Should I Get Roth Ira Or Traditional

Should I Get Roth IRA Or Traditional? Making the Right Retirement Choice

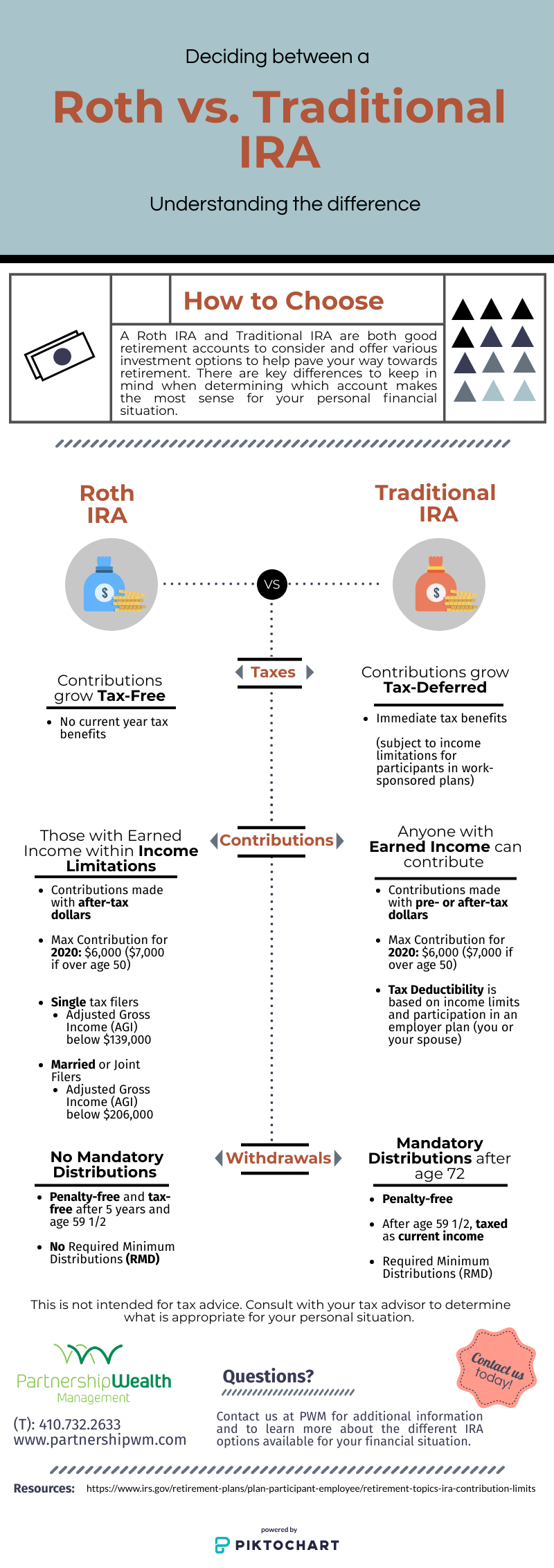

Deciding where to stash your retirement savings can feel like navigating a maze, especially when faced with the dreaded question: Should I get Roth IRA or Traditional? You are definitely not alone. This choice is one of the biggest financial decisions you will make, and it primarily boils down to one critical factor: taxes.

Both the Roth IRA and the Traditional IRA are excellent investment vehicles designed to help you save for the future, but they offer dramatically different tax advantages. Understanding these differences is key to maximizing your retirement income. Let's break down which option is likely the winner for you, based on where you are in your career and what you predict for your future earnings.

