How To Get Paycheck Early

How To Get Paycheck Early: Your Guide to Faster Funds

We've all been there: rent is due, an unexpected bill pops up, or you just need a little extra cash to tide you over until Friday. Waiting for your regularly scheduled payday can feel agonizing when you need money now. If you're searching for "How To Get Paycheck Early," you're in luck! Modern financial technology has made it easier than ever to access the money you've already earned without resorting to high-interest payday loans.

Accessing your paycheck early, often referred to as Earned Wage Access (EWA), can be a financial game-changer. This comprehensive guide will walk you through the safest, fastest, and most responsible ways to bridge that financial gap and get your hands on your hard-earned wages ahead of schedule.

Understanding Early Wage Access (EWA) Solutions

Early Wage Access (EWA) is the overarching term for technologies that allow employees to tap into their earned wages before their official payday. Unlike traditional loans, this isn't borrowed money; it's simply accessing the money you have already worked for. This system is gaining massive popularity because it helps users manage cash flow effectively and avoids late fees.

There are generally two main categories of EWA solutions: direct-to-consumer apps and employer-sponsored programs. Both offer distinct advantages and drawbacks depending on your employment situation and financial needs.

Paycheck Advance Apps: The Digital Lifesaver

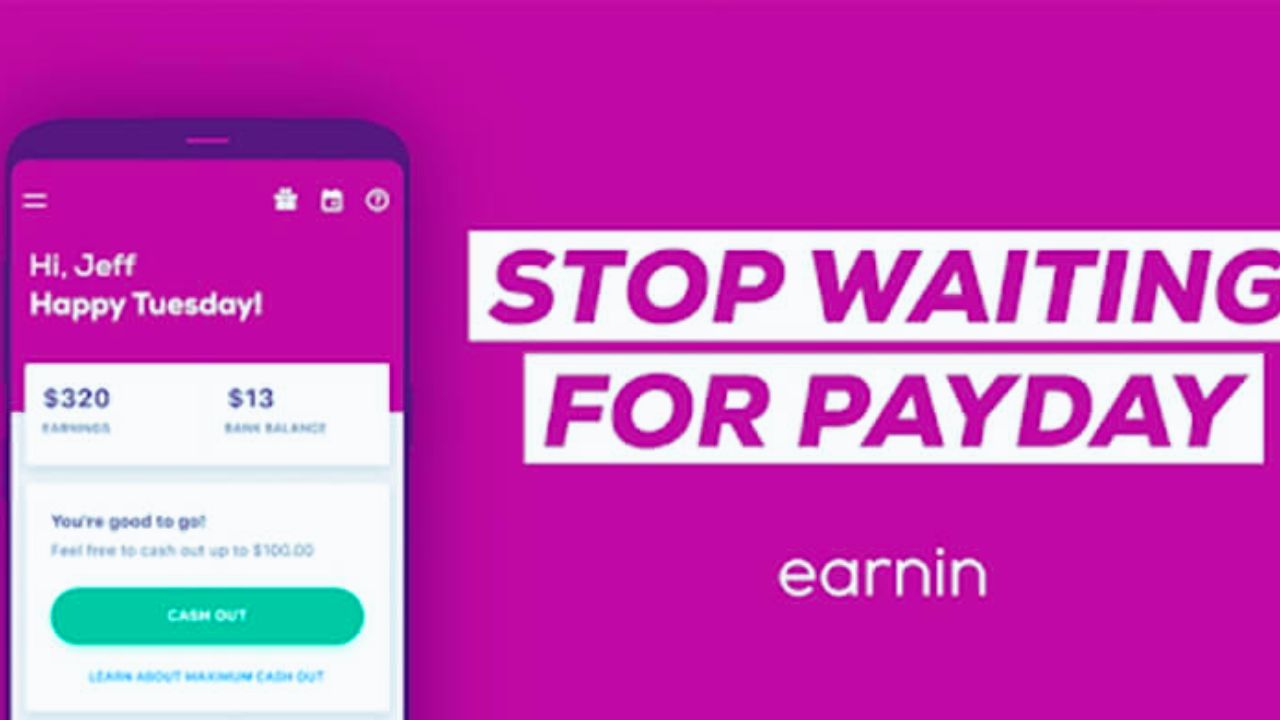

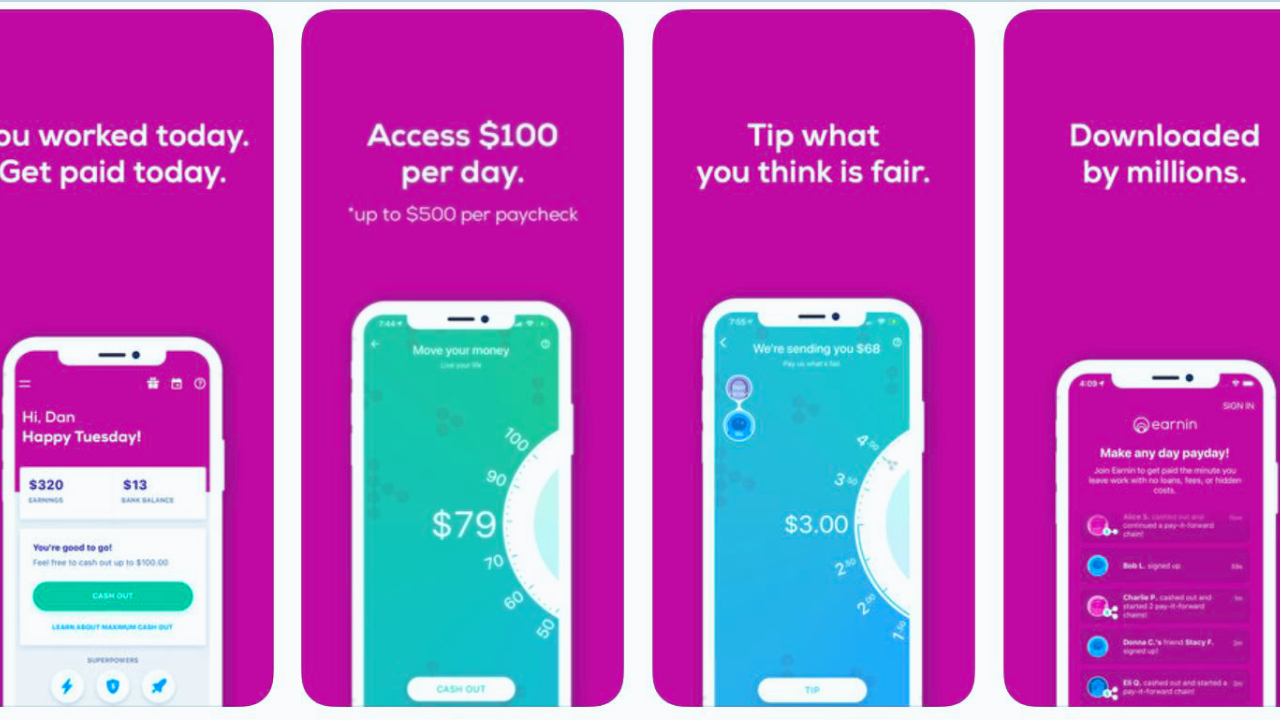

These third-party applications have become the most common way for individuals to figure out how to get paycheck early. Apps like Dave, Brigit, Chime, and Earnin link directly to your bank account and track your work hours or direct deposits to estimate your accrued earnings.

Once verified, they let you withdraw a small portion of your earned wages immediately. When your official payday hits, the app automatically deducts the advanced amount (plus any fees or tips) from your incoming direct deposit. It's quick, convenient, and completely digital.

Pros and Cons of Using Advance Apps

- Pros: Immediate access to funds, no credit check required, lower fees than payday loans, and 24/7 availability.

