How To Get Ozempic Covered By Insurance

How To Get Ozempic Covered By Insurance: Your Complete Guide

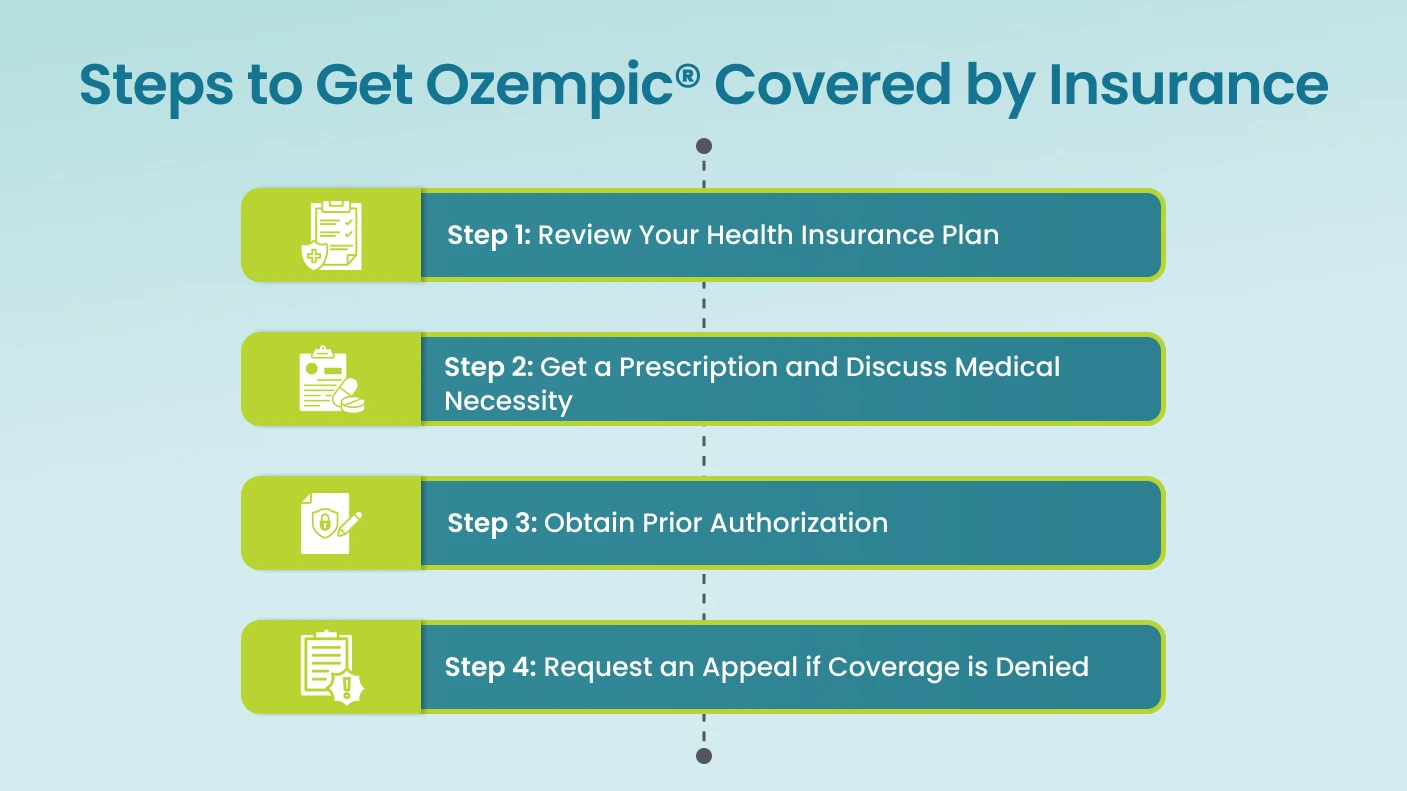

If you or a loved one has been prescribed Ozempic (semaglutide), you know it can be a game-changer for managing Type 2 diabetes and sometimes for weight management. However, the price tag without insurance can be shocking—often exceeding $1,000 per month. Trying to figure out How To Get Ozempic Covered By Insurance can feel like navigating a complex maze. Don't worry; we are here to break down the process step-by-step, making it much easier to understand and execute.

The key to successful coverage lies in understanding your specific insurance plan's rules, establishing irrefutable medical necessity, and being prepared to advocate for yourself. Getting approval requires patience, persistence, and thorough documentation. Let's dive into what you need to do to maximize your chances of getting this crucial medication covered.

