How To Get Payment Plan With Irs

How To Get Payment Plan With IRS: Your Guide to Stress-Free Tax Debt Management

Falling behind on your taxes can feel overwhelming, but don't panic. The IRS understands that life happens, and they offer structured payment options to help taxpayers manage their outstanding balances. If you're currently asking, "How To Get Payment Plan With IRS?" you've come to the right place. Getting started is easier than you might think, especially if you know exactly what options are available to you.

This comprehensive guide will walk you through the various IRS payment plans, detail the application process, and ensure you have the information needed to secure an agreement that works for your financial situation. Let's break down how you can take control of your tax debt today.

Why You Need a Payment Plan (And Why the IRS Offers Them)

The primary reason to secure a payment plan is simple: avoiding further penalties and collection actions. When you owe the IRS money, penalties and interest accrue daily. By entering into an agreement, you signal to the IRS that you are making a good-faith effort to resolve the debt.

The IRS offers these plans, known officially as Installment Agreements, because it's better for them to receive payments over time than to struggle to collect the full balance immediately. Establishing a payment plan prevents aggressive collection tactics, such as levies on wages or bank accounts.

The Immediate Benefits of Establishing an Installment Agreement

Once your agreement is accepted, the IRS typically reduces or stops the failure-to-pay penalty rate, although interest still applies. This can save you a significant amount of money over the life of the debt.

Furthermore, an approved payment plan gives you peace of mind. Instead of worrying about aggressive correspondence or collection threats, you can focus on making steady, manageable payments. This stability is invaluable when dealing with long-term financial obligations.

Remember, if you owe the IRS, taking the initiative to establish a repayment strategy is always the best move.

Types of IRS Payment Plans Available

The IRS offers several options depending on the amount you owe and how quickly you can pay it off. Understanding these options is key to successfully determining how to get payment plan with IRS that suits your needs.

Short-Term Payment Plan (Up to 180 Days)

If you can pay off your tax liability within 180 days, you should opt for a Short-Term Payment Plan. This option is beneficial because the IRS does not charge a setup fee for this arrangement.

However, keep in mind that interest and penalties still apply until the balance is paid in full. You can usually request this plan easily through the IRS website or by calling the IRS directly.

Streamlined Installment Agreement (SIA)

This is the most common option for most taxpayers who need a longer repayment period. The Streamlined Installment Agreement allows you up to 72 months (six years) to pay off your debt. The qualification requirements are clear and generally easy to meet for many individuals and small businesses.

To qualify for the SIA, you must meet specific debt thresholds:

- Individuals (and certain businesses): Must owe a combined total of $50,000 or less (tax, penalty, and interest).

- Businesses (other than sole proprietors): Must owe $25,000 or less in total.

The beauty of the SIA is that the application process is quick, and the IRS typically does not require you to submit detailed financial statements showing your ability to pay, streamlining the approval process significantly.

Offer in Compromise (OIC): An Alternative to Explore

While technically not a payment plan in the same way, an Offer in Compromise (OIC) is an arrangement where the IRS agrees to accept less than the full amount owed. This option is usually reserved for taxpayers who are experiencing extreme financial hardship and truly cannot pay the full debt.

If you believe you meet this criteria, you will need to complete Form 656, Offer in Compromise, and submit extensive financial documentation. The IRS will look closely at your income, expenses, and asset equity to determine your ability to pay.

Step-by-Step Guide on How To Get Payment Plan With IRS

Ready to move forward? The application process is straightforward, especially if you qualify for the Streamlined Installment Agreement. Follow these steps to successfully set up your repayment schedule.

Determine Your Eligibility and Compliance

Before applying for any long-term payment plan, you must ensure that you are "in compliance" with IRS rules. This means you must have filed all required tax returns.

If you have unfiled tax years, you must file those first, even if you can't pay the resulting balance. The IRS will reject your payment plan request if your filing requirements are not up to date. This is the critical first step in learning how to get payment plan with IRS approval.

