Can You Get More Than One Life Insurance Policy

Can You Get More Than One Life Insurance Policy? The Definitive Guide

You've been thinking about your future and ensuring your loved ones are protected financially. Maybe you already have a policy through work, but you realize it's not quite enough. Or perhaps your life circumstances have changed drastically since you first bought coverage.

This leads to a very common question we hear all the time: Can you get more than one life insurance policy? It sounds complicated, but we're here to break it down simply. Spoiler alert: The answer is almost certainly yes, but there are important rules you need to know first.

If you're wondering whether layering policies is the right strategy for maximizing your family's safety net, read on. We'll cover why people seek multiple policies and the key limitations set by insurers when considering Can You Get More Than One Life Insurance Policy.

The Short Answer: Yes, You Can Stack Policies

Absolutely, yes. There is no official law or rule preventing you from owning two, three, or even more life insurance policies simultaneously. People often mix and match policies from different carriers, or even hold several policies with the same insurance company.

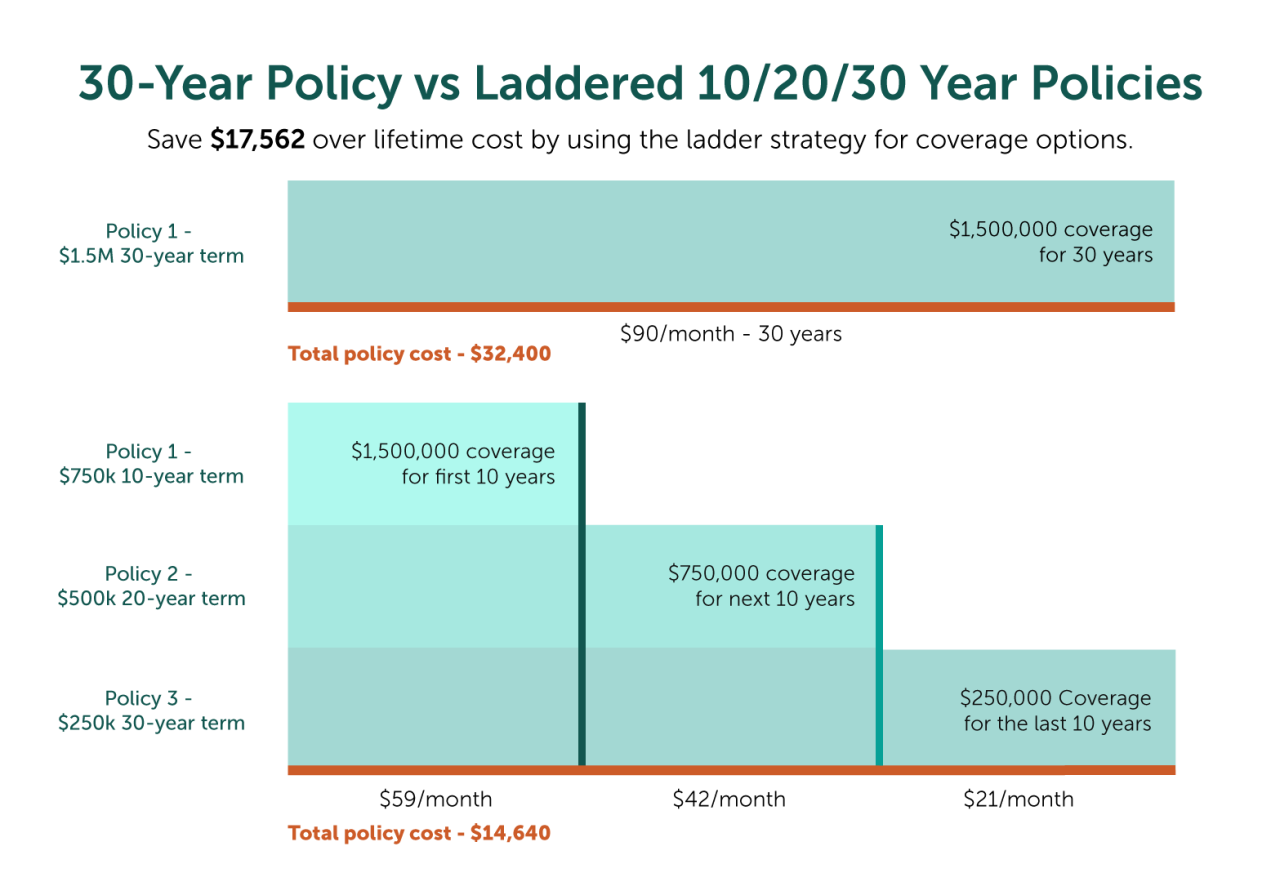

This practice is sometimes referred to as "laddering" or "stacking" policies. It's a strategic approach to ensure your financial coverage precisely matches your changing needs over time, rather than settling for one large, inflexible policy.

However, while the number of policies isn't capped, the total dollar amount of coverage you can purchase is restricted. Insurers base this on your financial need, a concept we will explore shortly.

