Will I Get Social Security If I Never Worked

Will I Get Social Security If I Never Worked? Here's the Scoop.

That is one of the most common and important questions people ask when they start planning for retirement or dealing with an unforeseen disability. The simple answer to "Will I Get Social Security If I Never Worked?" is often: maybe, but probably not based on your own earnings record. However, not having a work history doesn't necessarily mean you are out of luck.

The U.S. Social Security system is complex, relying primarily on credits earned through employment. Yet, several specialized programs exist specifically to provide essential support to individuals who have little or no work history. We are going to walk you through exactly how the system works and explore the different avenues available to you.

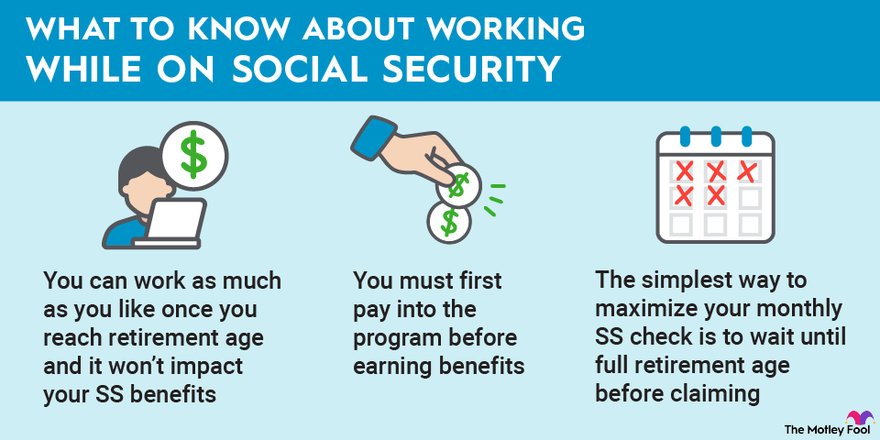

Understanding How Social Security Works (The 40 Credits Rule)

When most people talk about Social Security retirement benefits (SS), they are referring to the Old-Age, Survivors, and Disability Insurance (OASDI) program. To qualify for these benefits based on your own work record, you must earn enough "credits."

Credits are earned when you pay Social Security taxes (FICA) on your wages. You can earn up to four credits per year. To be "fully insured" for retirement benefits, you generally need 40 credits, which translates to about 10 years of work. If you have never worked, or if your work history falls significantly short of 40 credits, you will not qualify for standard Social Security benefits.

However, the Social Security Administration (SSA) recognizes that life circumstances, such as being a dedicated stay-at-home parent, caring for family members, or suffering from a lifelong disability, might prevent someone from accumulating those required credits. This is where derivative benefits and needs-based programs come into play.

Social Security Benefits You Might Qualify For (Even Without Working)

If you find yourself asking, "Will I Get Social Security If I Never Worked," don't despair. There are three primary ways you can still receive substantial support from the SSA, even without your own work credits.

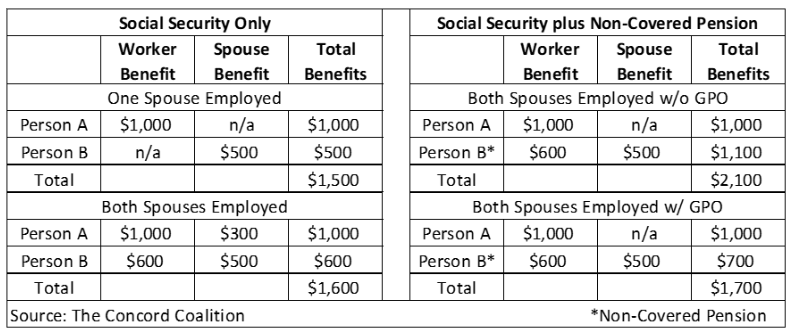

Spousal Benefits: Leveraging Your Spouse's Work History

One of the most common ways for a non-working individual to receive benefits is through their currently married or former spouse's earnings record. These are known as auxiliary benefits or derivative benefits. If your spouse qualifies for Social Security retirement or disability benefits, you may be eligible.

Generally, you can receive up to 50% of the benefit amount your spouse is entitled to receive at their full retirement age. You must be at least 62 years old, or caring for a child who is under age 16 or disabled.

