How Much Loan Can I Get Student

How Much Loan Can I Get Student: Your Comprehensive Guide to Maximum Borrowing

If you are planning your future education, one of the most pressing questions swirling in your mind is likely financial: How much loan can I get student? It's a complex question because the answer isn't a single dollar figure. Instead, it depends heavily on your specific circumstances, including your academic level, whether you are dependent on your parents, and the type of loan you pursue—federal or private.

We know navigating student financing can feel overwhelming, but don't worry. This guide breaks down exactly what determines your borrowing limits, ensuring you understand the maximum aid available to help fund your college dreams. Let's dive into the specifics of maximizing your financial aid without over-borrowing.

Understanding Student Loan Categories

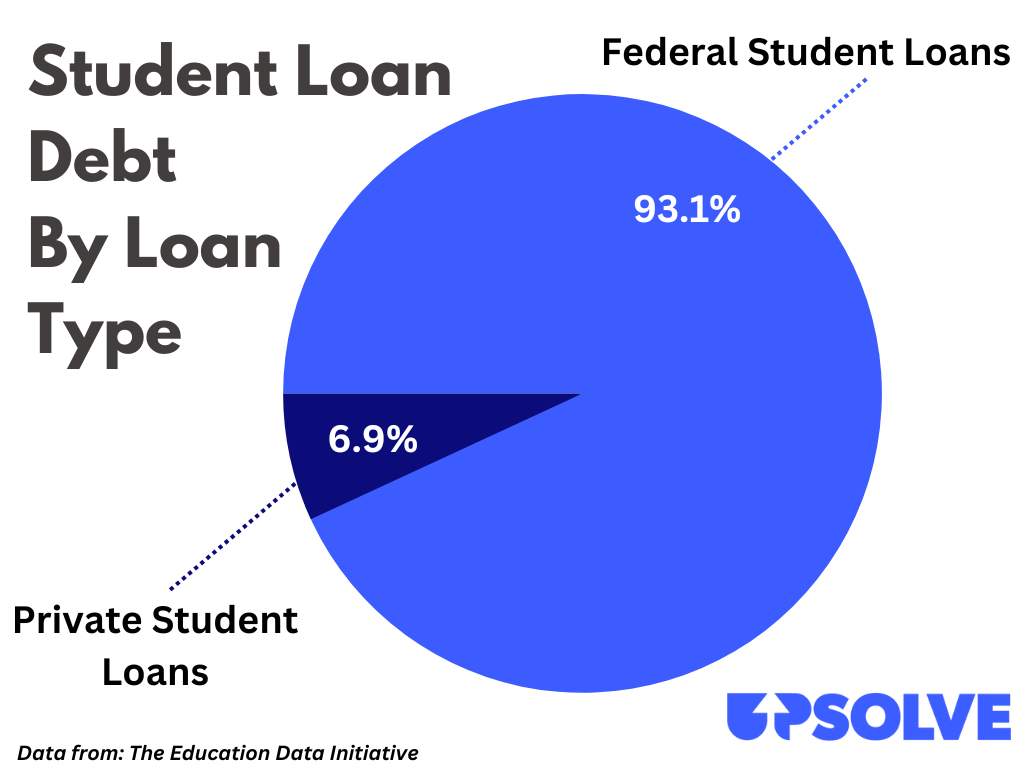

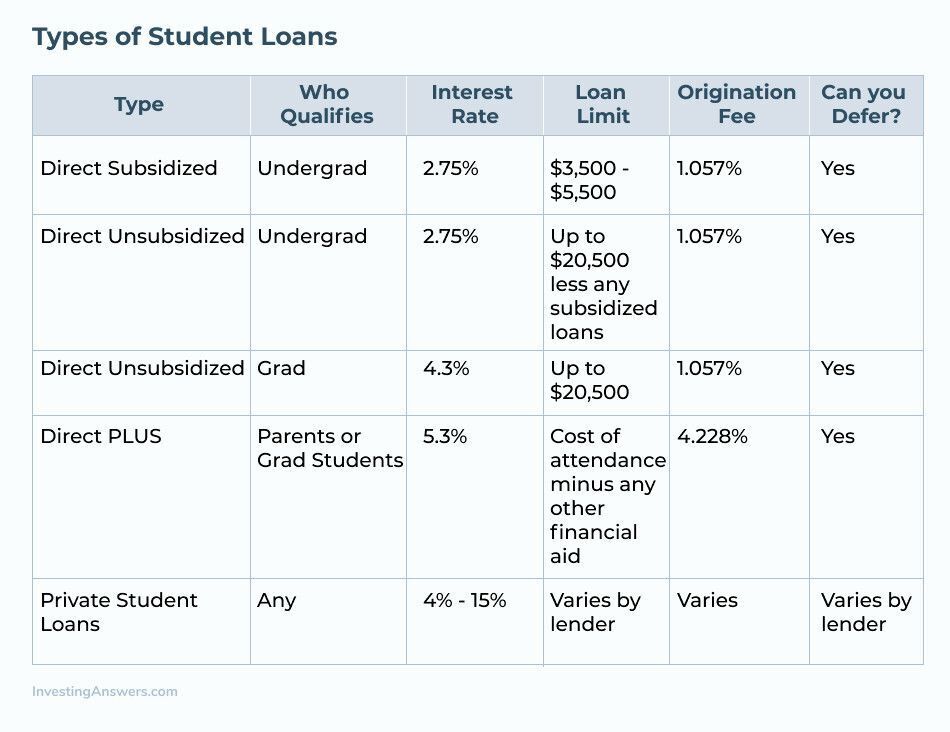

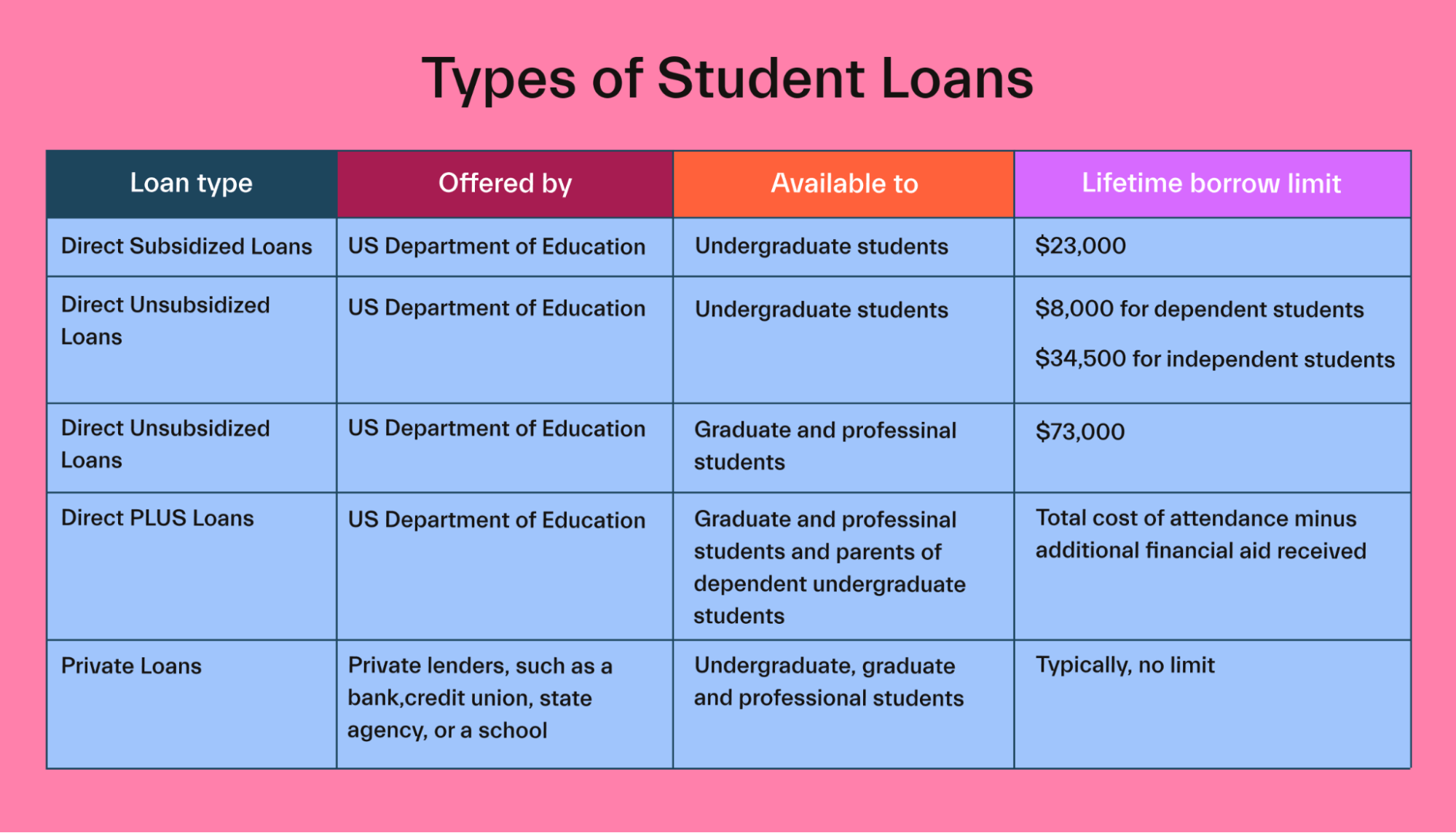

The first step in calculating your potential loan amount is understanding the two major categories of student loans: federal and private. Federal loans generally offer better terms and fixed limits set by Congress, while private loans are determined by the lender and your creditworthiness.

Federal Student Loans: Limits Set by the Government

Federal loans are highly recommended first because they typically have lower interest rates, offer flexible repayment plans, and may include options for loan forgiveness. The limits for these loans are statutory and are based largely on your status as a dependent or independent student.

