How To Get A Preparer Tax Identification Number

How To Get A Preparer Tax Identification Number: Your Essential Guide

If you're planning to prepare or assist in preparing federal tax returns for compensation, you've landed in the right place. Becoming a professional tax preparer is a rewarding path, but it comes with a mandatory first step: obtaining a Preparer Tax Identification Number, commonly known as a PTIN.

The PTIN is your unique identifier recognized by the Internal Revenue Service (IRS). Without it, you cannot legally sign and submit tax returns for payment. Getting your PTIN might seem like a daunting bureaucratic task, but we're here to walk you through exactly How To Get A Preparer Tax Identification Number in a simple, step-by-step manner.

Think of this guide as your friendly roadmap. We'll cover everything from why you need a PTIN to the exact steps for registration and renewal.

Why Do You Need a PTIN?

Simply put, the IRS requires it. If you are preparing or assisting in the preparation of all or substantially all of a tax return, and you are being paid for this service, the law mandates that you have a current PTIN. This requirement applies regardless of whether you are an enrolled agent, a CPA, an attorney, or an unenrolled preparer.

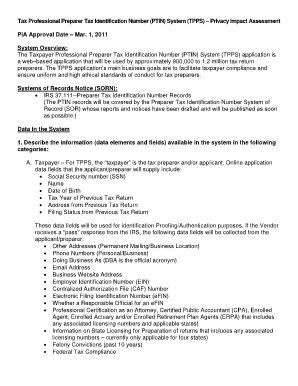

The PTIN serves several critical functions for the IRS. It allows the agency to track who prepares tax returns, promoting accountability and ensuring the highest standards of ethics and accuracy in the tax preparation industry. It also helps the IRS communicate important updates and changes directly to tax professionals.

If you prepare returns voluntarily and receive no compensation, you generally do not need a PTIN. However, if any money changes hands, even a small fee, you must register.

Step-by-Step Guide on How To Get A Preparer Tax Identification Number

The process of obtaining your PTIN is managed through the IRS's dedicated online system. While the steps are straightforward, you need to make sure you have all your ducks in a row before you start the application.

Eligibility and Requirements Check

Before you even click the 'Apply' button, confirm you meet the basic prerequisites. If you are wondering How To Get A Preparer Tax Identification Number quickly, having this information ready is key.

Here's what you absolutely need:

- A valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you are a foreign preparer who will not be preparing U.S. returns, special rules apply regarding SSNs.

- A valid mailing address and email address.

- Previous year's PTIN, if applicable (for renewals).

- Personal background information, including any criminal convictions or issues with tax compliance.

- Payment method for the application fee (which is subject to change annually).

Make sure all your identification documents are current and that you have access to a secure computer and stable internet connection.

Navigating the IRS PTIN System (Registration Process)

The IRS strongly encourages all applicants to use the online application system for speed and efficiency. The process takes about 15 minutes once you have all your information ready.

Follow these steps to successfully register your PTIN:

- Visit the IRS PTIN Website: Navigate to the official IRS website and locate the Tax Professional PTIN System.

- Create a New Account: If you are a first-time user, you must register for a secure account. This involves setting up a username, password, and security questions. You will receive an email to validate your email address.

- Start the Application: Once logged in, select the option to obtain a new PTIN. You will be asked a series of questions to confirm your identity and tax compliance status.

- Input Personal Information: Enter your name, address, SSN/ITIN, business affiliation, and previous tax compliance history. Be meticulous here—accuracy is crucial.

- Professional Designation Disclosure: If you are an Enrolled Agent (EA), CPA, or attorney, you will be required to provide your professional licensing information and jurisdiction.

- Review and Certify: Review all the information you have entered. You must electronically sign and certify that all statements made are true and correct under penalty of perjury.

- Pay the Fee: Pay the required, non-refundable user fee using a debit card, credit card, or electronic funds withdrawal (EFW).