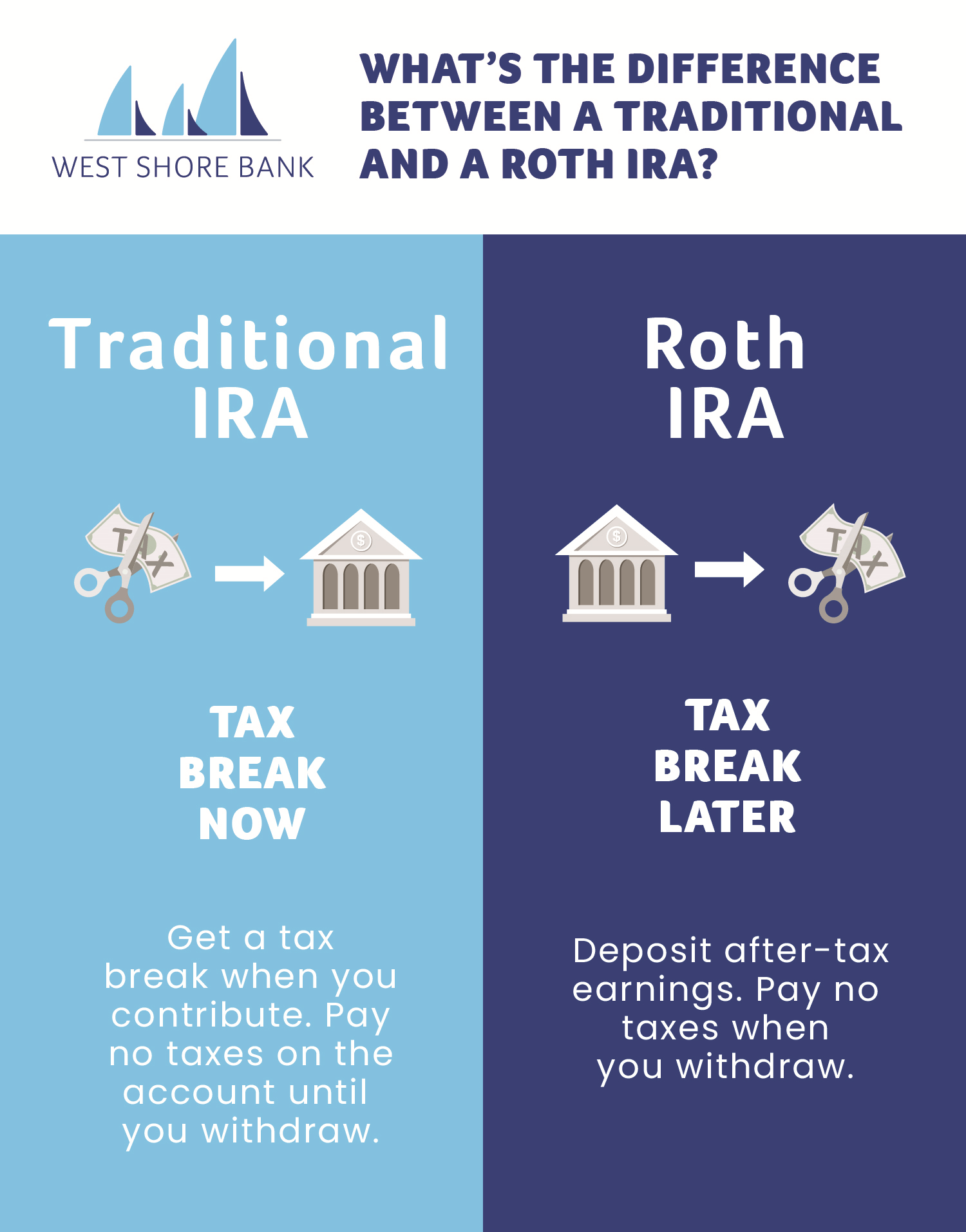

Understanding the Core Difference: Tax Timing

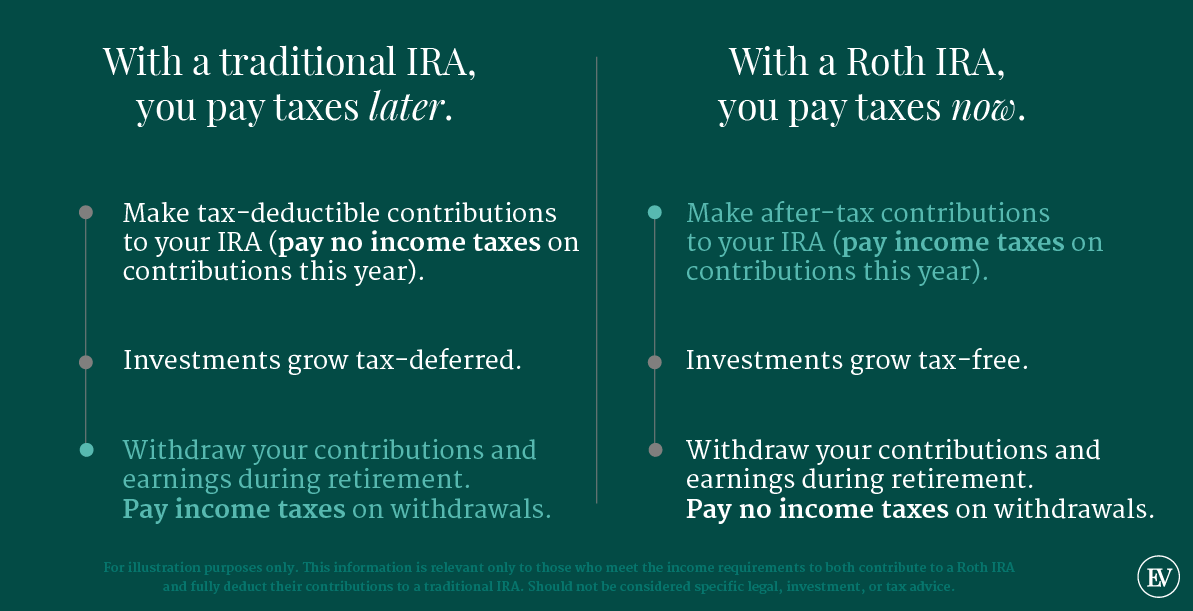

The single most important concept differentiating the Roth and the Traditional IRA is when you pay income tax on the money. This decision dictates whether you enjoy a tax break today or a tax break tomorrow.

When you ask yourself, "Should I get Roth IRA or Traditional?" you are really asking: "Do I want to pay taxes now or later?"