These loans primarily fall into two categories for students:

- Direct Subsidized Loans: Available only to undergraduates who demonstrate financial need. The government pays the interest while you are in school and during specific grace periods.

- Direct Unsubsidized Loans: Available to both undergraduate and graduate students, regardless of financial need. Interest accrues immediately, even while you are attending school.

Private Student Loans: Variable Limits

Private loans are issued by banks, credit unions, or other financial institutions. Unlike federal loans, private lenders do not have standardized limits across the board. The maximum amount you can borrow is usually based on two main factors: your credit score (or your co-signer's credit score) and your school's Cost of Attendance (COA).

Generally, private lenders will allow you to borrow up to 100% of the COA, minus any other financial aid you have received. Therefore, if you have excellent credit, the question of "How much loan can I get student" regarding private loans often boils down to how expensive your education is.

Key Factors Determining Your Loan Limit

Whether you apply for federal or private aid, several key variables come into play when determining the exact dollar figure you are eligible to receive.

Cost of Attendance (COA)

The Cost of Attendance (COA) is the absolute ceiling for all student loans, both federal and private. The COA is determined by your school and includes tuition and fees, room and board, books and supplies, transportation, and other miscellaneous personal expenses. You cannot borrow more than your COA, regardless of the loan type.

If your COA is $25,000 for the year, and you receive $5,000 in scholarships and grants, you can only borrow up to $20,000 in student loans combined.

Dependency Status

For federal loans, dependency status is crucial. Dependent students typically have lower annual and aggregate borrowing limits because the government assumes their parents will provide some financial support. Independent students, who often must rely solely on themselves, receive higher limits.

You are generally considered an independent student if you meet certain criteria, such as being over 24, married, a veteran, or working on a graduate degree.

Academic Level

Your year in school also impacts how much loan you can get as a student. Loan limits typically increase as you progress from freshman to senior year. The logic is that upperclassmen are closer to graduation and have demonstrated commitment to their education.

Graduate and professional students have the highest limits because the cost of advanced degrees is often significantly higher.

Detailed Federal Loan Limits: Answering "How Much Loan Can I Get Student"

Let's look at the concrete numbers for Direct Subsidized and Unsubsidized loans. Remember, these limits are set per academic year and also have an aggregate (lifetime) limit.

