How To Get A Secured Credit Card

How To Get A Secured Credit Card: Your Ultimate Guide to Rebuilding Credit

If you've struggled with credit in the past, or maybe you are just starting your financial journey, you've probably heard the term "secured credit card." This tool can be an absolute game-changer for improving your credit score, but knowing exactly How To Get A Secured Credit Card can feel confusing.

Don't worry, you are in the right place! We'll walk you through the entire process, from understanding what these cards are to using them effectively to catapult your credit score back into the excellent range. Getting started is easier than you think, especially when you follow a clear plan.

What Exactly Is a Secured Credit Card?

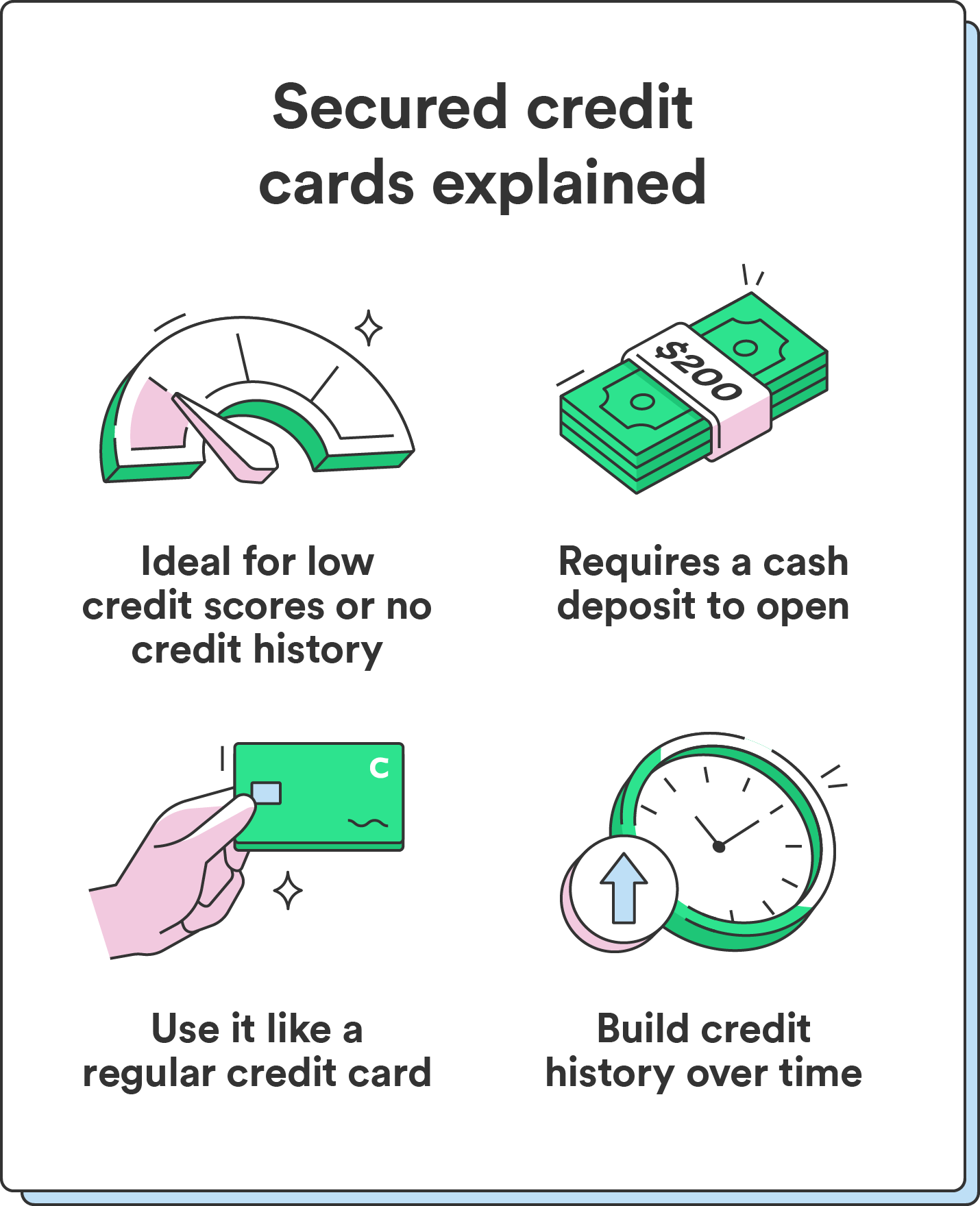

Simply put, a secured credit card is backed by a cash deposit you pay to the issuer. Unlike traditional, unsecured credit cards (which require the bank to take a risk on your ability to pay), the secured card uses your money as collateral. This makes them much safer for the lender.