Understanding Your Insurance Policy: The Foundation for Coverage

Before you even speak to your doctor about filing paperwork, you need to understand the specifics of your existing plan. Insurance companies manage drug coverage through complex systems designed to control costs, which often means they don't automatically cover high-cost brand-name drugs like Ozempic.

Your goal here is simple: find out if Ozempic is listed on your plan's formulary, and if so, what hoops you need to jump through to get approval. You can usually find this information by calling your insurance provider directly or checking their online drug list portal.

Decoding Formularies and Preferred Drug Lists

A formulary is essentially the list of medications that your insurance plan has agreed to cover. Drugs are usually categorized into tiers, which determine your co-pay amount. Understanding these tiers is crucial for figuring out your potential out-of-pocket costs.

When searching for Ozempic, look for these three common statuses on the formulary:

- Preferred Brand: This is the best-case scenario. It means it's covered, usually with a moderate co-pay, but often still requires Prior Authorization (PA).

- Non-Preferred Brand: It's covered, but your co-pay will be much higher, sometimes making it nearly as expensive as paying cash.

- Excluded: This means the medication is not covered at all, and you will need to pay 100% of the cost unless you win an appeal based on medical necessity.

Medical Necessity: Proving You Need Ozempic

The single most important step in How To Get Ozempic Covered By Insurance is proving that it is medically necessary for your specific condition. Insurance companies are much more likely to cover Ozempic if it is prescribed for its FDA-approved indication: treating Type 2 diabetes. If it is being prescribed solely for weight loss (which is the indication for its sister drug, Wegovy), coverage becomes significantly harder to obtain.

You and your healthcare provider must work together to build a strong case proving that Ozempic is the most appropriate and effective treatment for you, particularly if you have tried and failed with other, less expensive treatments first.

The Role of Prior Authorization (PA)

Prior Authorization is the process where your doctor sends detailed information to the insurance company justifying why you need Ozempic. This often involves demonstrating that cheaper alternatives haven't worked or are contraindicated for your health status.

The PA form is critical and must be filled out meticulously by your prescribing physician. This is where your doctor articulates the medical necessity in a language the insurance company understands.

The PA process often involves the following steps, sometimes called "Step Therapy":

- The patient must first try a generic or lower-tier medication (e.g., Metformin).

- If the initial medication fails to control blood sugar or causes unacceptable side effects, the doctor must document the failure.

- The doctor then submits the PA request, documenting the history of failed treatments and providing lab results (like A1C) that justify the need for Ozempic.

- The insurance company reviews the PA and either approves or denies coverage, usually within a few business days.

Documentation is Key

When seeking coverage, detail matters. Ensure your doctor includes specific clinical evidence to support the prescription. Vague submissions are easily rejected, adding frustration and delays to the process.

- Current A1C levels showing inadequate glycemic control.

- Documentation of co-morbidities (such as heart disease risk) that Ozempic can help mitigate.

- Detailed list of other diabetic medications tried, the duration they were used, and the reason they failed (e.g., severe hypoglycemia, allergic reaction, lack of efficacy).

- A clear diagnosis code matching Type 2 Diabetes (E11.x) or another covered diagnosis.

Strategies If Coverage Is Denied

Don't panic if your initial request for coverage is denied. Rejection is actually very common, especially for high-cost medications like Ozempic. The crucial difference between those who get covered and those who don't is the willingness to follow through with the appeals process.

Understand the reason for the denial. Did they say you hadn't tried enough alternative medications? Was the documentation incomplete? Use the denial letter as a roadmap for your next step.

Navigating the Appeals Process

You typically have two main levels of appeal available. Start with the internal appeal, which requires your doctor to submit additional clinical information refuting the insurance company's reason for denial.

If the internal appeal fails, you can move to an external review. This involves an independent third party reviewing your case and the insurance company's decision. If the external reviewer finds in your favor, the insurance company is usually required to cover the medication.

Remember that throughout this process, communication between you, your doctor's office staff, and the insurance company is key. Keep meticulous records of all correspondence, reference numbers, and submission dates.

Alternative Options and Cost-Saving Tips

Even if your insurance coverage is still pending or permanently denied, there are ways to afford Ozempic. Do not let the initial sticker price prevent you from pursuing this important treatment.