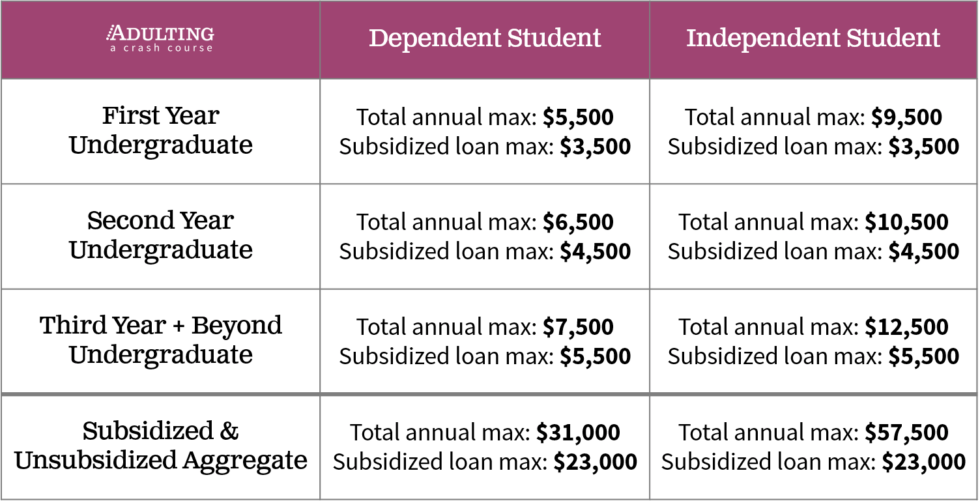

Undergraduate Federal Loan Limits

These figures represent the total amount you can borrow annually from both Subsidized and Unsubsidized Direct Loans combined. Note the significant difference between dependent and independent status.

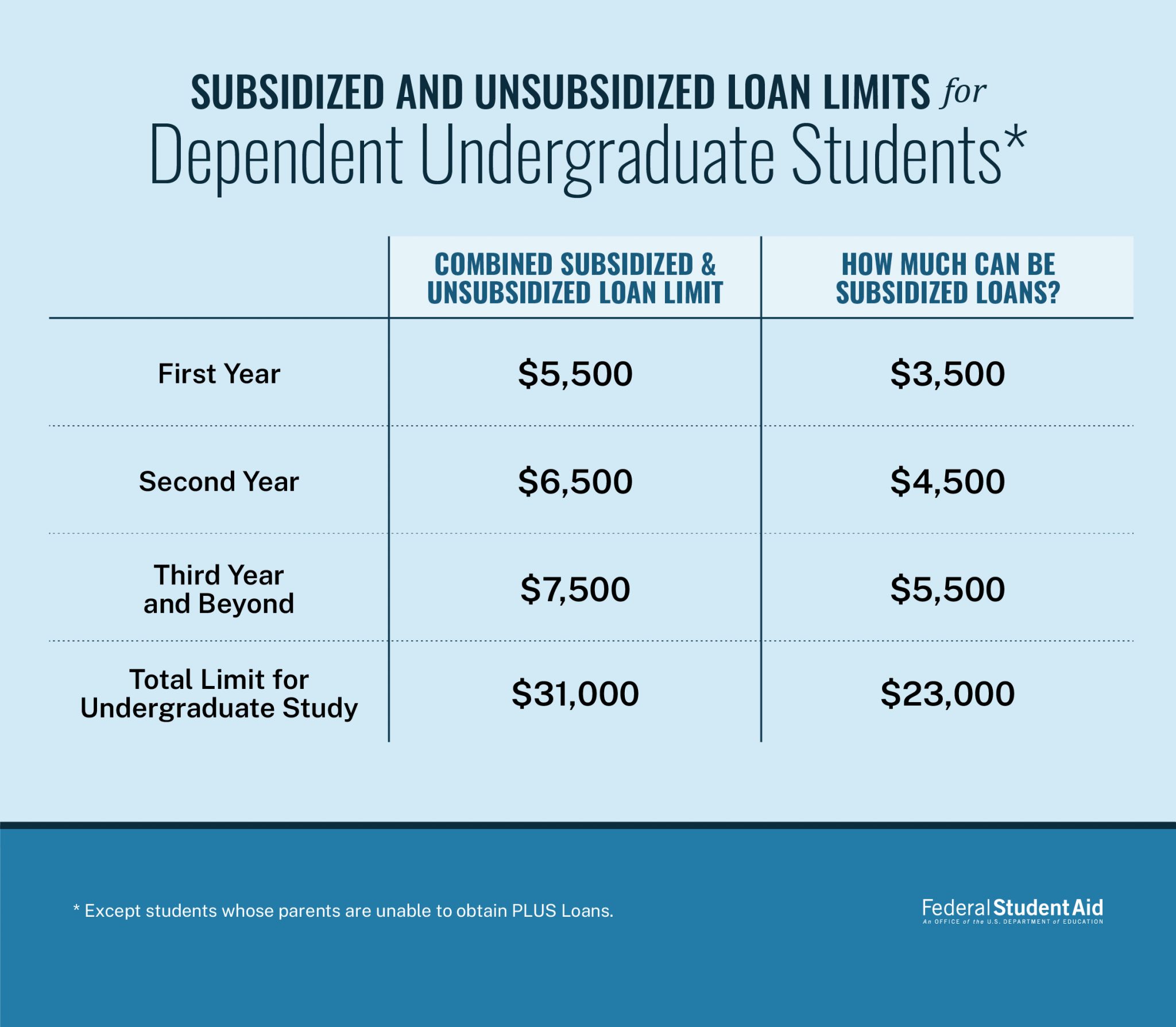

Dependent Undergraduate Students (Annual Limits)