The Divorced Spouse Benefit: What You Need to Know

The good news is that even if you are divorced, you might still be able to claim benefits based on your former spouse's record. This can be especially helpful if you haven't worked or your own work history is minimal. The requirements are quite specific and include:

- Your marriage must have lasted 10 years or more.

- You must currently be unmarried (unless your remarriage occurred after age 60, or 50 if disabled).

- You must be age 62 or older.

- Your ex-spouse must be entitled to Social Security retirement or disability benefits.

- The benefit you receive on your own work record (if any) must be less than the benefit you would receive as a divorced spouse.

A significant advantage of the divorced spouse benefit is that claiming it does not affect the benefit amount your ex-spouse or their new partner receives. It's a completely independent claim.

Supplemental Security Income (SSI): Needs-Based Assistance

If you don't have a spouse or ex-spouse who qualifies, your next avenue is Supplemental Security Income (SSI). Crucially, SSI is a federal income supplement program funded by general tax revenues—not Social Security taxes—and is designed to help aged, blind, and disabled people who have limited income and resources.

This program is purely needs-based. Whether you've worked 10 days or 10 years is irrelevant for SSI qualification. The SSA assesses your financial situation instead. To qualify for SSI, you must meet strict limits on assets and income:

- Be age 65 or older, OR blind, OR disabled.

- Have very limited income (below a certain monthly threshold).

- Have limited resources (assets like bank accounts, stocks, etc.)—typically no more than $2,000 for an individual or $3,000 for a couple.

- Be a U.S. citizen or eligible non-citizen.

Because SSI is needs-based, the maximum monthly payment is fixed and adjusted annually. It is not tied to any previous earnings record.

Childhood Disability Benefits (CDB)

A third, lesser-known path is the Childhood Disability Benefit (CDB), also sometimes referred to as Disabled Adult Child (DAC) benefits. This program is for people who became disabled before the age of 22 and are unmarried.

The individual claiming CDB does not need their own work history. Instead, they must be dependent on a parent who is either deceased, receiving Social Security retirement benefits, or receiving Social Security disability benefits. This benefit is tied to the parent's work history, much like a spousal benefit.

CDB is an extremely important benefit for people who developed a serious disability early in life, preventing them from ever entering the workforce. It acknowledges the lifetime dependency on the parent's earnings.

Essential Eligibility Criteria for Non-Working Benefits

While the requirements vary significantly between derivative benefits (like spousal) and needs-based benefits (like SSI), there are core criteria you must meet when exploring options if you have never worked:

For Spousal/CDB Benefits:

You must establish a valid relationship with a worker who is "fully insured" by the SSA. This is the foundation upon which your benefit is built. The worker must have earned their 40 credits.

For SSI Benefits:

Your primary hurdle is demonstrating financial need. The SSA rigorously checks your countable income and resources, which must fall beneath the federal benefit rate and resource limits, respectively.

Calculating Your Potential Benefit Amount

If you qualify for spousal or CDB benefits, your benefit amount is directly derived from the working spouse's Primary Insurance Amount (PIA). This means the amount will fluctuate based on when you claim it (early claims result in reduced benefits) and the amount the worker earned.

If you qualify for SSI, the calculation is simpler but often less generous. SSI provides a maximum federal rate. Any "countable income" you receive (such as part-time earnings, gifts, or investment returns) is subtracted from that federal rate to determine your final monthly payment. Since SSI is purely a financial safety net, it operates completely independently of any work history.

It is important to remember that if you are eligible for both a small benefit on your own work record and a larger spousal benefit, the SSA will automatically combine them, ensuring you receive the highest benefit available to you.

Conclusion: The Answer to "Will I Get Social Security If I Never Worked"

The short answer is yes, you absolutely can get Social Security benefits even if you have never worked. However, these benefits will not come from standard retirement benefits based on your own earnings record.

Instead, your eligibility depends entirely on your relationship to a qualified worker (Spousal Benefits, Divorced Spouse Benefits, or Childhood Disability Benefits) or your financial necessity (Supplemental Security Income, or SSI). If you are struggling with limited resources or approaching retirement age without having earned 40 credits, review your situation against the requirements for spousal benefits and SSI immediately. Don't assume that a lack of work history means the SSA has nothing for you.

Frequently Asked Questions (FAQ)

- Can I collect both SSI and a Spousal Benefit?

