What Interest Rate Will I Get

What Interest Rate Will I Get? Your Guide to Understanding Loan Costs

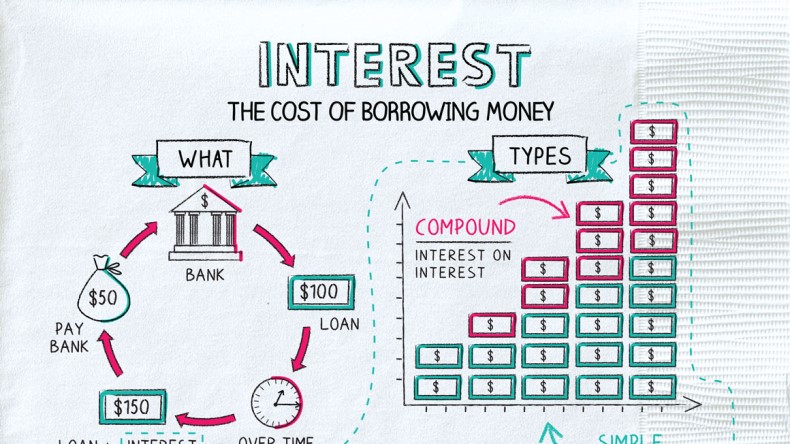

That is perhaps the biggest question on anyone's mind when they decide to borrow money. Whether you are looking for a new home, a car, or a simple personal loan, the interest rate you are offered can make or break your budget. It's not just a random number; it's a reflection of your financial health and the risk the lender is taking.

The short answer to What Interest Rate Will I Get is: it depends entirely on your specific situation. Don't worry, we are going to break down all the major elements that lenders use to calculate your personal rate. By the end of this article, you will know exactly what levers you can pull to get the lowest rate possible.

The Core Factors Influencing Your Interest Rate

Lenders are essentially risk assessors. When they look at your loan application, they are trying to determine the likelihood that you will pay them back on time, every time. The lower the perceived risk, the lower the interest rate they are willing to offer you. Here are the three main ingredients in that calculation.

Credit Score: Your Financial Report Card

Your credit score is arguably the most critical factor. It summarizes your past borrowing behavior, showing lenders how reliable you have been with previous debts. Higher scores indicate lower risk, leading to significantly better rates.

Generally, credit scores fall into tiers, and the tier you land in dictates the range of rates available to you. If you have a score below 620, you might still qualify for a loan, but the interest rate will be substantially higher to compensate the lender for the increased risk.

Typical Credit Score Tiers and Rate Impact

Understanding where you fall on this scale is the first step in knowing What Interest Rate Will I Get. If you are aiming for prime rates, a score above 740 is usually necessary.

- **Excellent (780+):** Access to the lowest advertised rates and best loan terms.

- **Good (700–779):** Very competitive rates, highly likely to be approved.

- **Fair (620–699):** Average rates; loans are accessible but may require careful budgeting.

- **Poor (Below 620):** High interest rates, potentially limited loan options, often requiring collateral.

Debt-to-Income (DTI) Ratio and Employment Stability

Lenders also need to know if you can actually afford the monthly payments. This is where your DTI ratio comes in. Your DTI is the percentage of your gross monthly income that goes toward servicing existing debt payments (credit cards, existing loans, rent/mortgage).

A low DTI (ideally below 36%) signals that you have plenty of leftover income to comfortably handle a new loan payment. If your DTI is too high, the lender sees higher repayment stress, and they will likely charge a higher interest rate—or deny the loan outright.

Additionally, consistent and stable employment over several years is a huge plus. Lenders prefer borrowers who can demonstrate reliable income history, as this drastically reduces the perceived risk of default.

Types of Loans and Their Rate Structures

The type of loan you seek also profoundly impacts the interest rate you are quoted. A 30-year mortgage will have a completely different rate structure than a two-year personal loan or a credit card.

