit card debt fast artwork, a true masterpiece of digital design.

Lush How To Get Out Of Credit Card Debt Fast Artwork Nature

Immerse yourself in the stunning details of this beautiful how to get out of credit card debt fast wallpaper, designed for a captivating visual experience.

Vivid How To Get Out Of Credit Card Debt Fast Picture Nature

Discover an amazing how to get out of credit card debt fast background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these how to get out of credit card debt fast wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Out Of Credit Card Debt Fast"

Post a Comment