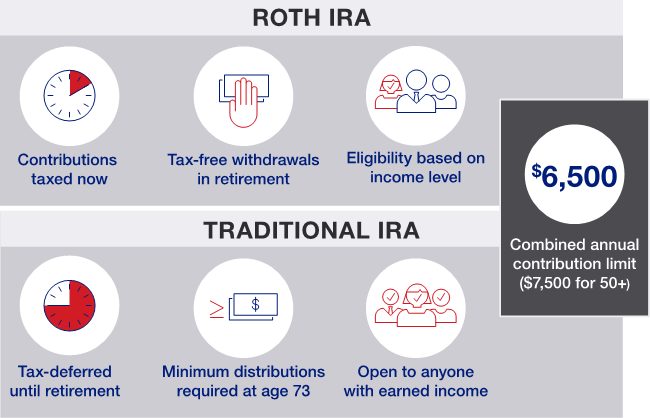

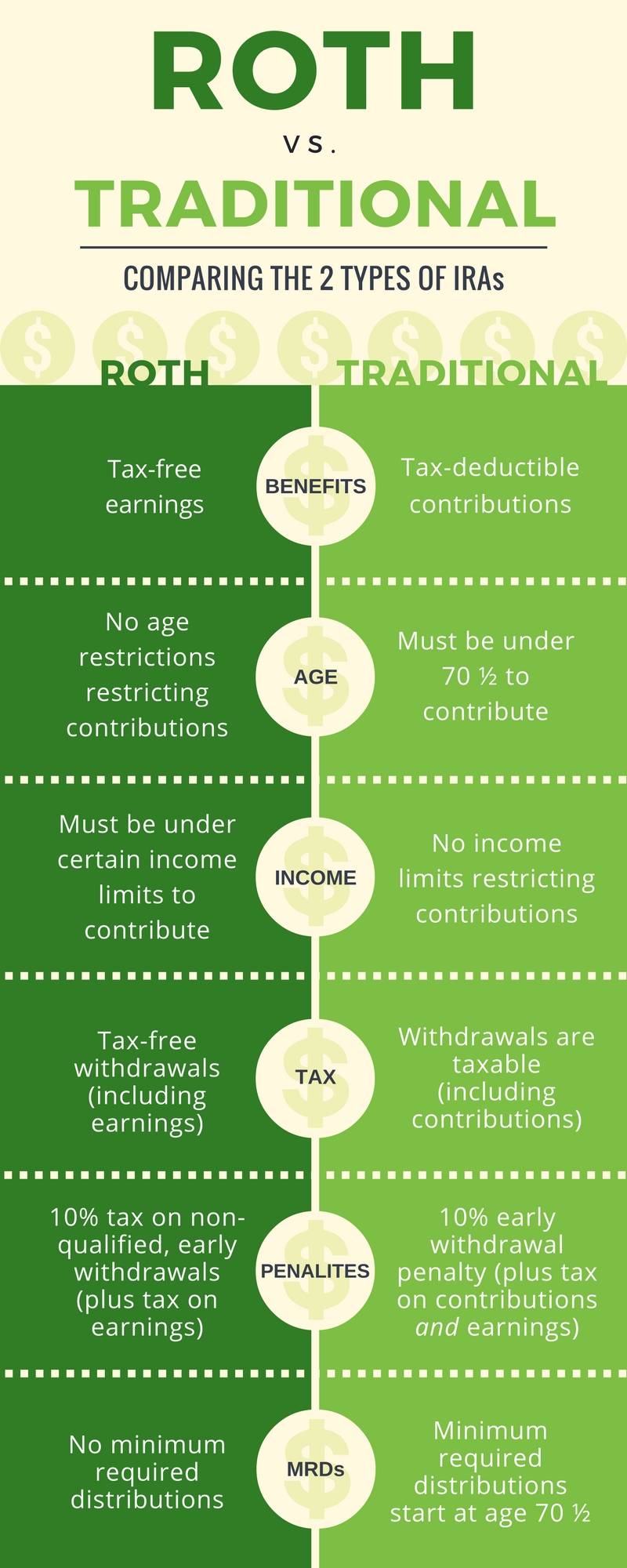

The Traditional IRA: Tax Deduction Now

The Traditional IRA is the classic choice for those looking for immediate gratification in the form of tax savings. Contributions to a Traditional IRA are often tax-deductible in the year you make them. This means the money you put in reduces your taxable income right now.

However, the tax bill is only postponed. When you retire and start taking distributions (withdrawals) from your Traditional IRA, that money is taxed as ordinary income. The government essentially says, "Thanks for saving, but now that you are using the money, we get our cut."

Key Perks of the Traditional IRA

- **Immediate Tax Savings:** Lower your current taxable income today, potentially bumping you down to a lower tax bracket now.

- **Anyone Can Contribute:** There are no income limits restricting who can contribute, though the deductibility of contributions might phase out based on income and workplace retirement plans.

The Roth IRA: Tax-Free Later

The Roth IRA operates in reverse. You contribute money that has already been taxed (after-tax dollars). This means you don't get an immediate deduction on your current tax return.

The amazing benefit, however, is that all growth, interest, and withdrawals in retirement are completely tax-free, provided you follow the rules (like being over age 59½ and having the account for at least five years). This is incredibly powerful if you expect your investments to grow substantially over decades.

Why the Tax-Free Growth is Huge

Imagine contributing $6,000 annually for 30 years, and that money grows to $500,000. With a Roth, that entire half-million dollars is yours, free and clear, without Uncle Sam asking for a percentage later. That guaranteed tax-free income stream in retirement offers incredible peace of mind.

Your Current Income vs. Future Income: The Deciding Factor

The core decision of "Should I get Roth IRA or Traditional?" comes down to predicting the future—specifically, where your tax bracket will be when you retire versus where it is today. You want to pay the taxes when your marginal tax rate is lowest.

Why Your Current Tax Bracket Matters

If you are in a relatively low tax bracket today (e.g., 12% or 22%), but expect to be wealthier in retirement due to investments, pensions, or social security, then paying the tax now at the lower rate is smart. Conversely, if you are currently in a very high tax bracket (e.g., 35%) and anticipate a lower income in retirement, taking the tax deduction now makes more sense.