- Cons: Potential for constant reliance on advances, optional "tips" that can function like high interest rates, and withdrawal limits that might not cover large expenses.

Employer-Sponsored EWA Programs

Some forward-thinking companies partner directly with EWA providers like DailyPay or PayActiv. If your employer offers this benefit, it's usually the safest and most transparent way to access your wages early. The integration is seamless with the company's payroll system.

Because the employer sanctions the process, the fees are generally minimal (often free or just a small flat transaction fee) and there is better oversight. Check with your Human Resources department to see if this is an available option for you.

Leveraging Banking Features to Get Paid Faster

You might not need a third-party app to learn how to get paycheck early. In the last few years, many challenger banks and fintech platforms have begun offering a standard perk: receiving your direct deposit up to two days earlier than traditional banks.

This feature works because the bank processes the Automated Clearing House (ACH) file immediately upon receiving it from your employer, instead of holding onto the funds until the official pay date. This simple switch can give you two days of wiggle room every pay period.

Direct Deposit and Early Access Banks

Switching your primary bank account can be one of the easiest, permanent solutions for early access to your funds. If you rely heavily on your direct deposit date, considering a switch might be worthwhile, especially since these banks often have low or no monthly maintenance fees.

Popular Financial Platforms Offering Early Paycheck Access:

- Chime: Famous for its "Get Paid Up to 2 Days Early" feature with qualifying direct deposits.

- Varo: Offers similar early direct deposit services with no overdraft fees.

- Current: Known for offering early direct deposit along with other money management tools.

- Discover Bank: While less common, some traditional banks are starting to adopt this faster processing method.

Alternatives When Apps Are Not An Option

Sometimes, your employer doesn't use EWA software, or you might not meet the deposit requirements for certain apps. In these cases, you still have options before you panic. These alternatives require a more traditional approach but can still deliver the funds you need quickly.

Asking Your Employer (The Direct Approach)

If you are in a pinch, talk to your manager or the payroll department directly. While many companies strictly adhere to their payroll schedule, some may make a one-time exception for an employee in good standing facing a genuine emergency. Frame your request professionally, emphasizing that this is a unique situation and not a request for a permanent change in your payment terms.

Be prepared for them to say no, but don't be afraid to ask. A formal written request or an email to HR is often required to ensure everything is documented properly.

Low-Interest Credit Union Loans

If the amount you need exceeds the limit offered by EWA apps, or you require a longer repayment timeline, a small personal loan from a credit union is typically far better than a traditional payday lender. Credit unions often offer "Payday Alternative Loans" (PALs) with significantly lower interest rates and more flexible terms.

While this isn't exactly getting your paycheck early, it provides immediate relief with a manageable repayment plan. This is a much safer financial move than risking the triple-digit Annual Percentage Rates (APR) associated with predatory lenders.

Crucial Tips Before Seeking Early Access

Whenever you access funds early, it's vital to think about the downstream effects. If you withdraw $100 today, your bank account will be short by $100 (plus fees) on your official payday. This practice can become a cycle if not managed carefully.

Always prioritize options that charge fixed fees or no fees over those that encourage "tipping." Tipping, while voluntary, often pushes the effective APR of the advance into questionable territory. Use early wage access solutions only for true emergencies or short-term needs, not as a permanent budgeting tool.

Before confirming any transaction, read the fine print regarding repayment and fees. Ensure the app or service is legitimate and has strong reviews from reliable financial sources.

Conclusion

The desire to get money quickly is understandable, and thankfully, modern solutions offer safe answers to the question "How To Get Paycheck Early." Whether you opt for an automated solution like an early direct deposit bank, a paycheck advance app like Dave or Earnin, or a formalized employer EWA program, you have several tools available to manage cash flow better.

Remember that the key to financial health is building a small cushion so that early access becomes a rare convenience rather than a constant necessity. Choose the option that offers the lowest fees and the most transparency to ensure you are truly helping your finances, not hurting them in the long run.