- Receive Your PTIN: Upon successful completion and payment, your PTIN will be displayed on the screen instantly. You will also receive confirmation via email. Save this number immediately!

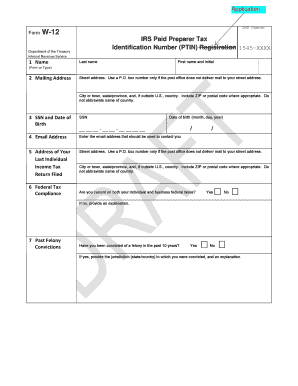

If you are unable to register online, you can submit Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal. However, this is significantly slower and may take 4-6 weeks to process.

Renewal and Maintenance: Keeping Your PTIN Active

Getting your PTIN is not a one-time event; it must be renewed annually. The renewal window typically opens in the late fall (October/November) for the following tax year. For example, if you want to prepare 2024 returns, you must renew your PTIN before December 31, 2023.

The renewal process is essentially a shortened version of the initial application. You will log into your existing IRS PTIN account, verify that all personal and professional data is current, certify your compliance status, and pay the annual renewal fee.

Failing to renew your PTIN means you cannot legally sign and submit paid tax returns for the new calendar year. Always mark your calendar for the renewal period!

Common Questions and Troubleshooting

We understand that navigating government websites can sometimes lead to confusion. Here are answers to some of the most frequently asked questions about How To Get A Preparer Tax Identification Number.

What if I Already Have an SSN/ITIN?

Your PTIN is entirely separate from your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). While you need an SSN or ITIN to apply for the PTIN, they serve different purposes.

Your SSN/ITIN identifies you as a taxpayer to the IRS, while your PTIN identifies you as a tax preparer. When you sign a return, you must use your PTIN, not your SSN. This distinction is crucial for protecting taxpayer privacy and adhering to IRS rules.

Fees and Processing Time

Understanding the costs involved is essential for budgeting your professional development.

- Application Fee: The IRS charges a non-refundable fee for obtaining or renewing a PTIN. This amount changes periodically, so always check the current rate on the official IRS site before applying.

- Third-Party Vendor Fee: In addition to the IRS fee, there is often a smaller, non-refundable fee charged by the third-party vendor that processes the registration and payment system.

- Processing Time (Online): If you apply online and pay successfully, your PTIN is issued immediately. This is the fastest way to proceed.

- Processing Time (Paper): If you mail in Form W-12, expect a significant delay, potentially 4 to 6 weeks.

Remember that the PTIN fee is usually tax-deductible as an ordinary and necessary business expense for tax professionals.

Conclusion: Mastering How To Get A Preparer Tax Identification Number

Obtaining your Preparer Tax Identification Number is an absolute necessity for anyone seeking compensation for federal tax preparation. By following the clear steps outlined above—checking eligibility, using the IRS online registration system, and paying the required fee—you can successfully secure your PTIN quickly and efficiently.

Once you know How To Get A Preparer Tax Identification Number, the path to building your professional practice becomes much smoother. Always keep your PTIN current through annual renewal and ensure you adhere to all ongoing continuing education requirements relevant to your designation. Happy preparing!

Frequently Asked Questions (FAQ)

- What is the main difference between an EIN and a PTIN?

- An EIN (Employer Identification Number) is used to identify a business entity for tax purposes. A PTIN (Preparer Tax Identification Number) is used to identify the specific individual who prepares tax returns for compensation. A single preparer may work for a business that uses an EIN, but they must always use their own PTIN when signing returns.

- Can I still use my old SSN instead of a PTIN on tax forms?

- No. As of 2011, paid tax preparers must use their assigned PTIN on all federal tax returns and forms. Using an SSN is prohibited and can lead to penalties.

- I am a foreign tax preparer who only prepares non-U.S. returns. Do I need a PTIN?

- If you prepare U.S. tax returns for compensation, even if you are outside the U.S., you need a PTIN. If you only prepare foreign returns for foreign citizens who have no U.S. tax obligation, then a PTIN is generally not required.