The security deposit usually equals your credit limit. For example, if you deposit $300, your spending limit will be $300. This deposit is held by the bank and is typically only refundable once you close the account or graduate to an unsecured card.

Who Needs a Secured Credit Card?

While secured cards look and function just like normal credit cards, they are specifically designed for two main groups of people:

- **Credit Builders:** Those who have never had credit before (like students or recent immigrants) and need to establish a payment history.

- **Credit Rebuilders:** Individuals who have damaged their credit score due to bankruptcies, defaults, or late payments, and cannot qualify for traditional unsecured products.

If you fall into either of these categories, learning How To Get A Secured Credit Card is your fastest route back to financial flexibility. The key benefit is that your responsible use of the card is reported to the major credit bureaus, helping you build a positive history over time.

Step-by-Step: How To Get A Secured Credit Card

Getting a secured credit card is a straightforward process, but it requires some initial preparation. Following these steps ensures you choose the best card for your needs and maximize your chances of approval.

Step 1: Check Your Credit Report

Before applying for any credit product, it's always smart to know where you stand. Access your free annual credit report from the major bureaus (Experian, Equifax, TransUnion). Although secured cards are generally easier to obtain, verifying your report allows you to spot and dispute any errors that might affect your application.

Reviewing your report also gives you a realistic view of the current state of your credit. If you have significant outstanding debts, you should address those before taking on new responsibilities.

Step 2: Save Up for Your Security Deposit

Remember, the deposit is mandatory for a secured card. You must have this cash readily available when you apply and are approved. The size of the deposit determines your spending limit, so think about what spending limit you realistically need.

Understanding the Deposit Amount

Most issuers require a minimum deposit, often between $200 and $500. While you can opt for a larger deposit, try to stick to an amount you are comfortable locking up for 6 to 18 months. Since your goal is simply to build credit history, you do not need an extremely high limit right away.

A smaller deposit helps you practice managing a tight budget and ensures you aren't overspending, which is crucial for maximizing credit gains.

Step 3: Research and Compare Card Options

Not all secured cards are created equal. You need to shop around and compare features, fees, and requirements. Look at offerings from major national banks, credit unions, and online providers. Their terms can vary significantly.

Key Features to Compare

When you are trying to figure out How To Get A Secured Credit Card that works for you, focus on these critical factors:

- **Annual Fee:** Some secured cards charge an annual fee, which eats into your potential savings. Look for cards with low or zero annual fees.

- **Reporting Frequency:** Ensure the issuer reports to all three major credit bureaus (Experian, Equifax, and TransUnion). This is non-negotiable for credit building.

- **"Graduation" Policy:** Does the card offer a path to convert to an unsecured card after consistent, timely payments? A graduation policy means you eventually get your deposit back while keeping the credit line.

- **Interest Rate (APR):** While you should aim to pay your balance in full every month, a lower APR is better in case of emergencies where you carry a balance.

Step 4: Apply for the Card

Once you've chosen your card, the application process is similar to that of an unsecured card. You will need to provide personal information, including your Social Security Number, income details, and address. Applications are usually completed online and take only a few minutes.

Be prepared for a soft pull or a hard pull on your credit report. Because these cards are designed for those with lower scores, the approval criteria are often much more lenient than for traditional cards.

Step 5: Fund Your Deposit

Upon approval, the issuer will ask you to transfer the security deposit. This usually must be done within a specific timeframe (e.g., 7 to 14 days). Once the deposit clears, your secured card will be mailed to you, and your credit limit will be active.

Using Your Secured Card Wisely for Maximum Credit Boost

Getting the card is only half the battle; using it correctly is how you truly maximize your credit score improvement. Responsible usage translates directly into positive reporting on your credit file.

Here are the key best practices:

- **Pay on Time, Every Time:** Payment history is the single largest factor (35%) in your FICO score. Never miss a due date. Set up automatic payments if necessary.

- **Keep Utilization Low:** Credit utilization (the amount you owe vs. your total credit limit) should ideally be under 30%. For best results, aim for 10% or less. If your limit is $300, only charge $30 or less each month.

- **Use it Regularly, But Lightly:** Don't let the card sit idle. Use it for small, predictable monthly expenses, like a streaming subscription or gas. This shows active, responsible use.

- **Pay Off the Balance in Full:** Always pay the entire statement balance by the due date. This avoids high-interest charges and demonstrates excellent financial management to the credit bureaus.

By consistently following these steps for 6 to 12 months, you will demonstrate to issuers that you are a reliable borrower. This performance will eventually allow you to qualify for unsecured cards with higher limits and better rewards.

