Budget Planning Software

Stop Guessing, Start Growing: Finding the Best Budget Planning Software for You

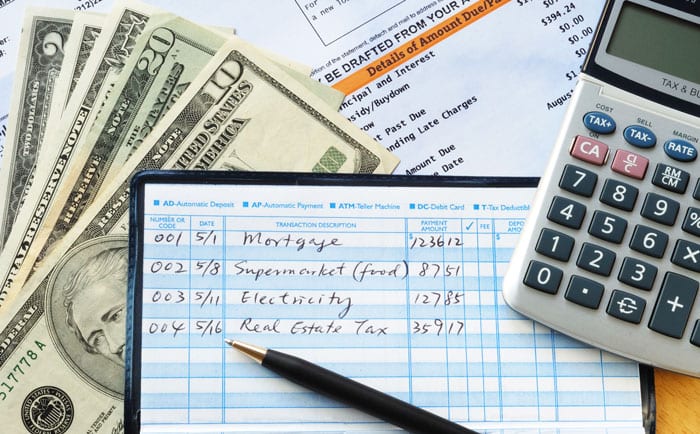

Let's be honest. Managing money often feels less like professional accounting and more like trying to herd cats—a chaotic, frustrating, and usually unprofitable endeavor. We start with the best intentions, maybe download a spreadsheet template, and then forget about it three weeks later.

If that sounds familiar, it's time to stop fighting gravity and embrace technology. Finding the right Budget Planning Software isn't just about tracking expenses; it's about regaining control, reducing anxiety, and setting a clear, actionable path toward financial freedom.

But with hundreds of apps claiming to be the "best," how do you cut through the noise? This deep-dive guide will equip you with the knowledge (and the E-E-A-T criteria) needed to select a powerful tool that transforms your relationship with money.

Why Traditional Budgeting Fails (and Why Software Wins)

The biggest hurdle in personal finance is consistency. Manual methods, like notebooks or complex Excel sheets, demand constant effort. This is where modern budget planning software steps in and completely changes the game.

Traditional methods fail because they are:

- Manual: Requiring tedious entry of every single transaction.

- Lagging: You only see your status when you update it, usually once a week or month.

- Error-Prone: Typos and forgotten receipts quickly skew the results.

The beauty of a good software solution is its automation. It connects securely to your bank accounts and credit cards, categorize transactions instantly, and provides real-time insights. Instead of tracking data, you spend your time making informed decisions.

This automated approach has been shown to significantly improve financial behavior and savings rates, turning budgeting from a chore into an empowering habit. Financial experts consistently recommend leveraging technology to maintain accuracy and discipline.

E-E-A-T Check: Defining What Makes Great Budget Planning Software

When dealing with sensitive financial information, Trustworthiness, Expertise, Authority, and Experience (E-E-A-T) are non-negotiable. Don't just pick the flashiest app; pick the most reliable one.

Expertise: Synchronization and Data Security

The core expertise of any top-tier budget software lies in its ability to securely and reliably sync with thousands of financial institutions. Look for apps that utilize established third-party services like Plaid or Yodlee, which act as secure intermediaries. They should offer bank-level security (often 256-bit AES encryption).

Experience: Intuitive UX Design

A complicated tool is a tool you won't use. The best user experience (UX) means a clean interface, easy categorization rules, and visually engaging charts that make complex data simple to understand. Can you check your remaining budget at a glance on mobile? If not, move on.

Authority: Integration with Financial Institutions

The authority of the software is often confirmed by its partnership level. Does the application integrate smoothly with major U.S. or global banks? A service that struggles to connect with standard institutions lacks the necessary backend authority and infrastructure.

Trustworthiness: Privacy and Compliance

Your data privacy is paramount. Ensure the company has a transparent policy stating they do not sell your transactional data to third parties. Look for compliance badges and confirm they employ multi-factor authentication (MFA) to protect your login. Check regulations and consumer protections governing financial technology.

Key Features You Must Look For (A Comparison Table)

While the market is flooded with options, the must-have features in effective budget planning software often boil down to core functionality versus advanced tools.

| Feature | Benefit | Ideal User Profile |

|---|---|---|

| Zero-Based Budgeting (ZBB) | Ensures every dollar has a job; highly effective for debt reduction. | Debt payers, highly disciplined users. |

| Goal Tracking & Forecasting | Projects future net worth and tracks progress toward large purchases (e.g., house, retirement). | Long-term planners, investors. |

| Investment/Net Worth Tracking | Aggregates 401k, brokerage, and crypto accounts alongside cash balances. | High net worth individuals, active traders. |

| Shared Access/Multi-User | Allows spouses or partners to collaborate on the same budget in real-time. | Couples, families, roommates. |

For most users, synchronization, categorization, and the ability to set spending targets are the most critical functions.

Top Contenders: Who Rules the Budget Planning Space? (Brief Overview)

The specific "best" software depends entirely on your needs. Here is a quick breakdown based on user profile:

For the Beginner: Simple and Straightforward

If you need minimal setup and robust auto-categorization, aim for products that emphasize ease of use and visual reports. These apps often focus on tracking where your money went rather than rigorous planning upfront.

For the Advanced User: Deep Customization

Users who embrace the "Zero-Based Budgeting" philosophy need software that treats every dollar as an assignment. These tools often have a steeper learning curve but provide unparalleled control over cash flow and future projections. They often require a paid subscription, but the control they offer is worth the investment for serious savers.

