What Percent Do You Get Back In Taxes

What Percent Do You Get Back In Taxes? A Friendly Guide to Understanding Your Refund

Tax season can feel like a guessing game. You file your return, cross your fingers, and hope for a hefty chunk of change back. But the burning question remains: what percent do you get back in taxes? If you've ever wondered if there's a standard percentage everyone receives, you've come to the right place.

The short answer is that there isn't a fixed, universal percentage. Your tax refund percentage is deeply personal and depends entirely on your specific financial situation, how much tax you paid throughout the year, and the credits and deductions you qualify for. Think of it as a unique financial fingerprint!

We're going to break down exactly how your refund is calculated, the factors that dramatically swing that number, and how you can take control of your financial planning so you aren't leaving money on the table.

Understanding Tax Refunds: It's Not Free Money

Before we dive into percentages, it's crucial to understand what a tax refund actually is. Many people mistake it for a bonus from the government, but that's far from the truth. A tax refund is simply the excess money you paid to the government throughout the tax year.

Every time you get a paycheck, your employer typically withholds federal income taxes based on the information you provided on your W-4 form. This withheld amount is an estimate of what you owe for the year. Your refund occurs when the total amount withheld is greater than your actual tax liability (what you truly owe).

For example, if you had $10,000 withheld throughout the year, but your final tax liability calculated on your return is only $8,500, you will receive a $1,500 refund. The refund percentage, therefore, is directly tied to the difference between your withholding and your true tax obligation.

The Difference Between Tax Bracket and Effective Tax Rate

When discussing tax percentages, two terms often cause confusion: your tax bracket and your effective tax rate. Understanding this difference is key to knowing how much tax you really paid.

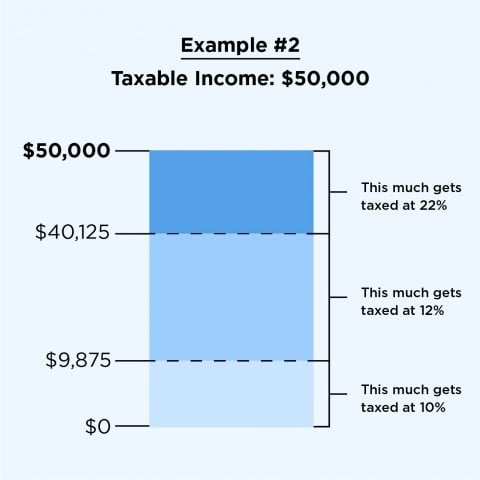

Your tax bracket is the marginal rate applied to the last dollar you earned. The US uses a progressive tax system, meaning you pay different rates on different portions of your income.

Conversely, your effective tax rate is the actual percentage of your total taxable income that you paid in taxes. This is always lower than your top tax bracket percentage. When people ask, "What percent do you get back in taxes?" they are often trying to figure out if their effective rate was too high.

Key Factors Influencing Your Tax Refund Percentage

The size of your refund—and thus, the "percentage" of previously paid taxes you get back—is driven by several dynamic variables. These variables determine whether you overpaid significantly or underpaid throughout the year.

Here are the top factors that influence your tax refund:

- W-4 Accuracy: The allowances or information you provided on your W-4 directly controls how much your employer withholds. If you claimed too few dependents or didn't account for deductions, you likely overpaid and will see a larger refund.

- Tax Credits: Credits are hugely impactful because they reduce your tax liability dollar-for-dollar. Certain refundable credits, like the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit, can generate a refund even if you had zero tax liability.

- Deductions (Standard vs. Itemized): Deductions reduce your taxable income. If your itemized deductions (e.g., mortgage interest, medical expenses) are significantly higher than the standard deduction, your tax liability decreases, increasing your potential refund.

- Changes in Income or Life Events: Getting married, having a baby, or moving states can drastically change your tax liability mid-year. If your withholding wasn't adjusted immediately, this often leads to a large refund.

Why Getting a Big Refund Isn't Always the Best Thing

While receiving a massive refund check feels like a win, financially speaking, it often means you mismanaged your money throughout the year. Essentially, you gave the IRS an interest-free loan.