Conclusion

If you were wondering How To Get A Secured Credit Card, you now have a comprehensive roadmap. Secured credit cards are powerful financial tools, specifically designed to help consumers establish or repair their credit profiles without significant risk to the lender.

Start by assessing your current situation, saving up for a modest security deposit, and comparing card options carefully, focusing on low fees and strong reporting policies. By using your secured card consistently and paying off the balance every month, you are setting yourself up for long-term financial success and the eventual transition to the world of unsecured credit.

Frequently Asked Questions (FAQ)

- Can I lose my security deposit?

- Yes, but only if you fail to pay your bills. The deposit acts as collateral. If you default on your payments, the issuer will use your deposit to cover the debt you owe. If you pay your bill diligently, the deposit remains yours and is refundable upon closing the account or graduating.

- How long does it take for a secured card to improve my credit score?

- You typically start seeing noticeable credit improvement within six months of opening the card, provided you maintain timely payments and low credit utilization. Many issuers review your account for "graduation" to an unsecured card after 6 to 12 months.

- Is a secured credit card better than a prepaid debit card?

- Absolutely. Prepaid debit cards do not report activity to credit bureaus, meaning they do nothing to help build your credit history. Secured credit cards function exactly like regular credit cards and are specifically designed to report positive activity to credit bureaus.

- What happens when I graduate to an unsecured card?

- When you "graduate," the issuer converts your account to a standard, unsecured credit card, often with a higher limit, and returns your original security deposit. Your account history remains intact, ensuring continuous credit reporting.

How To Get A Secured Credit Card

How To Get A Secured Credit Card Wallpapers

Collection of how to get a secured credit card wallpapers for your desktop and mobile devices.

Serene How To Get A Secured Credit Card Landscape Nature

Transform your screen with this vivid how to get a secured credit card artwork, a true masterpiece of digital design.

Mesmerizing How To Get A Secured Credit Card Scene Concept

Discover an amazing how to get a secured credit card background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How To Get A Secured Credit Card Photo in HD

A captivating how to get a secured credit card scene that brings tranquility and beauty to any device.

Breathtaking How To Get A Secured Credit Card Photo for Mobile

Experience the crisp clarity of this stunning how to get a secured credit card image, available in high resolution for all your screens.

Gorgeous How To Get A Secured Credit Card Scene in 4K

Find inspiration with this unique how to get a secured credit card illustration, crafted to provide a fresh look for your background.

Dynamic How To Get A Secured Credit Card Abstract Nature

A captivating how to get a secured credit card scene that brings tranquility and beauty to any device.

Mesmerizing How To Get A Secured Credit Card Capture for Desktop

Experience the crisp clarity of this stunning how to get a secured credit card image, available in high resolution for all your screens.

Crisp How To Get A Secured Credit Card Design for Mobile

Find inspiration with this unique how to get a secured credit card illustration, crafted to provide a fresh look for your background.

Spectacular How To Get A Secured Credit Card Image Nature

This gorgeous how to get a secured credit card photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How To Get A Secured Credit Card Artwork Art

Transform your screen with this vivid how to get a secured credit card artwork, a true masterpiece of digital design.

Amazing How To Get A Secured Credit Card Image Nature

Transform your screen with this vivid how to get a secured credit card artwork, a true masterpiece of digital design.

Mesmerizing How To Get A Secured Credit Card Picture for Mobile

Explore this high-quality how to get a secured credit card image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing How To Get A Secured Credit Card Picture Nature

Transform your screen with this vivid how to get a secured credit card artwork, a true masterpiece of digital design.

Vibrant How To Get A Secured Credit Card Background Nature

Discover an amazing how to get a secured credit card background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush How To Get A Secured Credit Card Moment in 4K

A captivating how to get a secured credit card scene that brings tranquility and beauty to any device.

Captivating How To Get A Secured Credit Card Photo Illustration

This gorgeous how to get a secured credit card photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic How To Get A Secured Credit Card Photo Photography

Find inspiration with this unique how to get a secured credit card illustration, crafted to provide a fresh look for your background.

Beautiful How To Get A Secured Credit Card Artwork in HD

Explore this high-quality how to get a secured credit card image, perfect for enhancing your desktop or mobile wallpaper.

.jpg)

Vivid How To Get A Secured Credit Card Scene in 4K

Explore this high-quality how to get a secured credit card image, perfect for enhancing your desktop or mobile wallpaper.

Vivid How To Get A Secured Credit Card Background Digital Art

Transform your screen with this vivid how to get a secured credit card artwork, a true masterpiece of digital design.

Download these how to get a secured credit card wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get A Secured Credit Card"

Post a Comment