How Do I Get An Auto Loan

How Do I Get An Auto Loan: Your Step-by-Step Friendly Guide

Thinking about buying a new car? That's exciting! However, the process often stops cold when people ask the crucial question: How do I get an auto loan? It can feel complicated, full of jargon, and maybe a little intimidating, but trust us, it doesn't have to be.

Securing the right financing is just as important as choosing the right vehicle. A good auto loan means manageable monthly payments and less stress down the road. This comprehensive guide will break down the entire process into simple, actionable steps, ensuring you are prepared to negotiate and drive away happy.

We're going to walk you through everything, from checking your credit score to signing on the dotted line. Ready to get started?

Preparation is Key: Getting Your Financial Ducks in a Row

Before you even step foot in a dealership or browse online car listings, you need to understand your current financial standing. Lenders look closely at your ability to repay the loan, and preparing early gives you a significant advantage.

Understanding Your Credit Score

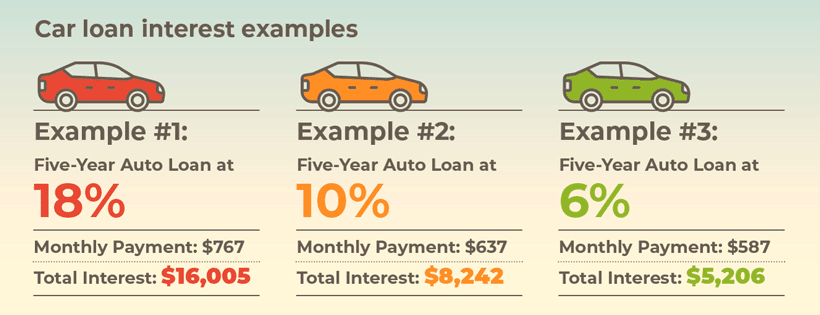

Your credit score is the single most important factor determining your interest rate (APR). A higher score translates directly to a lower interest rate, which can save you thousands of dollars over the life of the loan. Therefore, pulling your credit report early is essential.

Take time to review your report for any errors. If you spot mistakes, dispute them immediately, as this could quickly boost your score. Knowing your score also helps you set realistic expectations for the loan terms you will be offered.

Generally speaking, a score above 700 is considered good, while 740 and above will likely secure you the best rates. If your score is low, consider waiting a few months to pay down existing debt before applying for an auto loan.

Calculating Your Budget and Down Payment

How much car can you actually afford? Financial experts recommend that your total car expenses (including insurance and maintenance) should not exceed 10% to 15% of your take-home pay. Be mindful that aiming for the lowest possible monthly payment often means extending the loan term, which results in paying much more interest overall.

Furthermore, prepare a healthy down payment. Putting money down shows the lender that you are committed and reduces the principal amount you need to borrow. A minimum 10% down payment is often advised, but 20% is ideal, especially for new cars, as it helps prevent you from being "upside down" on your loan (owing more than the car is worth).

The Hunt Begins: Securing Your Financing

Once you know what you can afford, it's time to start shopping for the loan itself. This step is critical because having financing secured before you talk to the dealer gives you powerful negotiating leverage.

Pre-Approval vs. Dealer Financing

When asking, "How do I get an auto loan?" you essentially have two main paths: getting pre-approved by a third party or using the dealership's financing office. We highly recommend starting with pre-approval.

Pre-approval is an offer from a lender stating they are willing to lend you up to a certain amount at a specific interest rate. When you walk into the dealership with a pre-approval letter, you stop negotiating the *financing* and focus only on the *price* of the car. This prevents dealers from obscuring the true cost by manipulating the loan terms.

Dealer financing can sometimes offer excellent deals, especially promotional rates (like 0% APR) directly from the manufacturer. However, having a pre-approval in hand acts as a competitive benchmark. If the dealer can't beat your outside rate, you simply use the pre-approved loan.

Where to Apply for an Auto Loan Pre-Approval

The key to securing the best rate is to shop around. Don't settle for the first offer you receive. Apply to at least three different lenders within a two-week window, as multiple loan inquiries during this period generally count as a single inquiry on your credit report.

- Banks: Large national banks often offer competitive rates, especially if you are an existing customer.

- Credit Unions: These often have the lowest interest rates because they are non-profit organizations. Membership might be required, but it's often simple to join.

- Online Lenders: Companies specializing in online financing often offer quick decisions and streamlined application processes.

Navigating the Application Process

Whether you choose an external lender or the dealer, the application process requires specific documentation to verify your identity and financial stability. Being organized will speed up the entire transaction significantly.

Required Documents for an Auto Loan

Make sure you have all these items ready before submitting your application. This prevents frustrating delays and shows the lender you are a serious borrower.

- Proof of Identity (Driver's License, Passport).

- Proof of Income (Recent pay stubs or tax returns if self-employed).

- Proof of Residence (Utility bill or lease agreement).

- Auto Insurance Information (Required before the loan is finalized).

- Social Security Number (For credit check purposes).

If you are trading in an old vehicle, you will also need the title and registration documents for that car.

Comparing Loan Offers

When comparing the different pre-approval offers you've received, you must look beyond just the monthly payment. Focus primarily on the Annual Percentage Rate (APR) and the loan term.

