Where Do I Get My 1099 Sa

Where Do I Get My 1099 Sa: Your Essential Guide to HSA Tax Forms

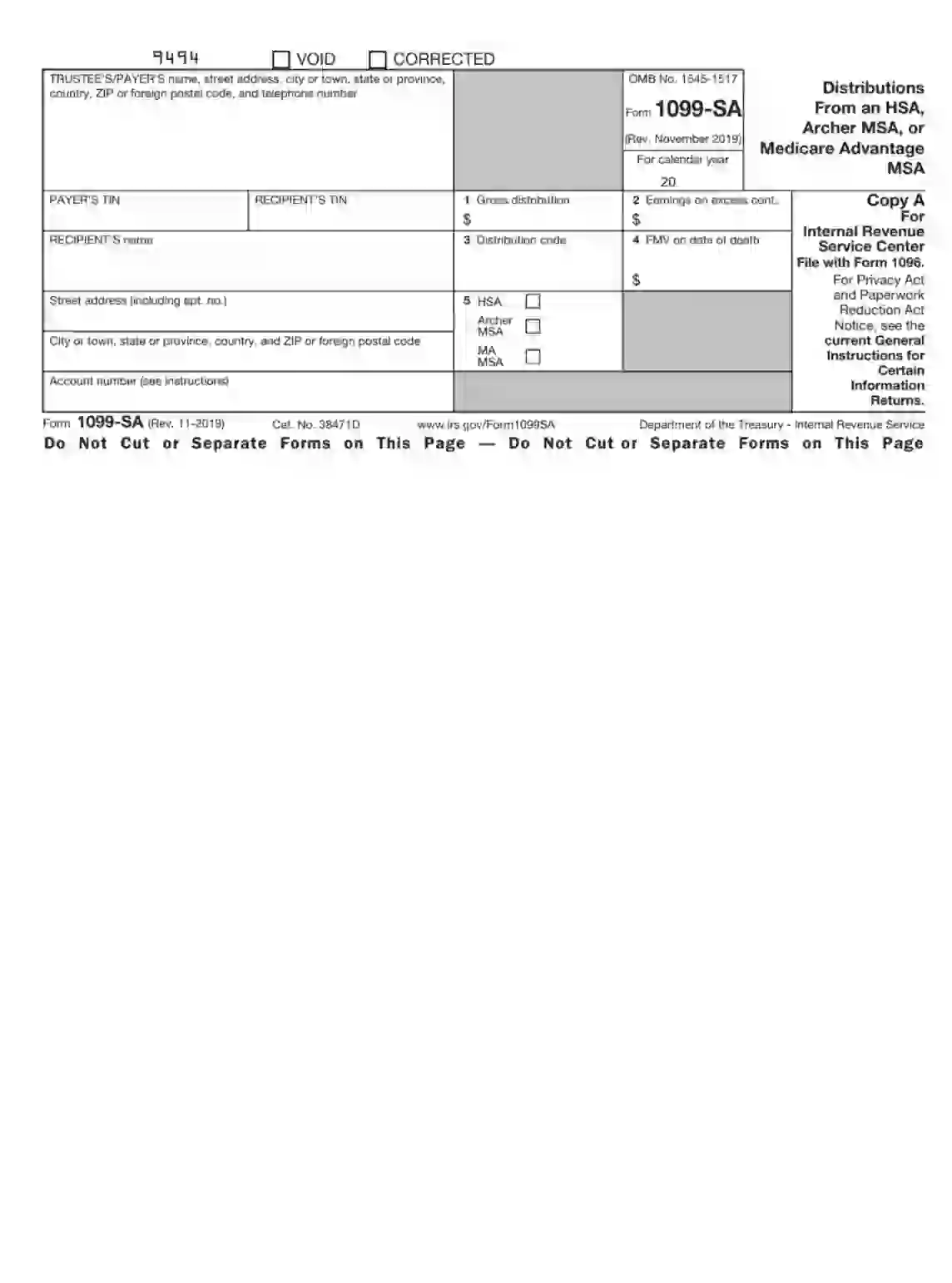

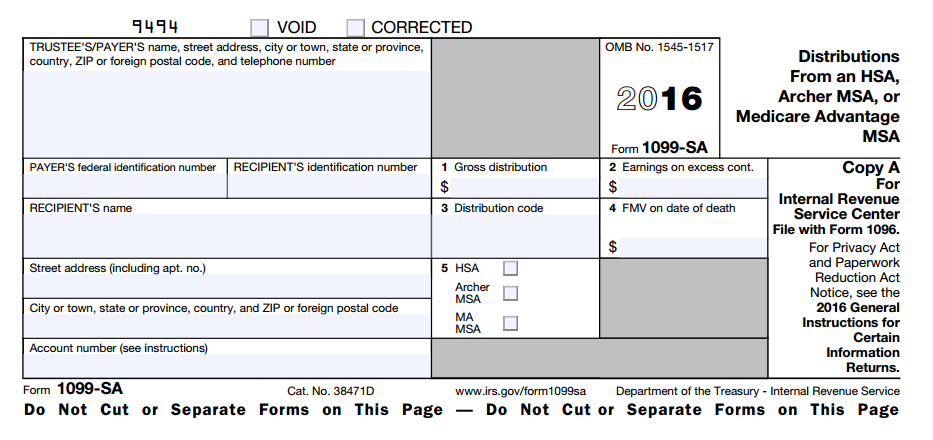

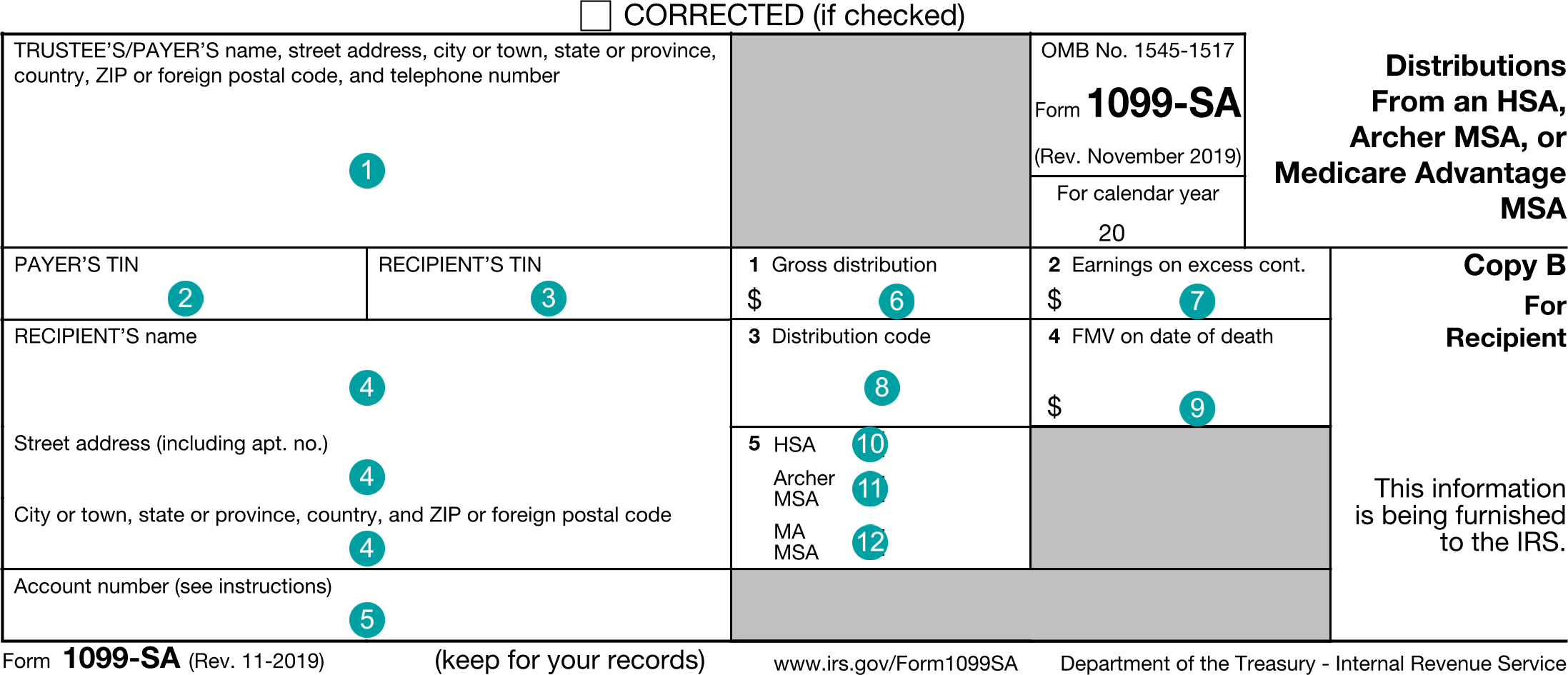

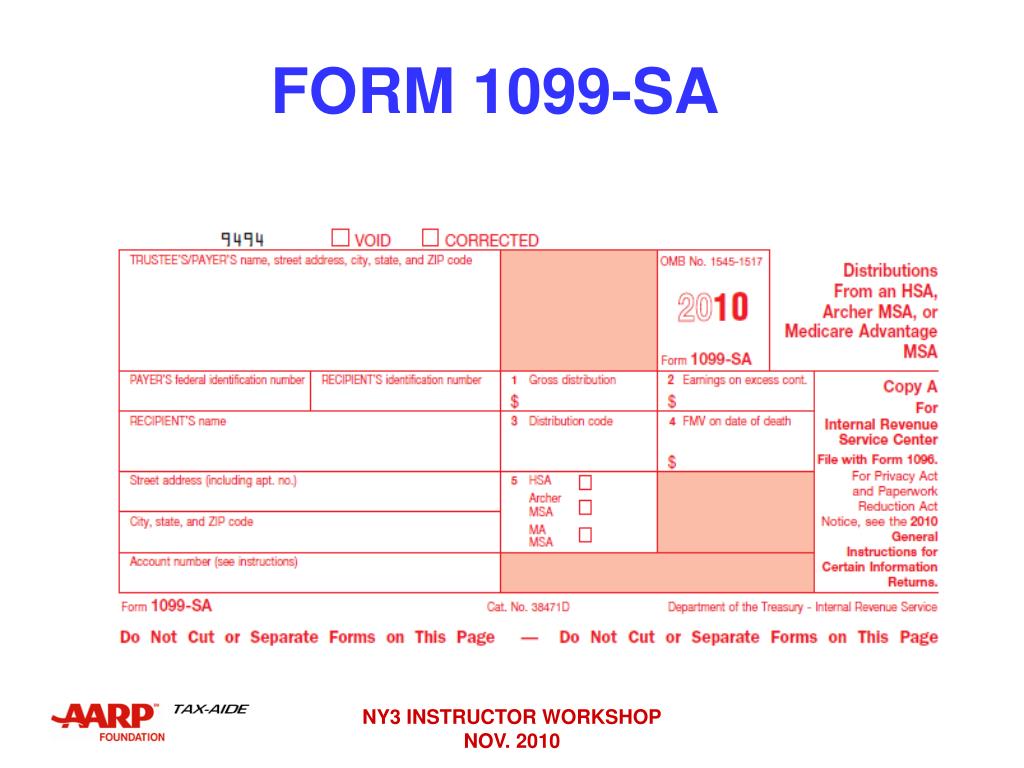

Tax season often brings a flurry of official-looking envelopes, and if you utilize a Health Savings Account (HSA) or Archer Medical Savings Account (MSA), one crucial document you'll need is Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. If you've been asking yourself, "Where Do I Get My 1099 Sa?" you are definitely not alone.

This form is vital because it reports any distributions—meaning money you took out—from your account during the past year. Even if you used that money for qualified medical expenses, the IRS still needs to know about the distribution. Don't worry, finding this document is usually straightforward once you know where to look. Let's dive into the specifics.

