How To Get Paid Collections Off Your Credit Report

How To Get Paid Collections Off Your Credit Report: Your Ultimate Guide

It's an incredibly frustrating feeling. You did the responsible thing, settled that old collection account, and finally paid off the debt. Yet, when you check your credit report, that pesky collection entry is still staring back at you, dragging your score down. You might be asking: "I paid it, so why is it still there?"

The short answer is that paying off a collection account simply updates the status from "unpaid" to "paid." Unfortunately, the negative history still remains for up to seven years under the Fair Credit Reporting Act (FCRA). But don't worry, you are not powerless. This comprehensive guide will walk you through exactly How To Get Paid Collections Off Your Credit Report using tried-and-true strategies.

Understanding Paid Collections and Your Credit Score

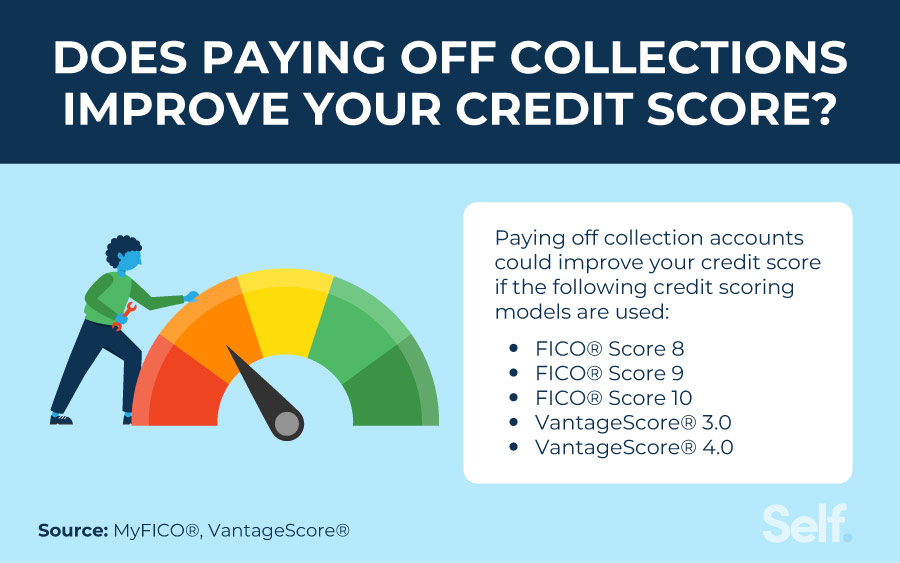

When an account goes into collections, it's one of the most damaging events for your credit score. Many people assume that once the debt is settled, the score immediately rebounds. While a "Paid" status looks better than "Unpaid," the historical record of the default still weighs heavily on scoring models like FICO and VantageScore.

Our goal isn't just to mark the debt as paid; our goal is full removal. Deleting the entire entry is the most effective way to see a significant positive impact on your creditworthiness, making it easier to qualify for loans and better interest rates.

The Difference Between "Paid" and "Deleted"

Think of your credit report as a resume. A "Paid" collection is like leaving a problematic job on your resume but noting that the conflict was resolved. A "Deleted" collection is like removing the problematic job entirely, leaving only positive history behind.

This is why understanding How To Get Paid Collections Off Your Credit Report requires a proactive strategy beyond just settling the balance. You need the collection agency to agree to remove the historical reporting entirely.