When Traditional Wins: Betting on a Lower Retirement Rate

The Traditional IRA is usually the better choice for high earners currently in their peak earning years. By contributing to a Traditional IRA, they reduce their current high tax bill. When they retire, they expect their income to drop significantly, meaning they will pay taxes on those distributions at a lower marginal rate.

This also applies to people who anticipate living primarily off tax-free Social Security and Roth funds in retirement, thereby keeping their taxable income low.

When Roth Shines: Betting on a Higher Retirement Rate

If you are young, just starting your career, and in a low tax bracket, the Roth is generally the optimal choice. Your income today is likely lower than it will be in the future, so paying a small amount of tax now guarantees decades of tax-free growth.

Furthermore, the Roth is excellent for people who worry that tax rates will be higher generally in the future (a common concern given current government debt levels). By using a Roth, you lock in today's tax rate, avoiding future uncertainties.

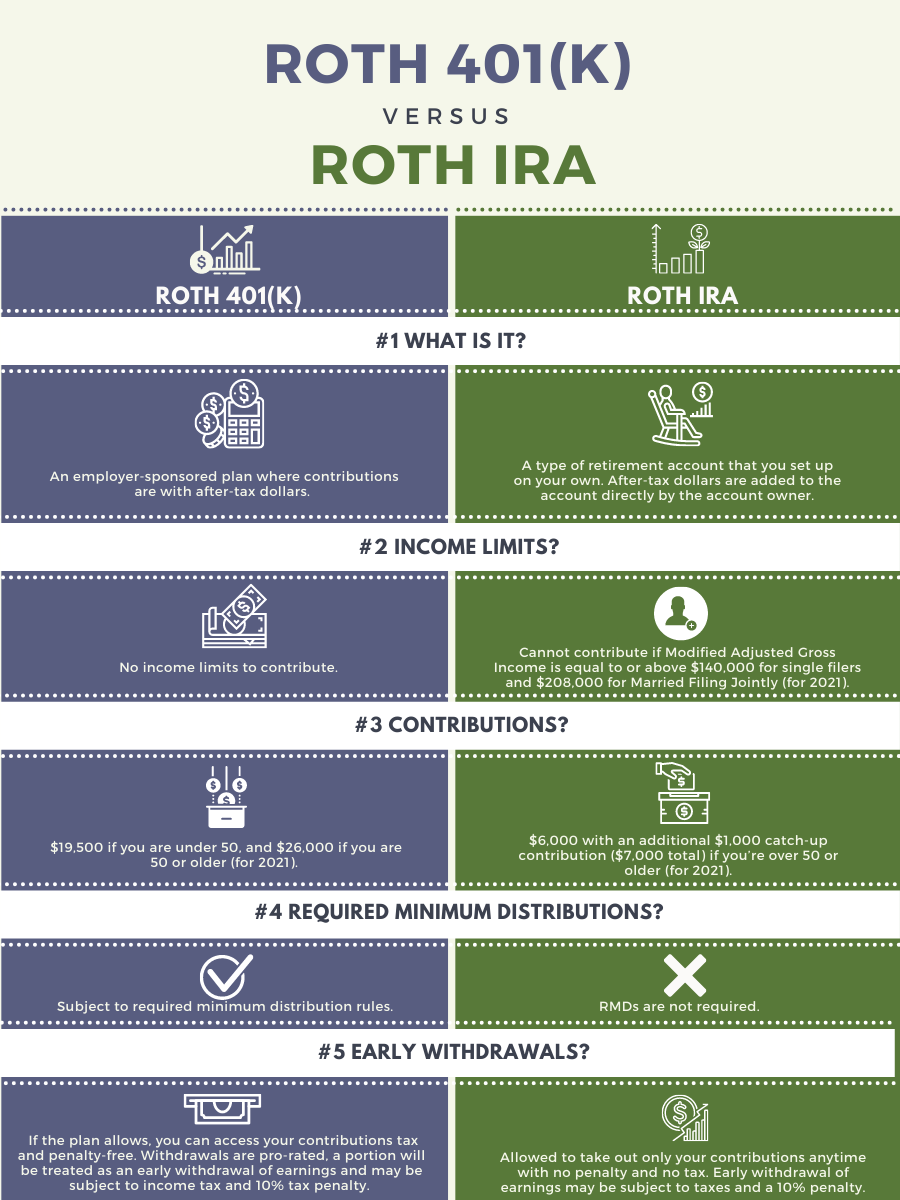

Contribution Rules and Eligibility Checks

While the tax comparison is key, you must also consider whether you are even eligible to contribute to both accounts, especially the Roth.

Income Limits: The Roth Hurdle

Unlike the Traditional IRA, the Roth IRA has strict Modified Adjusted Gross Income (MAGI) limits. If you earn too much, you may be prohibited from contributing to a Roth, or your contribution may be limited (phased out). These limits change annually and depend on your filing status (Single, Married Filing Jointly, etc.).

If you are a very high earner, the Traditional IRA may be your only direct IRA option, although the "Backdoor Roth" contribution strategy can sometimes be employed.

Contribution Caps

The annual contribution limits are generally the same for both accounts (e.g., $7,000 for 2024, plus an additional catch-up contribution for those aged 50 and over). However, you cannot contribute the full amount to both; the total contribution to all your IRAs (Roth and Traditional combined) is capped.

Furthermore, you must have earned income to contribute to either account.

Flexibility and Withdrawals: Beyond Retirement

A final consideration when figuring out "Should I get Roth IRA or Traditional?" is flexibility, especially in terms of early withdrawals and requirements later in life.

RMDs (Required Minimum Distributions) and Roth's Advantage