The APR is the true cost of borrowing, as it includes the interest rate and any fees. Always choose the lowest APR available. Furthermore, be careful of excessively long loan terms (like 72 or 84 months). While they lower the monthly payment, they drastically increase the total interest paid and keep you in debt longer.

Choose the shortest term you can comfortably afford to minimize the overall cost of ownership.

Finalizing the Deal and Driving Away

Once you have decided on the vehicle and the financing, the final step involves signing the contracts. Read everything carefully! Watch out for hidden fees or expensive add-ons like extended warranties, gap insurance, or fabric protection that may have been silently included in the financing agreement.

If you have your external pre-approval, confirm that the dealer is using that specific financing or has offered an even better rate. Ensure the final APR and loan amount match the figures you agreed upon.

Ultimately, by preparing your finances, shopping for the best rate, and staying focused during negotiations, you have successfully answered the question, "How do I get an auto loan?" You are now ready to enjoy your new ride!

Conclusion

Getting an auto loan doesn't have to be a source of anxiety. By following a methodical approach—understanding your credit, defining your budget, securing pre-approval, and comparing offers—you place yourself in a powerful position. Remember, lenders are competing for your business, so use that to your advantage.

By taking these steps, you will not only know definitively How Do I Get An Auto Loan but you will also ensure you get the absolute best deal possible, saving you money and setting you up for financial success with your new vehicle.

Frequently Asked Questions (FAQ) About Auto Loans

- What is the minimum credit score needed to get an auto loan?

- While you can technically get a loan with a very low score (often called a subprime loan), most prime lenders prefer a minimum score in the high 600s. Scores below 600 will face very high interest rates and fees.

- Is pre-approval guaranteed financing?

- No, pre-approval is not a guarantee. It is an initial commitment based on the information you provided and your credit check. The final approval is contingent on verifying all your documents and ensuring the chosen vehicle meets the lender's criteria (e.g., age and mileage limits).

- Does applying for an auto loan hurt my credit score?

- Yes, it results in a "hard inquiry," which can temporarily drop your score by a few points. However, if you apply to multiple lenders within a short period (typically 14–45 days, depending on the scoring model), they are usually treated as a single inquiry, minimizing the impact.

- Should I get a 72-month or 84-month loan?

- While longer terms lower monthly payments, they greatly increase the total interest paid and raise the risk of being "upside down" on the loan. It is generally recommended to stick to 60-month or 72-month terms unless absolutely necessary.

How Do I Get An Auto Loan

How Do I Get An Auto Loan Wallpapers

Collection of how do i get an auto loan wallpapers for your desktop and mobile devices.

Amazing How Do I Get An Auto Loan Abstract Concept

Transform your screen with this vivid how do i get an auto loan artwork, a true masterpiece of digital design.

Serene How Do I Get An Auto Loan Moment for Your Screen

Discover an amazing how do i get an auto loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid How Do I Get An Auto Loan Scene for Mobile

Explore this high-quality how do i get an auto loan image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How Do I Get An Auto Loan Landscape Illustration

Experience the crisp clarity of this stunning how do i get an auto loan image, available in high resolution for all your screens.

Detailed How Do I Get An Auto Loan Moment Nature

Experience the crisp clarity of this stunning how do i get an auto loan image, available in high resolution for all your screens.

Serene How Do I Get An Auto Loan Capture for Mobile

Discover an amazing how do i get an auto loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant How Do I Get An Auto Loan Landscape for Desktop

Experience the crisp clarity of this stunning how do i get an auto loan image, available in high resolution for all your screens.

Serene How Do I Get An Auto Loan Scene for Your Screen

Experience the crisp clarity of this stunning how do i get an auto loan image, available in high resolution for all your screens.

:max_bytes(150000):strip_icc()/approved-car-loan-application-98570101-5b800241c9e77c0050572c53.jpg)

Lush How Do I Get An Auto Loan Artwork in 4K

Find inspiration with this unique how do i get an auto loan illustration, crafted to provide a fresh look for your background.

Serene How Do I Get An Auto Loan Landscape Photography

Discover an amazing how do i get an auto loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing How Do I Get An Auto Loan Image in 4K

Explore this high-quality how do i get an auto loan image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How Do I Get An Auto Loan Capture Digital Art

Explore this high-quality how do i get an auto loan image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How Do I Get An Auto Loan Wallpaper in 4K

Immerse yourself in the stunning details of this beautiful how do i get an auto loan wallpaper, designed for a captivating visual experience.

High-Quality How Do I Get An Auto Loan Background for Desktop

Experience the crisp clarity of this stunning how do i get an auto loan image, available in high resolution for all your screens.

Detailed How Do I Get An Auto Loan Background Photography

Discover an amazing how do i get an auto loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed How Do I Get An Auto Loan Moment Illustration

Experience the crisp clarity of this stunning how do i get an auto loan image, available in high resolution for all your screens.

Vibrant How Do I Get An Auto Loan Wallpaper Art

Explore this high-quality how do i get an auto loan image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful How Do I Get An Auto Loan Wallpaper Concept

Explore this high-quality how do i get an auto loan image, perfect for enhancing your desktop or mobile wallpaper.

Artistic How Do I Get An Auto Loan Artwork Digital Art

This gorgeous how do i get an auto loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How Do I Get An Auto Loan Background Digital Art

This gorgeous how do i get an auto loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these how do i get an auto loan wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How Do I Get An Auto Loan"

Post a Comment