For the Family/Household: Shared Finances

Couples managing joint finances require seamless collaboration. Look for software that manages multiple user logins and clearly defines shared versus individual expenses, minimizing financial friction in the household.

Implementation: How to Successfully Integrate Budget Planning Software

The software is only as good as the effort you put into the initial setup and maintenance. Don't rush this process!

Step 1: Link Everything. Connect all checking, savings, credit card, and loan accounts. The more complete the picture, the better the software can analyze your habits.

Step 2: Define Your Categories. The software will guess categories, but you must refine them. Use specific categories that reflect your lifestyle (e.g., instead of just "Groceries," try "Dining Out" and "Home Cooking Ingredients").

Step 3: Set Realistic Goals. Don't try to save 50% overnight. Start small. If you currently spend $500 on dining, aim for $450 next month. Consistency beats extremity.

Step 4: Review Weekly. Spend 15 minutes every Sunday reviewing the transactions and adjusting your categories. This short habit ensures you stay proactive rather than reactive.

Need help setting up your categories? [Baca Juga: The Ultimate Guide to Zero-Based Budgeting]

Conclusion: The Investment in Clarity

Choosing the right Budget Planning Software is arguably the most crucial step you can take toward financial stability. It shifts budgeting from a tedious chore to a powerful clarity tool. Whether you are a beginner looking to understand where your paycheck goes or an advanced user tracking complex investments, the power of automation and real-time data is undeniable.

Prioritize E-E-A-T criteria—security, synchronization, and user experience—and you will find a tool that doesn't just track your money, but helps you grow it.

Frequently Asked Questions (FAQ) About Budget Planning Software

Is paid budget software worth the cost?

For most users with complex finances (multiple streams of income, investments, or debt), yes. Paid software typically offers robust features like detailed forecasting, zero-based budgeting, investment tracking, and superior customer support. If a $10 monthly fee saves you $100 in accidental spending or overdraft fees, it pays for itself.

How secure are these applications?

Top-tier budget software is highly secure. They use bank-grade encryption (256-bit AES) and often only read your data—they cannot move or transfer money. Always check that the application uses third-party authenticators (like Plaid) and multi-factor authentication for login.

How long does it take to set up?

The initial setup—linking accounts and setting basic budget categories—usually takes between 30 minutes to one hour. However, getting fully accustomed to the system and refining your custom categories may take one to two months of consistent use.

Budget Planning Software

Budget Planning Software Wallpapers

Collection of budget planning software wallpapers for your desktop and mobile devices.

Dynamic Budget Planning Software Wallpaper in HD

Immerse yourself in the stunning details of this beautiful budget planning software wallpaper, designed for a captivating visual experience.

Amazing Budget Planning Software Background Collection

Experience the crisp clarity of this stunning budget planning software image, available in high resolution for all your screens.

Captivating Budget Planning Software Abstract for Desktop

Find inspiration with this unique budget planning software illustration, crafted to provide a fresh look for your background.

Vibrant Budget Planning Software Photo Concept

Explore this high-quality budget planning software image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Budget Planning Software Picture in HD

A captivating budget planning software scene that brings tranquility and beauty to any device.

Breathtaking Budget Planning Software View Concept

Experience the crisp clarity of this stunning budget planning software image, available in high resolution for all your screens.

Detailed Budget Planning Software Wallpaper Collection

Transform your screen with this vivid budget planning software artwork, a true masterpiece of digital design.

Captivating Budget Planning Software Image Concept

Immerse yourself in the stunning details of this beautiful budget planning software wallpaper, designed for a captivating visual experience.

Captivating Budget Planning Software Background for Mobile

This gorgeous budget planning software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Budget Planning Software Picture Illustration

A captivating budget planning software scene that brings tranquility and beauty to any device.

Artistic Budget Planning Software Abstract Illustration

Find inspiration with this unique budget planning software illustration, crafted to provide a fresh look for your background.

High-Quality Budget Planning Software Wallpaper Concept

Explore this high-quality budget planning software image, perfect for enhancing your desktop or mobile wallpaper.

Lush Budget Planning Software Artwork Digital Art

Immerse yourself in the stunning details of this beautiful budget planning software wallpaper, designed for a captivating visual experience.

Vibrant Budget Planning Software Abstract Illustration

Explore this high-quality budget planning software image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic Budget Planning Software Photo in HD

Find inspiration with this unique budget planning software illustration, crafted to provide a fresh look for your background.

Dynamic Budget Planning Software Background for Your Screen

Immerse yourself in the stunning details of this beautiful budget planning software wallpaper, designed for a captivating visual experience.

Crisp Budget Planning Software Moment Illustration

Find inspiration with this unique budget planning software illustration, crafted to provide a fresh look for your background.

Beautiful Budget Planning Software View in 4K

Experience the crisp clarity of this stunning budget planning software image, available in high resolution for all your screens.

Vibrant Budget Planning Software Scene Photography

Explore this high-quality budget planning software image, perfect for enhancing your desktop or mobile wallpaper.

Stunning Budget Planning Software Abstract for Desktop

Immerse yourself in the stunning details of this beautiful budget planning software wallpaper, designed for a captivating visual experience.

Download these budget planning software wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Budget Planning Software"

Post a Comment