- No. Spousal benefits count as "unearned income" for SSI purposes. While SSI is a needs-based program, if you begin receiving a spousal benefit, that income will likely reduce or eliminate your SSI payment, as the SSI resource caps are very strict.

- What if my spouse hasn't filed for their own benefits yet?

- In most cases, you cannot file for a spousal benefit until your spouse has filed for their own retirement or disability benefit. The exception is the divorced spouse benefit, where you may be able to file if you have been divorced for at least two years and your former spouse is eligible for benefits but has not yet filed.

- If I qualify for SSI, does that include health insurance?

- Yes, generally. In most states, qualifying for SSI automatically makes you eligible for Medicaid, which provides vital health coverage. This is a crucial benefit for those who have limited income and resources.

- What is the minimum age to claim derivative benefits?

- The minimum age to claim most spousal and divorced spouse benefits is 62. However, if you are caring for a child under age 16 or a disabled child, you may be able to claim a child-in-care spousal benefit before age 62.

Will I Get Social Security If I Never Worked

Will I Get Social Security If I Never Worked Wallpapers

Collection of will i get social security if i never worked wallpapers for your desktop and mobile devices.

Dynamic Will I Get Social Security If I Never Worked Image Nature

A captivating will i get social security if i never worked scene that brings tranquility and beauty to any device.

Lush Will I Get Social Security If I Never Worked Image in HD

Find inspiration with this unique will i get social security if i never worked illustration, crafted to provide a fresh look for your background.

Captivating Will I Get Social Security If I Never Worked Abstract Concept

Immerse yourself in the stunning details of this beautiful will i get social security if i never worked wallpaper, designed for a captivating visual experience.

Vivid Will I Get Social Security If I Never Worked Wallpaper Collection

Transform your screen with this vivid will i get social security if i never worked artwork, a true masterpiece of digital design.

Breathtaking Will I Get Social Security If I Never Worked Wallpaper for Desktop

Experience the crisp clarity of this stunning will i get social security if i never worked image, available in high resolution for all your screens.

Gorgeous Will I Get Social Security If I Never Worked Background Concept

This gorgeous will i get social security if i never worked photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed Will I Get Social Security If I Never Worked Picture Digital Art

Transform your screen with this vivid will i get social security if i never worked artwork, a true masterpiece of digital design.

Vibrant Will I Get Social Security If I Never Worked Moment Photography

Discover an amazing will i get social security if i never worked background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Will I Get Social Security If I Never Worked Moment Art

Discover an amazing will i get social security if i never worked background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality Will I Get Social Security If I Never Worked Image in 4K

Experience the crisp clarity of this stunning will i get social security if i never worked image, available in high resolution for all your screens.

High-Quality Will I Get Social Security If I Never Worked Picture Concept

Experience the crisp clarity of this stunning will i get social security if i never worked image, available in high resolution for all your screens.

Amazing Will I Get Social Security If I Never Worked Artwork in 4K

Explore this high-quality will i get social security if i never worked image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Will I Get Social Security If I Never Worked Artwork Digital Art

A captivating will i get social security if i never worked scene that brings tranquility and beauty to any device.

Stunning Will I Get Social Security If I Never Worked Artwork in HD

Immerse yourself in the stunning details of this beautiful will i get social security if i never worked wallpaper, designed for a captivating visual experience.

Mesmerizing Will I Get Social Security If I Never Worked Wallpaper Collection

Explore this high-quality will i get social security if i never worked image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Will I Get Social Security If I Never Worked Capture Photography

Find inspiration with this unique will i get social security if i never worked illustration, crafted to provide a fresh look for your background.

Mesmerizing Will I Get Social Security If I Never Worked Background for Mobile

Transform your screen with this vivid will i get social security if i never worked artwork, a true masterpiece of digital design.

Vibrant Will I Get Social Security If I Never Worked Landscape Digital Art

Discover an amazing will i get social security if i never worked background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Will I Get Social Security If I Never Worked Landscape Collection

Find inspiration with this unique will i get social security if i never worked illustration, crafted to provide a fresh look for your background.

Vivid Will I Get Social Security If I Never Worked Design Photography

Transform your screen with this vivid will i get social security if i never worked artwork, a true masterpiece of digital design.

Download these will i get social security if i never worked wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Will I Get Social Security If I Never Worked"

Post a Comment