Secured vs. Unsecured Loans

This is a fundamental differentiator in the loan world. Secured loans require collateral, meaning you offer up an asset (like a house or car) that the lender can seize if you default. Unsecured loans, like personal loans or credit cards, require no collateral.

Because secured loans offer the lender a safety net, they almost always come with lower interest rates. If you want to know What Interest Rate Will I Get, recognize that loans secured by high-value assets (like mortgages) attract the lowest rates in the marketplace.

Fixed vs. Variable Rates: Which is Right for You?

When reviewing loan offers, you must pay attention to whether the rate is fixed or variable. This determines the predictability and potential risk of your future payments.

- **Fixed Rate:** The interest rate remains the same for the entire life of the loan. This provides stability and predictability, making budgeting much easier. While the initial fixed rate might be slightly higher than a variable rate, you are protected if market rates increase dramatically.

- **Variable (Adjustable) Rate:** The interest rate can fluctuate based on a benchmark interest rate (like the prime rate or SOFR). Your rate could go down, saving you money, or it could go up, increasing your monthly payments. These are often used for adjustable-rate mortgages (ARMs).

If you prefer certainty and have a long repayment timeline, a fixed rate is usually the safer choice. If you anticipate paying the loan off quickly or believe market rates will fall, a variable rate might offer temporary savings.

How to Improve Your Chances of Getting the Best Rate

You are not powerless in this process. While market conditions are outside your control, several steps can drastically improve the personal interest rate you qualify for.

Shopping Around for Lenders

Never take the first offer you receive. Different lenders—banks, credit unions, and online providers—have varying risk models and overhead costs, meaning they will offer different rates even for the exact same borrower profile.

Applying for pre-approval with several institutions within a short window (usually 14 to 45 days, depending on the credit model) minimizes the impact on your credit score. This allows you to compare actual offers side-by-side and truly understand the lowest rate available to you.

Negotiating Your Interest Rate

Yes, sometimes you can negotiate, especially for car loans or mortgages. If you have a solid credit history and a competitive offer from another lender, use it as leverage.

Simply telling your preferred lender, "Lender B offered me 5.5%, can you match or beat that?" can often shave valuable basis points off your rate. Don't be afraid to ask!

Key Preparation Steps Before Applying

Before you even submit an application, take these steps to ensure you put your best foot forward:

- **Review Your Credit Report:** Check for any errors or inaccuracies that might be artificially dragging your score down. Dispute these immediately.

- **Pay Down High-Interest Debt:** Reducing your credit utilization ratio (how much debt you have versus your available credit) can quickly boost your score.

- **Save a Larger Down Payment:** For secured loans, a larger down payment reduces the principal loan amount and signals financial stability, often leading to better rates.

Conclusion: Knowing Where You Stand

Determining What Interest Rate Will I Get is about understanding the intersection of your financial profile and current market conditions. The best rates are reserved for borrowers with high credit scores (740+), low debt-to-income ratios (under 36%), and a reliable work history.

Remember that you have the power to improve your rate by strengthening your credit and meticulously comparing offers from multiple lenders. By approaching the loan process informed and prepared, you can secure the financing you need without paying more in interest than absolutely necessary.

Frequently Asked Questions (FAQ)

- What is the difference between APR and interest rate?

- The interest rate is the percentage charged on the principal loan amount. The Annual Percentage Rate (APR) is broader; it includes the interest rate plus any additional mandatory fees (like origination or processing fees). The APR gives you a truer picture of the total annual cost of borrowing.

- Will checking my rate multiple times hurt my credit score?

- Generally, no, if you do it correctly. Most lenders offer a "soft inquiry" or pre-qualification check which does not impact your score. If you proceed to a full loan application, that is a "hard inquiry" and might temporarily drop your score by a few points. However, credit models treat multiple hard inquiries for the same type of loan (like a mortgage or auto loan) within a short window (often 14-45 days) as a single inquiry, so shopping around is fine.