Why Would Someone Need Multiple Policies?

Why bother with the hassle of managing multiple plans? Most often, people decide to pursue additional coverage when a major life event occurs, or when they realize their financial obligations are not static.

Here are the most common reasons people realize the answer to Can You Get More Than One Life Insurance Policy is a definite 'yes':

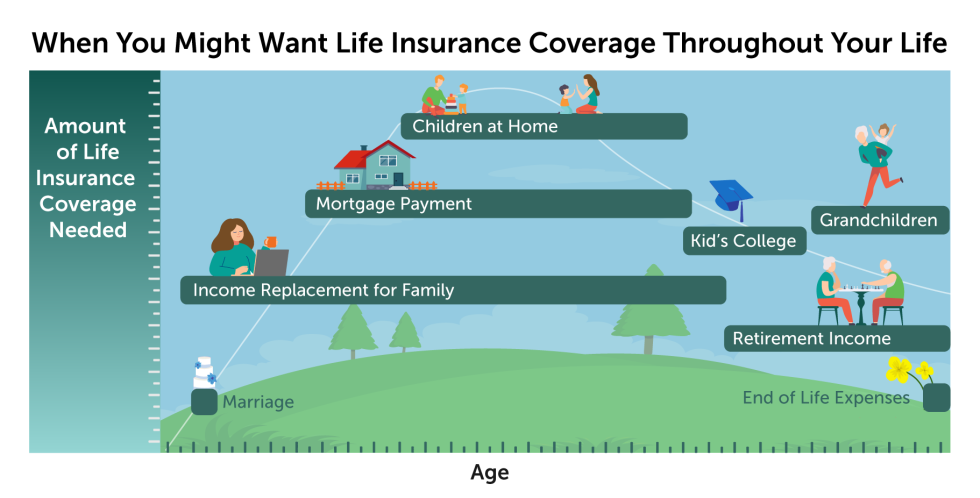

Covering Different Financial Stages

Your financial needs are highest when you are young and have significant debt—mortgages, student loans, and dependent children. As you age, your mortgage might be paid off and your kids become self-sufficient.

By using multiple Term Life Insurance policies, you can align the death benefit amount with specific financial burdens. For example, you might buy a $500,000 policy that lasts 30 years to cover your mortgage, and a separate $200,000 policy that lasts 15 years to cover childcare costs. When the 15-year policy expires, you stop paying that premium, but the core coverage remains.

Blending Policy Types (Term vs. Permanent)

Many financial advisors recommend owning a permanent policy (like Whole Life) for long-term final expenses and estate planning, combined with a larger, more affordable Term Life policy to cover high-need years.

This blend offers the best of both worlds: high protection when you need it most, and guaranteed lifelong coverage for your basic final needs.

Separating Business and Personal Needs

If you own a business, you might need a life insurance policy specifically dedicated to that venture. This policy could be used for a Key Person policy or to fund a Buy/Sell Agreement with partners.

