How To Get Workers Comp Insurance

How To Get Workers Comp Insurance: A Simple Guide for Business Owners

If you're running a business—whether it's a small startup or a growing enterprise—you know that protecting your team is non-negotiable. One of the most critical safeguards you need is Workers' Compensation insurance. This coverage protects both your employees if they get hurt on the job and your business from potentially devastating lawsuits.

The process of securing this coverage can feel a bit overwhelming, especially if you're a new business owner. Don't worry, we're here to simplify it. This comprehensive guide breaks down exactly How To Get Workers Comp Insurance, ensuring you meet legal requirements without the headache.

Let's dive in and make sure your business is properly protected.

Understanding Workers' Compensation: Why You Need It

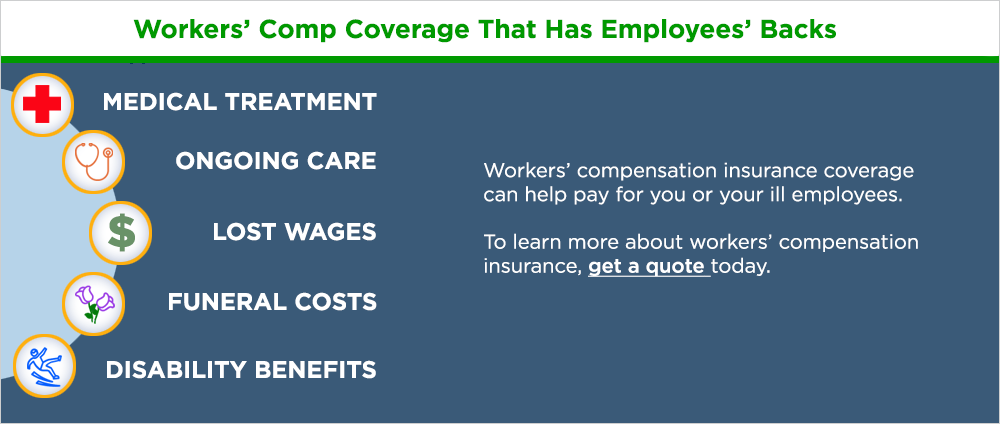

Workers' Compensation, often just called "Workers Comp" or "Workman's Comp," is a type of insurance that provides wage replacement and medical benefits to employees injured in the course of employment. In exchange for this coverage, the employee generally gives up the right to sue their employer for negligence.

For you, the business owner, this insurance is crucial. It acts as a safety net, covering costs related to workplace injuries, from minor sprains requiring physical therapy to catastrophic accidents requiring long-term care. Without it, you could be liable for massive medical bills and lost wages out of pocket.

This coverage is mandatory in almost every U.S. state, though the specific requirements—like how many employees trigger the mandate—vary widely.

Is Workers Comp Mandatory for Your Business?

The short answer is usually yes, but the details depend entirely on where you operate. Most states require coverage even if you have only one employee, and some states even include corporate officers or LLC members in the count. Furthermore, if you hire independent contractors, some states may still consider them employees for the purpose of workers' comp, depending on the nature of their work.

If you fail to provide coverage when mandated, the penalties can be severe. These can include hefty fines, stop-work orders, and even potential criminal charges. Therefore, the first step in learning How To Get Workers Comp Insurance is confirming your state's legal obligations.

Here are the common factors that influence mandatory coverage:

- Number of Employees: Some states have thresholds (e.g., 3 or 5 employees) while others require it for the very first hire.

- Industry Type: High-risk industries (like construction or manufacturing) often have stricter rules.

- Exemptions: Certain types of employment, such as agricultural workers or domestic employees, may be exempt, depending on the state.

Step-by-Step Guide: How To Get Workers Comp Insurance

Now that you understand the necessity, let's walk through the practical steps to secure your policy. Getting covered doesn't have to be complicated if you approach it systematically.

Step 1: Assess Your Needs and Risks

Insurance providers base their quotes almost entirely on the risk associated with your business. The more risk exposure, the higher the premium. Before approaching a broker or insurer, you need to have accurate data ready.

Start by calculating your projected annual payroll. Insurance companies need this number because premiums are ultimately based on how much you pay your workers. Next, you need to accurately describe what your employees actually do.

Identifying Employee Classifications (NOC Codes)

Every job function in the US has a numerical code associated with it, usually called an NCCI classification code (or similar state-specific code). These codes reflect the inherent risk of the work. For example, an administrative assistant has a lower-risk code than a roofer. Misclassifying an employee can lead to incorrect premiums or serious auditing problems later on.

You must break down your total payroll by these classification codes. If you have five office workers and two laborers, their payrolls need to be reported separately using their corresponding codes. Accuracy here is key to managing your costs.

Step 2: Choosing Your Insurance Provider Path

Once you have your payroll figures and classification codes ready, you need to decide where to buy your policy. Depending on your state, you typically have three main avenues:

- Private Carriers: These are standard commercial insurance companies (e.g., Travelers, Hartford). Most businesses use this path.