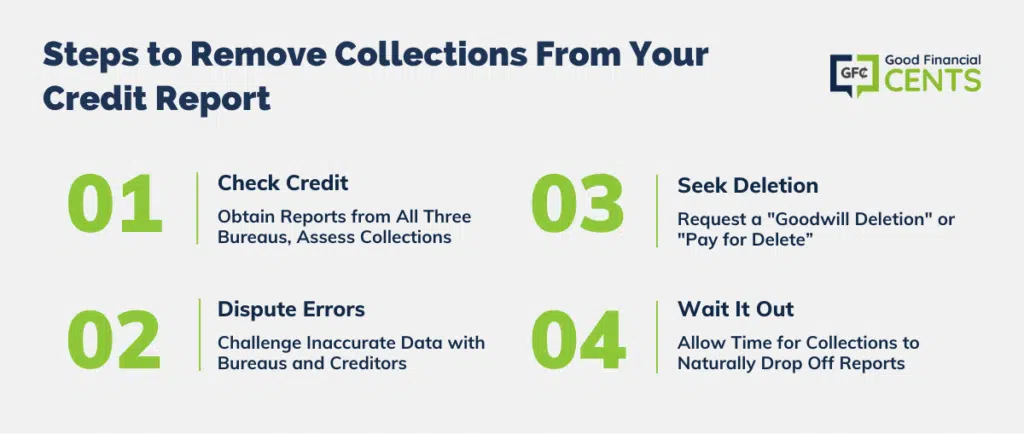

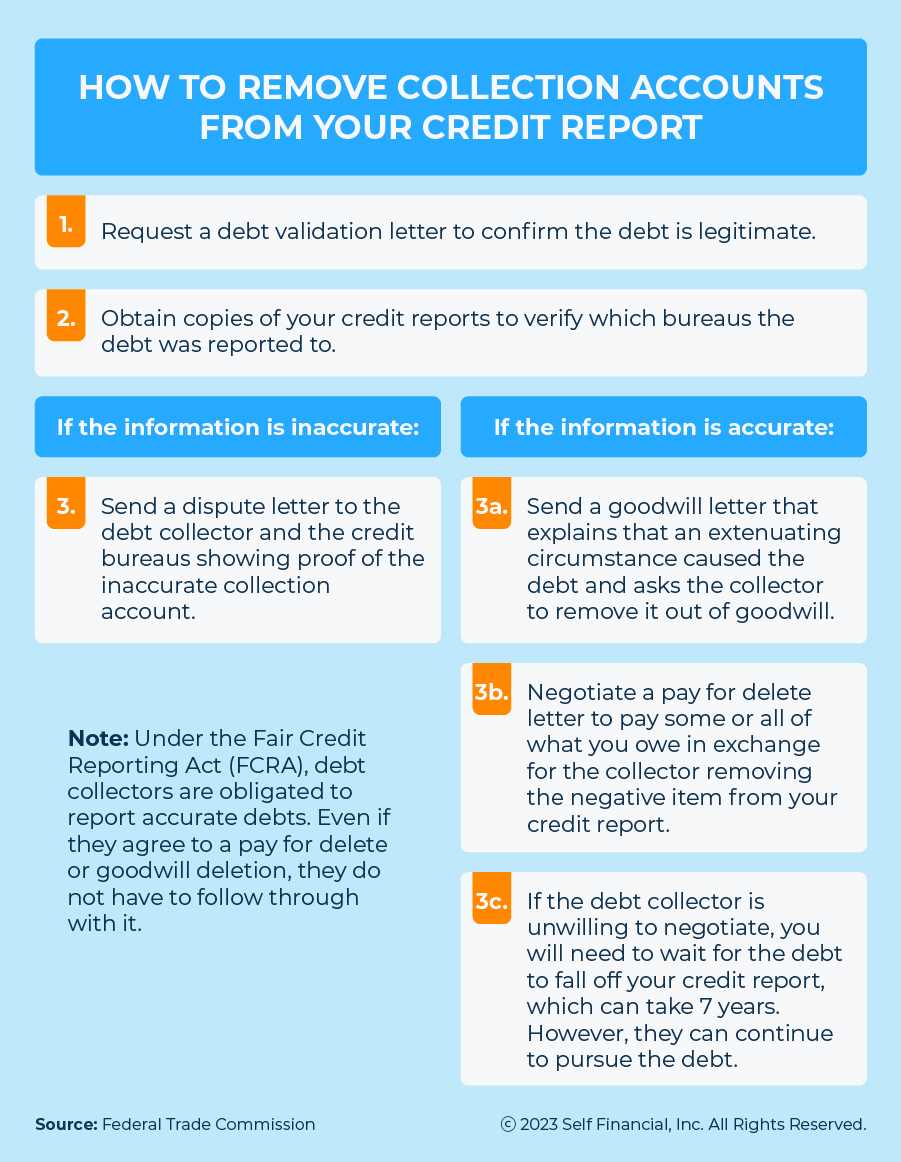

Strategy 1: The 'Pay-for-Delete' Negotiation

The "Pay-for-Delete" (PFD) strategy is the most aggressive and often the quickest way to remove a paid collection entry. It involves negotiating with the collection agency to delete the negative entry from your credit reports in exchange for payment, or proof that payment has already been made.