Frequently Asked Questions (FAQ) About Early Paycheck Access

- Is getting my paycheck early considered a loan?

- No. Legitimate Early Wage Access (EWA) providers are not issuing a loan. They are simply allowing you to access wages you have already accrued based on the hours you have already worked. A loan implies borrowing money that hasn't been earned yet.

- Do early wage access apps charge interest?

- Most EWA apps do not charge traditional interest. Instead, they usually charge a small subscription fee, a flat transaction fee (e.g., $1.99 per transfer), or rely on voluntary "tips" from users. Be cautious of services that use excessive fees disguised as tips.

- Can I get my full paycheck early?

- Typically, no. EWA apps and services usually cap the amount you can withdraw early (often between $100 and $500). This limit helps ensure that you have enough funds left in your account on payday to cover the repayment and still handle your basic expenses.

- Does getting paid early affect my credit score?

- Generally, using EWA apps or early direct deposit features does not impact your credit score, as these services do not perform hard credit inquiries and are not classified as credit products. However, failure to repay the advanced funds could lead to collection efforts that might eventually affect your credit.

How To Get Paycheck Early

How To Get Paycheck Early Wallpapers

Collection of how to get paycheck early wallpapers for your desktop and mobile devices.

Vibrant How To Get Paycheck Early Photo Concept

Explore this high-quality how to get paycheck early image, perfect for enhancing your desktop or mobile wallpaper.

Vivid How To Get Paycheck Early Moment for Your Screen

Explore this high-quality how to get paycheck early image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful How To Get Paycheck Early Abstract Photography

Explore this high-quality how to get paycheck early image, perfect for enhancing your desktop or mobile wallpaper.

Artistic How To Get Paycheck Early Photo for Desktop

This gorgeous how to get paycheck early photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic How To Get Paycheck Early Scene in HD

A captivating how to get paycheck early scene that brings tranquility and beauty to any device.

Spectacular How To Get Paycheck Early Background Nature

Immerse yourself in the stunning details of this beautiful how to get paycheck early wallpaper, designed for a captivating visual experience.

Gorgeous How To Get Paycheck Early View Nature

A captivating how to get paycheck early scene that brings tranquility and beauty to any device.

Amazing How To Get Paycheck Early Landscape Collection

Experience the crisp clarity of this stunning how to get paycheck early image, available in high resolution for all your screens.

Artistic How To Get Paycheck Early Abstract Collection

Find inspiration with this unique how to get paycheck early illustration, crafted to provide a fresh look for your background.

Amazing How To Get Paycheck Early View for Mobile

Experience the crisp clarity of this stunning how to get paycheck early image, available in high resolution for all your screens.

Detailed How To Get Paycheck Early Image in 4K

Experience the crisp clarity of this stunning how to get paycheck early image, available in high resolution for all your screens.

Mesmerizing How To Get Paycheck Early Artwork Digital Art

Explore this high-quality how to get paycheck early image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get Paycheck Early Capture in HD

This gorgeous how to get paycheck early photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How To Get Paycheck Early Design Photography

Discover an amazing how to get paycheck early background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing How To Get Paycheck Early Abstract Art

Transform your screen with this vivid how to get paycheck early artwork, a true masterpiece of digital design.

Breathtaking How To Get Paycheck Early Landscape Concept

Discover an amazing how to get paycheck early background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning How To Get Paycheck Early View Art

Find inspiration with this unique how to get paycheck early illustration, crafted to provide a fresh look for your background.

Beautiful How To Get Paycheck Early Background Photography

Discover an amazing how to get paycheck early background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous How To Get Paycheck Early Wallpaper Illustration

This gorgeous how to get paycheck early photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed How To Get Paycheck Early Landscape Collection

Transform your screen with this vivid how to get paycheck early artwork, a true masterpiece of digital design.

Download these how to get paycheck early wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Paycheck Early"

Post a Comment