Turbotax 1041 Software

Don't Fear Form 1041: A Deep Dive into TurboTax 1041 Software Capabilities

Filing tax returns can feel like navigating a dense jungle, and when you introduce the complexities of estates and trusts, that jungle gets even thicker. If you are responsible for managing the income generated by an estate or a complex trust, you are likely facing the infamous IRS Form 1041.

The natural question arises: Can a trusted name like TurboTax handle this specialized filing? The short answer is yes, but with significant caveats. This article will thoroughly explore whether TurboTax 1041 software is the right tool for your fiduciary return, focusing on the necessary versions, the user experience, and the limits of DIY tax preparation in this highly technical area.

We're here to break down the confusion and give you the clear path forward, maintaining a tone that is both relaxed and deeply informative.

Understanding Form 1041: The Basics of Fiduciary Returns

Before jumping into the software, we must establish what Form 1041 is and why it differs so much from the standard Form 1040 (Individual Income Tax Return). The 1041 is known as the U.S. Income Tax Return for Estates and Trusts, and it calculates the taxable income of a fiduciary entity.

Unlike personal income, the core function of the 1041 is often calculating Distributable Net Income (DNI) and determining how income should be allocated between the entity itself and the beneficiaries.

Who Needs to File a 1041?

Generally, an estate or trust must file a 1041 if it meets certain income thresholds, such as having gross income of $600 or more, or if it has a non-resident alien beneficiary. Common scenarios include the income generated after someone passes away (the estate) or ongoing income from assets held in a complex trust.

This is not a form for simple, revocable living trusts while the grantor is alive. Those typically file as disregarded entities, and the income flows directly onto the grantor's personal 1040.

Key Schedules Involved: The K-1 Nightmare (or Necessity)

One of the most complex parts of the 1041 process is generating the Schedule K-1. This schedule reports each beneficiary's share of the income, deductions, and credits. Every K-1 issued to a beneficiary must accurately reflect the complex allocations defined in the trust or estate document.

Any reliable TurboTax 1041 software solution must handle the K-1 generation and distribution process seamlessly, as errors here impact multiple individual returns.

[Baca Juga: Understanding Schedule K-1 for Trusts]

Which TurboTax Product Handles the 1041 Form?

This is the most critical piece of information. If you head to the grocery store and buy the standard TurboTax Deluxe or Premier CD, you will quickly find out those versions do *not* support Form 1041.

Filing the 1041 return requires the specific, often desktop-only, version designed for business and complex entity returns. Historically, this has been **TurboTax Business**.

The TurboTax Business Requirement

TurboTax Business is generally the only consumer-facing software offered by Intuit that supports Forms 1065 (Partnership), 1120/1120-S (Corporate), and crucially, Form 1041 (Estate/Trust). This version is typically purchased as a standalone desktop download or physical CD and is separate from the online versions used for personal returns.

It's essential to verify the current tax year's version specifics, as Intuit occasionally adjusts its product lineup, but the segregation of 1041 remains consistent.

Why Online TurboTax Won't Work

The online versions of TurboTax (Basic, Deluxe, Premier, Self-Employed) are designed for individual filers (1040 series) and do not contain the specialized modules, interview questions, or logic needed to calculate DNI, handle complex principal/income allocations, or generate accurate Schedule K-1s for multiple beneficiaries.

The complexity of trust instruments requires software with much deeper logic than a standard personal tax calculator can provide.

Step-by-Step UX: Using TurboTax 1041 Software

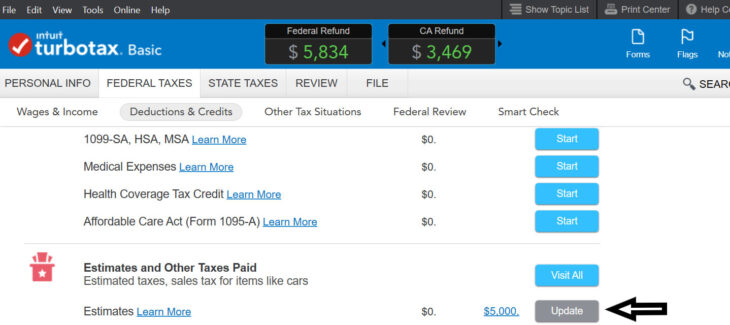

Assuming you have purchased the correct TurboTax Business product, how does the experience feel? The good news is that Intuit's core strength—the guided interview process—is still present, though it's necessarily more detailed.

Data Input and Navigation

The software guides the user through various sections corresponding to the lines on the 1041 form. You will be prompted to enter income (interest, dividends, rental income), deductions (fiduciary fees, attorney costs), and most importantly, the trust or estate document details that dictate distributions.

The UX is generally strong for inputting basic financial data, similar to the 1040 process. The challenge comes in accurately classifying the income as taxable to the trust/estate or distributable to the beneficiaries.

Handling Complex Distributions: Where DIY Gets Tricky

If your trust is simple—meaning all income must be distributed annually—the TurboTax 1041 software handles the math quite well. However, if you manage a complex trust where the fiduciary has discretion over distributions, or if there are specific rules about distributing principal versus income, the software requires expert input.

You must accurately categorize every distribution, ensuring compliance with both the IRS code and the governing legal instrument. This is where even good software can't replace tax expertise. For high-stakes or complex trusts, consulting a tax professional is highly recommended regardless of the software used.