Remember that collection agencies are primarily interested in collecting money. If the debt is already paid, they have less leverage, but they still might agree if they are seeking good customer relations or clearing their internal records.

Executing the Pay-for-Delete When the Debt is Already Paid

If you have already paid the collection, your approach changes slightly. Instead of offering payment, you are leveraging the goodwill associated with the settled debt and asking for administrative removal.

Here's the step-by-step process:

- Formal Written Request: Send a certified letter (always certified!) to the collection agency referencing the account number and the date the payment was posted.

- State Your Terms Clearly: Explicitly request that they delete the entry from all three major credit bureaus (Equifax, Experian, TransUnion) within 15-30 days of receiving your letter.

- Maintain Records: Keep a copy of your letter and the certified mail receipt. Do not accept verbal agreements; everything must be in writing.

A PFD is always a negotiation. While some agencies strictly adhere to reporting policies, smaller agencies or those eager to close older files might be more flexible.

Strategy 2: Dispute the Debt, Even When Paid

If the Pay-for-Delete strategy fails, your next powerful tool is the official dispute process under the FCRA. Even when the debt is legitimately yours and you've paid it, the reporting must be 100% accurate and complete.

Debt collectors often purchase old debt in large batches. This can lead to minor reporting errors—a wrong date, an incorrect balance (even if paid later), or misreporting the original creditor. This inaccuracy is your leverage.

Identifying Inaccuracies on Your Report

Before disputing, comb through the entry for discrepancies. Any of the following points can be grounds for a dispute:

- The original creditor's name is incorrect.

- The date of last activity is wrong.

- The amount (even if reported as zero now) was incorrect at any point.

- The account status is vaguely reported or inaccurate (e.g., still showing as 'open' or 'settled' when it should be 'paid in full').

- The reporting violates the statute of limitations (which we will discuss next).

When you file a dispute, the credit bureau must investigate the claim within 30 days. If the collection agency cannot verify the accuracy of the account details (which often happens when information is old or incomplete), the bureau is legally required to remove the entry.

Strategy 3: Waiting Game and Statute of Limitations

If you've exhausted negotiation and dispute options, or if the debt is simply very old, you need to rely on the rules governing how long negative information can remain on your file. Under the FCRA, most negative items, including collections, must be removed seven years after the date of first delinquency (DOFD).

Importantly, paying off the debt does not reset the seven-year clock. If the collection is approaching its expiration date, sometimes the best course of action regarding How To Get Paid Collections Off Your Credit Report is patience.

Preventing Recalculation of the Removal Date

Be extremely careful not to accidentally reset the clock! While paying the debt won't reset the reporting period for FCRA purposes, some states have laws regarding the statute of limitations (SOL) for collections.

If a debt is past the SOL in your state, the collector cannot successfully sue you to recover it. However, the SOL and the FCRA reporting period are different concepts. Always verify the DOFD and make sure the collector is not reporting the wrong removal date.

Taking Action: Essential Steps Before Contacting Debt Collectors

Preparation is key to dealing with collection agencies. They are professionals; you need to approach them strategically. Here are the necessary steps to secure your position before initiating contact, whether for PFD or dispute.

- Pull All Three Reports: Get current reports from Equifax, Experian, and TransUnion. Verify that the collection appears on all three, and check if the details match exactly across all reports.

- Gather Proof of Payment: Locate the bank statement, canceled check, or transaction confirmation that shows when you paid the debt and the amount. This is your leverage.

- Determine the Date of First Delinquency (DOFD): This is the most crucial date. It determines when the item should naturally drop off your report.

- Draft the Letter: Never communicate via phone. Prepare a clear, concise negotiation or dispute letter using professional language.

By following these steps, you ensure that you know precisely what information the collector has (or lacks) and you have your ammunition ready for successful deletion.

Conclusion: Mastering How To Get Paid Collections Off Your Credit Report

Dealing with paid collections requires diligence and strategy. It's not enough just to pay the bill; you must actively negotiate the removal of the negative tradeline. To master How To Get Paid Collections Off Your Credit Report, remember these key tactics: first, attempt the 'Pay-for-Delete' strategy in writing, leveraging the fact that the debt is already settled. Second, use the FCRA dispute process to challenge any tiny inaccuracies in the reporting. Finally, be patient if the debt is near its seven-year expiration date.