- Freshman (1st Year): $5,500 (with a maximum of $3,500 subsidized)

- Sophomore (2nd Year): $6,500 (with a maximum of $4,500 subsidized)

- Junior/Senior (3rd/4th Year): $7,500 (with a maximum of $5,500 subsidized)

The total lifetime aggregate limit for a dependent undergraduate student is $31,000, with no more than $23,000 of that total being subsidized loans.

Independent Undergraduate Students (Annual Limits)

Independent students, or dependent students whose parents cannot obtain a PLUS Loan, have much higher limits:

- Freshman (1st Year): $9,500 (with a maximum of $3,500 subsidized)

- Sophomore (2nd Year): $10,500 (with a maximum of $4,500 subsidized)

- Junior/Senior (3rd/4th Year): $12,500 (with a maximum of $5,500 subsidized)

The total lifetime aggregate limit for an independent undergraduate student is $57,500, with no more than $23,000 being subsidized.

Graduate and Professional Student Limits

If you are pursuing a master's or doctoral degree, your loan limits are substantially higher. Graduate students are considered independent for federal aid purposes.

The annual limit for Direct Unsubsidized Loans for graduate and professional students is $20,500.

The total lifetime aggregate limit for graduate students (including loans taken during undergraduate study) is $138,500. This is a very important number to keep in mind!

Alternative Borrowing: PLUS Loans

If the standard federal limits aren't enough to cover the Cost of Attendance, students (or their parents) can turn to PLUS Loans, which are also offered by the federal government.

Grad PLUS Loans

Graduate and professional students can apply for Grad PLUS Loans to cover any remaining educational costs, up to the full COA. Eligibility requires a credit check, and these loans generally have higher interest rates than Direct Unsubsidized Loans.

Parent PLUS Loans

Parents of dependent undergraduate students can apply for Parent PLUS Loans. Similar to Grad PLUS, the limit is the COA minus other aid received. These loans are in the parent's name, and repayment is generally the parent's responsibility.

Calculating Your Final Borrowing Need

To accurately answer "How much loan can I get student," you should first identify your absolute borrowing requirement by working through this simple calculation:

- Determine your school's official Cost of Attendance (COA).

- Subtract all gift aid (scholarships and grants) from the COA.

- Subtract the maximum federal Direct Loan amount you are eligible for (based on your academic year and dependency status).

- The remaining balance is the amount you would need to cover using Parent PLUS, Grad PLUS, or private loans.

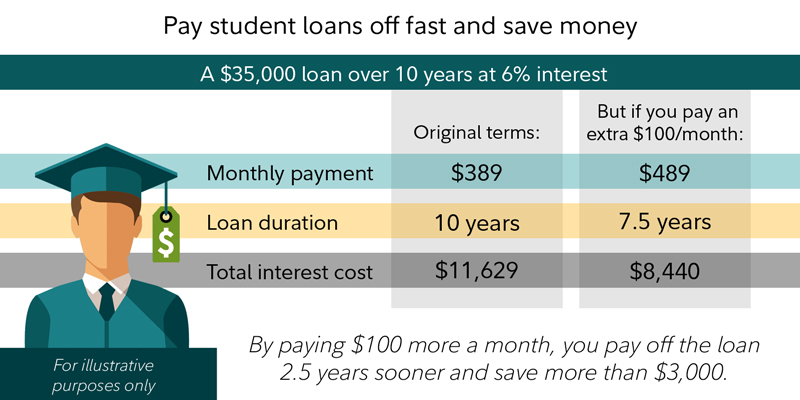

Remember that even if you are eligible to borrow the maximum amount, it is always wise to borrow only what is absolutely necessary. Lower debt upon graduation translates to greater financial flexibility in the future.

Conclusion

If you've been wondering, "How much loan can I get student," the answer is multifaceted but manageable. For federal loans, the limits are strictly defined by your dependency status and academic year, ranging from $5,500 to $20,500 annually, plus access to PLUS loans up to the COA. Private loan amounts are generally capped by the Cost of Attendance and require a strong credit history.