Keeping this business policy separate from your personal policy (which names your spouse or children as beneficiaries) simplifies the payout process and ensures the designated funds go exactly where they are intended, without delay.

Staying Under Insurability Limits

Most insurers allow you to buy smaller amounts of coverage without requiring a full medical exam. This is often referred to as "simplified issue" or "no-exam" life insurance.

If you want a very high amount of total coverage but want to avoid repeated blood work and extensive medical underwriting, you might purchase a large medically underwritten policy, and then supplement it with smaller, no-exam policies from other providers to easily bump up your total coverage.

Understanding the Rules: Insurability and Financial Limits

While you can buy many policies, insurance companies are legally bound to ensure you are not "over-insured." Insurers want to make sure the policy you buy reflects a genuine financial loss to your beneficiaries, not a windfall profit.

This limitation is essential when asking Can You Get More Than One Life Insurance Policy, because it dictates the total amount you can obtain.

The Total Coverage Cap (The Needs Analysis)

When you apply for a new policy, the underwriter performs a Needs Analysis, often using a specific formula. This formula generally limits your total coverage (including existing policies) to a multiple of your current income.

For example, if you are 40 years old, an insurer might cap your total coverage at 20 times your annual income. If you earn $100,000, your maximum combined coverage across all existing and new policies would likely be around $2 million.

If you already have $1.5 million in coverage, the new insurer will only allow you to purchase an additional $500,000.

The Application Process: Full Disclosure is Key

When applying for a new policy, you must disclose all existing life insurance coverage you hold. This is mandatory and non-negotiable.

If you intentionally hide existing policies to exceed the financial limits set by the underwriter, you risk having the new policy deemed void or contested later on. Always be honest and upfront about all your current coverage amounts.

Practical Strategy: How to Make Multiple Policies Work for You

If you've decided that holding multiple policies is the right approach, here is how you can effectively structure your insurance portfolio. Think of this as creating an insurance 'ladder' that provides robust coverage now, but saves you money later.

Here are common methods for structuring multiple policies:

- The Core Permanent Policy: Start with a small Whole Life or Universal Life policy ($50,000–$100,000) to cover final expenses, regardless of when you pass away.

- The Mortgage Policy: Layer a 30-year Term policy on top, sized specifically to pay off your mortgage balance.

- The Child-Rearing Policy: Add a shorter Term policy (10 or 15 years) to cover the years until your children graduate from college and become independent.

- The Income Protection Policy: If you are planning to retire soon, you might buy a 5-year Term policy to bridge any gap in retirement savings should you pass unexpectedly early.

This approach ensures that your insurance costs drop significantly as your policy needs expire, reducing your overall lifetime premium expenditure compared to one massive, long-term policy.

The Advantages of Stacking

Stacking policies isn't just about covering different expenses; it provides flexibility and better rates:

- Cost Efficiency: You only pay for high coverage when your financial exposure is greatest.

- Better Rate Classes: If your health declines after purchasing your first policy, your second or third policies (which were purchased when you were younger and healthier) retain their superior rate class.

- Guaranteed Insurability: You lock in coverage amounts early, protecting against future health issues that might make new coverage prohibitively expensive or unavailable.

Conclusion: Get the Coverage You Deserve

So, Can You Get More Than One Life Insurance Policy? Absolutely. It's a smart, flexible strategy that allows you to match your coverage precisely to your financial timeline.

While you are free to purchase policies from multiple carriers, remember that all insurers will assess your total financial need to determine how much coverage you qualify for. Transparency during the application process is crucial to ensure all your policies remain valid when your family needs them most.

If you feel your current policy is lacking, don't hesitate to speak with a financial advisor or insurance agent to explore how stacking a second life insurance policy can strengthen your family's future protection.

Frequently Asked Questions (FAQ)

- Can I have two different Term Life policies?

- Yes, you can absolutely have two or more different Term Life policies, even from the same company. This is a common strategy known as laddering, allowing you to tailor coverage periods and amounts to specific financial goals, like a mortgage or tuition.