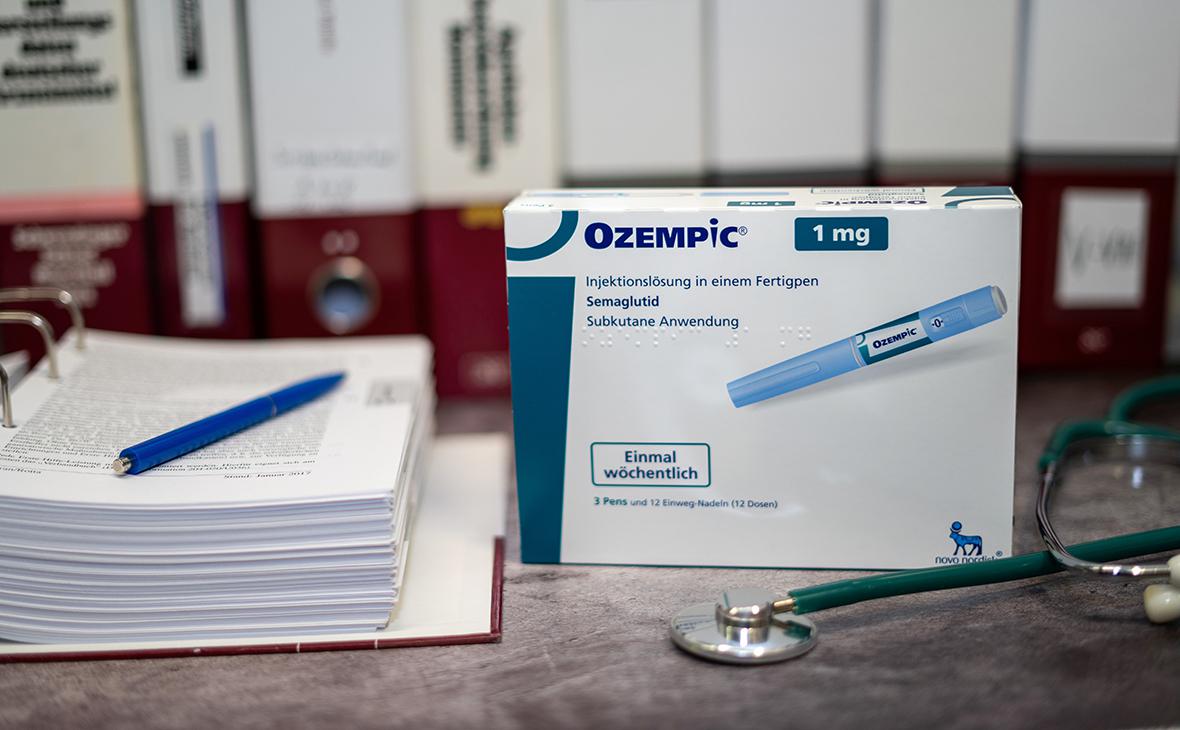

The manufacturer, Novo Nordisk, often provides robust support programs specifically designed for patients who face high costs or lack adequate insurance coverage. These options can significantly lower your monthly expense.

- Manufacturer Savings Cards/Coupons: If you have commercial insurance (not Medicare or Medicaid), you are likely eligible for an Ozempic savings card. This can reduce your monthly co-pay to as little as $25 for a set period.

- Patient Assistance Programs (PAP): If you are uninsured or underinsured and meet specific income requirements, you might qualify for the Novo Nordisk Patient Assistance Program, which often provides the medication for free.

- Alternative Medications (Compounding): While not recommended as a first choice, some patients explore compounded semaglutide from specialized pharmacies, though regulatory oversight is less strict for these products. Always discuss this thoroughly with your physician.

- Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs): Use pre-tax dollars from these accounts to pay for deductibles, co-pays, and other covered expenses related to Ozempic.

These alternatives offer important bridges while you are working on getting the medication approved through your insurance, or serve as excellent long-term solutions if the insurance battle proves too challenging.

Conclusion

Learning How To Get Ozempic Covered By Insurance requires a strategic approach. It starts with meticulously checking your formulary and then working closely with your prescribing doctor to submit a comprehensive Prior Authorization that demonstrates medical necessity, particularly if you have Type 2 diabetes. Be prepared for initial denial, and utilize the appeals process diligently.

If full coverage remains elusive, remember that manufacturer savings programs and Patient Assistance Programs are powerful resources designed to make Ozempic accessible. By staying organized and advocating strongly for your health needs, you significantly increase your chances of obtaining affordable access to this vital medication.