Start with the FAFSA to access subsidized and unsubsidized loans first. Then, if you still have a funding gap, explore PLUS loans or carefully research private lenders. Always aim to borrow conservatively to set yourself up for financial success post-graduation!

Frequently Asked Questions (FAQ) About Student Loan Limits

- Can I borrow more than the aggregate limit if my degree is expensive?

- The aggregate limit for Federal Direct Loans is strictly enforced. However, if you are a graduate student and still need more funding, you can utilize Grad PLUS loans, which have a limit based on your Cost of Attendance, not a set aggregate amount.

- How does my credit score affect how much loan I can get as a student?

- Your credit score does not affect your eligibility or limit for Direct Subsidized and Unsubsidized federal loans. However, it is a key factor for PLUS loans and the primary factor for determining both your eligibility and maximum amount when seeking private student loans.

- Do scholarships and grants reduce my loan eligibility?

- Yes, they do. All financial aid, including scholarships and grants, must be subtracted from the total Cost of Attendance (COA). You can only borrow loans up to the remaining balance of the COA. This is a good thing, as it ensures you don't over-borrow.

- What happens if my parents are denied a Parent PLUS Loan?

- If a parent is denied a Parent PLUS Loan due to adverse credit history, the dependent undergraduate student automatically becomes eligible for the higher independent student federal loan limits. This significantly increases "How much loan can I get student" on an annual basis.

How Much Loan Can I Get Student

How Much Loan Can I Get Student Wallpapers

Collection of how much loan can i get student wallpapers for your desktop and mobile devices.

Mesmerizing How Much Loan Can I Get Student Picture for Mobile

Transform your screen with this vivid how much loan can i get student artwork, a true masterpiece of digital design.

Serene How Much Loan Can I Get Student Moment Art

Transform your screen with this vivid how much loan can i get student artwork, a true masterpiece of digital design.

Gorgeous How Much Loan Can I Get Student Artwork Art

Find inspiration with this unique how much loan can i get student illustration, crafted to provide a fresh look for your background.

Stunning How Much Loan Can I Get Student Landscape Digital Art

This gorgeous how much loan can i get student photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How Much Loan Can I Get Student Scene Nature

Transform your screen with this vivid how much loan can i get student artwork, a true masterpiece of digital design.

Serene How Much Loan Can I Get Student View Collection

Transform your screen with this vivid how much loan can i get student artwork, a true masterpiece of digital design.

Exquisite How Much Loan Can I Get Student Landscape Art

This gorgeous how much loan can i get student photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp How Much Loan Can I Get Student Background for Mobile

This gorgeous how much loan can i get student photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful How Much Loan Can I Get Student Abstract Photography

Discover an amazing how much loan can i get student background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular How Much Loan Can I Get Student Landscape Concept

This gorgeous how much loan can i get student photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular How Much Loan Can I Get Student Wallpaper for Mobile

Immerse yourself in the stunning details of this beautiful how much loan can i get student wallpaper, designed for a captivating visual experience.

Mesmerizing How Much Loan Can I Get Student Picture Collection

Transform your screen with this vivid how much loan can i get student artwork, a true masterpiece of digital design.

Vivid How Much Loan Can I Get Student Image in 4K

Transform your screen with this vivid how much loan can i get student artwork, a true masterpiece of digital design.

Breathtaking How Much Loan Can I Get Student Moment in 4K

Explore this high-quality how much loan can i get student image, perfect for enhancing your desktop or mobile wallpaper.

Serene How Much Loan Can I Get Student Artwork for Mobile

Experience the crisp clarity of this stunning how much loan can i get student image, available in high resolution for all your screens.

Gorgeous How Much Loan Can I Get Student Abstract for Your Screen

A captivating how much loan can i get student scene that brings tranquility and beauty to any device.

Captivating How Much Loan Can I Get Student Capture for Mobile

A captivating how much loan can i get student scene that brings tranquility and beauty to any device.

Mesmerizing How Much Loan Can I Get Student Abstract Art

Experience the crisp clarity of this stunning how much loan can i get student image, available in high resolution for all your screens.

Spectacular How Much Loan Can I Get Student Picture for Mobile

Find inspiration with this unique how much loan can i get student illustration, crafted to provide a fresh look for your background.

Amazing How Much Loan Can I Get Student Wallpaper Illustration

Discover an amazing how much loan can i get student background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these how much loan can i get student wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How Much Loan Can I Get Student"

Post a Comment