Imagine if that money—the percentage you got back—had been in your savings account or invested in the stock market throughout the year. You could have earned interest or dividends. Therefore, the optimal goal for savvy financial planning isn't to ask what percent do you get back in taxes, but rather, "How can I make my refund as close to zero as possible?"

Getting a small refund, or even owing a small amount, indicates that your withholding was accurate, and you had access to your money throughout the year when you needed it most.

How to Estimate Your Tax Refund Percentage

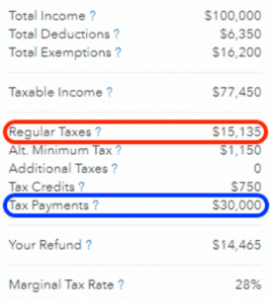

If you want to move away from guesswork and get a clearer picture of your expected refund, the IRS provides excellent tools. This process involves calculating your current tax liability versus your year-to-date withholding.

Follow these steps to estimate your potential refund:

- Review Pay Stubs: Total the federal income tax withheld from all your paychecks throughout the year. This is the total amount you've prepaid.

- Calculate Taxable Income: Start with your gross income and subtract above-the-line deductions (like 401k contributions or HSA contributions) to find your Adjusted Gross Income (AGI).

- Apply Deductions: Subtract either the standard deduction for your filing status or your total itemized deductions from your AGI to find your taxable income.

- Determine Liability: Use the IRS tax tables (or an online calculator) to find the tax owed based on your filing status and taxable income.

- Calculate Refund: Subtract your total tax liability from your total withholding. A positive number is your estimated refund.

Maximizing Your Return: Tips and Tricks for Taxpayers

If you prefer a larger refund over adjusting your withholding—perhaps you use it as forced savings—there are legal and strategic ways to ensure you maximize the percentage you get back in taxes. The key is to optimize your deductions and credits.

Don't Overlook Valuable Tax Credits

Credits are the most powerful tool for boosting your refund because they directly chip away at your tax bill. Always check your eligibility for these common credits:

- Child Tax Credit (CTC): A significant credit for parents, partially or fully refundable, depending on your income.

- Earned Income Tax Credit (EITC): Specifically designed for low-to-moderate-income working individuals and families, this is one of the biggest refund generators.

- Education Credits: Credits like the American Opportunity Tax Credit or Lifetime Learning Credit can offset the cost of higher education expenses.

- Saver's Credit: Designed to help those who save for retirement, providing a credit based on contributions to an IRA or employer-sponsored plan.

The Importance of Record Keeping

A surprising number of taxpayers miss out on potential refunds simply because they don't keep meticulous records. If you itemize, every receipt for eligible medical expenses, charitable donations, or business mileage counts. The better your documentation, the more confident you can be in claiming every dollar you are owed.

Additionally, remember to review your W-4 form annually. If you had a major life change (marriage, divorce, new dependent), updating your W-4 prevents significant over-withholding, ensuring you get the most accurate percentage of your money throughout the year, not just at tax time.

Conclusion: What Percent Do You Get Back In Taxes? It Varies Wildly

So, we come back to the core question: what percent do you get back in taxes? The answer remains highly conditional. There is no percentage average you should rely on. A person who claimed zero dependents and qualifies for three refundable tax credits might receive back 20% or more of their gross income, while someone with perfectly balanced withholding might receive back 0.5%.

Your refund is not determined by a set rate, but by the complex interplay of your income, your deductions, and the credits you claim. By understanding your withholding and proactively seeking out tax credits, you can stop guessing and start controlling the flow of your money throughout the year.

Frequently Asked Questions (FAQ) About Tax Refunds

- What is the average tax refund amount in the U.S.?

- While the specific average varies year-to-year, the typical federal tax refund is often in the range of $2,500 to $3,000. However, relying on this average doesn't tell you what percent do you get back in taxes, as it's an average dollar amount, not a percentage calculation.

- Is it better to get a large refund or a small refund?