Frequently Asked Questions (FAQ)

- Can I get Ozempic covered by insurance for weight loss only?

- Insurance coverage for weight loss is highly variable. While Ozempic's active ingredient (semaglutide) is FDA-approved for weight loss under the brand name Wegovy, many insurance plans specifically exclude weight loss medications. You may have better luck pursuing coverage for Wegovy than Ozempic if weight loss is the sole indication, but be prepared for stricter requirements and potential denial.

- How long does the Prior Authorization (PA) process take?

- The initial PA review usually takes 2–10 business days after your doctor submits the necessary paperwork. However, if the PA is denied and you proceed through internal and external appeals, the entire process could take several weeks or even months.

- What if my doctor won't fill out the PA paperwork?

- PA paperwork is time-consuming, and some doctors' offices are overburdened. Politely emphasize the financial necessity of the PA. If they are unwilling to complete it, you may need to consult a specialist (like an endocrinologist) who is more familiar with the documentation requirements for drugs like Ozempic.

- Is Ozempic covered by Medicare or Medicaid?

- Ozempic is typically covered by Medicare Part D plans as long as it is prescribed for Type 2 diabetes and meets the plan's specific criteria (often involving a PA and step therapy). Medicaid coverage varies significantly by state, so you must check your state's specific guidelines and formulary.

How To Get Ozempic Covered By Insurance

How To Get Ozempic Covered By Insurance Wallpapers

Collection of how to get ozempic covered by insurance wallpapers for your desktop and mobile devices.

Mesmerizing How To Get Ozempic Covered By Insurance Moment Photography

Explore this high-quality how to get ozempic covered by insurance image, perfect for enhancing your desktop or mobile wallpaper.

Vivid How To Get Ozempic Covered By Insurance Moment Art

Experience the crisp clarity of this stunning how to get ozempic covered by insurance image, available in high resolution for all your screens.

Stunning How To Get Ozempic Covered By Insurance Moment Illustration

This gorgeous how to get ozempic covered by insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid How To Get Ozempic Covered By Insurance Capture Photography

Experience the crisp clarity of this stunning how to get ozempic covered by insurance image, available in high resolution for all your screens.

Vivid How To Get Ozempic Covered By Insurance Picture for Your Screen

Explore this high-quality how to get ozempic covered by insurance image, perfect for enhancing your desktop or mobile wallpaper.

Crisp How To Get Ozempic Covered By Insurance Picture Concept

Immerse yourself in the stunning details of this beautiful how to get ozempic covered by insurance wallpaper, designed for a captivating visual experience.

High-Quality How To Get Ozempic Covered By Insurance Wallpaper Digital Art

Experience the crisp clarity of this stunning how to get ozempic covered by insurance image, available in high resolution for all your screens.

Vivid How To Get Ozempic Covered By Insurance Background Photography

Explore this high-quality how to get ozempic covered by insurance image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get Ozempic Covered By Insurance Image Concept

Transform your screen with this vivid how to get ozempic covered by insurance artwork, a true masterpiece of digital design.

Dynamic How To Get Ozempic Covered By Insurance Capture Digital Art

A captivating how to get ozempic covered by insurance scene that brings tranquility and beauty to any device.

Mesmerizing How To Get Ozempic Covered By Insurance Artwork Nature

Explore this high-quality how to get ozempic covered by insurance image, perfect for enhancing your desktop or mobile wallpaper.

Serene How To Get Ozempic Covered By Insurance Scene Concept

Explore this high-quality how to get ozempic covered by insurance image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How To Get Ozempic Covered By Insurance Moment Collection

Explore this high-quality how to get ozempic covered by insurance image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get Ozempic Covered By Insurance Capture Nature

Find inspiration with this unique how to get ozempic covered by insurance illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get Ozempic Covered By Insurance Abstract Photography

Explore this high-quality how to get ozempic covered by insurance image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful How To Get Ozempic Covered By Insurance Background Nature

Experience the crisp clarity of this stunning how to get ozempic covered by insurance image, available in high resolution for all your screens.

Beautiful How To Get Ozempic Covered By Insurance Moment Digital Art

Experience the crisp clarity of this stunning how to get ozempic covered by insurance image, available in high resolution for all your screens.

0 Response to "How To Get Ozempic Covered By Insurance"

Post a Comment