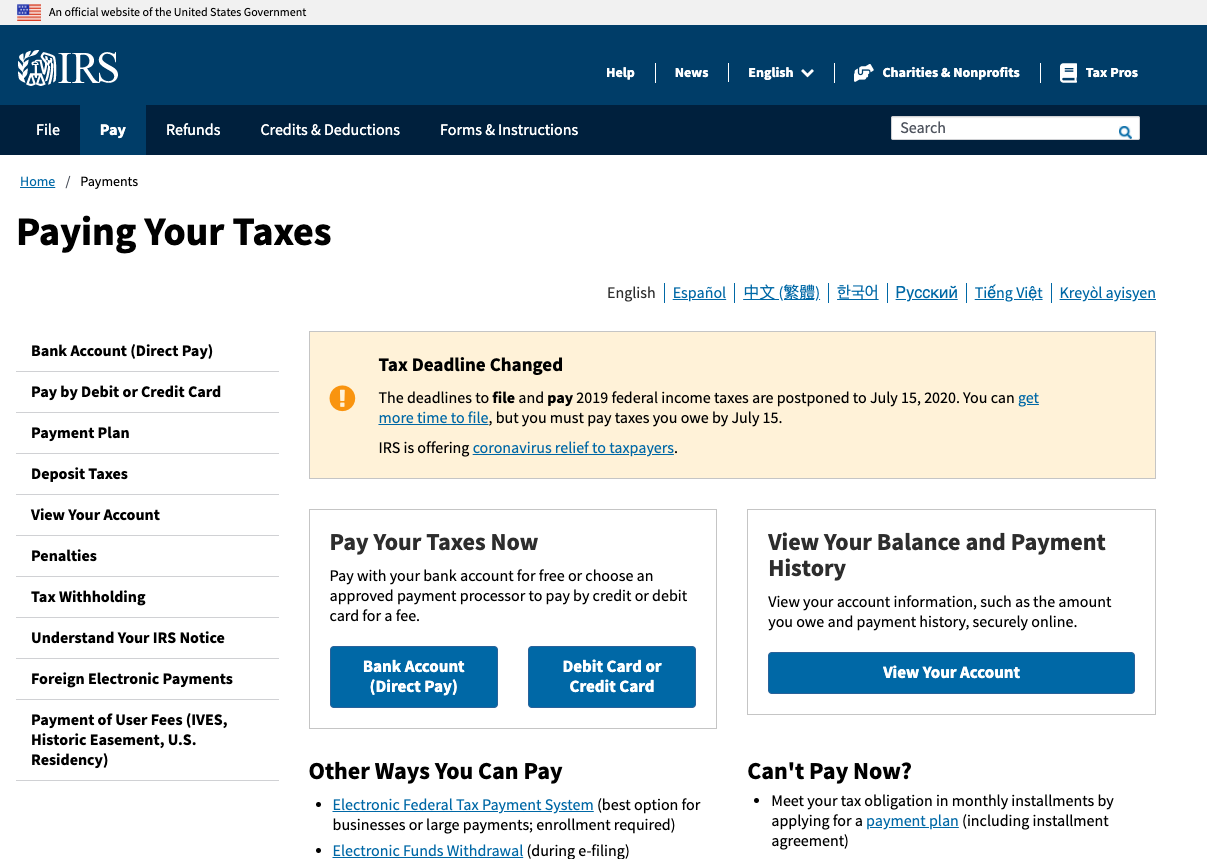

Choosing Your Application Method

Most taxpayers find applying online to be the fastest and easiest method. However, you have two main options:

- Online Payment Agreement (OPA) Tool: Recommended for individuals and businesses owing $50,000 or less, who can receive immediate approval.

- Form 9465 (Installment Agreement Request): Required if you owe more than $50,000 or if the OPA tool doesn't apply to your situation. This form is usually submitted with your tax return or mailed separately.

Applying Using the OPA Tool Online

If you qualify for the Streamlined Installment Agreement, the IRS Online Payment Agreement (OPA) tool is your best friend. This tool allows eligible taxpayers to set up a monthly payment plan entirely online, often resulting in instant confirmation.

You will need your name, address, Social Security Number (or TIN), and your current balance due. The OPA tool will calculate your proposed payment based on the maximum 72-month period. Once approved, you must keep up with your payments and future tax filing obligations.

The IRS User Fee

Keep in mind that the IRS charges a user fee for setting up a long-term Installment Agreement. This fee varies based on how you apply and your method of payment.

- Applying online (OPA) with automatic direct debit payments usually carries the lowest fee.

- Applying by mail (Form 9465) or without direct debit increases the user fee.

- If you qualify as a low-income taxpayer, you may be eligible for a reduced fee.

Important Things to Remember After Getting Approved

Getting approved for a payment plan is a huge win, but the work isn't over. To maintain your agreement and avoid default, you must strictly adhere to the terms set by the IRS. Defaulting on an installment agreement can lead to the IRS restarting collection efforts.

The two most critical responsibilities moving forward are:

- Make all monthly payments on time. If you anticipate missing a payment, call the IRS immediately to discuss your situation.

- Remain current on all future tax obligations. This means filing and paying any new taxes due on time, including estimated taxes. If you fail to file or pay future taxes, the IRS will default your current Installment Agreement.

If your financial situation improves, you can pay off the debt early without penalty. If your situation worsens, you may be able to contact the IRS to restructure the payment amount, though this is not guaranteed.