Understanding Form 1099-SA and Why It's Important

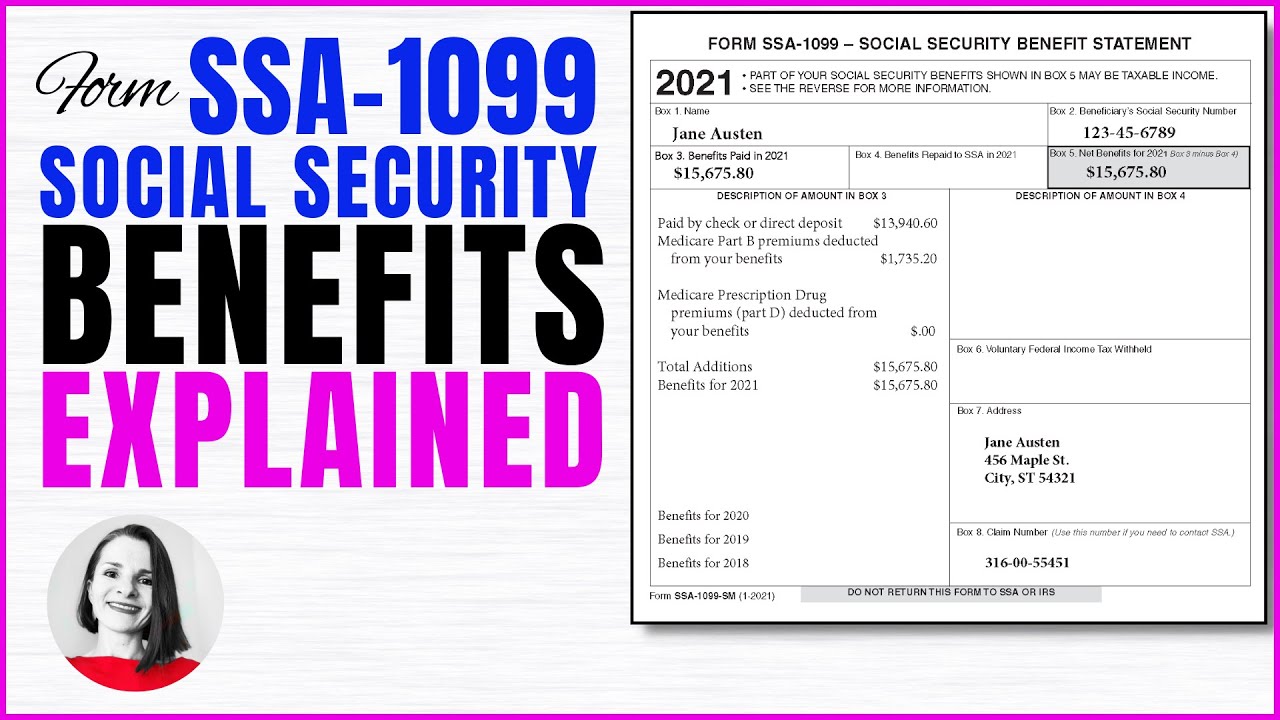

Form 1099-SA serves as the official IRS record detailing how much money you withdrew from your health savings account during the tax year. Think of it like a W-2, but for your HSA distributions. You must report this information when filing your taxes, usually alongside Form 8889 (Health Savings Accounts and Archer MSAs).

Why is this necessary? While HSA funds are tax-free when used for qualified medical expenses, the distribution must still be reported. If you withdraw money for non-medical purposes, that distribution becomes taxable income, and you may face a 20% penalty. Therefore, the IRS needs the 1099-SA to track and verify these details.

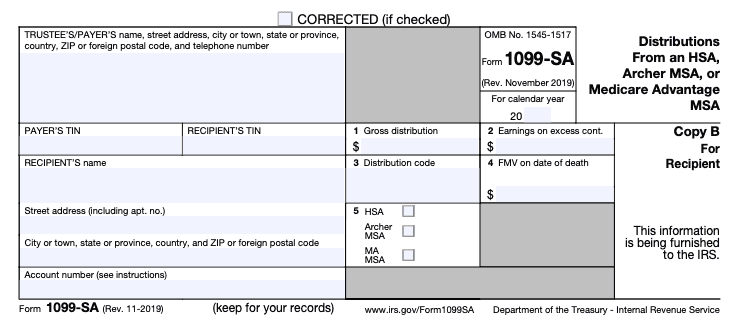

The form itself contains several key pieces of information:

- Box 1: Gross distribution amount (the total amount withdrawn).

- Box 2: Earnings from excess contributions (less common, but important if it applies).

- Box 3: Distribution code (this tells the IRS the type of distribution, such as normal or excess contribution return).

The Key Place: Your HSA Custodian or Trustee

The simplest answer to "Where Do I Get My 1099 Sa?" is the financial institution that holds your HSA. This entity is known as your HSA custodian or trustee. This could be a major bank, a credit union, an investment brokerage, or a specialized HSA administrator.