Removing these entries can dramatically improve your credit standing, opening up better financial opportunities. Take a deep breath, prepare your documentation, and execute your strategy with confidence.

Frequently Asked Questions (FAQ)

- Can a collection agency legally refuse a "Pay-for-Delete" request?

- Yes, they can. Collection agencies are generally required to report information accurately. Deleting an accurate entry is voluntary. However, many agencies will agree to PFD to close the file quickly and ensure they retain payment, especially if the debt is older.

- Will paying a collection debt hurt my credit score?

- When you pay a collection, the status updates from "Unpaid" to "Paid," which is positive. However, the update itself can sometimes trigger a score recalculation, temporarily causing a minor dip, before the long-term benefit sets in. The overall impact is positive, provided you secure a deletion agreement.

- If I dispute a paid collection, does the 30-day investigation period apply?

- Yes. Under the FCRA, the credit bureau has 30 days to investigate your claim regarding the accuracy or completeness of the reported information. If the collection agency fails to verify the details within that time frame, the bureau must remove the entry.

- What should I do if the collection agency violates our Pay-for-Delete agreement?

- If you have the agreement in writing (which is mandatory!), send a copy of the agreement to the credit bureaus and dispute the entry, stating that the collection agency is violating a contractual obligation to delete the entry. This written proof is usually sufficient for the bureau to side with you and remove the item.

How To Get Paid Collections Off Your Credit Report

How To Get Paid Collections Off Your Credit Report Wallpapers

Collection of how to get paid collections off your credit report wallpapers for your desktop and mobile devices.

Lush How To Get Paid Collections Off Your Credit Report Design for Desktop

Immerse yourself in the stunning details of this beautiful how to get paid collections off your credit report wallpaper, designed for a captivating visual experience.

Gorgeous How To Get Paid Collections Off Your Credit Report View for Mobile

A captivating how to get paid collections off your credit report scene that brings tranquility and beauty to any device.

Gorgeous How To Get Paid Collections Off Your Credit Report Scene for Mobile

This gorgeous how to get paid collections off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How To Get Paid Collections Off Your Credit Report Picture Collection

Discover an amazing how to get paid collections off your credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic How To Get Paid Collections Off Your Credit Report View Collection

This gorgeous how to get paid collections off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous How To Get Paid Collections Off Your Credit Report Background Illustration

This gorgeous how to get paid collections off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking How To Get Paid Collections Off Your Credit Report Background in HD

Experience the crisp clarity of this stunning how to get paid collections off your credit report image, available in high resolution for all your screens.

Artistic How To Get Paid Collections Off Your Credit Report View Nature

This gorgeous how to get paid collections off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get Paid Collections Off Your Credit Report Picture Illustration

This gorgeous how to get paid collections off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid How To Get Paid Collections Off Your Credit Report Artwork Photography

Experience the crisp clarity of this stunning how to get paid collections off your credit report image, available in high resolution for all your screens.

Mesmerizing How To Get Paid Collections Off Your Credit Report Picture Illustration

Transform your screen with this vivid how to get paid collections off your credit report artwork, a true masterpiece of digital design.

Amazing How To Get Paid Collections Off Your Credit Report View in 4K

Explore this high-quality how to get paid collections off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Lush How To Get Paid Collections Off Your Credit Report Capture Photography

This gorgeous how to get paid collections off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic How To Get Paid Collections Off Your Credit Report Picture Concept

Find inspiration with this unique how to get paid collections off your credit report illustration, crafted to provide a fresh look for your background.

High-Quality How To Get Paid Collections Off Your Credit Report Scene Photography

Transform your screen with this vivid how to get paid collections off your credit report artwork, a true masterpiece of digital design.

Artistic How To Get Paid Collections Off Your Credit Report Design for Desktop

A captivating how to get paid collections off your credit report scene that brings tranquility and beauty to any device.

Artistic How To Get Paid Collections Off Your Credit Report Moment Photography

Find inspiration with this unique how to get paid collections off your credit report illustration, crafted to provide a fresh look for your background.

0 Response to "How To Get Paid Collections Off Your Credit Report"

Post a Comment