Traditional IRAs require you to start taking Required Minimum Distributions (RMDs) once you reach a certain age (currently 73). If you don't take these, you face a hefty penalty. This is the government finally collecting the taxes you deferred.

Crucially, the original owner of a Roth IRA is exempt from RMDs during their lifetime. This offers incredible flexibility for estate planning and allows your money to continue growing tax-free for longer.

Early Withdrawals: Access to Contributions

One major benefit of the Roth IRA is the ability to withdraw your original contributions (not the earnings) tax-free and penalty-free at any time, for any reason. Since those funds were already taxed, the IRS doesn't care if you need them in an emergency.

With a Traditional IRA, almost any withdrawal before age 59½ is subject to income tax and usually a 10% early withdrawal penalty, making it a much less flexible emergency fund source.

- **Roth:** Contributions can be withdrawn anytime, penalty-free.

- **Traditional:** Withdrawals are usually taxed and penalized unless an exception applies (e.g., first-time home purchase, unreimbursed medical expenses).

Conclusion: The Ultimate Tiebreaker

So, after diving deep into the details, how do you finally settle the question: Should I get Roth IRA or Traditional?

The general advice is this: If you believe your income (and therefore your tax bracket) is higher today than it will be in retirement, choose the **Traditional IRA** for the immediate tax deduction. If you believe your income and tax bracket will be higher in retirement than they are today, choose the **Roth IRA** to enjoy massive tax-free withdrawals later.

For most young professionals who expect their salaries to increase over time, the Roth IRA is often the more advantageous option. For established high earners focused on lowering their current tax burden, the Traditional IRA provides immediate relief. Furthermore, remember that you can (and often should) contribute to both if you have the resources, diversifying your tax exposure in retirement—it doesn't have to be an all-or-nothing decision.

Frequently Asked Questions (FAQ)

- Can I contribute to both a Roth IRA and a Traditional IRA?

- Yes, you can contribute to both accounts, but your total combined annual contributions cannot exceed the IRS limit for that tax year (plus any catch-up contribution if applicable).

- What happens if I over-contribute to my IRA?

- If you contribute more than the allowable limit, you may face a 6% excise tax penalty on the excess contribution for every year the excess remains in the account. It is crucial to monitor your contributions closely.

- Which IRA is better if I am close to retirement?