Your custodian is legally responsible for reporting all account activity, including distributions, to the IRS and to you. If you moved funds from an old HSA to a new one (a rollover), both custodians might issue a 1099-SA. Remember, distributions reported on the 1099-SA include payments made directly to you and payments made directly to medical providers.

Digital Access vs. Paper Mail

In the digital age, relying solely on snail mail can be tricky. Many HSA custodians now prioritize digital delivery, especially if you opted for paperless statements when setting up your account. This is the first place you should check if the mail hasn't arrived.

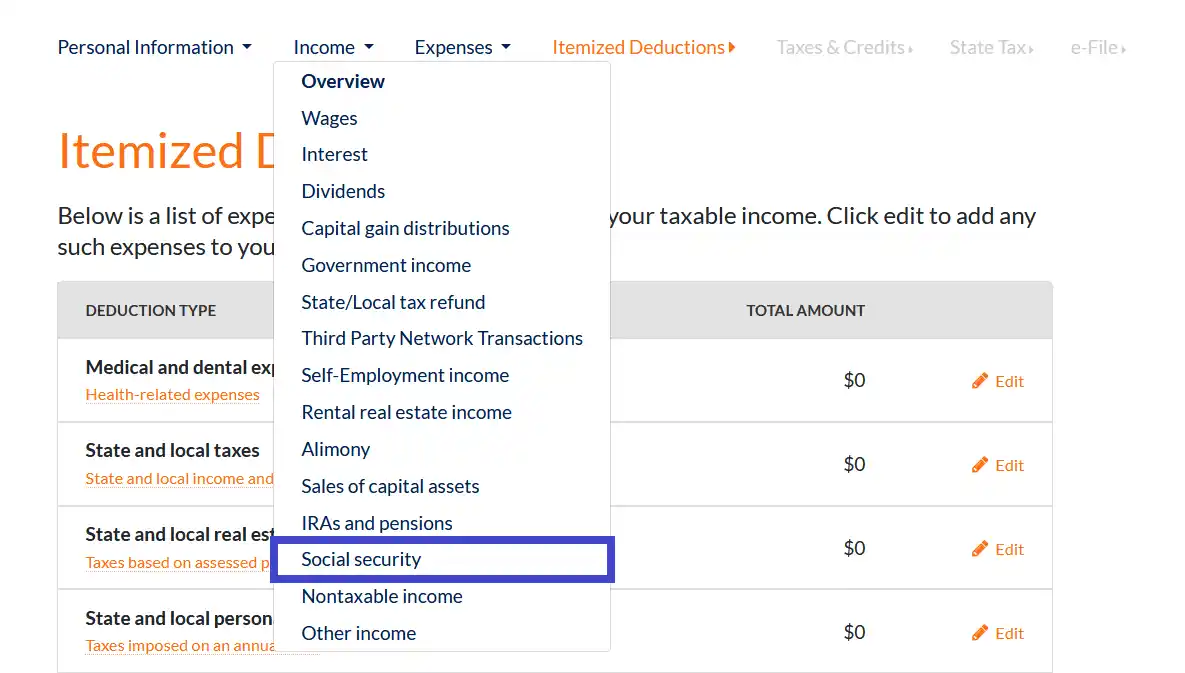

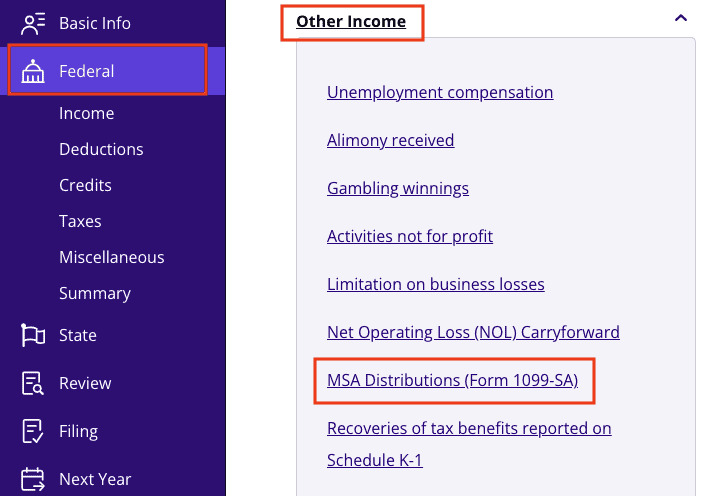

To find your 1099-SA digitally, log into your HSA account portal. Look for sections labeled "Tax Documents," "Statements," or "Document Library." Usually, the 1099-SA will be available to download as a PDF starting in mid-to-late January.