- Does the loan term affect the interest rate I get?

- Yes, it often does. Longer loan terms (e.g., a 30-year mortgage versus a 15-year mortgage) typically come with a higher interest rate because the lender is exposed to the risk of default for a longer period. While the longer term means lower monthly payments, you pay significantly more interest overall.

- Can I refinance my loan later if I improve my credit score?

- Absolutely. Refinancing is a great strategy if your financial profile has improved significantly since you originally took out the loan. If your credit score has increased, or interest rates have dropped generally, you may be able to refinance into a new loan with a lower interest rate, saving you thousands over the life of the debt.

What Interest Rate Will I Get

What Interest Rate Will I Get Wallpapers

Collection of what interest rate will i get wallpapers for your desktop and mobile devices.

Mesmerizing What Interest Rate Will I Get View for Mobile

Experience the crisp clarity of this stunning what interest rate will i get image, available in high resolution for all your screens.

Breathtaking What Interest Rate Will I Get Picture Collection

Explore this high-quality what interest rate will i get image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic What Interest Rate Will I Get Background for Mobile

Find inspiration with this unique what interest rate will i get illustration, crafted to provide a fresh look for your background.

Vivid What Interest Rate Will I Get Picture Nature

Discover an amazing what interest rate will i get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite What Interest Rate Will I Get Landscape Digital Art

Immerse yourself in the stunning details of this beautiful what interest rate will i get wallpaper, designed for a captivating visual experience.

Serene What Interest Rate Will I Get View Digital Art

Explore this high-quality what interest rate will i get image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic What Interest Rate Will I Get Photo for Desktop

Immerse yourself in the stunning details of this beautiful what interest rate will i get wallpaper, designed for a captivating visual experience.

Crisp What Interest Rate Will I Get Moment for Mobile

Find inspiration with this unique what interest rate will i get illustration, crafted to provide a fresh look for your background.

Beautiful What Interest Rate Will I Get View Illustration

Transform your screen with this vivid what interest rate will i get artwork, a true masterpiece of digital design.

Stunning What Interest Rate Will I Get Background Digital Art

A captivating what interest rate will i get scene that brings tranquility and beauty to any device.

Captivating What Interest Rate Will I Get Capture Art

This gorgeous what interest rate will i get photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking What Interest Rate Will I Get Moment Collection

Transform your screen with this vivid what interest rate will i get artwork, a true masterpiece of digital design.

/GettyImages-140671550-56a636e83df78cf7728bdbc1.jpg)

High-Quality What Interest Rate Will I Get Artwork in HD

Transform your screen with this vivid what interest rate will i get artwork, a true masterpiece of digital design.

Breathtaking What Interest Rate Will I Get Moment for Desktop

Discover an amazing what interest rate will i get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed What Interest Rate Will I Get Wallpaper Digital Art

Explore this high-quality what interest rate will i get image, perfect for enhancing your desktop or mobile wallpaper.

Amazing What Interest Rate Will I Get Capture for Desktop

Discover an amazing what interest rate will i get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing What Interest Rate Will I Get Image Photography

Experience the crisp clarity of this stunning what interest rate will i get image, available in high resolution for all your screens.

Spectacular What Interest Rate Will I Get Capture Nature

Find inspiration with this unique what interest rate will i get illustration, crafted to provide a fresh look for your background.

Exquisite What Interest Rate Will I Get View Collection

Immerse yourself in the stunning details of this beautiful what interest rate will i get wallpaper, designed for a captivating visual experience.

Artistic What Interest Rate Will I Get Moment for Mobile

Immerse yourself in the stunning details of this beautiful what interest rate will i get wallpaper, designed for a captivating visual experience.

Download these what interest rate will i get wallpapers for free and use them on your desktop or mobile devices.

0 Response to "What Interest Rate Will I Get"

Post a Comment