[Baca Juga: Guide to Trust Fiduciary Responsibilities]

Comparison: TurboTax 1041 vs. Professional Alternatives

TurboTax 1041 software exists in a unique space. It's significantly cheaper than professional accounting software but vastly more expensive and complex than standard consumer tax software. Here is how it stacks up against alternatives:

| Feature | TurboTax Business (1041) | Intuit ProConnect (Pro) | Specialized Fiduciary Software (e.g., CCH) |

|---|---|---|---|

| Target User | DIY Fiduciary, Small/Simple Estates | Tax Professionals, CPAs | Trust Accountants, Wealth Managers |

| Cost (Annual Estimate) | $150 - $200 (One-time purchase) | Varies widely (Per-return fee or subscription) | $1,000+ (High annual subscription) |

| State Returns | Often included/available as add-on | Comprehensive state filing included | |

| Complexity Handling | Good for simple distributions/allocations | Handles all levels of complexity |

If your situation is straightforward—say, a deceased person's estate generating simple investment income for one year—TurboTax 1041 software is a highly cost-effective and reliable DIY solution. If the trust involves business interests, complex capital gains, or complicated remainder allocations, professional software (or a professional preparer) is the wiser choice.

For more detailed information on fiduciary rules, the official IRS documentation is always the ultimate source of truth in Publication 559.

Conclusion: Is TurboTax 1041 Software Right for You?

TurboTax 1041 software, housed exclusively within the TurboTax Business product, is a powerful tool for the informed executor or trustee. It successfully bridges the gap between consumer tax software and professional applications, providing a guided experience for a notoriously difficult form.

However, the key determinant of success isn't the software itself, but the user's understanding of fiduciary accounting principles. If you are confident in your ability to distinguish between principal and income, and understand the requirements laid out in the governing legal document, TurboTax 1041 software provides excellent value and capability for most non-professional users.

Frequently Asked Questions (FAQ)

Since Form 1041 is complex, here are the most common questions regarding using TurboTax for fiduciary returns:

- Can I use the standard TurboTax Premier online version to file Form 1041?

No. You must purchase the TurboTax Business desktop software (or a comparable professional-grade Intuit product) to access and file Form 1041. The online consumer versions do not include the necessary forms or logic.

- Does TurboTax 1041 software handle state fiduciary returns?

Generally, yes. The TurboTax Business desktop version usually supports the most common state fiduciary returns, often as a separate add-on purchase or download. Always check the specific version details for your state before purchasing.

- Is the help guidance in TurboTax Business sufficient for a beginner?

While TurboTax provides helpful guidance, Form 1041 requires a fundamental understanding of trust documentation and fiduciary duties that goes beyond typical tax knowledge. The software is excellent for computation, but not a replacement for legal interpretation of the trust/estate documents.

- How do I handle the Schedule K-1 distribution process using the software?

Once you input the trust/estate income and deductions, the software calculates the Distributable Net Income (DNI). It then guides you through generating individual Schedule K-1s based on the distributions you entered, which are then provided to the beneficiaries for their personal 1040 filings.

Turbotax 1041 Software

Turbotax 1041 Software Wallpapers

Collection of turbotax 1041 software wallpapers for your desktop and mobile devices.

Spectacular Turbotax 1041 Software Background in HD

This gorgeous turbotax 1041 software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Turbotax 1041 Software Photo Digital Art

A captivating turbotax 1041 software scene that brings tranquility and beauty to any device.

Dynamic Turbotax 1041 Software Capture for Your Screen

This gorgeous turbotax 1041 software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking Turbotax 1041 Software Photo Illustration

Experience the crisp clarity of this stunning turbotax 1041 software image, available in high resolution for all your screens.

Dynamic Turbotax 1041 Software Background Digital Art

A captivating turbotax 1041 software scene that brings tranquility and beauty to any device.

Exquisite Turbotax 1041 Software Artwork Art

A captivating turbotax 1041 software scene that brings tranquility and beauty to any device.

Crisp Turbotax 1041 Software Moment for Your Screen

Find inspiration with this unique turbotax 1041 software illustration, crafted to provide a fresh look for your background.

Detailed Turbotax 1041 Software Moment in 4K

Explore this high-quality turbotax 1041 software image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous Turbotax 1041 Software Capture in HD

Immerse yourself in the stunning details of this beautiful turbotax 1041 software wallpaper, designed for a captivating visual experience.

Vibrant Turbotax 1041 Software Design in 4K

Experience the crisp clarity of this stunning turbotax 1041 software image, available in high resolution for all your screens.

Spectacular Turbotax 1041 Software Artwork for Your Screen

A captivating turbotax 1041 software scene that brings tranquility and beauty to any device.

Mesmerizing Turbotax 1041 Software Moment in 4K

Transform your screen with this vivid turbotax 1041 software artwork, a true masterpiece of digital design.

Spectacular Turbotax 1041 Software Scene for Mobile

A captivating turbotax 1041 software scene that brings tranquility and beauty to any device.

High-Quality Turbotax 1041 Software Moment Art

Explore this high-quality turbotax 1041 software image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing Turbotax 1041 Software Landscape Collection

Transform your screen with this vivid turbotax 1041 software artwork, a true masterpiece of digital design.

Vibrant Turbotax 1041 Software Background Nature

Discover an amazing turbotax 1041 software background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Turbotax 1041 Software Moment Digital Art

Transform your screen with this vivid turbotax 1041 software artwork, a true masterpiece of digital design.

Vivid Turbotax 1041 Software Design Photography

Experience the crisp clarity of this stunning turbotax 1041 software image, available in high resolution for all your screens.

Spectacular Turbotax 1041 Software Picture Collection

Immerse yourself in the stunning details of this beautiful turbotax 1041 software wallpaper, designed for a captivating visual experience.

Captivating Turbotax 1041 Software Moment in 4K

Find inspiration with this unique turbotax 1041 software illustration, crafted to provide a fresh look for your background.

Download these turbotax 1041 software wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Turbotax 1041 Software"

Post a Comment