- What should I do if I forget my PTIN or login information?

- If you forget your PTIN, you can retrieve it by logging into your existing account on the IRS PTIN registration system. If you forget your login details, use the "Forgot Username" or "Forgot Password" links on the login page. You will need to answer the security questions you set up during the initial registration.

- Do I need to report Continuing Education (CE) hours when applying for a PTIN?

- If you are an Enrolled Agent, CPA, or Annual Filing Season Program (AFSP) participant, you must confirm that you have met your required CE hours. While the PTIN application itself doesn't require uploading proof, you are certifying compliance with the rules relevant to your professional designation.

How To Get A Preparer Tax Identification Number

How To Get A Preparer Tax Identification Number Wallpapers

Collection of how to get a preparer tax identification number wallpapers for your desktop and mobile devices.

Artistic How To Get A Preparer Tax Identification Number Design for Your Screen

Find inspiration with this unique how to get a preparer tax identification number illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get A Preparer Tax Identification Number Picture Digital Art

Explore this high-quality how to get a preparer tax identification number image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get A Preparer Tax Identification Number View for Your Screen

Explore this high-quality how to get a preparer tax identification number image, perfect for enhancing your desktop or mobile wallpaper.

Crisp How To Get A Preparer Tax Identification Number Moment in HD

Immerse yourself in the stunning details of this beautiful how to get a preparer tax identification number wallpaper, designed for a captivating visual experience.

Gorgeous How To Get A Preparer Tax Identification Number Abstract Digital Art

Find inspiration with this unique how to get a preparer tax identification number illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get A Preparer Tax Identification Number Image for Your Screen

Transform your screen with this vivid how to get a preparer tax identification number artwork, a true masterpiece of digital design.

High-Quality How To Get A Preparer Tax Identification Number Design Art

Experience the crisp clarity of this stunning how to get a preparer tax identification number image, available in high resolution for all your screens.

Amazing How To Get A Preparer Tax Identification Number Artwork Illustration

Discover an amazing how to get a preparer tax identification number background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning How To Get A Preparer Tax Identification Number Wallpaper for Mobile

Immerse yourself in the stunning details of this beautiful how to get a preparer tax identification number wallpaper, designed for a captivating visual experience.

Vivid How To Get A Preparer Tax Identification Number Wallpaper for Mobile

Explore this high-quality how to get a preparer tax identification number image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous How To Get A Preparer Tax Identification Number Image Digital Art

Immerse yourself in the stunning details of this beautiful how to get a preparer tax identification number wallpaper, designed for a captivating visual experience.

Captivating How To Get A Preparer Tax Identification Number Design Digital Art

A captivating how to get a preparer tax identification number scene that brings tranquility and beauty to any device.

Vivid How To Get A Preparer Tax Identification Number Wallpaper Art

Discover an amazing how to get a preparer tax identification number background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush How To Get A Preparer Tax Identification Number View in HD

This gorgeous how to get a preparer tax identification number photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed How To Get A Preparer Tax Identification Number Capture Art

Discover an amazing how to get a preparer tax identification number background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful How To Get A Preparer Tax Identification Number Artwork Art

Explore this high-quality how to get a preparer tax identification number image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic How To Get A Preparer Tax Identification Number Background Digital Art

A captivating how to get a preparer tax identification number scene that brings tranquility and beauty to any device.

Dynamic How To Get A Preparer Tax Identification Number Artwork Art

Immerse yourself in the stunning details of this beautiful how to get a preparer tax identification number wallpaper, designed for a captivating visual experience.

Detailed How To Get A Preparer Tax Identification Number Wallpaper Illustration

Experience the crisp clarity of this stunning how to get a preparer tax identification number image, available in high resolution for all your screens.

Gorgeous How To Get A Preparer Tax Identification Number Wallpaper Concept

This gorgeous how to get a preparer tax identification number photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these how to get a preparer tax identification number wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get A Preparer Tax Identification Number"

Post a Comment