However, if you receive paper statements, your 1099-SA should arrive via physical mail. It's important to keep an eye out for this document, as it can sometimes look like junk mail or a regular monthly statement.

Dealing with Multiple HSAs

Do you have multiple Health Savings Accounts? Perhaps one through an employer and another that you manage personally? If you took distributions from more than one account, you will receive a separate 1099-SA from each corresponding custodian.

It is crucial to collect every single 1099-SA you receive. When preparing your taxes, you must accurately sum up all distributions reported across all your forms. Failing to include a form could lead to discrepancies with the IRS later on, potentially resulting in unnecessary taxes or penalties.

The Timing: When Should You Expect Your 1099-SA?

The IRS requires financial institutions to mail or make available all 1099 forms by January 31st of the year following the tax year in question. For distributions made in 2023, you should expect your 1099-SA by January 31, 2024.

While custodians strive to meet this deadline, delivery times can vary, especially with physical mail. Give it at least a week or two after the deadline before you panic. Many administrators make the forms available online sooner, often by the second or third week of January.

What If It's Delayed?

Sometimes forms are delayed, either due to processing errors, postal issues, or because your address is outdated. If the end of February rolls around and you still haven't received the document, it's time to take proactive steps. Do not attempt to guess the distribution amounts, as accuracy is essential for tax filing.

First, reconfirm your delivery preference—paper or digital—by logging into your account. If you verified that it should be mailed, check your address on file to ensure it's current. A simple address mismatch is a very common reason for delay.

I Can't Find My 1099-SA: Troubleshooting Steps

If you have thoroughly checked your digital portal, your mailbox, and even your junk folders, and you still haven't found the answer to "Where Do I Get My 1099 Sa?" it's time to reach out to the source. Remember, HSA custodians are required to provide this document, so they can certainly help you locate it or issue a duplicate.

Before contacting them, review your own personal records. Did you actually take any distributions last year? If you only contributed money and never took any withdrawals, the custodian may not be required to send you a 1099-SA.

Contacting Your Custodian Directly

Most HSA administrators have dedicated customer service lines specifically for tax documents during tax season. This is often the fastest route to resolution. Be prepared to wait on hold, as this is a high-volume time for tax inquiries.

When you call, clearly state that you are missing your Form 1099-SA for the previous tax year. They can often immediately confirm whether the form was mailed, whether it is available online, or if they need to reissue a copy to a corrected address.

What Information Do They Need?

To speed up the process of receiving your duplicate 1099-SA, have your account details ready. They will likely need several pieces of information to verify your identity and locate your account records quickly. Preparing this information beforehand saves significant time and frustration.

Key information to have on hand includes:

- Your full name and Social Security Number (SSN).

- Your HSA account number(s).

- The exact address they have on file (even if it's incorrect, they need to verify it).

- The specific tax year for the missing document (e.g., 2023).

Once verified, the custodian can usually email you a secured digital copy or send a replacement via mail. Be sure to confirm the estimated delivery timeline for the replacement document.

Conclusion: Finding Your 1099-SA is Easier Than You Think

Determining "Where Do I Get My 1099 Sa?" ultimately comes down to knowing your HSA custodian and understanding their delivery preferences. Whether you access it digitally through your online portal or await its arrival in your mailbox, the 1099-SA is a non-negotiable part of filing your taxes accurately when you have an HSA.

If you took distributions, expect the form by January 31st. Check your account's digital library first, and if all else fails, a quick, informed call to your custodian's tax support line is the best route to secure your necessary documentation. Getting this form right ensures you correctly report your distributions on Form 8889 and avoid potential penalties from the IRS.

Frequently Asked Questions (FAQ) About Form 1099-SA

- What if I contributed to my HSA but never took any money out?

- If you only contributed money and did not take any distributions (withdrawals), your HSA custodian is generally not required to send you a 1099-SA. The form that reports contributions is typically Form 5498-SA, though contributions are often tracked through W-2 (Box 12, Code W) if done via payroll.