Conclusion

Understanding how to get payment plan with IRS is the first step toward achieving financial clarity and resolving your tax debt efficiently. Whether you qualify for a Short-Term Plan or the widely available Streamlined Installment Agreement, the key is proactive action.

By ensuring all your returns are filed and applying through the Online Payment Agreement tool if eligible, you can quickly establish a manageable repayment schedule. Don't let tax debt keep you up at night; utilize these IRS options to move forward confidently.

Frequently Asked Questions (FAQ)

- What happens if I miss a payment on my IRS payment plan?

- If you miss a payment, the IRS may send you a Notice of Intent to Terminate the Installment Agreement. You typically have 30 days to respond and make up the missed payment, or the agreement will default, and the IRS will resume full collection activities.

- Can I still apply for an Installment Agreement if I haven't filed all my tax returns?

- No. You must be in full compliance before the IRS will approve an Installment Agreement. You must file all outstanding tax returns before applying for a long-term payment plan.

- How long does it take for the IRS to approve the payment plan?

- If you apply online using the Online Payment Agreement (OPA) tool and qualify for the Streamlined Installment Agreement, approval is often instant. If you mail in Form 9465, approval can take several weeks as the IRS processes the request manually.

- Do I have to pay a setup fee for an IRS payment plan?

- For long-term Installment Agreements (over 180 days), yes, the IRS charges a user fee. This fee is lower if you agree to make payments via automatic direct debit from your bank account.

How To Get Payment Plan With Irs

How To Get Payment Plan With Irs Wallpapers

Collection of how to get payment plan with irs wallpapers for your desktop and mobile devices.

Vivid How To Get Payment Plan With Irs Abstract Digital Art

Explore this high-quality how to get payment plan with irs image, perfect for enhancing your desktop or mobile wallpaper.

Detailed How To Get Payment Plan With Irs Capture Photography

Discover an amazing how to get payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful How To Get Payment Plan With Irs Moment Digital Art

Discover an amazing how to get payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful How To Get Payment Plan With Irs Abstract for Mobile

Discover an amazing how to get payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing How To Get Payment Plan With Irs Scene in 4K

Explore this high-quality how to get payment plan with irs image, perfect for enhancing your desktop or mobile wallpaper.

Crisp How To Get Payment Plan With Irs Capture Nature

A captivating how to get payment plan with irs scene that brings tranquility and beauty to any device.

Breathtaking How To Get Payment Plan With Irs Picture Illustration

Experience the crisp clarity of this stunning how to get payment plan with irs image, available in high resolution for all your screens.

Vivid How To Get Payment Plan With Irs Photo for Desktop

Experience the crisp clarity of this stunning how to get payment plan with irs image, available in high resolution for all your screens.

Exquisite How To Get Payment Plan With Irs Image for Mobile

A captivating how to get payment plan with irs scene that brings tranquility and beauty to any device.

Captivating How To Get Payment Plan With Irs Scene Art

Immerse yourself in the stunning details of this beautiful how to get payment plan with irs wallpaper, designed for a captivating visual experience.

Beautiful How To Get Payment Plan With Irs Artwork for Your Screen

Discover an amazing how to get payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic How To Get Payment Plan With Irs Scene Collection

Find inspiration with this unique how to get payment plan with irs illustration, crafted to provide a fresh look for your background.

Stunning How To Get Payment Plan With Irs Abstract Photography

Find inspiration with this unique how to get payment plan with irs illustration, crafted to provide a fresh look for your background.

Detailed How To Get Payment Plan With Irs Abstract in HD

Explore this high-quality how to get payment plan with irs image, perfect for enhancing your desktop or mobile wallpaper.

Captivating How To Get Payment Plan With Irs Artwork for Desktop

Find inspiration with this unique how to get payment plan with irs illustration, crafted to provide a fresh look for your background.

Amazing How To Get Payment Plan With Irs Wallpaper in 4K

Experience the crisp clarity of this stunning how to get payment plan with irs image, available in high resolution for all your screens.

Detailed How To Get Payment Plan With Irs Design Digital Art

Experience the crisp clarity of this stunning how to get payment plan with irs image, available in high resolution for all your screens.

Mesmerizing How To Get Payment Plan With Irs Artwork Collection

Discover an amazing how to get payment plan with irs background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic How To Get Payment Plan With Irs Photo Nature

This gorgeous how to get payment plan with irs photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How To Get Payment Plan With Irs Image Nature

Transform your screen with this vivid how to get payment plan with irs artwork, a true masterpiece of digital design.

Download these how to get payment plan with irs wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Payment Plan With Irs"

Post a Comment