- Do I have to tell the new insurance company about my old policy?

- Yes, full disclosure of all existing life insurance coverage is required on every new application. Underwriters need this information to ensure you do not exceed the total coverage amount permitted based on your income and financial need.

- Is it more expensive to have multiple life insurance policies?

- While you pay multiple premiums, strategically buying smaller, shorter-term policies when your needs are highest can actually be more cost-effective over the long run than purchasing one very large, long-term policy.

- What if my health has declined since I bought my first policy?

- If your health has declined, any new policy you apply for will be underwritten at your current health status and might result in a higher premium. However, your existing policies (which were issued based on your previous good health) will not change their rate or cost.

Can You Get More Than One Life Insurance Policy

Can You Get More Than One Life Insurance Policy Wallpapers

Collection of can you get more than one life insurance policy wallpapers for your desktop and mobile devices.

Amazing Can You Get More Than One Life Insurance Policy Image Concept

Discover an amazing can you get more than one life insurance policy background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality Can You Get More Than One Life Insurance Policy Image for Desktop

Transform your screen with this vivid can you get more than one life insurance policy artwork, a true masterpiece of digital design.

Breathtaking Can You Get More Than One Life Insurance Policy Design in 4K

Transform your screen with this vivid can you get more than one life insurance policy artwork, a true masterpiece of digital design.

Spectacular Can You Get More Than One Life Insurance Policy Design in 4K

Find inspiration with this unique can you get more than one life insurance policy illustration, crafted to provide a fresh look for your background.

Exquisite Can You Get More Than One Life Insurance Policy Design Photography

Immerse yourself in the stunning details of this beautiful can you get more than one life insurance policy wallpaper, designed for a captivating visual experience.

Stunning Can You Get More Than One Life Insurance Policy Artwork in HD

A captivating can you get more than one life insurance policy scene that brings tranquility and beauty to any device.

Breathtaking Can You Get More Than One Life Insurance Policy Picture Nature

Explore this high-quality can you get more than one life insurance policy image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Can You Get More Than One Life Insurance Policy Photo for Desktop

Discover an amazing can you get more than one life insurance policy background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Can You Get More Than One Life Insurance Policy Scene in HD

Find inspiration with this unique can you get more than one life insurance policy illustration, crafted to provide a fresh look for your background.

Lush Can You Get More Than One Life Insurance Policy Capture for Your Screen

A captivating can you get more than one life insurance policy scene that brings tranquility and beauty to any device.

High-Quality Can You Get More Than One Life Insurance Policy Abstract Photography

Transform your screen with this vivid can you get more than one life insurance policy artwork, a true masterpiece of digital design.

Breathtaking Can You Get More Than One Life Insurance Policy Background for Your Screen

Explore this high-quality can you get more than one life insurance policy image, perfect for enhancing your desktop or mobile wallpaper.

Lush Can You Get More Than One Life Insurance Policy Wallpaper Illustration

A captivating can you get more than one life insurance policy scene that brings tranquility and beauty to any device.

Mesmerizing Can You Get More Than One Life Insurance Policy Picture for Mobile

Explore this high-quality can you get more than one life insurance policy image, perfect for enhancing your desktop or mobile wallpaper.

Serene Can You Get More Than One Life Insurance Policy Image Collection

Experience the crisp clarity of this stunning can you get more than one life insurance policy image, available in high resolution for all your screens.

High-Quality Can You Get More Than One Life Insurance Policy Landscape for Mobile

Transform your screen with this vivid can you get more than one life insurance policy artwork, a true masterpiece of digital design.

Breathtaking Can You Get More Than One Life Insurance Policy Capture for Mobile

Transform your screen with this vivid can you get more than one life insurance policy artwork, a true masterpiece of digital design.

Breathtaking Can You Get More Than One Life Insurance Policy Photo Collection

Explore this high-quality can you get more than one life insurance policy image, perfect for enhancing your desktop or mobile wallpaper.

0 Response to "Can You Get More Than One Life Insurance Policy"

Post a Comment