- State Funds: Some states operate their own workers' comp funds (like Ohio or Wyoming). In these states, you must purchase coverage directly from the state agency.

- Assigned Risk Pool: If your business is considered high-risk, or if you have a poor claim history, private carriers might refuse you. In this case, you can obtain coverage through the state's assigned risk pool (often called the "insurer of last resort").

The Role of Insurance Brokers

For most business owners tackling How To Get Workers Comp Insurance, working with an independent broker is highly recommended. Brokers specialize in commercial coverage and can shop multiple carriers to find you the best rate and coverage options. They also handle the complex paperwork and ensure you are using the correct state classification codes, minimizing future audit issues.

If you choose to bypass a broker, you can approach insurance carriers directly, but you will need to do all the comparison shopping and negotiation yourself.

Step 3: Submitting Your Application and Finalizing the Policy

The application process requires detailed information about your business history, location, payroll, and safety protocols. Be prepared to provide the following:

- Your Employer Identification Number (EIN).

- Detailed payroll projections by job class.

- Details on previous workers' comp claims (if any).

- Information about your safety program and risk management procedures.

Once the insurer reviews your application, they will provide a binding quote. Review the policy carefully. Look at the payment terms, the deductible (if applicable), and ensure the policy effective date aligns with when you need coverage. Once you accept the quote and make the initial payment, your coverage is officially in force. Congratulations, you've mastered the steps for How To Get Workers Comp Insurance!

Costs and Compliance: What Happens After You're Covered?

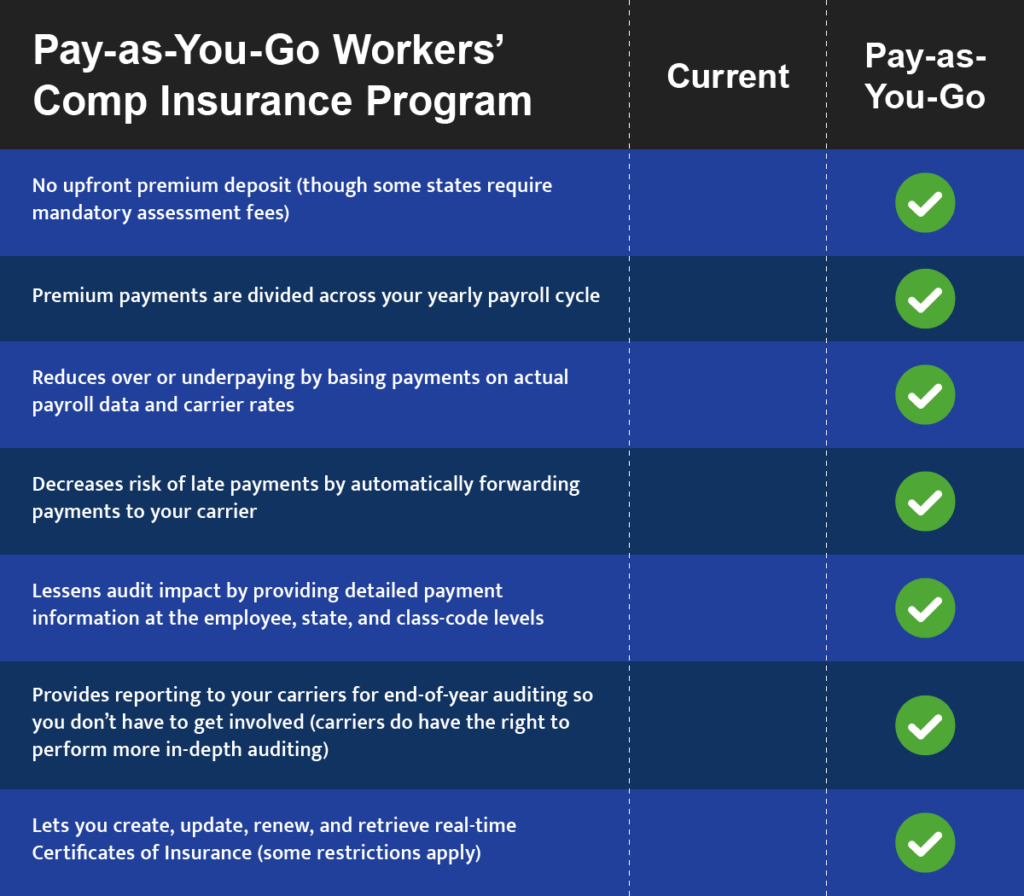

Getting the policy is only the beginning. Workers' comp premiums are generally calculated based on an initial estimate of your payroll. At the end of the policy period, the insurer will conduct an audit (a payroll audit) to verify the actual wages paid during the year.

If your actual payroll was higher than the estimate, you will owe an additional premium. If it was lower, you might receive a refund. Keeping meticulous payroll records throughout the year is essential to prevent unexpected charges during this audit.

Furthermore, maintaining a strong safety culture can significantly reduce your future costs. Fewer claims mean a lower Experience Modification Rate (E-Mod), which is a multiplier applied to your premium. A good E-Mod means lower premiums; a bad E-Mod means higher premiums.