- Financially, it is generally better to aim for a refund close to zero. A large refund means you provided an interest-free loan to the government throughout the year. A small refund means you kept more of your money working for you in your bank account or investments.

- How does my W-4 affect the percentage I get back?

- Your W-4 form dictates how much tax is withheld from each paycheck. If you over-withhold (which happens if your W-4 is filled out conservatively), you are essentially forcing yourself to get a larger percentage back at the end of the year.

- Can tax credits increase my refund percentage above 100% of my tax liability?

- Yes, if you qualify for refundable tax credits (like the Earned Income Tax Credit or the Additional Child Tax Credit). These credits can reduce your tax liability to zero and then result in a payment of the remaining credit amount to you, thus creating a refund even if you had no tax owed.

What Percent Do You Get Back In Taxes

What Percent Do You Get Back In Taxes Wallpapers

Collection of what percent do you get back in taxes wallpapers for your desktop and mobile devices.

Exquisite What Percent Do You Get Back In Taxes Landscape Digital Art

Find inspiration with this unique what percent do you get back in taxes illustration, crafted to provide a fresh look for your background.

Gorgeous What Percent Do You Get Back In Taxes Landscape for Desktop

This gorgeous what percent do you get back in taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene What Percent Do You Get Back In Taxes Wallpaper Collection

Explore this high-quality what percent do you get back in taxes image, perfect for enhancing your desktop or mobile wallpaper.

Stunning What Percent Do You Get Back In Taxes Capture in 4K

This gorgeous what percent do you get back in taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality What Percent Do You Get Back In Taxes Capture Art

Experience the crisp clarity of this stunning what percent do you get back in taxes image, available in high resolution for all your screens.

Amazing What Percent Do You Get Back In Taxes Capture for Mobile

Discover an amazing what percent do you get back in taxes background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous What Percent Do You Get Back In Taxes Scene Art

This gorgeous what percent do you get back in taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene What Percent Do You Get Back In Taxes View in HD

Explore this high-quality what percent do you get back in taxes image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking What Percent Do You Get Back In Taxes Capture Concept

Discover an amazing what percent do you get back in taxes background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp What Percent Do You Get Back In Taxes View Illustration

This gorgeous what percent do you get back in taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush What Percent Do You Get Back In Taxes Scene Illustration

A captivating what percent do you get back in taxes scene that brings tranquility and beauty to any device.

Beautiful What Percent Do You Get Back In Taxes Capture Concept

Explore this high-quality what percent do you get back in taxes image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful What Percent Do You Get Back In Taxes Abstract for Your Screen

Transform your screen with this vivid what percent do you get back in taxes artwork, a true masterpiece of digital design.

Gorgeous What Percent Do You Get Back In Taxes Background Concept

This gorgeous what percent do you get back in taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite What Percent Do You Get Back In Taxes View Illustration

Find inspiration with this unique what percent do you get back in taxes illustration, crafted to provide a fresh look for your background.

Spectacular What Percent Do You Get Back In Taxes Scene Nature

Find inspiration with this unique what percent do you get back in taxes illustration, crafted to provide a fresh look for your background.

Exquisite What Percent Do You Get Back In Taxes Scene for Mobile

Find inspiration with this unique what percent do you get back in taxes illustration, crafted to provide a fresh look for your background.

Stunning What Percent Do You Get Back In Taxes Background Photography

Find inspiration with this unique what percent do you get back in taxes illustration, crafted to provide a fresh look for your background.

Beautiful What Percent Do You Get Back In Taxes Background in 4K

Experience the crisp clarity of this stunning what percent do you get back in taxes image, available in high resolution for all your screens.

Gorgeous What Percent Do You Get Back In Taxes Photo Collection

Find inspiration with this unique what percent do you get back in taxes illustration, crafted to provide a fresh look for your background.

Download these what percent do you get back in taxes wallpapers for free and use them on your desktop or mobile devices.

0 Response to "What Percent Do You Get Back In Taxes"

Post a Comment