- If you are close to retirement and already in a high tax bracket, the Traditional IRA offers immediate tax savings which might be very valuable. If you believe tax rates are likely to increase drastically right before you retire, a Roth conversion might be worth exploring, but this is complicated and usually requires professional tax advice.

- Do Roth IRAs have required minimum distributions (RMDs)?

- No, the original owner of a Roth IRA is not subject to RMDs. This unique feature allows the funds to continue compounding tax-free throughout the owner's life.

Should I Get Roth Ira Or Traditional

Should I Get Roth Ira Or Traditional Wallpapers

Collection of should i get roth ira or traditional wallpapers for your desktop and mobile devices.

Vibrant Should I Get Roth Ira Or Traditional View Collection

Discover an amazing should i get roth ira or traditional background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush Should I Get Roth Ira Or Traditional Moment Collection

A captivating should i get roth ira or traditional scene that brings tranquility and beauty to any device.

Lush Should I Get Roth Ira Or Traditional Capture Illustration

A captivating should i get roth ira or traditional scene that brings tranquility and beauty to any device.

Artistic Should I Get Roth Ira Or Traditional Design Photography

Immerse yourself in the stunning details of this beautiful should i get roth ira or traditional wallpaper, designed for a captivating visual experience.

Dynamic Should I Get Roth Ira Or Traditional Capture in HD

A captivating should i get roth ira or traditional scene that brings tranquility and beauty to any device.

Captivating Should I Get Roth Ira Or Traditional Image Nature

Immerse yourself in the stunning details of this beautiful should i get roth ira or traditional wallpaper, designed for a captivating visual experience.

/medriva/media/post_banners/content/uploads/2023/12/roth-vs-traditional-iras-comparison-20231216040347.jpg)

Stunning Should I Get Roth Ira Or Traditional Artwork in HD

A captivating should i get roth ira or traditional scene that brings tranquility and beauty to any device.

Vivid Should I Get Roth Ira Or Traditional View Collection

Transform your screen with this vivid should i get roth ira or traditional artwork, a true masterpiece of digital design.

Spectacular Should I Get Roth Ira Or Traditional Design Nature

This gorgeous should i get roth ira or traditional photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Should I Get Roth Ira Or Traditional Scene Digital Art

Transform your screen with this vivid should i get roth ira or traditional artwork, a true masterpiece of digital design.

Serene Should I Get Roth Ira Or Traditional Design Nature

Explore this high-quality should i get roth ira or traditional image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Should I Get Roth Ira Or Traditional Moment for Mobile

A captivating should i get roth ira or traditional scene that brings tranquility and beauty to any device.

Detailed Should I Get Roth Ira Or Traditional Image for Your Screen

Experience the crisp clarity of this stunning should i get roth ira or traditional image, available in high resolution for all your screens.

Crisp Should I Get Roth Ira Or Traditional View for Mobile

Immerse yourself in the stunning details of this beautiful should i get roth ira or traditional wallpaper, designed for a captivating visual experience.

Spectacular Should I Get Roth Ira Or Traditional Moment for Desktop

This gorgeous should i get roth ira or traditional photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Should I Get Roth Ira Or Traditional View Art

Immerse yourself in the stunning details of this beautiful should i get roth ira or traditional wallpaper, designed for a captivating visual experience.

Gorgeous Should I Get Roth Ira Or Traditional Landscape Collection

Find inspiration with this unique should i get roth ira or traditional illustration, crafted to provide a fresh look for your background.

Detailed Should I Get Roth Ira Or Traditional Abstract in 4K

Transform your screen with this vivid should i get roth ira or traditional artwork, a true masterpiece of digital design.

Crisp Should I Get Roth Ira Or Traditional Scene Concept

Find inspiration with this unique should i get roth ira or traditional illustration, crafted to provide a fresh look for your background.

Captivating Should I Get Roth Ira Or Traditional Scene Nature

A captivating should i get roth ira or traditional scene that brings tranquility and beauty to any device.

Download these should i get roth ira or traditional wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Should I Get Roth Ira Or Traditional"

Post a Comment