- Is the 1099-SA different from Form 5498-SA?

- Yes, they are different! The 1099-SA reports distributions (money taken out). The 5498-SA reports contributions (money put in) and the fair market value of the account. Custodians usually send Form 5498-SA later, often in May, because people can still make prior-year contributions up until the tax deadline.

- What should I do if the amount on my 1099-SA is wrong?

- If you believe the distribution amount listed on the form is incorrect, you must immediately contact your HSA custodian. You need them to issue a corrected form (often noted as "CORRECTED" at the top) before you file your tax returns. Using an incorrect 1099-SA could cause issues with the IRS matching process.

- If I rolled over my HSA funds, do I get a 1099-SA?

- Yes. A direct rollover (transferring funds directly between custodians) should still be reported on a 1099-SA from the distributing custodian, but the distribution code (Box 3) should indicate a tax-free rollover. This amount must be reported on Form 8889 to ensure it is not counted as taxable income.

Where Do I Get My 1099 Sa

Where Do I Get My 1099 Sa Wallpapers

Collection of where do i get my 1099 sa wallpapers for your desktop and mobile devices.

Vivid Where Do I Get My 1099 Sa Photo Digital Art

Explore this high-quality where do i get my 1099 sa image, perfect for enhancing your desktop or mobile wallpaper.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Dynamic Where Do I Get My 1099 Sa Design Art

Immerse yourself in the stunning details of this beautiful where do i get my 1099 sa wallpaper, designed for a captivating visual experience.

Detailed Where Do I Get My 1099 Sa Artwork Digital Art

Experience the crisp clarity of this stunning where do i get my 1099 sa image, available in high resolution for all your screens.

Vivid Where Do I Get My 1099 Sa Artwork Collection

Transform your screen with this vivid where do i get my 1099 sa artwork, a true masterpiece of digital design.

Breathtaking Where Do I Get My 1099 Sa Scene Nature

Discover an amazing where do i get my 1099 sa background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Where Do I Get My 1099 Sa View Photography

Experience the crisp clarity of this stunning where do i get my 1099 sa image, available in high resolution for all your screens.

Mesmerizing Where Do I Get My 1099 Sa Wallpaper for Mobile

Explore this high-quality where do i get my 1099 sa image, perfect for enhancing your desktop or mobile wallpaper.

Lush Where Do I Get My 1099 Sa Landscape in HD

This gorgeous where do i get my 1099 sa photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Where Do I Get My 1099 Sa Picture Digital Art

Explore this high-quality where do i get my 1099 sa image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Where Do I Get My 1099 Sa Capture Photography

Transform your screen with this vivid where do i get my 1099 sa artwork, a true masterpiece of digital design.

Detailed Where Do I Get My 1099 Sa Landscape Photography

Experience the crisp clarity of this stunning where do i get my 1099 sa image, available in high resolution for all your screens.

Artistic Where Do I Get My 1099 Sa Wallpaper Nature

Immerse yourself in the stunning details of this beautiful where do i get my 1099 sa wallpaper, designed for a captivating visual experience.

Serene Where Do I Get My 1099 Sa Artwork Digital Art

Experience the crisp clarity of this stunning where do i get my 1099 sa image, available in high resolution for all your screens.

Mesmerizing Where Do I Get My 1099 Sa Picture in HD

Discover an amazing where do i get my 1099 sa background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic Where Do I Get My 1099 Sa Photo Digital Art

Find inspiration with this unique where do i get my 1099 sa illustration, crafted to provide a fresh look for your background.

Amazing Where Do I Get My 1099 Sa Picture for Mobile

Experience the crisp clarity of this stunning where do i get my 1099 sa image, available in high resolution for all your screens.

Breathtaking Where Do I Get My 1099 Sa View Collection

Discover an amazing where do i get my 1099 sa background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic Where Do I Get My 1099 Sa Background Art

Immerse yourself in the stunning details of this beautiful where do i get my 1099 sa wallpaper, designed for a captivating visual experience.

Amazing Where Do I Get My 1099 Sa Capture Illustration

Discover an amazing where do i get my 1099 sa background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush Where Do I Get My 1099 Sa Wallpaper Art

This gorgeous where do i get my 1099 sa photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these where do i get my 1099 sa wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Where Do I Get My 1099 Sa"

Post a Comment