Conclusion: Wrapping Up How To Get Workers Comp Insurance

Securing Workers' Compensation insurance is a necessary legal requirement and a smart business decision. By following a clear process—assessing your state requirements and payroll, accurately classifying your employees, and leveraging the expertise of a broker—you can navigate the market efficiently.

Remember, the core objective when figuring out How To Get Workers Comp Insurance is not just compliance, but the peace of mind that comes from knowing your greatest asset—your employees—are protected should the unthinkable happen. Take the time to get this right, and your business will be on solid ground.

Frequently Asked Questions About Workers Comp

- What is the 'Experience Modification Rate' (E-Mod)?

- The E-Mod is a factor used by insurance carriers to calculate premiums based on your company's actual claims history compared to the expected claims history for similar businesses in your industry. An E-Mod below 1.0 means you have better-than-average claims history, resulting in a premium discount.

- Can I purchase Workers Comp coverage online?

- Yes, many carriers and digital brokers now offer online quoting and purchasing options, especially for smaller, low-risk businesses. However, for complex businesses or those in high-risk industries, working with a specialized agent is usually better.

- If I only hire contractors (1099 workers), do I still need Workers Comp?

- It depends on the state and the nature of the work. While true independent contractors are typically exempt, if a state auditor determines that your "contractors" function more like traditional employees (based on control, supervision, and supplied equipment), you could be required to cover them and face penalties for lack of coverage.

- How long does it take to get coverage?

- If your business is low-risk and you have all your documentation (payroll, EIN) ready, you can often receive a quote and bind coverage within 24 to 48 hours. However, more complex policies or high-risk businesses might take longer for underwriting review.

How To Get Workers Comp Insurance

How To Get Workers Comp Insurance Wallpapers

Collection of how to get workers comp insurance wallpapers for your desktop and mobile devices.

Beautiful How To Get Workers Comp Insurance Landscape for Your Screen

Transform your screen with this vivid how to get workers comp insurance artwork, a true masterpiece of digital design.

Dynamic How To Get Workers Comp Insurance Background for Mobile

Find inspiration with this unique how to get workers comp insurance illustration, crafted to provide a fresh look for your background.

Vivid How To Get Workers Comp Insurance Landscape for Your Screen

Explore this high-quality how to get workers comp insurance image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic How To Get Workers Comp Insurance Scene Concept

A captivating how to get workers comp insurance scene that brings tranquility and beauty to any device.

Amazing How To Get Workers Comp Insurance Artwork in 4K

Explore this high-quality how to get workers comp insurance image, perfect for enhancing your desktop or mobile wallpaper.

Artistic How To Get Workers Comp Insurance Moment Collection

Find inspiration with this unique how to get workers comp insurance illustration, crafted to provide a fresh look for your background.

Serene How To Get Workers Comp Insurance Design in HD

Discover an amazing how to get workers comp insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene How To Get Workers Comp Insurance Wallpaper Art

Transform your screen with this vivid how to get workers comp insurance artwork, a true masterpiece of digital design.

Vibrant How To Get Workers Comp Insurance Abstract for Mobile

Discover an amazing how to get workers comp insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking How To Get Workers Comp Insurance Artwork Photography

Transform your screen with this vivid how to get workers comp insurance artwork, a true masterpiece of digital design.

Detailed How To Get Workers Comp Insurance Image Art

Transform your screen with this vivid how to get workers comp insurance artwork, a true masterpiece of digital design.

Mesmerizing How To Get Workers Comp Insurance Landscape for Mobile

Explore this high-quality how to get workers comp insurance image, perfect for enhancing your desktop or mobile wallpaper.

Artistic How To Get Workers Comp Insurance Landscape Photography

A captivating how to get workers comp insurance scene that brings tranquility and beauty to any device.

Vibrant How To Get Workers Comp Insurance Landscape for Mobile

Explore this high-quality how to get workers comp insurance image, perfect for enhancing your desktop or mobile wallpaper.

Detailed How To Get Workers Comp Insurance Moment in 4K

Transform your screen with this vivid how to get workers comp insurance artwork, a true masterpiece of digital design.

Beautiful How To Get Workers Comp Insurance Picture Illustration

Transform your screen with this vivid how to get workers comp insurance artwork, a true masterpiece of digital design.

Vivid How To Get Workers Comp Insurance Landscape Collection

Discover an amazing how to get workers comp insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic How To Get Workers Comp Insurance Abstract Illustration

Find inspiration with this unique how to get workers comp insurance illustration, crafted to provide a fresh look for your background.

Exquisite How To Get Workers Comp Insurance Background Collection

Find inspiration with this unique how to get workers comp insurance illustration, crafted to provide a fresh look for your background.

Vibrant How To Get Workers Comp Insurance Wallpaper in 4K

Experience the crisp clarity of this stunning how to get workers comp insurance image, available in high resolution for all your screens.

Download these how to get workers comp insurance wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Workers Comp Insurance"

Post a Comment